Market Overview

Based on a recent historical assessment, the USA aviation maintenance repair and overhaul MRO software market recorded a market size of USD 3.46 billion, supported by strong digital adoption across commercial airlines, defense aviation units, and independent MRO providers. The market is driven by rising aircraft fleet utilization, mandatory regulatory compliance for digital maintenance records, and increasing pressure on operators to reduce aircraft downtime and lifecycle maintenance costs. Airlines and MRO operators continue investing in predictive maintenance, real-time fleet monitoring, and integrated maintenance planning platforms to improve operational efficiency, safety assurance, and cost visibility across complex multi-fleet environments.

Based on a recent historical assessment, the United States dominates this market due to the presence of major aviation hubs such as Dallas–Fort Worth, Atlanta, Chicago, Los Angeles, and Seattle, which host large airline fleets and dense MRO ecosystems. The country benefits from a mature aerospace manufacturing base, strong defense aviation activity, and stringent aviation safety regulations enforced by federal authorities. High technology readiness, widespread cloud infrastructure, and early adoption of advanced analytics solutions further support leadership, while proximity to major aircraft OEMs and software developers accelerates system integration and continuous innovation.

Market Segmentation

By Product Type

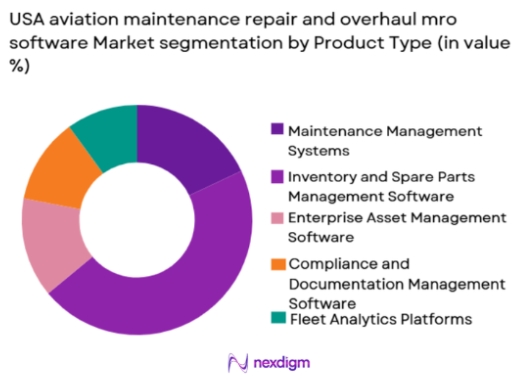

USA aviation maintenance repair and overhaul MRO software market is segmented by product type into maintenance management systems, inventory and spare parts management software, enterprise asset management software, compliance and documentation management software, and fleet analytics platforms. Recently, maintenance management systems have a dominant market share due to their central role in coordinating line, base, and component maintenance activities across large and diverse fleets. These systems integrate work order management, scheduling, labor tracking, and regulatory compliance into a single operational backbone, making them essential for airlines and MRO providers operating under strict safety oversight. High aircraft utilization rates and increasing maintenance complexity have amplified demand for centralized maintenance control, while integration compatibility with OEM systems and regulatory databases further strengthens adoption.

By Deployment Model

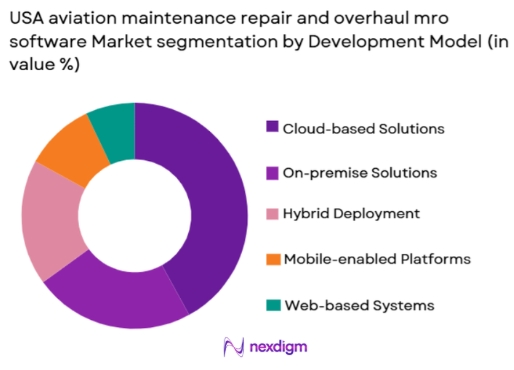

USA aviation maintenance repair and overhaul MRO software market is segmented by deployment model into cloud-based solutions, on-premise solutions, hybrid deployment, mobile-enabled platforms, and web-based systems. Recently, cloud-based solutions have a dominant market share due to scalability advantages, lower upfront infrastructure costs, and ease of integration across geographically distributed maintenance facilities. Cloud platforms enable real-time data sharing between airlines, MRO providers, and regulators, supporting faster decision-making and predictive maintenance use cases. Enhanced cybersecurity frameworks, regulatory acceptance, and improved reliability of cloud infrastructure have further accelerated adoption, especially among commercial airlines and large independent MRO operators managing multi-location operations.

