Market Overview

The USA autopilot system market is valued in billions ~ USD, driven by rising demand for autonomous technologies across aviation sectors, including commercial, military, and private aviation. The market is influenced by advancements in artificial intelligence, machine learning, and sensor technologies, which enhance the reliability and safety of autopilot systems. The increase in air traffic, coupled with stringent regulations on aviation safety, is further accelerating the demand for automated flight systems. Based on a recent historical assessment, the market is poised for significant expansion, with a strong push from both governmental and commercial investments.

The United States dominates the market due to its leadership in aviation technology development, supported by strong investments from aerospace giants, government programs, and military contracts. The integration of autopilot systems into civilian and military aircraft across cities like Seattle, Los Angeles, and Washington, D.C., reflects the country’s strategic focus on autonomous systems. Factors such as the country’s robust infrastructure, technological expertise, and regulatory framework ensure global dominance in the autopilot market. Leading aerospace manufacturers and defense contractors in the U.S. contribute heavily to this growth.

Market Segmentation

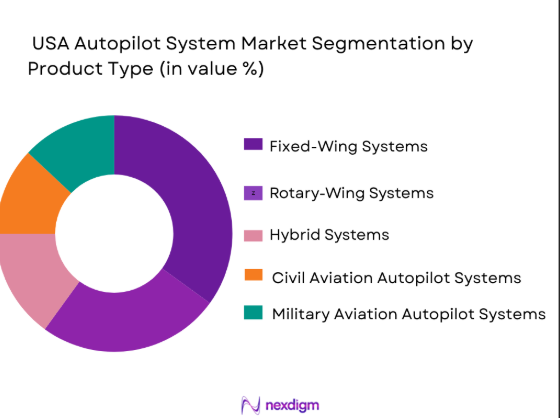

By Product Type

The USA autopilot system market is segmented by product type into fixed-wing systems, rotary-wing systems, hybrid systems, civil aviation autopilot systems, and military aviation autopilot systems. Recently, fixed-wing systems have had a dominant market share due to factors such as greater demand from commercial airlines, ease of integration into large aircraft, and their ability to handle long-range flights with minimal human intervention. Additionally, the increasing focus on reducing pilot workload and improving flight safety contributes to the growth of fixed-wing autopilot systems in both civilian and military applications.

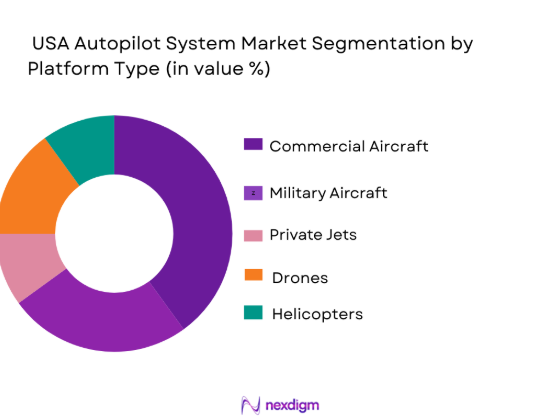

By Platform Type

The market is segmented by platform type into commercial aircraft, military aircraft, private jets, drones, and helicopters. Commercial aircraft has the dominant market share due to the increasing adoption of autopilot systems for long-haul flights, along with the growing need to improve operational efficiency, safety, and cost-effectiveness. The growing number of international air travel passengers and the need for advanced automation in commercial aviation have made autopilot systems a vital component of modern aircraft, driving the demand for these systems in the commercial aviation segment.

Competitive Landscape

The USA autopilot system market is highly competitive, with major players dominating both the civilian and military segments. Consolidation within the market is prevalent as leading companies integrate new technologies into their systems, often collaborating with governments and military agencies. The competition is fierce among aerospace giants, each vying for dominance in both commercial and defense sectors. Major players are investing in advanced sensor technologies, machine learning algorithms, and autonomous flight systems to gain a competitive edge.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| Boeing | 1916 | Chicago, Illinois | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | Phoenix, Arizona | ~ | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | Cedar Rapids, Iowa | ~ | ~ | ~ | ~ | ~ |

| Garmin International | 1989 | Olathe, Kansas | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, Virginia | ~ | ~ | ~ | ~ | ~ |

USA autopilot system Market Analysis

Growth Drivers

Advancements in Artificial Intelligence

The integration of AI and machine learning into autopilot systems is revolutionizing the aviation industry. AI enhances autopilot capabilities by improving decision-making, real-time data processing, and flight optimization. AI systems can monitor and analyze vast amounts of flight data, adapt to changing conditions, and enhance system reliability. This has led to a surge in the adoption of AI-powered autopilot systems, especially in commercial aircraft and military drones. Furthermore, AI’s ability to reduce pilot workload and improve overall flight safety plays a pivotal role in increasing the demand for autonomous flight technologies across the aviation sector. Additionally, advancements in AI algorithms continue to improve autopilot systems’ accuracy, making them more efficient and capable of handling complex flight scenarios. The ongoing research and development in AI technologies suggest significant growth potential for the autopilot system market, as aviation companies are increasingly investing in automation for operational cost reductions and safety enhancements. AI has become a critical component in making flight operations safer, more predictable, and highly efficient, contributing to its growth in the autopilot system market.

