Market Overview

The USA aviation augmented and virtual reality market is experiencing significant growth, driven by increasing adoption across the aviation industry for both training and maintenance purposes. The market size is expected to reach USD ~ billion in 2024, as reported by credible sources such as aviation technology studies and reports from industry leaders like Boeing and Lockheed Martin. The rise of immersive training systems, which offer cost-effective and efficient solutions, plays a critical role in the market expansion, alongside advancements in augmented and virtual reality technologies that enhance pilot and crew training experiences.

Dominant countries such as the United States and the United Kingdom are leading the market, owing to their advanced aviation infrastructure and robust defense spending. The USA is a significant player, with leading aviation companies integrating augmented and virtual reality technologies into their operations. The dominance is attributed to high investment in technology development, strong defense and commercial aviation sectors, and governmental support for modernizing aviation training methods. Additionally, regions with high air traffic, including major cities like New York, Los Angeles, and Chicago, are key contributors to the market’s growth.

Market Segmentation

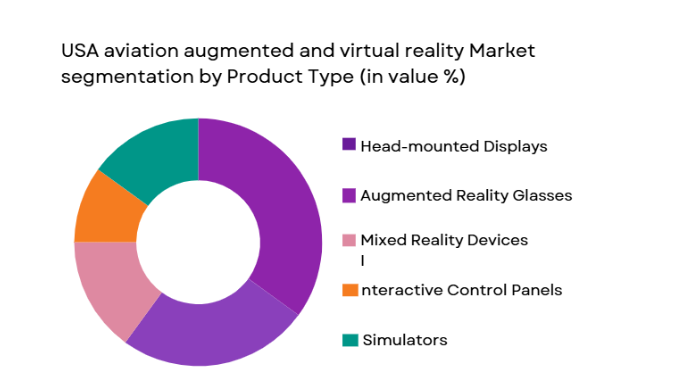

By Product Type

The USA aviation augmented and virtual reality market is segmented by product type into head-mounted displays, augmented reality glasses, mixed reality devices, interactive control panels, and simulators. Recently, head-mounted displays have dominated the market share due to the increasing demand for realistic, immersive experiences in pilot training. These displays offer high-resolution visuals and ease of use, making them suitable for both commercial and military aviation training. With advancements in lightweight, ergonomic designs and enhanced comfort, head-mounted displays continue to drive their widespread adoption. Additionally, their compatibility with various training simulators and the rising need for cost-efficient training solutions are significant contributors to their market dominance.

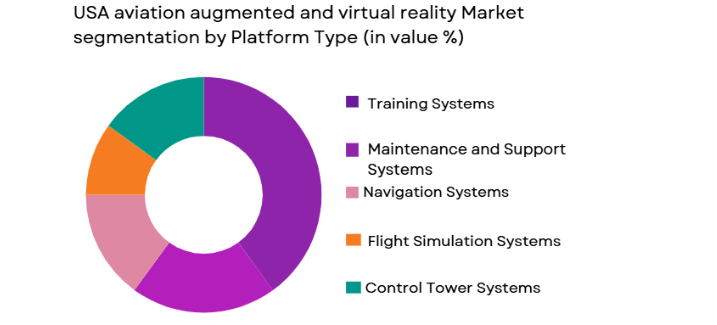

By Platform Type

The USA aviation augmented and virtual reality market is segmented by platform type into training systems, maintenance and support systems, navigation systems, flight simulation systems, and control tower systems. Training systems have a dominant market share due to the rising demand for virtual training environments that reduce operational costs and increase training efficiency. These systems provide realistic scenarios for pilots and crew, ensuring better preparedness without the high expenses of traditional training methods. With the growing focus on safety, airlines and military aviation sectors are increasingly adopting these systems to simulate critical in-flight situations and emergency protocols.

Competitive Landscape

The USA aviation augmented and virtual reality market is highly competitive, with major players focusing on technological innovation, product differentiation, and partnerships to gain market share. The consolidation of key players in the market, such as Boeing and Lockheed Martin, has contributed to technological advancements and enhanced market penetration. These companies are also investing heavily in R&D to develop next-generation augmented and virtual reality solutions tailored to the aviation sector. Their dominance is attributed to their strong infrastructure, broad client base, and government contracts, which ensure steady revenue streams and long-term growth.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Boeing | 1916 | Chicago, Illinois | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | Bethesda, Maryland | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, Virginia | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | La Défense, France | ~ | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | Charlotte, North Carolina | ~ | ~ | ~ | ~ | ~ |

USA aviation augmented and virtual reality Market Analysis

Growth Drivers

Technological Advancements in Augmented and Virtual Reality

The rapid development of augmented and virtual reality technologies is a major growth driver in the USA aviation AR/VR market. Innovations in display technologies, sensors, and motion tracking have significantly enhanced the realism and effectiveness of AR and VR systems used in aviation. This has led to widespread adoption, particularly in pilot training and maintenance procedures, where real-time, immersive simulations are essential. Companies such as Boeing and Lockheed Martin are actively investing in AR/VR technologies to create highly detailed, interactive environments that replicate real-world scenarios. As the technology improves, the quality of training and operational efficiency will continue to rise, further driving the demand for these systems. Additionally, the integration of AI and machine learning with AR/VR platforms is expected to enable predictive maintenance and enhance the performance of virtual simulations, creating a new wave of growth opportunities in the sector. Furthermore, advancements in 5G networks and cloud computing technologies will enable better connectivity and faster data processing, ensuring seamless AR/VR experiences, particularly in complex environments like flight simulation. These technological improvements will be critical in addressing the limitations of traditional aviation training methods, making AR/VR solutions increasingly essential to the aviation industry.

