Market Overview

Based on a recent historical assessment, the USA aviation headsets market was valued at approximately USD ~ million, driven by sustained demand from commercial aviation, general aviation, military aviation, and flight training activities. Growth is supported by mandatory cockpit communication standards, increased pilot focus on hearing protection, and widespread adoption of active noise reduction technologies. Federal Aviation Administration safety norms and ongoing aircraft fleet utilization across civilian and defense sectors continue to reinforce consistent procurement of certified aviation headsets across fixed-wing and rotary platforms nationwide.

Based on a recent historical assessment, dominance in the USA aviation headsets market is concentrated in aviation hubs such as Texas, Florida, California, and Arizona due to high aircraft registrations, dense pilot populations, and strong flight training ecosystems. These regions host major airline bases, military air stations, general aviation airports, and maintenance centers, creating continuous headset demand. The country benefits from established aerospace manufacturing infrastructure, strong defense aviation presence, and widespread adoption of advanced cockpit communication systems supporting market leadership.

Market Segmentation

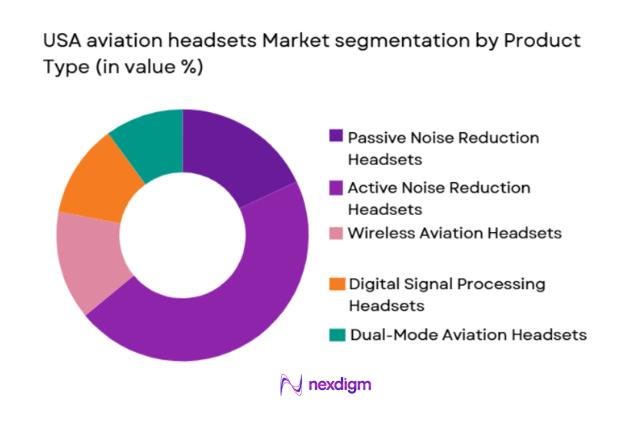

By Product Type:

USA aviation headsets market is segmented by product type into passive noise reduction headsets, active noise reduction headsets, wireless aviation headsets, digital signal processing headsets, and dual-mode aviation headsets. Recently, active noise reduction headsets have a dominant market share due to increasing pilot exposure to long flight hours, higher cockpit noise levels, and growing awareness of long-term hearing protection. These headsets significantly reduce low-frequency engine noise, improving communication clarity and pilot comfort. Strong brand presence, regulatory acceptance, and compatibility with modern avionics further support adoption. Commercial pilots, military crews, and business jet operators increasingly prioritize ANR technology for operational efficiency, fatigue reduction, and compliance with occupational noise safety requirements, reinforcing its leading position.

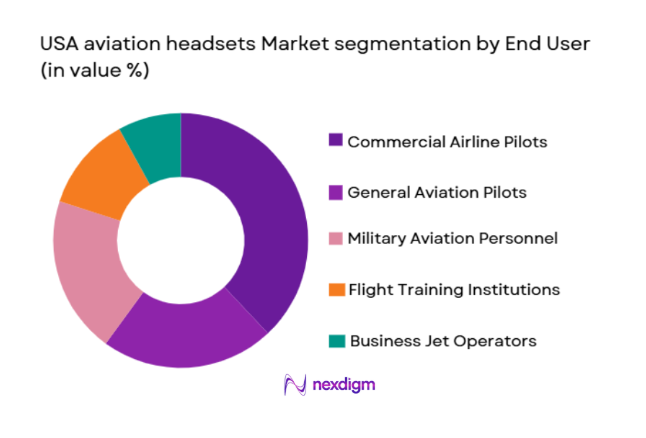

By End User:

USA aviation headsets market is segmented by end user into commercial airline pilots, general aviation pilots, military aviation personnel, flight training institutions, and business jet operators. Recently, commercial airline pilots have held a dominant market share due to high cockpit crew volumes, strict communication standards, and continuous fleet operations. Airline pilots require certified, durable, and comfortable headsets to support extended duty cycles and complex air traffic environments. Large-scale airline procurement programs, standardized equipment policies, and replacement demand further strengthen this segment. Ongoing domestic air travel activity and fleet modernization initiatives sustain consistent headset demand from commercial operators.

