Market Overview

The USA paint booth market, one of the core capex categories inside automotive painting equipment is valued at USD ~ million in the latest year, with the broader purchasing environment supported by refinish activity: U.S. automotive refinish coatings sales were USD ~ billion in the prior year and were projected to increase to USD ~ billion in the latest year, reflecting higher repair throughput and material usage that typically triggers booth upgrades, filtration replacements, and airflow/controls retrofits.

Within the USA, dominance is concentrated in automotive manufacturing and refinish hubs such as the Midwest and the Southern automotive corridor due to dense OEM and supplier footprints, while large population states with high vehicle parc density drive refinish demand. Globally, technology leadership and equipment design standards influencing the market are shaped by engineering ecosystems in Europe and advanced automation platforms from Asia, which drive robotics integration, airflow control systems, and digital paint-process management adopted by USA facilities.

Market Segmentation

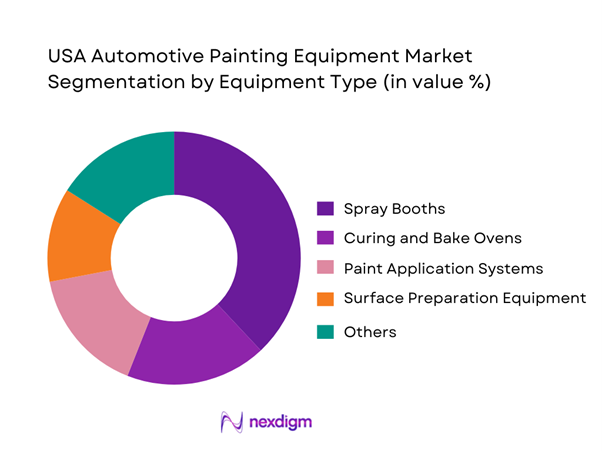

By Equipment Type

The USA Automotive Painting Equipment market is segmented by equipment type into spray booths, curing and bake ovens, paint application systems, surface preparation equipment, filtration and air management systems, and paint mixing rooms. Spray booths dominate the market as they form the core controlled environment necessary for achieving consistent finish quality, regulatory compliance, and throughput optimization. Booths are typically the most capital-intensive asset in a paint shop and are the primary determinant of airflow stability, contamination control, and temperature management. Their dominance is reinforced by mandatory replacement cycles driven by filtration degradation, airflow inefficiencies, and evolving environmental requirements, making them the focal point of both greenfield and retrofit investments.

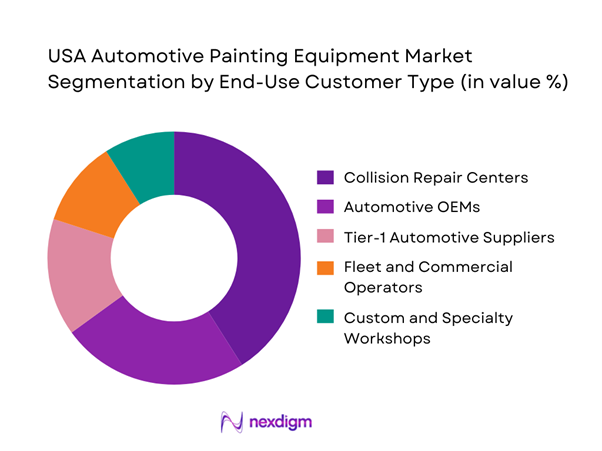

By End-Use Customer Type

By end-use customer type, the market is segmented into automotive OEMs, tier-1 automotive suppliers, collision repair centers, fleet and commercial vehicle operators, and custom or specialty vehicle workshops. Collision repair centers dominate due to the sheer scale and recurring nature of refinishing activity across the country. High accident frequency, insurance-driven repair workflows, and the need to reduce cycle time and rework push these facilities to continuously invest in booth upgrades, curing efficiency, and application precision. The rise of multi-shop operators further strengthens this segment, as standardized equipment procurement across networks accelerates volume purchasing and replacement demand.

Competitive Landscape

The USA Automotive Painting Equipment market is dominated by a few major players, including Dürr and global or regional brands like ABB, FANUC, and Global Finishing Solutions. This consolidation highlights the significant influence of these key companies.

| Company | Established | Headquarters | Core Offering Fit | Typical Buyer Fit | Automation / Robotics Depth | Aftermarket & Service Model | Controls / Digital Capability | Retrofit Strength |

| Dürr | 1896 | Germany (near Stuttgart region) | ~ | ~ | ~ | ~ | ~ | ~ |

| ABB | 1988 | Zurich, Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| FANUC | 1972 | Oshino-mura, Yamanashi, Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Global Finishing Solutions (GFS) | 1975 | Osseo, Wisconsin, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Nordson | 1954 | Westlake, Ohio, USA | ~ | ~ | ~ | ~ | ~ | ~ |