Government and Military Investments in Aviation Technologies

Government and military investments in next-generation aviation technologies have been a crucial driver of market growth for augmented and virtual reality applications. The USA government’s focus on modernizing its military aviation infrastructure has accelerated the adoption of AR/VR systems, particularly in defense training and maintenance. The Department of Defense and related agencies are heavily investing in AR/VR solutions to enhance the training capabilities of military personnel, including fighter pilots and air traffic controllers. These systems provide immersive, cost-effective training for complex and dangerous scenarios, reducing the need for live exercises and minimizing risks. Additionally, the growing importance of cybersecurity in military operations has spurred investments in AR/VR technologies that offer secure and simulated environments for operational training. This trend extends to the commercial aviation sector, where governments are providing incentives and subsidies to integrate advanced technologies into training facilities. The military’s large-scale procurement of AR/VR systems is expected to significantly contribute to the growth of the market, with sustained demand anticipated for the foreseeable future. As a result, augmented and virtual reality technologies will continue to play a vital role in enhancing the safety, efficiency, and effectiveness of aviation operations, driven by both government and military investments.

Market Challenges

High Initial Investment and Maintenance Costs

One of the primary challenges facing the USA aviation augmented and virtual reality market is the high initial investment and maintenance costs associated with AR/VR systems. While these technologies offer significant long-term savings by reducing the need for physical training and maintenance procedures, the upfront costs can be prohibitive, especially for smaller airlines and training organizations. The cost of hardware, software, and specialized infrastructure needed to run AR/VR systems is substantial, and the ongoing maintenance and updates required to keep the systems running smoothly add to the financial burden. Additionally, integrating AR/VR systems with existing aviation infrastructure, which may rely on older technologies, can be costly and complex. Despite the cost-effectiveness of AR/VR solutions in the long term, the initial financial commitment can deter potential adopters from fully embracing these technologies. Moreover, the need for continuous training and support to operate and maintain these systems can further strain resources. As the market grows, these cost-related challenges need to be addressed through innovations in hardware and software that can reduce the financial barriers to entry, ensuring that the benefits of AR/VR technology are accessible to a broader range of aviation industry stakeholders.

Integration with Legacy Systems

The integration of augmented and virtual reality technologies with legacy aviation systems is another significant challenge in the market. Many airlines and aviation organizations still rely on traditional training and maintenance systems, and the introduction of AR/VR technologies requires a complete overhaul of existing infrastructure. Compatibility issues between modern AR/VR systems and older systems can result in delays, increased costs, and operational disruptions. Additionally, the adaptation of legacy systems to accommodate new AR/VR solutions requires extensive testing and customization, further complicating the integration process. Furthermore, training personnel to effectively use AR/VR systems alongside traditional methods can be time-consuming and costly. The challenge of seamlessly integrating AR/VR technologies into the aviation industry’s established workflows and systems is a major hurdle to overcome for many companies. As the market progresses, efforts will be needed to create more flexible, adaptable AR/VR systems that can integrate smoothly with a wide range of existing infrastructure, reducing implementation complexities and minimizing downtime during the transition.

Opportunities

Expansion of AR/VR in Air Traffic Control Systems

One of the key opportunities in the USA aviation augmented and virtual reality market lies in the expansion of AR/VR technologies in air traffic control (ATC) systems. As air traffic continues to grow, there is an increasing need for more efficient and effective methods of managing airspace. AR/VR technologies can provide air traffic controllers with immersive, real-time visualizations of air traffic, enabling them to manage complex flight paths and prevent collisions more effectively. These technologies allow for the simulation of various traffic scenarios, including high-density airspace conditions and emergency situations, providing controllers with the training necessary to handle real-world challenges without the risks and limitations of traditional methods. Furthermore, the integration of AR/VR with AI and predictive analytics can enhance decision-making processes, helping air traffic controllers anticipate and manage traffic flow more efficiently. This is particularly relevant in regions with congested airspaces, such as major airports and international hubs, where AR/VR technologies can significantly improve operational efficiency. The increasing adoption of AR/VR in ATC training and operations presents a significant growth opportunity for the aviation industry, as it helps streamline air traffic management and improve overall air safety.