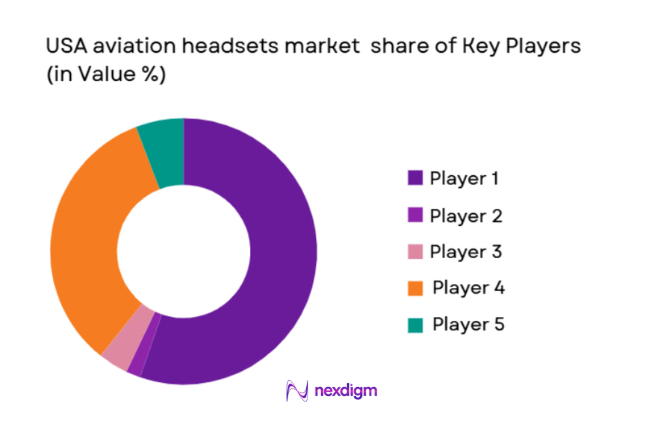

Competitive Landscape

The USA aviation headsets market exhibits moderate consolidation, with a few established manufacturers exerting strong influence through brand recognition, technology leadership, and long-standing relationships with airlines, defense agencies, and pilot communities. Major players focus on product innovation, ergonomic design, and noise reduction performance while maintaining regulatory compliance. Competitive intensity is shaped by aftermarket sales, OEM partnerships, and defense procurement contracts.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Certification Coverage |

| Bose Aviation | 1964 | Massachusetts, USA | ~ | ~ | ~ | ~ | ~ |

| Lightspeed Aviation | 1996 | Oregon, USA | ~ | ~ | ~ | ~ | ~ |

| David Clark Company | 1935 | Massachusetts, USA | ~ | ~ | ~ | ~ | ~ |

| Gentex Corporation | 1894 | Michigan, USA | ~ | ~ | ~ | ~ | ~ |

| Telex Communications | 1936 | Minnesota, USA | ~ | ~ | ~ | ~ | ~ |

USA aviation headsets Market Analysis

Growth Drivers

Expansion of Commercial and General Aviation Operations:

Expansion of commercial and general aviation operations is a key growth driver for the USA aviation headsets market as increasing aircraft movements require reliable cockpit communication equipment across all flight categories. Airline route expansions, domestic air travel demand, and consistent utilization of general aviation aircraft generate steady headset replacement cycles. Pilots operating in congested airspace depend on high-quality audio clarity for air traffic coordination and safety compliance. Growth in private aviation and charter services also contributes to higher headset adoption among business jet pilots. Fleet utilization across short-haul and long-haul operations amplifies wear and tear, driving recurring demand. The Federal Aviation Administration’s strict communication requirements further reinforce standardized headset usage. Aviation workforce expansion increases pilot populations requiring certified equipment. Together, these operational factors sustain long-term headset procurement demand across multiple aviation segments.

Advancement in Noise Reduction and Connectivity Technologies:

Advancement in noise reduction and connectivity technologies significantly drives the USA aviation headsets market by improving pilot comfort, communication accuracy, and situational awareness. Active noise reduction systems reduce cockpit fatigue during extended operations, particularly in high-noise aircraft environments. Integration of Bluetooth and digital audio interfaces enables seamless connectivity with avionics, electronic flight bags, and mobile devices. Pilots increasingly prefer headsets supporting multitasking and real-time data access without compromising safety. Technological innovation differentiates premium products and supports higher adoption rates. Manufacturers invest in lightweight materials and ergonomic designs to enhance usability. These advancements align with evolving cockpit digitization trends. As technology expectations rise among pilots, demand for advanced headsets continues to strengthen.

Market Challenges

High Product Costs and Price Sensitivity:

High product costs and price sensitivity present a major challenge in the USA aviation headsets market, particularly among general aviation pilots and flight training institutions. Advanced noise reduction and wireless technologies increase manufacturing complexity and retail pricing. Smaller operators and student pilots often prioritize affordability over premium features, limiting adoption of high-end products. Training academies require bulk purchases, amplifying budget constraints. Replacement cycles may be extended to delay expenditure. Competitive pricing pressure affects manufacturer margins. Import duties on electronic components further elevate costs. These factors collectively restrict rapid penetration of technologically advanced headsets across cost-sensitive segments.

Compatibility and Certification Constraints:

Compatibility and certification constraints challenge market growth due to diverse aircraft cockpit configurations and strict regulatory approval processes. Headsets must integrate seamlessly with varying communication systems across commercial, general aviation, and military platforms. Certification requirements add development time and cost burdens for manufacturers. Delays in regulatory approvals can slow product launches. Military specifications require additional testing and ruggedization. Operators hesitate to adopt non-standard equipment due to safety concerns. Managing compatibility across legacy and modern avionics systems remains complex. These constraints limit rapid innovation deployment and create barriers for new entrants.

Opportunities

Growth of Flight Training and Pilot Development Programs:

Growth of flight training and pilot development programs presents a significant opportunity for the USA aviation headsets market as increasing pilot shortages drive enrollment in aviation academies. Training institutions require standardized, durable headsets for student pilots. Frequent usage leads to higher replacement rates compared to commercial operations. Partnerships with training schools enable manufacturers to establish early brand loyalty. Entry-level headset offerings tailored for training environments can capture volume demand. Government-supported aviation workforce initiatives further support training expansion. As pilot pipelines grow, headset procurement scales accordingly. This segment offers long-term customer retention potential.

