Market Overview

The USA Automotive Hand Tools Market (hand tools primarily used in vehicle maintenance, repair, bodywork, and workshop operations across professional and DIY channels) is valued at USD ~ billion in 2023 and USD ~ billion in 2024. Growth is being pulled by higher tool consumption in repair bays and mobile service workflows (ratcheting systems, torque-control, insulated tools, specialty sockets), and by continued demand for general-purpose mechanic toolsets that anchor routine fastener work, clamps, and cutting tasks across the service lifecycle.

Market activity concentrates in high-density vehicle and repair ecosystems where workshop throughput and tool replenishment are structurally higher—especially the South (large vehicle parc states, sustained residential/commercial activity, and broad retail footprint) and the West (urban growth, infrastructure work, and strong DIY + e-commerce pull). Tool demand also clusters around automotive manufacturing and supplier corridors (Upper Midwest/Great Lakes) and large logistics metros where fleet maintenance intensity raises recurring tool consumption.

Market Segmentation

By Type

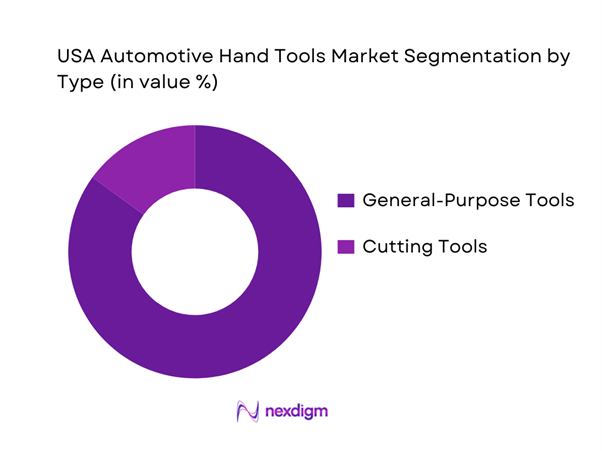

The USA Automotive Hand Tools Market is segmented into general-purpose tools and cutting tools. Recently, general-purpose tools hold a dominant share because automotive service and repair is still fundamentally a fastener-and-access workflow: technicians repeatedly cycle through sockets/ratchets, combination wrenches, torque tools, screwdrivers, pliers, pry tools, and striking tools across preventive maintenance, brakes, suspension, driveline, underbody work, and accessory installs. General-purpose tools also sit at the center of tool-truck replenishment and mechanic starter kits, making them the default procurement bucket for independent shops, dealership bays, and fleet garages. Cutting tools remain essential (trim removal, hose and gasket prep, exhaust/body tasks), but purchase frequency is typically lower than core fastening tools, and many cutting tasks shift to powered solutions—keeping general-purpose kits structurally ahead in recurring demand.

By Distribution Channel

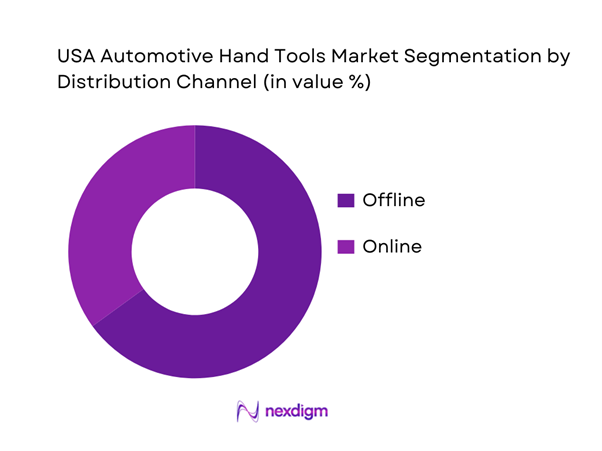

The USA Automotive Hand Tools Market is segmented into offline and online channels. Offline remains dominant because professional automotive buyers often require in-hand evaluation (fit/finish, grip ergonomics, ratchet back-drag, torque feel), immediate availability for bay uptime, and service-layer confidence (warranty swaps, local account terms, and on-route support). This advantage is amplified by the U.S. automotive tool ecosystem where mobile dealer networks and specialty tool outlets bundle tools with financing, weekly visits, and rapid replacement—an operating model aligned to technicians’ cashflow and productivity. Online is growing fast due to assortment breadth and price transparency, but for many pro users, the deciding factor is still downtime risk and warranty friction—areas where offline networks (including tool-truck fulfillment and local distributors) continue to outperform for critical, daily-use mechanic tools.