Competitive Landscape

The competitive landscape of the USA aviation maintenance repair and overhaul MRO software market is moderately consolidated, with a mix of global enterprise software providers and specialized aviation-focused vendors. Large players leverage integrated product portfolios, long-term airline contracts, and strong regulatory expertise, while niche vendors compete through advanced analytics, user-friendly interfaces, and faster deployment models.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Primary End-User Focus |

| Ramco Systems | 1997 | USA | ~ | ~ | ~ | ~ | ~ |

| IFS | 1983 | USA | ~ | ~ | ~ | ~ | ~ |

| Oracle | 1977 | USA | ~ | ~ | ~ | ~ | ~ |

| SAP | 1972 | USA | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ | ~ |

USA aviation maintenance repair and overhaul mro software Market Analysis

Growth Drivers

Digital Transformation of Airline and MRO Operations:

Digital transformation of airline and MRO operations is a major growth driver because aviation operators increasingly depend on integrated software platforms to manage complex maintenance workflows across expanding and aging fleets. Airlines face continuous pressure to improve aircraft availability while complying with stringent safety and regulatory requirements, making manual or fragmented maintenance processes inefficient and risk prone. Advanced MRO software enables centralized control of maintenance planning, labor allocation, spare parts availability, and compliance documentation across multiple facilities. The growing adoption of predictive maintenance analytics allows operators to anticipate component failures before they disrupt operations, improving reliability and cost efficiency. Integration with aircraft health monitoring systems further enhances real-time decision-making for maintenance managers. As airlines expand route networks and fleet diversity, scalable digital platforms become operational necessities rather than optional tools. Defense aviation units also drive adoption by prioritizing mission readiness and secure maintenance data management. The presence of mature IT infrastructure in the United States supports faster deployment and integration of sophisticated software solutions. Overall, digital transformation aligns operational efficiency, safety assurance, and cost control objectives into a unified maintenance ecosystem.

Regulatory Compliance and Safety Mandates:

Regulatory compliance and safety mandates strongly drive market growth as aviation authorities require accurate, auditable, and real-time maintenance documentation. Federal aviation regulations enforce strict standards for aircraft inspection, component traceability, and maintenance record retention, making digital systems essential for compliance. MRO software automates documentation, ensures version control, and reduces human error associated with paper-based systems. Airlines and MRO providers increasingly adopt software platforms that integrate regulatory updates directly into maintenance workflows, minimizing compliance risks. Digital audit trails simplify inspections and reduce the administrative burden during regulatory reviews. Safety-focused analytics embedded in modern MRO software help identify recurring defects and maintenance inefficiencies, supporting proactive risk mitigation. The emphasis on continuous airworthiness management further reinforces reliance on integrated digital tools. As regulatory scrutiny intensifies with fleet expansion, compliance-driven software adoption becomes a strategic requirement. This sustained regulatory pressure ensures long-term demand stability for advanced MRO software solutions.

Market Challenges

High Implementation and Integration Complexity:

High implementation and integration complexity remains a critical challenge because many airlines and MRO providers operate legacy systems that are difficult to integrate with modern software platforms. Migrating historical maintenance data into new digital environments requires extensive validation to maintain regulatory compliance. Customization needs vary significantly across fleet types, maintenance philosophies, and operational scales, increasing deployment timelines and costs. Integration with OEM systems, enterprise resource planning platforms, and supply chain software adds further technical complexity. Smaller MRO providers often lack in-house IT expertise, making system adoption resource intensive. Training maintenance personnel to use advanced digital tools can disrupt operations during transition periods. Cybersecurity requirements also increase implementation complexity, particularly for cloud-based platforms handling sensitive operational data. Resistance to change among maintenance staff further slows adoption. These combined factors can delay return on investment and discourage smaller operators from upgrading systems.