Rising Adoption of Smart and Connected Aviation Accessories:

Rising adoption of smart and connected aviation accessories creates new opportunities for the USA aviation headsets market through value-added product differentiation. Integration with electronic flight bags and cockpit management systems enhances operational efficiency. Pilots increasingly seek connectivity features supporting navigation alerts and communication management. Smart headsets can improve safety through real-time audio prioritization. Manufacturers can introduce software-enabled upgrades and premium models. Demand for connected cockpits supports innovation-driven growth. This trend aligns with broader aviation digitization initiatives. Advanced features offer potential for higher margins and recurring aftermarket sales.

Future Outlook

The USA aviation headsets market is expected to maintain steady growth over the next five years, supported by sustained aviation activity, pilot workforce expansion, and continued technology upgrades. Advancements in noise reduction, wireless integration, and ergonomic design will shape product development. Regulatory emphasis on pilot safety and hearing protection will further support adoption. Demand from commercial, general aviation, and training segments is expected to remain resilient.

Major Players

- Lightspeed Aviation

- David Clark Company

- Gentex Corporation

- Telex Communications

- Sennheiser Aviation

- Flightcom Corporation

- Faro Aviation

- Clarity Aloft

- ASA Aviation

- Pilot Communications USA

- Thales Aviation

- Safran Electronics

- Meggitt Aviation

- UFlyMike

Key Target Audience

- Commercial airlines

- General aviation operators

- Military aviation units

- Flight training institutions

- Business jet operators

- Aviation equipment distributors

- Airport authorities

Research Methodology

Step 1: Identification of Key Variables

Market scope, product categories, end users, regulatory frameworks, and pricing structures were identified through secondary research and industry databases.

Step 2: Market Analysis and Construction

Data was analyzed using industry reports, government aviation statistics, and company disclosures to structure market segmentation and competitive assessment.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert interviews with aviation professionals, manufacturers, and regulatory specialists.

Step 4: Research Synthesis and Final Output

All insights were consolidated, cross-verified, and structured into a comprehensive market report ensuring accuracy and consistency.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising commercial and general aviation flight operations across domestic airspace

Increasing pilot focus on hearing protection and long-duration comfort

Integration of advanced noise cancellation and wireless technologies

Expansion of flight training academies and pilot certification programs

Sustained defense aviation modernization and fleet readiness initiatives - Market Challenges

High product replacement cycles limiting frequent upgrade demand

Price sensitivity among general aviation and training operators

Compatibility issues across diverse cockpit communication systems

Regulatory compliance costs for certified aviation accessories

Supply chain constraints affecting electronic component availability - Market Opportunities

Adoption of smart and connected aviation headset solutions

Growing demand for lightweight ergonomic designs for long-haul pilots

Customization opportunities for military and special mission aviation - Trends

Shift toward active noise reduction as standard equipment

Increasing penetration of Bluetooth and digital audio interfaces

Demand for dual-use civilian and military certified headsets

Focus on lightweight materials to reduce pilot fatigue

Growth of aftermarket upgrades and accessories - Government Regulations & Defense Policy

Federal aviation safety certification requirements influencing headset design

Defense communication interoperability standards shaping military procurement

Noise exposure regulations driving adoption of advanced protection systems - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Passive Noise Reduction Headsets

Active Noise Reduction Headsets

Digital Signal Processing Headsets

Wireless Aviation Headsets

Dual-Mode Aviation Headsets - By Platform Type (In Value%)

Fixed Wing Aircraft

Rotary Wing Aircraft

Business Jets

General Aviation Aircraft

Military Aircraft - By Fitment Type (In Value%)

Over-Ear Headsets

On-Ear Headsets

In-Ear Aviation Headsets

Helmet-Integrated Headsets

Modular Aviation Headsets - By EndUser Segment (In Value%)

Commercial Airline Operators

General Aviation Pilots

Military Aviation Units

Flight Training Schools

Charter and Business Jet Operators - By Procurement Channel (In Value%)

Direct OEM Supply

Aftermarket Replacement

Defense Procurement Contracts

Aviation Retail Distributors

Online Aviation Equipment Platforms - By Material / Technology (in Value %)

Carbon Composite Headsets

Lightweight Aluminum Frame Headsets

Digital Noise Cancellation Technology

Bluetooth-Enabled Communication Systems

Advanced Microphone Noise Filtering

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (product portfolio breadth, noise reduction capability, certification compliance, platform compatibility, pricing range, distribution reach, technology integration, durability standards, aftermarket support)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Bose Aviation

Lightspeed Aviation

David Clark Company

Telex Communications

Sennheiser Aviation

Flightcom Corporation

ASA Aviation

Pilot Communications USA

Clarity Aloft

Faro Aviation

Gentex Corporation

Thales Aviation Headsets

Meggitt Aviation

Safran Electronics

UFlyMike

- Commercial pilots prioritize comfort and communication clarity during extended operations

- General aviation users emphasize affordability and ease of cockpit integration

- Military aviation demands ruggedized and secure communication systems

- Training institutions focus on durability and standardized fleet compatibility

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035