Market Overview

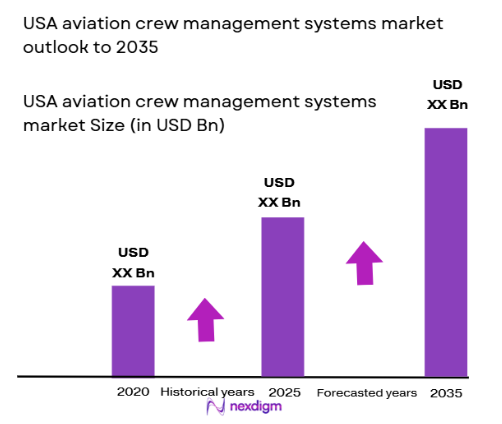

Based on a recent historical assessment, the USA aviation crew management systems market was valued at USD ~ billion, supported by regulatory-driven digitalization and operational efficiency requirements. The market size is driven by strict crew duty, rest compliance mandates issued by aviation authorities, rising airline operating complexity, and the need to optimize crew utilization. Commercial airlines, cargo operators, and defense aviation units increasingly rely on automated crew scheduling, fatigue risk management, and compliance tracking platforms to reduce costs, minimize disruptions, and enhance flight safety across expanding fleets.

Based on a recent historical assessment, the United States remains the dominant geography, with major adoption concentrated in cities such as Atlanta, Dallas, Chicago, Seattle, and Phoenix due to high airline hub density. These locations host major commercial airline headquarters, large maintenance bases, and integrated flight operations centers. Strong dominance is further reinforced by the presence of advanced aviation IT infrastructure, federal regulatory oversight, high fleet utilization rates, and early adoption of digital flight operations technologies by both commercial and defense aviation operators.

Market Segmentation

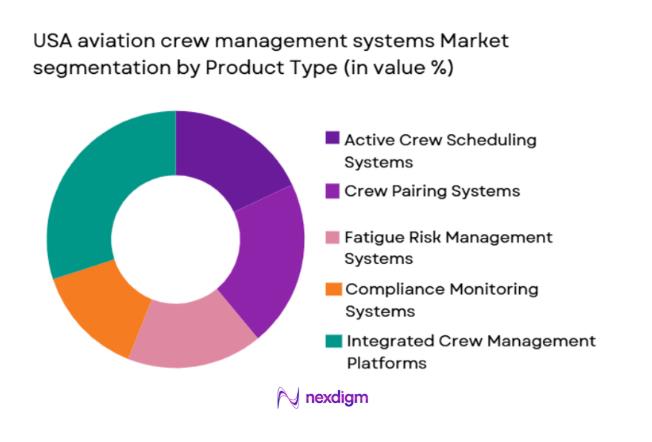

By Product Type

USA aviation crew management systems market is segmented by product type into crew scheduling systems, crew pairing systems, fatigue risk management systems, compliance monitoring systems, and integrated crew management platforms. Recently, integrated crew management platforms have a dominant market share due to their ability to consolidate scheduling, pairing, fatigue monitoring, and regulatory compliance into a single operational interface. Airlines increasingly prefer unified platforms to reduce system fragmentation, minimize manual intervention, and improve decision-making during disruptions. Integrated solutions also offer real-time data synchronization with flight operations and maintenance systems, enabling faster recovery during delays or crew shortages. Their scalability across large fleets and compatibility with regulatory reporting frameworks further strengthen adoption among major U.S. airlines and defense operators.

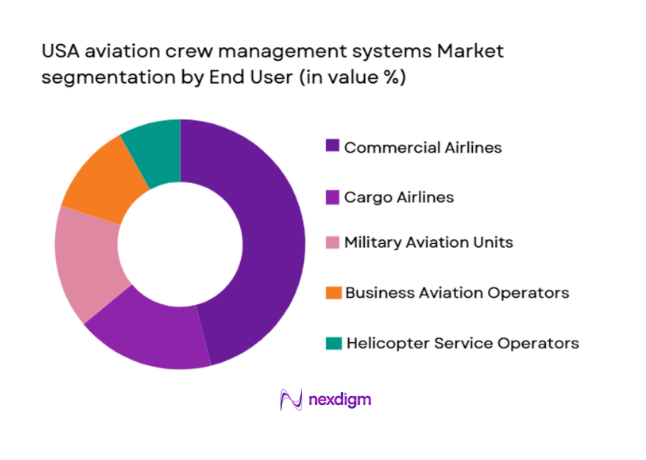

By End User

By End User: USA aviation crew management systems market is segmented by end user into commercial airlines, cargo airlines, military aviation units, business aviation operators, and helicopter service operators. Recently, commercial airlines have a dominant market share due to high crew volumes, complex scheduling requirements, and stringent compliance obligations. Large passenger carriers operate extensive route networks requiring continuous crew optimization to manage costs and maintain punctuality. Frequent schedule changes, labor agreements, and fatigue regulations further drive demand for advanced crew management platforms. Additionally, commercial airlines possess higher IT budgets and stronger digital transformation initiatives compared to smaller aviation operators, reinforcing their dominant position.

