Market Overview

The USA Automotive Diagnostic Tools market is valued at USD ~ billion, with substantial contributions from both the automotive repair industry and the growing adoption of advanced diagnostic systems. The market is primarily driven by the rise in vehicle complexity, with a growing number of ECUs (Electronic Control Units) requiring sophisticated diagnostic tools. The widespread implementation of telematics, electric vehicle (EV) diagnostics, and the shift toward remote diagnostics through cloud-based solutions are critical factors expanding the market. Increasing vehicle repair complexity and the trend toward preventive maintenance fuel the demand for high-end diagnostic tools and software.

The USA remains the largest market for automotive diagnostic tools due to its large automotive industry and the presence of leading automotive manufacturers and repair services. Cities such as Detroit, Michigan, known as the automotive capital, Los Angeles, and New York, are at the forefront, driven by a high volume of vehicles in need of regular diagnostics and maintenance. Additionally, the growing adoption of connected cars and electric vehicles in these regions enhances the demand for advanced diagnostic technologies, making them key contributors to the market.

Market Segmentation

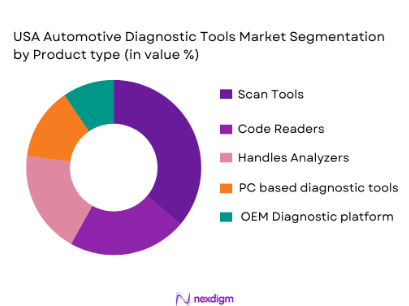

By Product Type

The USA automotive diagnostic tools market is segmented by product type into scan tools, code readers, handheld analyzers, PC-based diagnostic tools, and OEM diagnostic platforms. Scan tools dominate this segment due to their ability to read and clear diagnostic trouble codes (DTCs) for a wide range of vehicles, including electric and hybrid models. Their broad compatibility with multiple car brands, ease of use, and growing popularity among both independent and dealership service centers contribute to their substantial market share. The demand for mobile scan tools has risen with the increasing number of small workshops and independent technicians preferring mobile solutions for their cost-effectiveness.

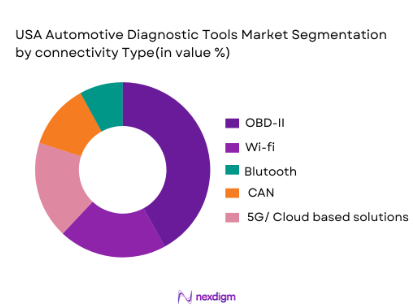

By Connectivity Type

The market is further divided by connectivity types into OBD-II (On-Board Diagnostics), Wi-Fi, Bluetooth, CAN, and 5G/Cloud-based solutions. OBD-II tools continue to dominate the market as the standard for automotive diagnostics due to their widespread use across vehicle models, especially in the USA. The introduction of wireless solutions, like Bluetooth and Wi-Fi, is gaining traction due to their convenience, ease of use, and mobility for both professional mechanics and DIY consumers. Cloud-based diagnostic tools are also growing rapidly, offering real-time diagnostics and remote troubleshooting, especially for fleets and larger repair shops looking to optimize service time.

Competitive Landscape

The USA automotive diagnostic tools market is highly competitive, with key players such as Snap-on Incorporated, Bosch Automotive Service Solutions, Autel Intelligent Technology, Delphi Technologies, and Launch Tech USA leading the charge. These companies have entrenched themselves in the market by offering a diverse portfolio of diagnostic tools ranging from simple code readers to advanced cloud-based diagnostic systems. Snap-on, Bosch, and Autel are particularly dominant in the aftermarket segment, due to their established brand presence, product innovation, and global reach. The competitive intensity in the market is further enhanced by technological advancements and price competition among emerging players.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Global Presence | Annual Revenue (USD) | Technology Focus | Market Position |

| Snap-on Incorporated | 1920 | Kenosha, Wisconsin | – | – | – | – | – |

| Bosch Automotive | 1886 | Stuttgart, Germany | – | – | – | – | – |

| Autel Intelligent | 2004 | Shenzhen, China | – | – | – | – | – |

| Delphi Technologies | 1994 | Troy, Michigan | – | – | – | – | – |

| Launch Tech USA | 1992 | Richmond, Virginia | – | – | – | – | – |

USA Automotive Diagnostic Tools Market Analysis

Growth Drivers

Vehicle Complexity & ECU Proliferation

The increasing complexity of vehicles, especially with the proliferation of Electronic Control Units (ECUs), is a major growth driver for the automotive diagnostic tools market. In 2024, there are over 100 million vehicles in the United States equipped with ECUs that control critical functions such as engine management, emissions control, and safety systems. With each vehicle featuring up to 80 ECUs, the need for specialized diagnostic tools to address ECU-related issues has grown. The rising number of automotive sensors and control units makes it essential for mechanics to utilize sophisticated diagnostic tools to keep up with repairs and maintenance. According to the World Bank, the global vehicle stock reached 1.5 billion units in 2023, with the U.S. accounting for 270 million vehicles. This sharp rise in vehicle complexity necessitates advanced diagnostics, boosting tool sales, and adoption.

