Market Overview

The USA Automotive Frames market current size stands at around USD ~ million, supported by annual production volumes exceeding ~ units across major OEM assembly lines and contract manufacturing partners. Recent market activity reflects shipment volumes of nearly ~ units for structural frames, with installed base levels across active vehicle platforms reaching ~ systems. Average selling prices for complete frame assemblies remain near USD ~ per unit, driven by material mix shifts and rising integration of multi-material architectures in mainstream vehicle programs.

Market activity is concentrated across the Midwest manufacturing corridor, the Southern automotive belt, and select West Coast production hubs. These regions dominate due to dense OEM plant networks, advanced stamping and welding infrastructure, and proximity to Tier I structural suppliers. Demand concentration is reinforced by fleet procurement clusters, logistics efficiency, and a mature supplier ecosystem that supports rapid platform launches. Supportive state-level manufacturing incentives and infrastructure readiness further strengthen these locations as primary centers for automotive frame production.

Market Segmentation

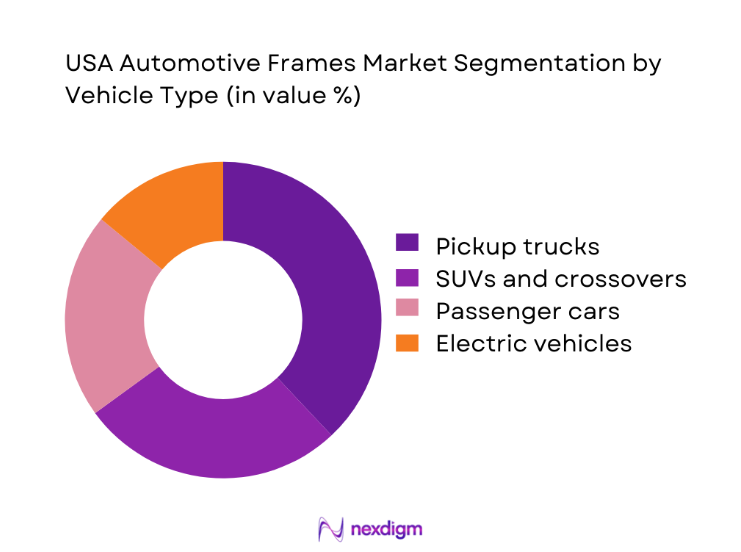

By Vehicle Type

Pickup trucks and large SUVs dominate the USA Automotive Frames market due to their structural reliance on body-on-frame architectures and higher material intensity per vehicle. These segments account for a significant share of total frame shipments, driven by sustained consumer preference for utility vehicles and strong fleet adoption in construction, logistics, and public services. Passenger cars, while shifting toward unibody platforms, continue to contribute through modular subframe demand. Electric vehicles add incremental growth through skateboard chassis programs, but their contribution remains concentrated in select OEM platforms rather than across the broader market.

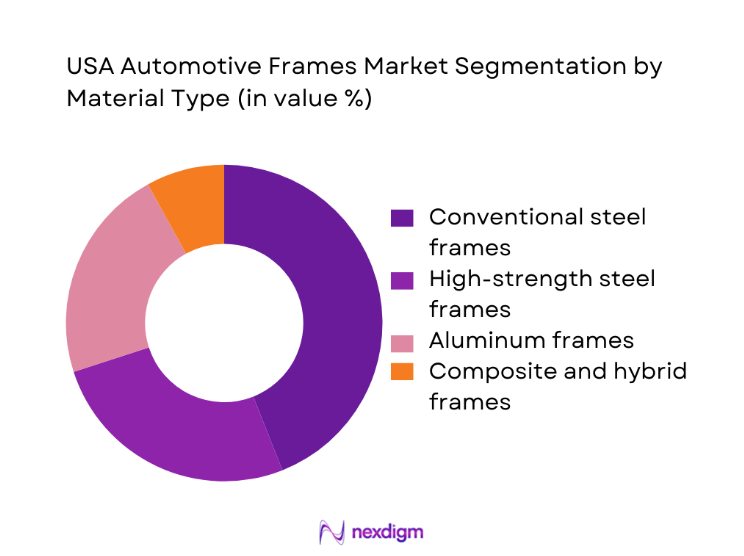

By Material Type

Steel-based frames continue to lead the market due to cost efficiency, well-established forming processes, and widespread repair ecosystem compatibility. High-strength steel has gained prominence as OEMs seek to balance weight reduction with crash performance. Aluminum frames are expanding rapidly in premium and electric vehicle segments, supported by corrosion resistance and mass reduction benefits. Composite and hybrid material frames remain niche, primarily used in performance and specialty vehicles, but are gaining attention as sustainability targets push manufacturers toward innovative material strategies.