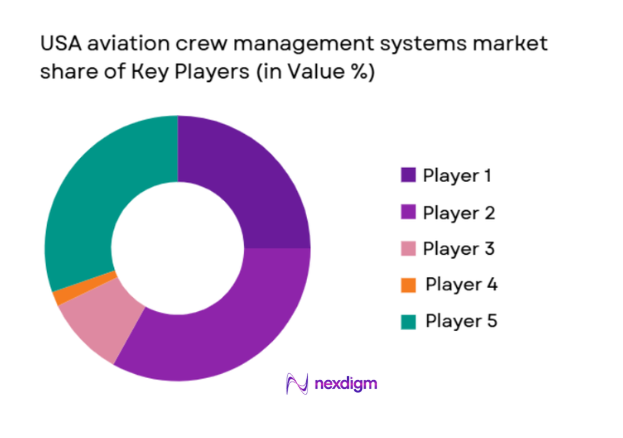

Competitive Landscape

The competitive landscape of the USA aviation crew management systems market is moderately consolidated, with a mix of global aviation software providers and specialized niche vendors. Major players focus on long-term contracts with airlines and defense agencies, creating high switching costs and strong customer lock-in. Continuous product upgrades, regulatory compliance expertise, and integration capabilities play a critical role in competitive positioning.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Primary End-User Focus |

| Jeppesen | 1934 | USA | ~ | ~ | ~ | ~ | ~ |

| Sabre Airline Solutions | 1960 | USA | ~ | ~ | ~ | ~ | ~ |

| Lufthansa Systems | 1995 | Germany | ~ | ~ | ~ | ~ | ~ |

| IBS Software | 1997 | India | ~ | ~ | ~ | ~ | ~ |

| CAE | 1947 | Canada | ~ | ~ | ~ | ~ | ~ |

USA aviation crew management systems Market Analysis

Growth Drivers

Regulatory Compliance and Crew Fatigue Management Mandates:

The USA aviation crew management systems market is significantly driven by stringent federal regulations governing crew duty time, rest periods, and fatigue risk management. Aviation authorities mandate precise documentation and monitoring of crew schedules to ensure safety and operational integrity. Manual processes are increasingly insufficient to meet compliance accuracy requirements, driving airlines toward automated systems. Advanced crew management platforms enable real-time monitoring of duty limits and fatigue thresholds across complex schedules. Airlines face financial penalties and operational disruptions if compliance lapses occur, reinforcing system adoption. Defense aviation units also require strict adherence to mission readiness and crew endurance policies. Integration of compliance reporting with scheduling tools improves audit readiness. As regulatory scrutiny intensifies, demand for compliant digital platforms continues to rise. This regulatory pressure creates sustained long-term demand for advanced crew management systems.

Operational Cost Optimization and Network Complexity:

Operational Cost Optimization and Network Complexity: Airlines operate within thin profit margins, making crew cost optimization a strategic priority. Crew expenses represent one of the largest controllable operational costs for airlines. Increasing route density, hub-and-spoke networks, and irregular operations amplify scheduling complexity. Automated crew management systems reduce overtime, minimize reserve crew usage, and optimize pairing efficiency. Real-time disruption management allows airlines to recover schedules faster during weather or technical events. Data-driven optimization enhances productivity without compromising compliance. Defense and cargo operators similarly benefit from efficient crew utilization. As operational networks grow more complex, reliance on intelligent crew management solutions increases. This directly accelerates market expansion across U.S. aviation sectors.

Market Challenges

High Integration Complexity with Legacy Systems:

One of the major challenges in the USA aviation crew management systems market is the integration of modern platforms with legacy airline IT infrastructure. Many airlines operate older flight operations, maintenance, and HR systems that lack interoperability. Integrating new crew management solutions requires extensive customization and data mapping. This increases deployment timelines and implementation costs. Operational disruptions during transition periods create resistance among airline management teams. Smaller operators often lack internal technical expertise to manage complex integrations. Defense aviation systems face additional security and interoperability constraints. Data synchronization issues can affect schedule accuracy if not properly managed. These integration challenges slow adoption rates and increase total cost of ownership for end users.

Data Security and Cyber Risk Exposure:

Crew management systems handle sensitive personal, operational, and security-related data, making them attractive targets for cyber threats. Airlines must comply with strict data protection and cybersecurity regulations. Any breach can result in operational disruption, regulatory penalties, and reputational damage. Cloud-based deployments, while efficient, raise concerns over data sovereignty and access control. Defense aviation users impose additional security clearance requirements. Continuous investment in cybersecurity infrastructure increases operational costs for vendors and users. Ensuring secure system architecture without affecting performance is complex. These risks can delay procurement decisions and extend vendor evaluation cycles. Cybersecurity concerns therefore remain a persistent market challenge.

Opportunities

Artificial Intelligence Driven Predictive Crew Analytics:

he integration of artificial intelligence presents a major opportunity within the USA aviation crew management systems market. AI-enabled platforms can predict crew shortages, fatigue risks, and disruption impacts before they occur. Predictive analytics improve proactive decision-making and reduce last-minute schedule changes. Airlines can simulate multiple operational scenarios to optimize crew allocation. AI also enhances long-term workforce planning by analyzing historical trends. Defense operators benefit from predictive mission readiness assessments. As AI models mature, system accuracy and value proposition increase. Vendors investing in advanced analytics gain competitive advantage. This opportunity supports premium pricing and long-term system adoption across aviation sectors.