Competitive Landscape

The USA Automotive Hand Tools Market is fragmented, with a small set of highly influential professional brands (deep mechanic sockets/ratcheting + diagnostics adjacencies) and a wide long-tail of value brands across retail and e-commerce. Competitive intensity is shaped by dealer-route ecosystems, warranty turnaround, SKU depth in automotive specialty tools, and merchandising power in mass retail and online marketplaces.

| Company | Est. Year | Headquarters | Primary Go-to-Market | Automotive Workshop Sweet Spot | SKU Depth Signal | Warranty / Service Model | Core Differentiation | Pro Pricing / Financing Orientation |

| Snap-on | 1920 | Kenosha, Wisconsin, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Stanley Black & Decker | 1843 | New Britain, Connecticut, USA | ~ | ~ | ~ | ` | ~ | ~ |

| Apex Tool Group | 2010 | Sparks, Maryland, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Klein Tools | 1857 | Lincolnshire, Illinois, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Channellock | 1886 | Meadville, Pennsylvania, USA | ~ | ~ | ~ | ~ | ~ | ~ |

USA Automotive Hand Tools Market Analysis

Growth Drivers

Technician Labor Shortage Impact

The U.S. automotive repair labor squeeze is structurally supportive for automotive hand tools because shops compensate for tight labor by standardizing bays, tightening tool control, and investing in time-saving, repeatable hand-tool systems (pre-kitted socket/bit sets, torque discipline tools, quick-change ratchets, modular storage). The scale of the service economy provides the spending “surface area” where tool utilization intensifies: U.S. personal consumption expenditures for motor vehicle maintenance and repair reached USD ~ (annual) versus USD ~ earlier, showing a larger pool of service events where hand tools are consumed, lost, or upgraded. At the same time, U.S. macro capacity remains large—GDP of USD ~ trillion and GDP per capita of USD ~—which sustains high vehicle usage and repair throughput even when labor is constrained, keeping bays active and tool wear high. Tool brands and distributors also see higher attach for ergonomic grips and anti-fatigue designs (lower rework, fewer drops), and for standardized torque/fastener systems that reduce comebacks when junior technicians are onboarded quickly. In practice, labor scarcity shifts purchasing from “nice-to-have” to “must-have” productivity hand tools (fine-tooth ratchets, flex-heads, fastener extraction kits) because saving minutes per RO compounds across a shop day.

Aging Vehicle Parc

An expanding and aging vehicle parc increases the volume of mechanical wear-driven jobs (brakes, suspension, steering, cooling, exhaust fasteners), which are hand-tool intensive due to seized bolts, rounded fasteners, and mixed-material assemblies that require controlled manual force rather than high-torque power tools. Highway Statistics show all motor vehicles registered increasing to ~ versus ~ in the prior reading—more registered units means more annual service demand, and more variability in model years and fastener standards that pushes shops and DIYers to broaden tool inventories (metric/SAE coverage, extraction sets, specialty pliers). This fleet scale sits inside a high-activity macro backdrop (GDP of USD ~ trillion), enabling sustained driving, ownership, and maintenance cycles. The “aging” mechanism that matters for hand tools is not just more vehicles, but more corrosion exposure and deferred repairs; older vehicles often arrive with rusted components, requiring more manual intervention: breaker bars, penetrating/impact-rated sockets (used manually), locking pliers, pry tools, and fastener restoration tools. Shops also tend to keep more redundant hand-tool sets per bay because older-vehicle jobs can tie up tools longer (soak time, staged disassembly), raising replacement demand. In short, higher registered vehicle counts directly increase the installed base for service and collision, and older-vehicle work increases the complexity of manual tasks, both of which expand hand-tool consumption without needing any price-based argument.

Challenges

Price Sensitivity vs Brand Premiums

A key market friction is the buyer split between premium professional brands (durability, warranty ecosystems, truck-based service) and value-driven alternatives (private label, import sets, e-commerce bundles). This tension tightens when macro conditions amplify operating discipline: even with strong output (GDP of USD ~ trillion), inflation (~) and cost-of-living pressures can make technicians and small independents more selective—purchasing fewer “nice” SKUs and focusing on the minimum set needed to complete jobs. The challenge is not that demand disappears; rather, mix shifts toward “good-enough” tools in commodity categories (basic pliers, standard sockets) while premium persists in mission-critical tools (torque, extraction, specialty access). For manufacturers and distributors, that creates margin pressure and higher promo intensity, while also increasing SKU churn because shoppers compare sets aggressively across online marketplaces. Downstream, the service economy remains very large—USD ~ in maintenance and repair consumption—so the market is active, but purchasing behavior becomes more transactional, with technicians delaying upgrades until a breakage event or job requirement forces a replacement. This also raises the importance of warranty execution speed (downtime cost), local availability, and kitting strategies (selling complete, role-based kits rather than single pieces). The premium/value divide is therefore a structural challenge: it forces brands to prove productivity and durability benefits in operational terms (reduced fastener rounding, fewer tool failures) rather than relying on reputation alone.