Competitive Landscape

The USA Automotive Frames market is moderately concentrated, with a group of large Tier I suppliers dominating high-volume OEM contracts while a long tail of regional fabricators serves specialty, aftermarket, and low-volume programs. Competitive dynamics are shaped by manufacturing scale, proximity to OEM plants, and long-term platform supply agreements rather than spot-market competition.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Magna International | 1957 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Gestamp | 1997 | Spain | ~ | ~ | ~ | ~ | ~ | ~ |

| Benteler Automotive | 1876 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Martinrea International | 1986 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Metalsa | 1956 | Mexico | ~ | ~ | ~ | ~ | ~ | ~ |

USA Automotive Frames Market Analysis

Growth Drivers

Rising demand for pickup trucks and large SUVs in the US

Structural frame demand has been closely tied to sustained production volumes of pickups and large SUVs, which together account for over ~ units of annual vehicle output across domestic plants. These segments require heavier and more complex frames, driving higher material consumption of nearly ~ tons of steel and aluminum per year. Fleet orders from construction, energy, and municipal services contribute approximately ~ vehicles annually, reinforcing stable baseline demand for ladder and perimeter frames. This structural dependency ensures consistent shipment volumes even during broader passenger car market fluctuations.

Platform consolidation and modular vehicle architectures

OEMs have accelerated platform consolidation strategies, reducing the number of vehicle architectures from more than ~ platforms to fewer than ~ standardized bases across major portfolios. This shift has increased per-platform frame volumes to over ~ units annually for high-volume models. Modular architectures enable shared frame components across multiple body styles, improving tooling utilization rates and supporting production runs exceeding ~ units per stamping line. As a result, suppliers benefit from longer contract cycles and more predictable demand patterns for structural assemblies.

Challenges

Volatility in steel and aluminum prices

Raw material cost swings have introduced significant uncertainty into frame manufacturing economics, with annual price variation often exceeding USD ~ per ton for steel and USD ~ per ton for aluminum. These fluctuations impact procurement planning for suppliers processing more than ~ tons of metal annually. Contract structures with OEMs frequently limit pass-through flexibility, exposing manufacturers to margin compression on programs exceeding ~ units per year. This volatility complicates long-term sourcing strategies and increases the need for hedging and diversified supplier networks.

High capital intensity of stamping and welding lines

Establishing a full-scale automotive frame production line typically requires capital investments of over USD ~ million for presses, robotic welding cells, and quality inspection systems. A single greenfield facility can demand more than ~ automated stations to meet OEM throughput requirements of ~ units annually. Such high entry barriers restrict new market participation and place financial strain on mid-sized suppliers seeking to expand capacity. Payback periods often extend beyond ~ years, heightening exposure to demand cycle risks.

Opportunities

Expansion of aluminum and composite frame adoption

Lightweighting initiatives have increased aluminum frame usage in select vehicle programs, with adoption rising to nearly ~ units annually across premium pickups and EV platforms. Aluminum-intensive frames reduce vehicle mass by approximately ~ kg per vehicle, supporting compliance with efficiency targets. Composite and hybrid structures, though currently limited to about ~ units annually, offer future potential in specialty and high-performance segments. Suppliers investing in advanced joining technologies and corrosion-resistant treatments are positioned to capture this emerging demand.

Growth in EV-specific skateboard platforms

Electric vehicle production has introduced new skateboard chassis architectures, with frame shipments for EV platforms surpassing ~ units in recent production cycles. These designs integrate battery housings and crash structures into a single load-bearing frame, increasing value per unit to nearly USD ~ compared to conventional designs. As OEMs expand dedicated EV plants capable of producing ~ vehicles annually, demand for specialized frames is expected to grow steadily, creating long-term supply opportunities for structural component manufacturers.

Future Outlook

The USA Automotive Frames market is expected to evolve alongside shifts toward electrification, modular platforms, and lightweight materials. Continued investment in advanced manufacturing and material science will redefine competitive positioning, while regional production hubs will remain central to supply chain resilience. Over the coming years, strategic partnerships between OEMs and Tier I suppliers will play a critical role in shaping innovation and capacity expansion across the structural components ecosystem.

