Market Overview

The USA Automotive Doors market current size stands at around USD ~ million, supported by annual production exceeding ~ vehicles and system deployments of over ~ units across passenger and commercial segments. Recent industry activity reflects investments of nearly USD ~ million in lightweight materials, power-operated mechanisms, and smart access systems. Manufacturing output remains concentrated in high-volume assembly corridors, with integrated supply networks supporting more than ~ plants and specialized component centers nationwide.

Market activity is strongest in regions with dense automotive manufacturing clusters and advanced supplier ecosystems. The Midwest continues to lead due to its mature OEM base, tooling infrastructure, and logistics connectivity. Southern states are gaining momentum from new electric vehicle assembly investments and favorable industrial policies. West Coast demand is shaped by technology integration, premium vehicle sales, and innovation-driven suppliers focused on smart door systems and lightweight composites.

Market Segmentation

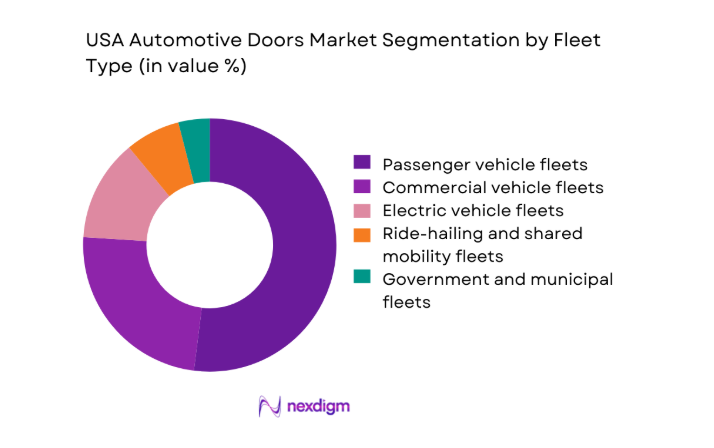

By Fleet Type

Passenger vehicle fleets dominate the USA Automotive Doors market due to the high concentration of sedans, SUVs, and crossovers produced for domestic consumption. Strong replacement demand from ride-hailing and rental fleets further reinforces this dominance. Commercial vehicle fleets contribute steadily, driven by light trucks and delivery vans that increasingly adopt power sliding and rear access doors. Electric vehicle fleets are emerging as a high-growth sub-segment, supported by platform redesigns that integrate modular door architectures. Government and municipal fleets add incremental demand through procurement of specialized utility and service vehicles requiring reinforced and customized door systems.

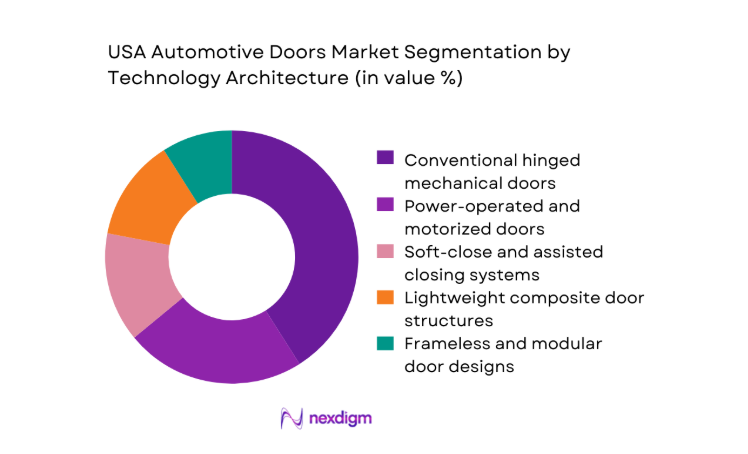

By Technology Architecture

Conventional hinged mechanical doors continue to account for the largest share due to cost efficiency and compatibility with mass-market vehicle platforms. However, power-operated and motorized doors are rapidly gaining traction in premium SUVs, minivans, and electric vehicles. Soft-close and assisted closing systems are increasingly adopted in luxury models, enhancing user experience and perceived quality. Lightweight composite door structures are expanding across both premium and mid-range segments as OEMs target weight reduction and energy efficiency. Frameless and modular door designs are emerging in niche and performance-oriented vehicles, signaling long-term architectural shifts in body-in-white engineering.