Counterfeit and Gray Market Tools

Counterfeit and gray-market tools distort channel trust and undermine premium brand economics, especially online where visual similarity is high and provenance is unclear. A credible enforcement signal is the scale of U.S. IPR seizures showing seizures of ~ and a reported monetary value of USD ~, pointing to a high-volume counterfeit ecosystem that can include tools and tool accessories moving through small-parcel pathways. For the hand-tools market, the operational risk is severe: counterfeit metallurgy and heat treatment can cause sudden failures (shattered sockets, stripped ratchets), increasing injury risk and shop downtime. Gray-market imports can also bypass authorized warranty channels, reducing the perceived value of premium tools and shifting buyers to “one-and-done” behavior. Macro context supports the “why now”: with GDP per capita of USD ~, e-commerce penetration and discretionary spend remain significant, and that demand is exactly what counterfeit networks target. The market response (authentication labels, serial verification, tighter authorized dealer programs) adds cost and complexity for legitimate brands and distributors. For buyers, counterfeit risk increases the value of reputable trade channels (industrial distributors, authorized tool trucks) even if unit prices are higher, but the presence of cheap fakes continues to pressure brand premiums and increases the burden of proof on genuine sellers.

Opportunities

EV-Specific Insulated Tools

The EV installed base is already large enough to justify “EV-ready” hand-tool portfolios as a growth lever in professional channels. Electric light-duty vehicles in operation reached ~ thousand, and EV density is concentrated in states that also host large technician workforces and high dealer and service-bay capacity. That creates a scalable opportunity for insulated tool kits, insulated torque tools, and EV-safe non-conductive service tools sold as compliant bundles (reducing procurement friction for dealer groups and national independents). The immediate driver is not future adoption projections; it is current service reality: EVs still require brakes, suspension, tires, thermal-system service, and HV-adjacent inspections—jobs that must be executed with safe tooling and disciplined torque. Macro support remains strong (GDP per capita USD ~), enabling continuing platform mix sophistication and employer willingness to equip technicians for higher-value service work. Tool makers can also differentiate through training and certification ecosystems around insulated-tool usage, periodic dielectric testing protocols, and kitting aligned to common EV service procedures. This is a “must-comply” category: once a shop commits to EV work, insulated hand tools become a gating item, creating recurring demand through replacement, calibration, and expansion across multiple bays.

Lightweight Ergonomic Designs

Ergonomics is an actionable opportunity because it addresses a constraint buyers feel every day: technician fatigue and injury risk during repetitive manual tasks (ratcheting, gripping, prying, overhead work). In a tight labor environment with modeled unemployment at ~, keeping technicians productive and reducing strain is economically meaningful for shops (fewer missed shifts, more consistent throughput). The scale of repair activity reinforces adoption: annual consumer spending on motor vehicle maintenance and repair is USD ~, indicating very high job volume where incremental efficiency and reduced fatigue compound across millions of labor-hours. Lightweight, high-strength alloys, optimized handle geometry, and vibration and pressure-distributing grips can reduce micro-fatigue, especially in high-frequency operations like fastener run-down and trim work. Importantly, ergonomics can be “sold” without relying on tool pricing: it is positioned as a productivity and retention lever—shops standardize ergonomic hand tools to reduce the physical toll on less-experienced technicians and to improve consistency across bays. In a USD ~ trillion GDP economy with broad vehicle ownership, this translates into repeatable procurement: dealer groups can roll out ergonomic standards across locations, fleets can mandate safer hand tools for in-house maintenance teams, and distributors can package ergonomic kits as role-based assortments (lube tech, brake specialist, EV tech).

Future Outlook

Over the next five-to-six years, the USA Automotive Hand Tools Market is expected to expand steadily as repair complexity increases (ADAS-adjacent service steps, EV safety procedures, new materials), while technician scarcity pushes shops toward productivity tooling (better access, faster fastener cycles, reduced rework). Channel strategy will keep shifting: offline remains crucial for uptime and warranty velocity, while online keeps gaining for replenishment, accessory SKUs, and price-led bundles. Manufacturers that win will be those that pair automotive specialty depth with fast warranty execution and mechanic-centric merchandising.

Major Players

- Snap-on

- Stanley Black & Decker

- Apex Tool Group

- Matco Tools

- Mac Tools

- Cornwell Quality Tools

- Klein Tools

- Channellock

- Milwaukee Tool

- Bosch Tools

- Wiha Tools USA

- Wera Tools

- RIDGID

- Harbor Freight Tools

Key Target Audience

- Automotive tool manufacturers and brand owners

- Tool-truck / mobile dealer networks and franchise operators

- Automotive aftermarket distributors and industrial suppliers

- National and regional repair chains

- Dealership groups and OEM-authorized service networks

- Fleet owners and fleet maintenance operators

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We build an automotive service–anchored tool ecosystem map covering technicians, repair formats (dealer/independent/fleet), dealer-route models, retail/e-commerce channels, and key product families (ratcheting/torque/specialty). Secondary research is used to define scope boundaries and standardize terminology across brands and channels.