Major Players

- Magna International

- Gestamp

- Benteler Automotive

- Martinrea International

- Metalsa

- Kirchhoff Automotive

- Autokiniton

- CIE Automotive

- thyssenkrupp Automotive Technology

- Hyundai Mobis

- Toyota Boshoku

- JFE Automotive

- ArcelorMittal Tailored Blanks

- voestalpine Automotive Components

- Aisin Corporation

Key Target Audience

- Automotive OEM manufacturing and platform strategy teams

- Tier I and Tier II structural component suppliers

- Electric vehicle startups and contract manufacturers

- Fleet operators and large commercial vehicle buyers

- Automotive-focused private equity and investment funds

- Investments and venture capital firms specializing in mobility

- U.S. Department of Transportation and National Highway Traffic Safety Administration

- State-level economic development and manufacturing policy agencies

Research Methodology

Step 1: Identification of Key Variables

Core demand indicators such as vehicle production volumes, frame material mix, and platform counts were identified. Supply-side variables including manufacturing capacity, tooling intensity, and regional plant distribution were mapped. Regulatory and safety compliance requirements were reviewed to understand structural design constraints.

Step 2: Market Analysis and Construction

Historical production and shipment patterns were analyzed to build baseline demand estimates. Regional manufacturing clusters were assessed based on infrastructure depth and logistics efficiency. Value chain mapping helped define cost structures and integration points across OEM and supplier ecosystems.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary market assumptions were tested through structured discussions with industry executives and engineering leaders. Feedback focused on material trends, EV platform evolution, and capacity expansion strategies. Insights were used to refine demand drivers and opportunity assessments.

Step 4: Research Synthesis and Final Output

All qualitative and quantitative insights were consolidated into a unified market framework. Scenario analysis was applied to future outlook development. Final outputs were structured to align with strategic planning and investment decision needs of industry stakeholders.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, terminology and abbreviations, automotive frame taxonomy across ladder unibody and modular architectures, market sizing logic by vehicle production and frame content value, revenue attribution across materials fabrication assembly and service parts, primary interview program with OEMs Tier 1 frame suppliers body builders and material providers, data triangulation and validation approach, assumptions limitations and data gaps)

- Definition and Scope

- Market evolution

- Usage pathways across vehicle platforms

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising demand for pickup trucks and large SUVs in the US

Platform consolidation and modular vehicle architectures

Lightweighting initiatives to meet fuel economy and emissions targets

Growth of electric vehicles requiring new chassis designs

OEM focus on safety and crashworthiness standards

Localization of frame manufacturing to reduce supply risk - Challenges

Volatility in steel and aluminum prices

High capital intensity of stamping and welding lines

Complexity of multi-material joining technologies

Supply chain disruptions and logistics constraints

Pressure on margins from OEM cost-down programs

Skilled labor shortages in advanced manufacturing - Opportunities

Expansion of aluminum and composite frame adoption

Growth in EV-specific skateboard platforms

Nearshoring and reshoring of structural component production

Digitalization of frame design through simulation and digital twins

Aftermarket demand for reinforced frames in commercial fleets

Strategic partnerships between OEMs and Tier I structure suppliers - Trends

Shift toward modular and scalable frame architectures

Increased use of hot-stamped and ultra-high-strength steel

Integration of sensors for structural health monitoring

Adoption of automation and robotics in frame assembly

Sustainability-driven use of recycled metals

Co-development of frames for autonomous-ready vehicles - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Fleet Type (in Value %)

Passenger vehicles

Light commercial vehicles

Heavy commercial vehicles

Off-highway and specialty vehicles - By Application (in Value %)

Body-on-frame trucks and SUVs

Unibody passenger cars

Electric vehicle skateboard platforms

Specialty and performance vehicles - By Technology Architecture (in Value %)

Steel ladder and perimeter frames

High-strength steel modular frames

Aluminum space frames

Hybrid steel-aluminum structures

Composite and multi-material frames - By End-Use Industry (in Value %)

Automotive OEM production

Contract manufacturing and Tier I integration

Aftermarket replacement and refurbishment

Motorsports and specialty vehicle builders - By Connectivity Type (in Value %)

Non-connected structural frames

Sensor-integrated frames for ADAS calibration

Telematics-enabled chassis for fleet monitoring - By Region (in Value %)

Midwest manufacturing corridor

Southern automotive belt

West Coast EV production hubs

Northeast specialty and aftermarket clusters

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (manufacturing footprint, material technology mix, OEM customer base, platform integration capability, cost competitiveness, innovation pipeline, supply chain resilience, sustainability practices)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Magna International

Gestamp

Benteler Automotive

Aisin Corporation

Martinrea International

thyssenkrupp Automotive Technology

CIE Automotive

Kirchhoff Automotive

Autokiniton

Metalsa

Hyundai Mobis

Toyota Boshoku

JFE Automotive

ArcelorMittal Tailored Blanks

voestalpine Automotive Components

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030