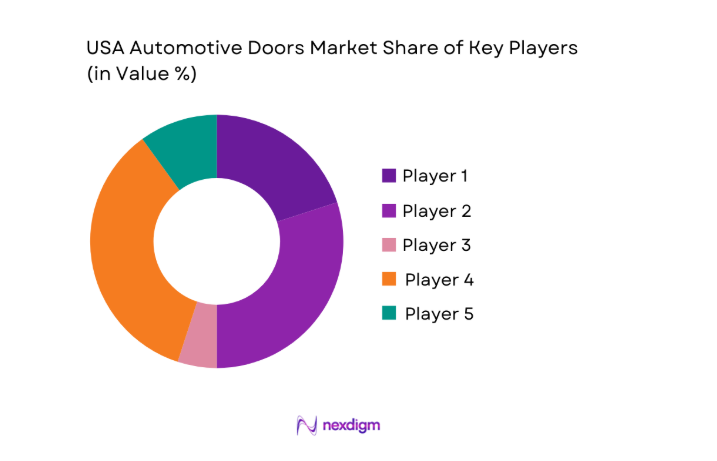

Competitive Landscape

The USA Automotive Doors market exhibits a moderately concentrated structure, led by a group of global Tier I suppliers with strong OEM relationships and vertically integrated manufacturing capabilities. These players dominate high-volume programs, while regional specialists focus on niche technologies and aftermarket solutions. Competitive differentiation is driven by engineering depth, lightweight material expertise, and the ability to integrate electronics into door modules for next-generation vehicle platforms.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Magna International | 1957 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Brose Fahrzeugteile | 1908 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Aisin Seiki | 1949 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Gestamp | 1997 | Spain | ~ | ~ | ~ | ~ | ~ | ~ |

| Inteva Products | 2008 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

USA Automotive Doors Market Analysis

Growth Drivers

Rising production of SUVs, crossovers, and pickup trucks

Rising output of SUVs and pickup trucks has significantly increased demand for larger and more complex door systems. Vehicle production volumes exceeded ~ vehicles in recent years, with these body styles accounting for more than ~ units annually. These segments require reinforced hinges, extended door panels, and integrated safety mechanisms, driving higher component utilization per vehicle. Manufacturing facilities across the Midwest and South collectively support over ~ assembly lines dedicated to these platforms, creating sustained demand for side doors, tailgates, and sliding door modules across OEM supply programs.

Increasing adoption of power and smart door systems

The adoption of power-operated and smart door systems has accelerated as premium features move into mid-range vehicles. Installations of motorized door modules now exceed ~ units annually, supported by investments of USD ~ million in electronics integration and actuator technologies. Smart access features, including hands-free opening and sensor-based safety controls, are being deployed across more than ~ vehicle platforms. This shift has expanded the average system value per vehicle while increasing demand for integrated mechatronic components within door assemblies.

Challenges

High cost of advanced door modules and electronics

Advanced door modules combining motors, sensors, and control units significantly increase system complexity and cost. Development investments for a single smart door platform often exceed USD ~ million, creating pricing pressure for OEM procurement teams. Manufacturing these systems requires specialized assembly lines, adding capital expenditure of USD ~ million per facility. These cost dynamics limit adoption in entry-level vehicles and constrain volume scaling, particularly in price-sensitive fleet segments where component affordability remains a critical purchasing factor.

Supply chain volatility in steel, aluminum, and composites

Volatility in raw material supply has disrupted door manufacturing across multiple production cycles. Annual consumption of steel and aluminum for automotive doors exceeds ~ million units of stamped panels, making the segment highly sensitive to procurement fluctuations. Composite material sourcing has also faced periodic constraints, delaying production schedules at more than ~ plants nationwide. These disruptions have increased lead times and forced suppliers to maintain higher inventory levels, tying up working capital of USD ~ million across the supply chain.

Opportunities

Growth in smart access and hands-free door technologies

Smart access technologies present a strong growth opportunity as OEMs integrate digital keys, proximity sensors, and automated opening systems into mainstream models. Deployment of hands-free door solutions already exceeds ~ units across premium and electric vehicle lines. Ongoing platform upgrades are expected to extend these features to an additional ~ vehicles annually. This trend supports higher per-unit system value and encourages long-term supplier partnerships focused on software-enabled door modules and connected vehicle ecosystems.

Increasing use of lightweight composite and aluminum doors

Lightweighting initiatives are accelerating the adoption of aluminum and composite door structures to improve energy efficiency and vehicle range. Annual production of lightweight door panels now surpasses ~ units, supported by capital investments of USD ~ million in advanced forming and bonding technologies. These materials reduce overall vehicle mass by ~ kg per platform, creating measurable efficiency gains. The shift also opens new opportunities for suppliers specializing in multi-material integration and sustainable manufacturing processes.

Future Outlook

The USA Automotive Doors market is expected to evolve alongside vehicle electrification and digitalization trends. Over the coming years, demand will increasingly favor modular, lightweight, and software-integrated door systems. OEMs are likely to prioritize suppliers that can deliver scalable smart access solutions and sustainable materials. Regulatory emphasis on safety and energy efficiency will further shape product development, positioning advanced door architectures as a strategic component of future vehicle platforms through the end of the decade.