Rising EV/Hybrid Penetration

The growing penetration of electric vehicles (EVs) and hybrids in the USA is a significant driver for automotive diagnostic tools, particularly those designed for EV battery diagnostics, electric drivetrains, and power electronics. As of 2023, EVs and hybrids made up 6.2% of total vehicle sales in the U.S., with over 1.1 million EVs on the road. This number is expected to rise as the Biden administration pushes for a cleaner transportation future, aiming for 50% of all new vehicle sales to be electric by 2030. EVs and hybrids require specialized diagnostic equipment for their unique components, such as battery management systems and charging interfaces, creating a growing demand for advanced diagnostic tools.

Market Challenges

High License Costs for Software Platforms

Automotive diagnostic software platforms, especially those offering advanced functionalities like cloud diagnostics, AI-driven analytics, and real-time remote updates, come with high licensing costs. Many small and medium-sized workshops face difficulty adopting these systems due to the substantial upfront investment and recurring costs for software updates. The high costs associated with these platforms, particularly in light of increased regulatory pressure to upgrade to newer versions to maintain compliance, deter many small businesses from adopting the latest diagnostic technologies. The high software costs have proven to be a limiting factor, particularly in regions with a higher density of independent workshops.

Technician Skill Gaps for Advanced Diagnostics

The rapid advancements in automotive diagnostics, particularly in areas like EV maintenance and ADAS calibration, have created a skills gap in the workforce. In 2023, a report from the U.S. Bureau of Labor Statistics found that there was a significant shortage of qualified technicians, particularly those skilled in EV systems, ADAS, and advanced diagnostics. With the increasing demand for specialized knowledge and certifications, many repair shops are struggling to find qualified technicians who can operate modern diagnostic tools effectively. The shortage of trained technicians poses a significant challenge to both the automotive repair industry and the adoption of cutting-edge diagnostic technologies.

Market Opportunities

Cloud-Based Diagnostics & OTA Firmware Update Tools

Cloud-based diagnostics and over-the-air (OTA) firmware update tools are gaining traction in the automotive industry. As of 2023, 15% of new vehicles in the U.S. are equipped with the ability to receive OTA updates for software and diagnostic tools, reducing the need for physical visits to service centers. This ability to diagnose and address issues remotely is a game-changer, especially for fleet operators and commercial vehicles. With growing vehicle connectivity, the shift towards cloud-based diagnostics and remote updates is expected to expand as the network infrastructure and vehicle technologies improve, creating immense opportunities for tool providers who can offer robust cloud and OTA solutions.

AI-Driven Predictive Fault Analytics

AI-driven predictive fault analytics is one of the most promising market opportunities for automotive diagnostic tools. With advancements in machine learning and artificial intelligence, predictive analytics can help technicians and fleet managers anticipate and address vehicle issues before they occur, thereby reducing maintenance costs and downtime. In 2023, the global adoption of AI in the automotive industry was accelerating, with over 50% of fleets in the U.S. using AI-driven diagnostic tools to predict mechanical failures and plan maintenance schedules. This trend is expected to continue, offering growth opportunities for diagnostic tool developers who integrate AI into their systems.

Future Outlook

Over the next 5 years, the USA automotive diagnostic tools market is expected to experience significant growth, driven by continuous innovations in diagnostic technology and increasing vehicle complexity. Advancements in electric vehicle (EV) diagnostics, the proliferation of Advanced Driver Assistance Systems (ADAS), and the growing demand for remote diagnostics solutions are expected to propel the market forward. Furthermore, the rise of cloud-based diagnostics and the growing trend of predictive maintenance for fleets are expected to be key drivers. The shift toward sustainable and energy-efficient vehicles will also increase the need for specialized diagnostic tools, providing new opportunities for market players to innovate.

Major Players in the Market

- Snap-on Incorporated

- Bosch Automotive Service Solutions

- Autel Intelligent Technology

- Launch Tech USA

- Delphi Technologies

- Hella Gutmann Solutions

- Innova Electronics

- Actron

- Denso Corporation

- Continental AG

- Automotive Test Solutions

- BlueDriver

- OBD Solutions

- Mitchell 1

- Vector Informatik

Key Target Audience

- Automotive Repair Shops and Service Centers

- OEMs (Original Equipment Manufacturers)

- Vehicle Fleet Operators

- Automotive Parts Distributors

- Automotive Diagnostic Equipment Retailers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., National Highway Traffic Safety Administration (NHTSA), Environmental Protection Agency (EPA))

- Automotive Associations and Trade Bodies (e.g., Automotive Aftermarket Suppliers Association (AASA))

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the critical stakeholders within the USA automotive diagnostic tools market. This includes manufacturers, distributors, service providers, and regulatory bodies. Desk research will be conducted using secondary data sources, such as industry reports and proprietary databases, to identify market variables like tool types, connectivity, and market distribution.