Adoption of AR/VR by Commercial Airlines for Customer Experience Enhancement

Another promising opportunity in the USA aviation augmented and virtual reality market is the adoption of AR/VR technologies by commercial airlines for customer experience enhancement. Airlines are increasingly leveraging AR/VR systems to offer immersive entertainment options, virtual cabin tours, and interactive in-flight services. These technologies allow passengers to experience a wide range of entertainment options, from virtual sightseeing tours to interactive gaming experiences, all while improving the overall travel experience. Additionally, AR/VR technologies are being integrated into flight attendants’ training programs to simulate real-world scenarios, such as emergency evacuations or medical emergencies, ensuring that they are better prepared to handle various situations. The use of AR/VR for customer engagement not only enhances passenger satisfaction but also helps airlines differentiate themselves in a competitive market. As airlines seek to improve the passenger experience and increase loyalty, the demand for AR/VR solutions in this space is expected to grow, providing a significant opportunity for growth in the market.

Future Outlook

The future outlook of the USA aviation augmented and virtual reality market is positive, with substantial growth anticipated over the next five years. Continued advancements in AR/VR technologies, combined with increased adoption across both the military and commercial sectors, are expected to drive market expansion. Moreover, regulatory support from government agencies and the military’s ongoing investment in AR/VR technologies for training and maintenance will contribute to sustained demand. As the industry embraces these technologies, innovations in AI, machine learning, and cloud computing are likely to enhance the capabilities and efficiency of AR/VR solutions, further boosting market growth. The increased focus on air traffic control and customer experience, coupled with the rising need for immersive training environments, presents significant growth opportunities. The market is poised for steady growth, with these technologies becoming integral to the aviation sector.

Major Players

- Boeing

- Lockheed Martin

- Northrop Grumman

- Thales Group

- Honeywell International

- Raytheon Technologies

- L3 Harris Technologies

- General Electric

- Rockwell Collins

- SAAB

- Elbit Systems

- Leonardo

- BAE Systems

- CAE Inc.

- Thales USA

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military aviation departments

- Airlines and aviation service providers

- Aerospace manufacturers

- Air traffic management authorities

- Defense contractors

- Aviation training facilities

Research Methodology

Step 1: Identification of Key Variables

Key variables for understanding market dynamics include technological advancements, regulatory changes, consumer demand patterns, and industry-specific drivers and challenges.

Step 2: Market Analysis and Construction

Analysis of historical data, market trends, competitive landscape, and growth potential enables a comprehensive market model that identifies key market segments.

Step 3: Hypothesis Validation and Expert Consultation

Consultation with industry experts, stakeholders, and technology developers ensures that market hypotheses are validated, and realistic forecasts are generated.

Step 4: Research Synthesis and Final Output

Combining primary and secondary data sources, market forecasts are synthesized into a comprehensive, validated report offering actionable insights and recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased demand for cost-effective pilot training solutions

Rising adoption of AR/VR for maintenance and repairs

Technological advancements in AR/VR hardware

Government initiatives for defense and aviation modernization

Enhancement in user experience with interactive systems - Market Challenges

High implementation and maintenance costs

Lack of trained professionals for AR/VR systems

Limited integration with existing aviation systems

Regulatory concerns regarding the use of augmented reality

Compatibility issues with legacy infrastructure - Market Opportunities

Rising demand for immersive training environments

Expanding use of AR/VR in air traffic control operations

Increased investment in smart airport solutions - Trends

Growth of AR/VR in air combat simulation

Shift towards mixed reality for real-time maintenance support

Integration of AI with AR/VR for predictive analytics

Widespread use of AR/VR in cabin design and innovation

Increased focus on passenger safety through augmented reality - Government Regulations & Defense Policy

Development of AR/VR regulations for aviation training

Government support for defense aviation modernization

Guidelines on the use of immersive technologies for air safety - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Head-mounted Displays

Augmented Reality Glasses

Mixed Reality Devices

Interactive Control Panels

Simulators - By Platform Type (In Value%)

Training Systems

Maintenance and Support Systems

Navigation Systems

Flight Simulation Systems

Control Tower Systems - By Fitment Type (In Value%)

Aircraft-mounted

Ground-based

Portable Systems

Cockpit Integration

Training Equipment - By EndUser Segment (In Value%)

Commercial Airlines

Military Aviation

Aircraft Manufacturers

Airports & Ground Services

Training & Simulation Institutes - By Procurement Channel (In Value%)

Direct Sales

OEMs

System Integrators

Online Retailers

Government Contracts - By Material / Technology (in Value%)

Optical Sensors

Motion Tracking Systems

Projection Systems

Haptic Feedback Devices

Artificial Intelligence

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Technology, Product Features, Pricing, Market Reach, Customer Support, Partnerships, R&D Investment, Manufacturing Capabilities, Distribution Channels, Product Innovation)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Boeing

Lockheed Martin

Thales Group

Raytheon Technologies

Northrop Grumman

L3 Technologies

Honeywell International

General Electric

Rockwell Collins

Aviation Training Solutions

Elbit Systems

QinetiQ

Microsoft Corporation

Dell Technologies

Vuzix Corporation

- Demand for immersive training tools in the military sector

- Growth of virtual air traffic management systems

- Adoption of AR/VR by major aircraft manufacturers for design and development

- Increase in airlines’ investment in AR/VR for customer experience enhancement

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035