Step 2: Market Analysis and Construction

We structure the market using channel-by-channel and use-case-by-use-case logic (professional bays vs DIY maintenance), aligning “type” and “distribution” segmentation to observed buying behavior. The approach emphasizes how fastener workflows, warranty expectations, and replenishment cycles shape spend concentration.

Step 3: Hypothesis Validation and Expert Consultation

We validate demand drivers and channel mechanics through expert interviews with route dealers, shop owners, parts distributors, and category managers. These discussions confirm purchase triggers (bay downtime, warranty turnaround, specialty tool needs) and refine assumptions around channel mix and toolkit composition.

Step 4: Research Synthesis and Final Output

We triangulate insights across published market benchmarks, channel realities, and competitive positioning to produce an actionable, business-facing view—highlighting where brands win (SKU depth, warranty velocity, financing, merchandising) and where whitespace exists (EV-ready kits, productivity tooling, digital replenishment).

- Executive Summary

- Research Methodology (Market Definitions and Scope Boundaries, Automotive Hand Tools Taxonomy and Tool-Class Mapping, OEM vs Aftermarket Usage Framework, Workshop Penetration Modeling, SKU-Level Bottom-Up Sizing Logic, Distributor-Led Validation, Technician Interviews and Workshop Audits, Price-Band Normalization Logic, Data Triangulation Across Retail, Pro and Industrial Channels, Research Limitations and Assumptions)

- Definition and Scope

- Market Genesis and Evolution of Automotive Hand Tools

- Industry Timeline and Technology Inflection Points

- Automotive Hand Tools Value Chain Analysis

- Stakeholder Ecosystem Mapping

- Growth Drivers

Technician Labor Shortage Impact

Aging Vehicle Parc

Rising Repair Complexity

EV Service Tooling Needs

Workshop Productivity Pressures - Challenges

Price Sensitivity vs Brand Premiums

Counterfeit and Gray Market Tools

Skilled Technician Attrition

Import Dependence of Forged Tools - Opportunities

EV-Specific Insulated Tools

Lightweight Ergonomic Designs

Tool Subscription Models

Fleet-Dedicated Tool Kits - Trends

Modular Tool Systems

Lifetime Warranty as Differentiator

Digitally Enabled Tool Tracking

Private Label Expansion - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Unit Volumes, 2019–2024

- By Average Selling Price, 2019–2024

- By Fleet Type (in Value %)

Passenger Vehicles

Light Commercial Vehicles

Heavy Commercial Vehicles

Electric Vehicles and Hybrids

Fleet and Rental Vehicles - By Application (in Value %)

Wrenches and Spanners

Sockets and Ratchets

Screwdrivers and Nut Drivers

Torque Tools

Specialty Automotive Tools - By Technology Architecture (in Value %)

Conventional Forged Tools

Heat-Treated Alloy Tools

Insulated Tools for EVs

Lightweight Composite-Handled Tools

Modular and Interchangeable Tool Systems - By Connectivity Type (in Value %)

Non-Connected Manual Tools

Digitally Enabled Torque Measurement Tools

Tool Tracking and Identification Enabled Tools - By End-Use Industry (in Value %)

OEM Dealership Service Centers

Independent Repair Shops

Franchise and Multi-Brand Chains

Fleet Maintenance Workshops

Collision Repair and Body Shops - By Region (in Value %)

Northeast

Midwest

South

West

- Market Share Analysis by Value and Volume

- Cross Comparison Parameters (Product Breadth Depth, Automotive-Grade Tool Coverage, Forging and Metallurgy Capability, Warranty Structure and Claim Rate, Distribution Reach Density, Mobile Tool Support Presence, Average Tool Lifespan in Workshop Use, Brand Premium Index)

- Competitive Benchmarking and Positioning Matrix

- Pricing Analysis by Tool Category and Brand Tier

- Detailed Company Profiles

Snap-on Incorporated

Stanley Black & Decker

Mac Tools

Matco Tools

Cornwell Tools

Proto Tools

GearWrench

Craftsman

Klein Tools

SK Tools

Husky Tools

Tekton Tools

Wera Tools

Facom

Bahco

- Tool Purchase Decision-Making Framework

- Tool Utilization Intensity and Replacement Patterns

- Brand Loyalty vs Price Switching Behavior

- Warranty Expectations and After-Sales Service Importance

- Pain Points Across Technician and Workshop Owners

- By Value, 2025–2030

- By Unit Volumes, 2025–2030

- By Average Selling Price, 2025–2030