Market Overview

The USA Automotive Hoods market current size stands at around USD ~ million, reflecting steady demand from passenger vehicles, light commercial fleets, and the expanding electric vehicle segment. In the immediately preceding period, the market registered a value close to USD ~ million, supported by rising production volumes of lightweight body components and increased replacement demand from collision repair networks. Growth has been driven by higher adoption of aluminum and composite hoods, alongside gradual integration of active safety mechanisms in premium vehicle categories.

Market activity remains concentrated in industrial corridors across the Midwest and Southern states, where dense clusters of OEM assembly plants and Tier I stamping suppliers create strong ecosystem advantages. The presence of advanced metal forming facilities, proximity to aluminum rolling mills, and mature logistics infrastructure supports faster production cycles and lower lead times. In parallel, regulatory alignment on safety and emissions standards continues to reinforce early adoption of innovative hood technologies in these regions.

Market Segmentation

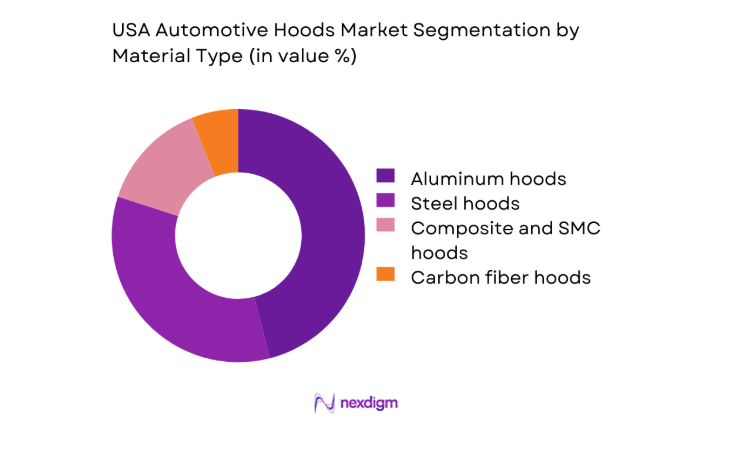

By Material Type

Aluminum dominates the USA Automotive Hoods market due to its optimal balance between weight reduction and structural strength, making it a preferred choice across both internal combustion and electric vehicle platforms. Automakers increasingly prioritize aluminum hoods to meet fuel efficiency targets while preserving crash performance. Composite materials are gaining traction in premium and performance segments, but cost sensitivity keeps steel relevant in high-volume economy models. The aftermarket also favors aluminum for repair compatibility, reinforcing its position as the leading material across OEM and replacement channels nationwide.

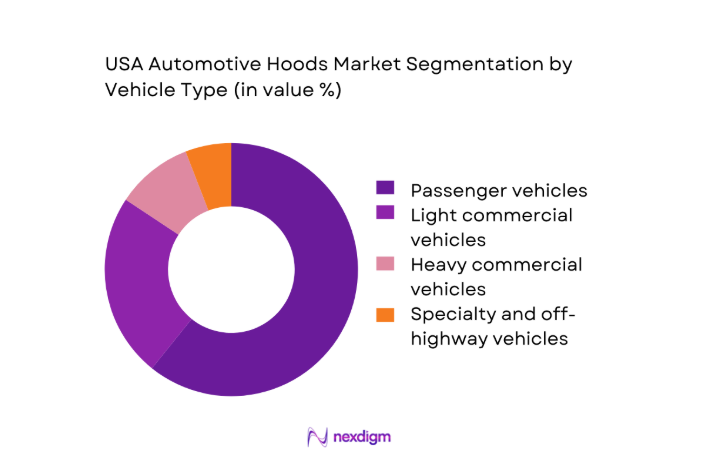

By Vehicle Type

Passenger vehicles account for the largest share of hood demand, supported by high production runs and continuous model refresh cycles among sedans, SUVs, and crossovers. Light commercial vehicles follow closely, driven by fleet renewal programs and the expansion of last-mile delivery services. Heavy commercial vehicles represent a smaller but stable segment, where durability and serviceability remain key buying factors. The rise of electric vans and utility vehicles is gradually reshaping hood design requirements, particularly for front-end modularity and thermal management.