Technological Advancements in Sensor Technologies

The development of advanced sensors is another key driver for the growth of the autopilot system market. New sensor technologies, such as LiDAR, radar, and infrared imaging, enable more precise monitoring of the environment surrounding the aircraft. These sensors are essential for ensuring safety by detecting obstacles, tracking weather patterns, and adjusting flight paths automatically based on real-time data. The integration of these sensors into autopilot systems has enhanced their capability to operate in a wider range of conditions, including poor visibility, adverse weather, and complex maneuvers. Furthermore, sensor systems have become more cost-effective, making their integration into various aircraft more accessible. The improved performance of sensors, coupled with their ability to integrate seamlessly with AI-driven systems, has significantly increased the adoption of autopilot technologies in both the military and commercial sectors. The ongoing improvements in sensor reliability and accuracy are expected to drive the growth of autopilot systems, further enhancing their market penetration in aviation.

Market Challenges

High Initial Investment Costs

One of the key challenges facing the USA autopilot system market is the high initial investment required for the installation of these advanced technologies. The upfront cost of acquiring, installing, and maintaining autopilot systems can be a significant barrier, particularly for smaller operators or those in the private aviation sector. While these systems offer long-term operational cost savings, the capital required for their adoption can deter many potential customers. Commercial airlines and military organizations typically have the financial capacity to invest in these systems, but smaller aviation companies may struggle to justify the initial expense. Moreover, the complexity of integrating autopilot systems into existing aircraft, along with the need for frequent updates to keep up with technological advancements, further contributes to the overall cost. Although technology’s long-term benefits are undeniable, the high initial capital requirement remains a key challenge in the widespread adoption of autopilot systems, especially in emerging markets where budget constraints are more pronounced.

Regulatory Challenges in Autonomous Aviation

Another major challenge in the USA autopilot system market is the complex regulatory environment surrounding autonomous flight technologies. While there is significant interest in the deployment of fully autonomous aircraft, the regulatory frameworks governing these systems are still evolving. The Federal Aviation Administration (FAA) and other international regulatory bodies are working to establish clear guidelines and safety standards for autonomous flight systems. However, these regulations are still in development, which creates uncertainty for manufacturers and operators looking to integrate autopilot systems into their fleets. The slow pace of regulatory approval and the lack of standardized global regulations could delay the widespread adoption of autonomous flight systems. Additionally, the need for rigorous testing, certification, and validation processes means that companies must navigate a complex regulatory landscape before bringing these systems to market. As regulators work to address these challenges, the market for autopilot systems may experience slowdowns in adoption, particularly civilian applications where regulatory approval is a prerequisite for widespread use.

Opportunities

Integration with Electric Aircraft

One significant opportunity in the USA autopilot system market lies in the integration of autopilot technologies with electric aircraft. The growing interest in electric aviation, driven by sustainability concerns and the desire for cost-effective flight solutions, presents a promising opportunity for autopilot systems. Electric aircraft, such as urban air mobility (UAM) vehicles and small commuter planes, often rely on advanced autopilot technologies for optimal performance. These vehicles require sophisticated flight management systems that can handle complex flight paths, manage energy efficiency, and ensure passenger safety. The integration of autopilot systems in electric aircraft could reduce pilot workload, enhance operational safety, and optimize fuel efficiency, making electric aviation a viable option for short regional flights and urban air taxis. As the electric aviation sector grows, the demand for autopilot systems in these aircraft is expected to increase, opening up new market segments for autopilot technology providers. Furthermore, governments and private investors are showing strong support for electric aviation development, creating a favorable environment for autopilot systems to flourish in this emerging market.