Expansion into Defense and Government Aviation Operations:

Defense and government aviation units represent a growing opportunity for crew management system providers. These operators require secure, compliant, and mission-focused crew scheduling solutions. Increasing defense modernization programs emphasize digital command and control systems. Crew readiness, endurance tracking, and compliance reporting are critical mission components. Vendors capable of meeting security and customization requirements can access long-term government contracts. Integration with defense logistics and training systems enhances value. Stable government budgets support sustained demand. This segment offers lower price sensitivity compared to commercial aviation. Expansion into this space strengthens overall market growth potential.

Future Outlook

Over the next five years, the USA aviation crew management systems market is expected to experience steady expansion driven by digital transformation initiatives across airlines and defense operators. Technological advancements in artificial intelligence, cloud computing, and real-time analytics will enhance system capabilities. Regulatory enforcement will continue to support adoption, while demand-side focus on cost optimization and operational resilience will shape procurement strategies.

Major Players

- Jeppesen

- Sabre Airline Solutions

- Lufthansa Systems

- IBS Software

- CAE

- Collins Aerospace

- SITA

- Navblue

- AIMS International

- Ramco Systems

- Thales Group

- Fujitsu Aviation

- Accelya

- Amadeus IT Group

- OpenAirlines

Key Target Audience

- Commercial airlines

- Cargo airlines

- Military and defense aviation units

- Business aviation operators

- Helicopter service providers

- Airport operators

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables related to system functionality, regulatory frameworks, operational requirements, and end-user demand were identified through industry documentation and aviation authority publications.

Step 2: Market Analysis and Construction

Qualitative and quantitative data were analyzed to construct market structure, segmentation logic, and competitive positioning using validated aviation industry benchmarks.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through consultations with aviation IT professionals, airline operations managers, and defense aviation specialists.

Step 4: Research Synthesis and Final Output

All findings were synthesized into a structured report ensuring accuracy, consistency, and relevance to stakeholders across the aviation ecosystem.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising operational complexity in airline crew scheduling

Regulatory mandates for crew duty time and fatigue management

Expansion of commercial and defense aviation fleets

Digital transformation initiatives across aviation operations

Demand for cost optimization and operational efficiency - Market Challenges

Integration complexity with legacy airline IT systems

High initial deployment and customization costs

Data security and cyber risk concerns

Resistance to change from manual or semi-automated processes

Shortage of skilled workforce for advanced system management - Market Opportunities

Adoption of AI-driven predictive crew analytics

Growing demand from regional and low-cost carriers

Expansion of crew management systems into unmanned and hybrid aviation operations - Trends

Shift toward cloud-native crew management platforms

Increased use of real-time data and mobile crew applications

Integration of crew management with flight operations and maintenance systems

Focus on predictive fatigue and wellness monitoring

Growth of software as a service based procurement models - Government Regulations & Defense Policy

Compliance with federal aviation crew duty and rest regulations

Defense modernization programs emphasizing digital command systems

Cybersecurity and data governance standards for aviation software - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Crew scheduling and rostering software

Crew pairing optimization systems

Fatigue risk management systems

Crew tracking and compliance systems

Integrated crew management platforms - By Platform Type (In Value%)

Commercial aviation platforms

Military aviation platforms

Business and general aviation platforms

Helicopter and rotorcraft platforms

Cargo and logistics aviation platforms - By Fitment Type (In Value%)

Line-fit installations

Retrofit installations

Cloud-based deployments

On-premise deployments

Hybrid deployment models - By EndUser Segment (In Value%)

Commercial airlines

Defense and military aviation units

Charter and business jet operators

Cargo and freight operators

Helicopter service operators - By Procurement Channel (In Value%)

Direct procurement from system vendors

Government and defense contracts

System integrator procurement

Software licensing agreements

Managed service and subscription contracts - By Material / Technology (in Value %)

Artificial intelligence based optimization

Machine learning driven analytics

Rule-based scheduling engines

Cloud computing infrastructure

Mobile and tablet enabled crew interfaces

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System scalability, Regulatory compliance capability, AI optimization level, Integration flexibility, Deployment model, User interface sophistication, Data security standards, Pricing structure, Customer support coverage)

- SWOT Analysis of Key Players

Pricing & Procurement Analysis

Key Players

Jeppesen

Sabre Airline Solutions

Lufthansa Systems

IBS Software

AIMS International

CAE

Collins Aerospace

Ramco Systems

Hexaware Aviation Solutions

SITA

Navblue

Aviolinx

OpenAirlines

Fujitsu Aviation

Thales Group

- Airlines prioritize systems that reduce crew costs and improve on-time performance

- Defense operators emphasize security, compliance, and mission readiness

- Cargo operators focus on flexible scheduling and rapid crew reassignment

- Business aviation users value customization and ease of integration

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035