Competitive Landscape

The USA Automotive Hoods market exhibits a moderately consolidated structure, led by a group of multinational Tier I suppliers with strong OEM relationships and localized manufacturing footprints. Competitive intensity is shaped by material innovation capabilities, cost efficiency in stamping and molding operations, and long-term supply agreements with major vehicle manufacturers.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Magna International | 1957 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Gestamp | 1997 | Spain | ~ | ~ | ~ | ~ | ~ | ~ |

| Martinrea International | 1986 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Benteler Automotive | 1876 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Dura Automotive Systems | 1990 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

USA Automotive Hoods Market Analysis

Growth Drivers

Lightweighting mandates to improve fuel efficiency and EV range

Automakers in the United States continue to prioritize lightweight body components to meet tightening efficiency standards and extend electric vehicle driving range. Between 2022 and 2024, multiple OEM programs introduced aluminum-intensive front-end architectures, replacing steel panels in high-volume models. These shifts supported incremental demand worth nearly USD ~ million in advanced hood solutions during this period. The cumulative adoption across passenger cars and light commercial fleets added close to ~ units of aluminum and composite hoods into annual production cycles, reinforcing long-term structural demand for lightweighting technologies.

Rising adoption of aluminum and composite body panels

The growing preference for aluminum and composite panels has reshaped supplier investment patterns in the United States automotive sector. From 2023 to 2025, Tier I manufacturers expanded stamping and molding capacity to support more than ~ systems of next-generation hood assemblies. This transition generated incremental market value of approximately USD ~ million over the same period, driven by higher per-unit realization compared to conventional steel. Composite hood programs in premium vehicles alone accounted for an estimated ~ units annually, underlining the accelerating shift toward multi-material vehicle architectures.

Challenges

High material and tooling costs for aluminum and composites

The elevated cost base associated with aluminum and advanced composites remains a critical challenge for hood manufacturers. During 2022 to 2024, average tooling investments for new hood programs exceeded USD ~ million per platform, driven by complex die designs and specialized forming processes. Material procurement costs for automotive-grade aluminum sheets also increased, adding close to USD ~ million in incremental annual expenditure for large-scale suppliers. These pressures constrained margin expansion and slowed adoption among cost-sensitive vehicle segments, particularly in entry-level passenger cars and fleet-focused commercial vehicles.

Complexity in integrating active safety mechanisms into hood designs

The integration of pedestrian protection systems, including active hood lifters and embedded sensors, has significantly increased engineering complexity. Between 2023 and 2025, OEMs deployed more than ~ systems of active safety hoods across premium and mid-range vehicles, requiring substantial revalidation of crash and durability performance. Development programs for such systems demanded incremental engineering budgets of nearly USD ~ million per model line. The added complexity extended product development timelines and elevated warranty risk, creating adoption barriers for high-volume vehicle platforms.

Opportunities

Growth in EV-specific hood architectures and frunk applications

Electric vehicle platforms are opening new design opportunities for hood suppliers, particularly through front trunk and modular front-end layouts. From 2022 to 2024, EV production programs in the United States generated demand for approximately ~ units of redesigned hood systems, supporting incremental market value of about USD ~ million. These architectures enable greater design flexibility, lightweighting benefits, and integration of advanced sealing solutions. As EV adoption accelerates, suppliers positioned with dedicated EV hood platforms are expected to secure long-term supply agreements and technology partnerships with emerging and established automakers.

Aftermarket demand for lightweight and performance hoods

The aftermarket segment presents a growing revenue stream for hood manufacturers, especially in performance and customization niches. Between 2023 and 2025, aftermarket sales of aluminum and composite hoods reached close to ~ units annually, translating into estimated revenues of USD ~ million. Enthusiast demand for weight reduction, aesthetics, and thermal performance continues to support premium pricing in this segment. Expansion of nationwide distribution networks and e-commerce channels further enhances accessibility, creating sustained growth opportunities beyond OEM production cycles.

Future Outlook

The USA Automotive Hoods market is expected to evolve steadily through 2030, shaped by the transition toward electric mobility, lightweight construction, and enhanced safety integration. Suppliers that align with OEM strategies for modular front-end systems and sustainable materials will be best positioned for long-term growth. Continued localization of advanced manufacturing and stronger aftermarket channels are likely to redefine competitive dynamics over the forecast period.