USA Automotive Painting Equipment Market Analysis

Growth Drivers

Expansion of Collision Repair Activity

Collision repair activity across the USA continues to intensify due to sustained growth in the vehicle parc, higher average vehicle age, and increased traffic density across urban and suburban corridors. As vehicles remain on the road for longer periods, the probability of minor and moderate collisions rises, directly increasing repainting and refinishing requirements. Collision repair centers are under constant pressure from insurers to reduce cycle times while maintaining OEM-grade finish standards, pushing shops to invest in higher-throughput painting equipment. Advanced spray booths, rapid curing systems, and optimized airflow designs enable faster turnaround without compromising surface quality. Additionally, the consolidation of collision repair into multi-shop operators has standardized performance benchmarks across locations, accelerating equipment replacement and retrofit decisions. These operational pressures collectively sustain continuous demand for automotive painting equipment, particularly systems that enhance productivity, reduce rework, and support predictable repair timelines in a high-volume collision repair environment.

Automation Adoption in OEM Paint Shops

OEM paint shops are progressively adopting automation to address variability, efficiency, and labor dependency challenges inherent in conventional painting operations. Automotive painting is a precision-critical process where inconsistency directly impacts aesthetics, corrosion resistance, and downstream assembly quality. Robotic painting systems, automated spray arms, and digitally controlled curing environments allow OEMs to achieve consistent film thickness, uniform color application, and repeatable surface finishes across high production volumes. Automation also minimizes material wastage by improving transfer efficiency and reducing overspray, which is particularly important for complex multi-layer coatings. Digitally integrated booths enable real-time process monitoring, recipe control, and defect traceability, supporting higher first-pass yield. As OEMs increasingly prioritize platform standardization and flexible manufacturing, automated and robotics-ready paint shop equipment becomes a foundational investment, reinforcing long-term demand for advanced automotive painting systems.

Challenges

High Capital Investment Requirements

Automotive painting equipment requires substantial upfront capital because it functions as an integrated system rather than a standalone asset. Spray booths must be paired with engineered ventilation, filtration, humidity control, fire suppression, and curing infrastructure, significantly increasing installation complexity and initial investment. Fully automated and robotics-integrated paint shops further raise capital intensity due to advanced controls, sensors, and safety systems. Smaller collision repair operators and independent body shops often face financial constraints that delay modernization, even when operational inefficiencies are evident. Long approval cycles, financing hurdles, and uncertain demand visibility can extend equipment replacement timelines. During periods of production volatility or repair volume fluctuations, decision-makers tend to prioritize asset utilization over capital upgrades. This creates uneven adoption across market segments, where only larger operators and OEMs can consistently absorb high initial costs despite the long-term efficiency and quality benefits of modern painting equipment.

Skilled Labor Shortage in Paint Operations

Despite increasing automation, automotive painting remains highly dependent on skilled technicians for setup, calibration, maintenance, and quality control. Paint preparation, surface inspection, defect correction, and color matching require experience and technical judgment that cannot be fully automated. Across the USA, the availability of experienced paint technicians has tightened due to workforce aging, reduced vocational enrollment, and competition from other industrial sectors. Labor shortages increase downtime risks, particularly when advanced equipment requires specialized knowledge to operate optimally. Inadequate staffing can also prevent full utilization of high-performance booths and automated systems, reducing return on investment. For OEMs and large repair networks, this challenge elevates dependency on supplier-led training, remote diagnostics, and service contracts. In smaller facilities, labor constraints may discourage adoption of complex equipment, reinforcing reliance on legacy systems even when productivity gains are achievable.

Opportunities

Retrofit and Modernization of Legacy Paint Booths

The USA has a substantial installed base of legacy paint booths that were designed for older coating technologies, lower throughput expectations, and less stringent environmental controls. Rather than pursuing full replacement, many operators are opting for targeted retrofits that modernize airflow management, filtration systems, lighting, and digital controls. Retrofitting allows shops to improve paint quality consistency, reduce contamination, and increase throughput while minimizing downtime and capital disruption. Upgrades such as variable-speed fans, improved exhaust filtration, and programmable temperature control extend equipment life and align operations with current compliance requirements. For equipment suppliers, retrofit programs create recurring revenue opportunities through modular upgrades, service contracts, and long-term maintenance agreements. This modernization trend is particularly attractive to multi-location repair networks and industrial finishers seeking standardized performance improvements without rebuilding facilities.