Expansion of Autonomous Delivery Drones

Another opportunity for the USA autopilot system market is the rapid expansion of autonomous delivery drones. The rise in e-commerce and the growing demand for fast, efficient delivery services have led to an increase in the use of drones for logistics. Autonomous delivery of drones rely heavily on autopilot systems to navigate, avoid obstacles, and complete deliveries autonomously. As regulatory frameworks evolve to support drone operations, companies are investing in the development of advanced autopilot systems that can ensure the safe and reliable operation of these drones in urban environments. The expansion of autonomous delivery networks presents a significant growth opportunity for autopilot system providers, as demand for these systems is expected to grow rapidly in the coming years. Additionally, the adoption of drones for delivering medical supplies, food, and other essential goods could drive further innovation in autopilot technology, creating a burgeoning market for autopilot systems in the logistics and delivery sectors. This segment represents a dynamic and rapidly expanding opportunity for the autopilot system market.

Future Outlook

The USA autopilot system market is set to experience significant growth over the next five years, driven by ongoing advancements in AI, machine learning, and sensor technologies. These developments will enable more efficient and reliable flight automation systems. Moreover, the increasing demand for autonomous flight solutions in both commercial and military applications, coupled with supportive government policies and investments in the aviation industry, will propel the market forward. Technological advancements, along with the regulatory frameworks that are expected to evolve, will play a crucial role in shaping the future of the market. The continued integration of autopilot systems into electric aircraft and drones will open new opportunities, further solidifying the market’s growth trajectory.

Major Players

- Boeing

- Honeywell Aerospace

- Rockwell Collins

- Garmin International

- Northrop Grumman

- Textron Systems

- Airbus

- Thales Group

- L3 Technologies

- Raytheon Technologies

- Lockheed Martin

- General Electric Aviation

- Safran

- UTC Aerospace Systems

- BAE Systems

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Commercial Airlines

- Military organizations

- Private aviation operators

- Drone manufacturers

- Aerospace technology developers

- Aviation safety agencies

Research Methodology

Step 1: Identification of Key Variables

Identify the key market variables, including system types, platforms, technologies, and regions, essential for comprehensive market analysis.

Step 2: Market Analysis and Construction

Analyze historical data and trends to build the market size, segmentation, and growth forecasts for autopilot systems.

Step 3: Hypothesis Validation and Expert Consultation

Consult with industry experts to validate assumptions, refine forecasts, and ensure accuracy in the analysis.

Step 4: Research Synthesis and Final Output

Synthesize all collected data and insights into a cohesive report, ensuring it provides actionable insights for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Advancements in aviation safety standards

Increased demand for unmanned aerial vehicles (UAVs)

Rising adoption of electric and hybrid aviation systems

Regulatory support for autonomous systems

Technological advancements in AI and machine learning - Market Challenges

High initial investment costs

Complexity in integration with existing systems

Data security and cybersecurity concern

Regulatory hurdles in various jurisdictions

Technical reliability and failure risks - Market Opportunities

Growth in autonomous air taxis

Increased focus on sustainability in aviation

Expanding military applications of autopilot systems - Trends

Integration of AI for advanced autopilot functionalities

Shift towards electric and hybrid-electric propulsion systems

Adoption of autonomous flight technologies in commercial aviation

Improved collaboration between industry stakeholders and regulators

Use of cloud computing and big data analytics for system optimization - Government Regulations & Defense Policy

FAA regulations on autonomous flight systems

Government investment in UAV research and development

Defense policies promoting autonomous military aviation systems - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Fixed-Wing Systems

Rotary-Wing Systems

Hybrid Systems

Civil Aviation Autopilot Systems

Military Aviation Autopilot Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Private Jets

Drones

Helicopters - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Retrofit Fitment

Upgraded Fitment

Modular Fitment - By End User Segment (In Value%)

Commercial Airlines

Military Organizations

Private Air Operators

Cargo and Freight Operators

Private and General Aviation - By Procurement Channel (In Value%)

Direct Sales

OEM Partnerships

Third-Party Distributors

Online Sales

B2B Contracts - By Material / Technology (in Value%)

Sensors

Software Algorithms

Control Systems

Power Supply Components

Communication Systems

- Market share snapshot of major players

- Cross Comparison Parameters (Technology, Market Penetration, Product Innovation, Cost Efficiency, Reliability, Regulatory Compliance, Brand Recognition, Customer Support)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Textron Systems

General Electric Aviation

Honeywell Aerospace

Rockwell Collins

Northrop Grumman

Garmin International

Lockheed Martin

Thales Group

Boeing

Raytheon Technologies

Airbus

Universal Avionics Systems

BAE Systems

L3 Technologies

DJI Innovations

- Increasing adoption of UAVs in military and defense

- Growth of autonomous commercial aviation systems

- Rising demand for UAVs in logistics and supply chain

- Enhanced safety protocols pushing for autonomous technology

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035