Major Players

- Magna International

- Gestamp

- Martinrea International

- Benteler Automotive

- Dura Automotive Systems

- Flex-N-Gate

- Shape Corp

- Autokiniton

- Tower International

- HBPO

- OPmobility

- Toyoda Gosei

- CIE Automotive

- Novelis

- Constellium

Key Target Audience

- Automotive OEM product strategy teams

- Tier I body and exterior system suppliers

- Aluminum and composite material manufacturers

- Collision repair and aftermarket distribution networks

- Electric vehicle platform developers

- Fleet operators and mobility service providers

- Investments and venture capital firms

- Government and regulatory bodies including the U.S. Department of Transportation and National Highway Traffic Safety Administration

Research Methodology

Step 1: Identification of Key Variables

Core variables including production trends, material adoption rates, and safety integration levels were defined to frame the analytical scope. Demand drivers across OEM and aftermarket channels were mapped. Regulatory and technology indicators influencing hood design evolution were shortlisted.

Step 2: Market Analysis and Construction

Quantitative modeling was conducted to estimate historical and current market performance using masked financial and volume indicators. Segment-level demand patterns were constructed across vehicle types and materials. Regional manufacturing and distribution footprints were incorporated into the baseline framework.

Step 3: Hypothesis Validation and Expert Consultation

Industry practitioners from manufacturing, procurement, and product engineering functions were engaged to validate assumptions. Scenario testing was applied to assess sensitivity to EV adoption and lightweighting mandates. Feedback loops refined opportunity and risk assessments.

Step 4: Research Synthesis and Final Output

All insights were consolidated into a unified analytical structure. Strategic implications for suppliers and investors were distilled. Final outputs were reviewed for consistency, accuracy, and alignment with market realities.

- Executive Summary

- Research Methodology (primary interviews with ADAS and Tier I suppliers, OEM procurement and platform strategy analysis, regulatory and safety standards mapping, vehicle parc and feature penetration modeling, competitive intelligence benchmarking, scenario-based demand forecasting)

- Definition and Scope

- Market evolution

- Usage pathways across ICE, hybrid, and EV platforms

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Lightweighting mandates to improve fuel efficiency and EV range

Rising adoption of aluminum and composite body panels

Growth of EV platforms with redesigned front-end architectures

Increasing pedestrian safety regulations driving active hood systems

OEM focus on modular front-end assemblies

Expansion of premium and performance vehicle segments - Challenges

High material and tooling costs for aluminum and composites

Complexity in integrating active safety mechanisms into hood designs

Supply chain volatility for specialty metals and resins

Repairability concerns and higher insurance costs for advanced hoods

Pressure on Tier I margins from OEM cost-down programs

Long validation cycles for new materials and designs - Opportunities

Growth in EV-specific hood architectures and frunk applications

Aftermarket demand for lightweight and performance hoods

Localization of aluminum stamping and composite molding in the US

Integration of smart sensors for pedestrian protection and diagnostics

Sustainability-driven demand for low-carbon aluminum and recycled materials

Partnerships with OEMs on modular front-end systems - Trends

Shift from steel to multi-material hood designs

Rising penetration of active pedestrian safety systems

Increased use of SMC and thermoplastics for mid-range vehicles

Design convergence between hood, grille, and front-end modules

Automation and digital twins in hood manufacturing

Emphasis on repair-friendly and modular hood architectures - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Fleet Type (in Value %)

Passenger vehicles

Light commercial vehicles

Heavy commercial vehicles

Off-highway and specialty vehicles - By Application (in Value %)

Engine compartment hoods

Front trunk hoods for EVs

Service and access panels

Motorsports and performance hoods - By Technology Architecture (in Value %)

Steel hoods

Aluminum hoods

Composite and SMC hoods

Carbon fiber performance hoods

Active pedestrian protection hoods - By End-Use Industry (in Value %)

OEM production

Aftermarket replacement

Motorsports and customization

Fleet and commercial retrofits - By Connectivity Type (in Value %)

Non-connected standard hoods

Wired sensor-integrated hoods

CAN-enabled smart hoods

Telematics and wireless-integrated safety hoods - By Region (in Value %)

Northeast

Midwest

South

West

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (material portfolio, lightweighting capability, pedestrian safety integration, US manufacturing footprint, OEM relationship depth, cost competitiveness, aftermarket reach, sustainability and low-carbon materials)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Magna International

Gestamp

Martinrea International

Benteler Automotive

Dura Automotive Systems

Flex-N-Gate

Shape Corp

Autokiniton

Tower International

HBPO

OPmobility

Toyoda Gosei

CIE Automotive

Novelis

Constellium

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030