Step 2: Market Analysis and Construction

In this phase, historical data will be compiled, focusing on key metrics such as market size, penetration rates, and revenue generation. Analysis of the market’s adoption of technologies like cloud diagnostics and EV tools will be undertaken, supported by secondary data and in-depth market reports to generate actionable insights.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding technological adoption and segment growth will be validated through expert consultations. Industry professionals, including mechanics, tool manufacturers, and fleet operators, will be interviewed via Computer-Assisted Telephone Interviews (CATI) to refine data accuracy and validate assumptions.

Step 4: Research Synthesis and Final Output

The final output will synthesize primary and secondary data from expert consultations, operational reports, and financial records. Detailed insights into product demand, pricing, and technological shifts will be compiled, offering a comprehensive outlook of the USA automotive diagnostic tools market.

- Executive Summary

- Research Methodology Market Definitions & Diagnostic Tool Categorization (Hardware vs Software), Assumptions & Base Year Metrics (Market Size, CAGR), Data Triangulation & Confidence Scoring (Quantitative vs Qualitative) Primary Research Protocols (OEMs, Workshops, Fleet Operators), Limitations and Data Integrity Controls.

- Definition and Scope of Automotive Diagnostic Tools

- Market Genesis & Evolution

- Innovation Timeline

- Industry Value Chain

- Supply Chain Dynamics

- Regulatory & Standardization Environment

- Growth Drivers

Vehicle Complexity & ECU Proliferation

Rising EV/Hybrid Penetration

Adoption of ADAS Calibration & Safety Diagnostics

Fleet Telematics & Predictive Maintenance Services - Market Challenges

Tool Compatibility with Multi‑Brand Systems

High License Costs for Software Platforms

Technician Skill Gaps for Advanced Diagnostics - Market Opportunities

Cloud‑Based Diagnostics & OTA Firmware Update Tools

AI‑Driven Predictive Fault Analytics

Subscription Revenue Models & Data Monetization - Emerging Trends

Wireless Interfaces (Bluetooth/Wi‑Fi) Dominance

Integration with Dealer Management Systems (DMS)

Subscription & Remote Support Services

- By Market Value, 2019-2025

- By Units Sold, 2019-2025

- By Average Selling Price, 2019-2025

- By Diagnostic Category, 2019-2025

- By Connectivity Type, 2019-2025

- By Tool Type (In Value %)

Scan Tools

Code Readers

Handheld Analyzers

PC‑Based Tools - By Software Offering (In Value %)

(Proprietary Software

SaaS Analytics Platforms

Cloud Diagnostics - By Connectivity Protocol (In Value %)

OBD‑II

CAN

Wi‑Fi

Bluetooth

LTE/5G Cloud - By Vehicle Type (In Value %)

Passenger Vehicles

Light Commercial Vehicles

Heavy Commercial

EV/Hybrid) - By End User (In Value %)

Dealership OEM Service

Independent Workshops

Fleet & Rental Operators

DIY Consumers - By Deployment Mode (In Value %)

(On‑Vehicle Diagnostics

Remote Diagnostics

Predictive Telematics

- Market Share by Value/Volume (Leading Vendors)

- Cross‑Comparison Parameters (Hardware/Software, Connectivity & Protocol OBD/CAN/Wi‑Fi/Bluetooth, Remote Diagnostics/OTA/Telematics, Annual Revenue & Market Penetration, Product Price Positioning & ASP

- Customer Support & Training Programs

- Software Update Frequency & Data Security Compliance

- SWOT Analysis of Key Players

- Pricing & SKU Benchmarking

- Detailed Company Profiles

Robert Bosch GmbH

Snap‑on Incorporated

Autel Intelligent Technology

Launch Tech USA

Delphi Technologies

Continental AG

Denso Corporation

Actron / Honeywell

Innova Electronics

Hella Gutmann Solutions

OBD Solutions

Mitchell 1 / Snap‑on Software

NI (National Instruments) Diagnostic Solutions

Vector Informatik

Fiix Software (Service & Diagnostic Analytics)

- Industry Adoption Patterns (OEM vs Aftermarket)

- Purchase Criteria (Feature Sets, Connectivity, Compatibility)

- Cost Benchmarks (Total Cost of Ownership)

- Pain Points (Data Integration, Security, Tech Literacy)

- Decision‑Making & Buying Cycle

- Forecast by Market Value, 2026-2030

- Forecast by Volume, 2026-2030

- Forecast by ASP, 2026-2030