Major Players

- Magna International

- Brose Fahrzeugteile

- Aisin Seiki

- Gestamp

- Inteva Products

- Kiekert AG

- Hyundai Mobis

- Toyota Boshoku

- OPmobility

- Yanfeng Automotive Interiors

- Grupo Antolin

- Forvia

- Valeo

- Aptiv

- Magna Closures

Key Target Audience

- Automotive OEMs and vehicle platform engineering teams

- Tier I and Tier II automotive component suppliers

- Electric vehicle manufacturers and mobility startups

- Fleet operators and commercial vehicle integrators

- Aftermarket distributors and service networks

- Investments and venture capital firms

- U.S. Department of Transportation and National Highway Traffic Safety Administration

- State-level transportation and industrial development agencies

Research Methodology

Step 1: Identification of Key Variables

Core demand drivers, production patterns, and technology adoption indicators were identified across passenger and commercial vehicle segments. Emphasis was placed on door architecture trends, material usage, and electronics integration. Regional manufacturing footprints and policy influences were mapped to establish baseline market conditions.

Step 2: Market Analysis and Construction

Quantitative models were developed to align vehicle production with door system penetration levels. Supply chain structures, capacity utilization, and technology roadmaps were evaluated to construct market size and segmentation logic. Scenario frameworks were applied to capture variations across economic and regulatory environments.

Step 3: Hypothesis Validation and Expert Consultation

Initial findings were validated through structured consultations with industry professionals across manufacturing, procurement, and product development functions. Feedback loops refined assumptions around adoption timelines, cost structures, and platform strategies to ensure realistic market representation.

Step 4: Research Synthesis and Final Output

All quantitative and qualitative insights were synthesized into a unified analytical framework. Data consistency checks and narrative alignment ensured consulting-grade output. The final report integrates strategic perspectives with actionable intelligence for stakeholders across the automotive value chain.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, automotive door system taxonomy across hinged sliding and liftgate designs, market sizing logic by vehicle production and door content value, revenue attribution across modules materials and service parts, primary interview program with OEMs Tier 1 suppliers and body structure manufacturers, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Usage pathways and functional role in vehicle safety and comfort

- Ecosystem structure across OEMs, Tier I and Tier II suppliers

- Supply chain and channel structure

- Regulatory and safety environment

- Growth Drivers

Rising production of SUVs, crossovers, and pickup trucks

Increasing adoption of power and smart door systems

Growing focus on vehicle safety and side-impact protection

Lightweighting trends to improve fuel efficiency and EV range

Rising consumer demand for premium comfort features

Expansion of electric vehicle manufacturing in the US - Challenges

High cost of advanced door modules and electronics

Supply chain volatility in steel, aluminum, and composites

Integration complexity with vehicle electronics architecture

Stringent safety and crash-test compliance requirements

Price pressure from OEMs on Tier I suppliers

Aftermarket fitment and standardization issues - Opportunities

Growth in smart access and hands-free door technologies

Increasing use of lightweight composite and aluminum doors

Rising demand for modular door systems in EV platforms

Expansion of premium vehicle segments in the US

Retrofit and aftermarket upgrades for fleet vehicles

Integration of biometric and digital key access systems - Trends

Shift toward power sliding doors in urban mobility vehicles

Adoption of frameless and panoramic door designs

Increased automation in door assembly lines

Use of recycled and sustainable materials in door panels

Integration of ADAS-linked safety sensors in doors

Growth of software-defined vehicle architectures impacting door systems - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Fleet Type (in Value %)

Passenger vehicle fleets

Commercial vehicle fleets

Electric vehicle fleets

Ride-hailing and shared mobility fleets

Government and municipal fleets - By Application (in Value %)

Front side doors

Rear side doors

Sliding doors for vans and MPVs

Tailgates and liftgates

Specialty access doors for utility vehicles - By Technology Architecture (in Value %)

Conventional hinged mechanical doors

Power-operated and motorized doors

Soft-close and assisted closing systems

Lightweight composite door structures

Frameless and modular door designs - By End-Use Industry (in Value %)

Passenger car manufacturing

Light commercial vehicle manufacturing

Heavy commercial vehicle manufacturing

Electric vehicle manufacturing

Specialty and recreational vehicle manufacturing - By Connectivity Type (in Value %)

Non-connected mechanical systems

Wired connected systems (CAN/LIN)

Ethernet-enabled smart door systems

Wireless and sensor-integrated door systems

Cloud-enabled diagnostics and access control - By Region (in Value %)

Northeast

Midwest

South

West

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product breadth, technology integration level, manufacturing footprint, OEM relationship strength, cost competitiveness, innovation pipeline, sustainability practices, aftermarket reach)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Magna International

Brose Fahrzeugteile

Aisin Seiki

Gestamp

Kiekert AG

Inteva Products

Magna Closures

Toyota Boshoku

Hyundai Mobis

OPmobility (Plastic Omnium)

Yanfeng Automotive Interiors

Grupo Antolin

Forvia (Faurecia)

Valeo

Aptiv

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030