Energy-Efficient and Low-Emission System Demand

Energy efficiency and emission control are becoming decisive procurement criteria for automotive painting equipment as operators seek to manage operating costs and regulatory exposure. Paint booths and curing ovens are among the most energy-intensive assets in repair and manufacturing facilities due to continuous ventilation and heating requirements. Technologies such as low-bake curing systems, heat recovery units, and optimized airflow designs significantly reduce energy consumption while maintaining finish quality. Waterborne-compatible systems and improved overspray capture also help reduce emissions and waste handling requirements. As environmental scrutiny increases at state and municipal levels, operators prioritize equipment that supports compliance without sacrificing productivity. Suppliers that integrate energy optimization, digital monitoring, and emission-reduction capabilities into their offerings gain a competitive edge, positioning themselves as long-term partners in operational efficiency rather than standalone equipment vendors.

Future Outlook

Over the coming years, the USA Automotive Painting Equipment market is expected to expand steadily, driven by sustained collision repair demand, ongoing OEM automation investments, and regulatory-driven modernization. Strategic focus will shift toward smart, energy-efficient systems with enhanced digital monitoring, while retrofit-led growth will play a central role in supplier revenue strategies.

Major Players

- Dürr

- ABB

- FANUC

- Global Finishing Solutions

- Nordson

- Graco

- Carlisle Fluid Technologies

- SAMES

- Blowtherm

- USI Italia

- Col-Met

- Garmat

- Accudraft

Key Target Audience

- Automotive OEM manufacturing units

- Tier-1 automotive component manufacturers

- Collision repair multi-shop operators

- Independent high-volume body shops

- Fleet and commercial vehicle operators

- Automotive equipment distributors

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The research begins by mapping the automotive painting ecosystem, identifying equipment categories, end-user segments, and regulatory touchpoints influencing demand dynamics.

Step 2: Market Analysis and Construction

Historical demand indicators are aligned with equipment adoption patterns to construct a coherent view of market size, installed base evolution, and revenue mix.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions are validated through structured interactions with industry participants, including manufacturers, distributors, and end users, to refine market logic.

Step 4: Research Synthesis and Final Output

Insights from primary and secondary inputs are synthesized, ensuring internal consistency and delivering a validated, client-ready market assessment.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Automotive Painting Equipment Usage and Value-Chain Mapping

- Business Cycle and Demand Seasonality

- USA Automotive Manufacturing and Refinish Delivery Architecture

- Growth Drivers

Expansion of Collision Repair Activity

Automation Adoption in OEM Paint Shops

Shift Toward Environmentally Compliant Coating Systems

Rising Vehicle Customization and Refinishing Demand

Operational Efficiency and Quality Consistency Requirements - Challenges

High Capital Investment Requirements

Skilled Labor Shortage in Paint Operations

Complex Environmental and Safety Compliance

Maintenance Downtime and Throughput Risks

Long Equipment Replacement Cycles - Opportunities

Retrofit and Modernization of Legacy Paint Booths

Energy-Efficient and Low-Emission System Demand

Integration of Digital Controls and Predictive Maintenance

Expansion of Multi-Shop Operator Networks

Growth in Electric and Specialty Vehicle Production - Trends

- Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Revenue, 2019–2024

- By Installed Base Expansion, 2019–2024

- By Average System Selling Price, 2019–2024

- By Equipment Type (in Value %)

Spray Booths

Curing and Bake Ovens

Paint Application Systems

Surface Preparation Equipment

Filtration and Air Management Systems

Paint Mixing Rooms and Kitchens - By Automation Level (in Value %)

Manual Painting Systems

Semi-Automated Painting Systems

Fully Automated Robotic Painting Systems

Hybrid Assisted Painting Systems

Digitally Controlled Painting Cells - By Technology Type (in Value %)

Solvent-Based Compatible Equipment

Water-Based Compatible Equipment

Powder Coating Equipment

Low-Bake and Infrared Systems

Electrostatic Painting Technology - By Distribution Model (in Value %)

Direct OEM Sales

Authorized Distributors

System Integrators and Turnkey Providers

Aftermarket and Replacement Sales - By End-Use Customer Type (in Value %)

Automotive OEMs

Tier-1 Automotive Suppliers

Collision Repair Centers

Fleet and Commercial Vehicle Operators

Custom and Specialty Vehicle Workshops - By Region (in Value %)

Midwest

Southern Automotive Corridor

West Coast

Northeast

- Competition ecosystem overview

- Cross Comparison Parameters (Product portfolio breadth, automation capability, energy efficiency, regulatory compliance readiness, aftermarket service coverage, system integration capability, digital controls sophistication, retrofit flexibility)

- SWOT analysis of major players

Pricing and commercial model benchmarking - Detailed Profiles of Major Companies

Dürr

ABB

FANUC

Global Finishing Solutions

Nordson

Graco

Carlisle Fluid Technologies

SAMES

Blowtherm

USI Italia

Col-Met

Garmat

Accudraft

Paintline

Rohner

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Revenue, 2025–2030

- By Installed Base Expansion, 2025–2030

- By Average System Selling Price, 2025–2030