Data Security and Cybersecurity Risks:

Data security and cybersecurity risks present a major challenge as MRO software platforms increasingly rely on cloud connectivity and real-time data exchange. Maintenance systems store sensitive information related to aircraft configurations, operational schedules, and compliance records, making them attractive targets for cyber threats. Breaches can disrupt operations, compromise safety, and result in regulatory penalties. Ensuring secure data transmission across multiple stakeholders, including airlines, MROs, OEMs, and regulators, requires robust encryption and access controls. Compliance with evolving cybersecurity regulations adds ongoing cost and complexity. Defense aviation users impose even stricter security requirements, limiting vendor eligibility. Smaller vendors may struggle to meet high cybersecurity standards, reducing competitive diversity. Continuous monitoring and system updates are required to mitigate emerging threats. These security concerns can slow cloud adoption and increase total cost of ownership.

Opportunities

Expansion of Predictive Maintenance and AI Integration:

Expansion of predictive maintenance and AI integration represents a major opportunity as operators seek to transition from reactive to condition-based maintenance strategies. Advanced analytics can process large volumes of aircraft health data to identify early signs of component degradation. AI-driven insights improve maintenance planning accuracy, reducing unscheduled downtime and spare parts inventory costs. Integration with digital twins enables lifecycle optimization of critical components. Airlines increasingly prioritize solutions that deliver measurable cost savings and operational resilience. The United States offers a strong ecosystem of data science talent and aviation technology startups to support innovation. Regulatory acceptance of predictive maintenance methodologies further accelerates adoption. Vendors that deliver explainable and auditable AI models gain competitive advantage. This opportunity supports long-term value creation across commercial and defense aviation segments.

Growth in Defense and Government Aviation Modernization:

Growth in defense and government aviation modernization offers a strong opportunity as public sector operators upgrade aging fleets and maintenance infrastructure. Defense aviation prioritizes mission readiness, data security, and lifecycle cost control, aligning well with advanced MRO software capabilities. Government-funded modernization programs encourage adoption of secure, interoperable maintenance platforms. Integration with logistics and asset management systems enhances operational visibility across defense fleets. Domestic vendors benefit from procurement preferences and long-term contracts. Increased focus on fleet availability and rapid deployment readiness drives investment in digital maintenance tools. Regulatory alignment between civilian and defense standards simplifies technology transfer. This sustained modernization activity provides stable demand and long-term revenue visibility for MRO software providers.

Future Outlook

The market is expected to experience steady growth over the next five years, supported by continued digitalization of maintenance operations and increasing reliance on predictive analytics. Technological advancements in AI, cloud computing, and cybersecurity will enhance software capabilities. Regulatory support for digital compliance will remain strong, while demand-side pressure for cost efficiency and fleet reliability will continue to drive adoption.

Major Players

- Ramco Systems

- IFS

- Oracle

- SAP

- Honeywell Aerospace

- Collins Aerospace

- GE Aerospace

- Lufthansa Technik

- Trax

- SwissAviationSoftware

- UltramainSystems

- EmpowerMX

- AMOS

- Rusada

- IBM

Key Target Audience

- Commercial airlines

- Independent MRO providers

- Aircraftleasing companies

- Defenseaviation units

- Government and regulatory bodies

- Airport operators

- Fleet management companies

- Investments and venture capitalist firms

Research Methodology

Step 1: Identification of Key Variables

Key variables related to fleet size, maintenance cycles, regulatory requirements, and software adoption patterns were identified through industry documentation and aviation authority publications.

Step 2: Market Analysis and Construction

Market structure was constructed by analyzing product categories, deployment models, end users, and competitive positioning across the United States aviation ecosystem.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert inputs from aviation maintenance professionals, software vendors, and regulatory specialists.

Step 4: Research Synthesis and Final Output

All insights were synthesized into a coherent framework to present market dynamics, competitive analysis, and future outlook.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising aircraft fleet size and utilization rates in the United States

Increasing regulatory emphasis on digital maintenance records and traceability

Operational cost reduction through predictive and condition-based maintenance

Integration of advanced analytics and AI in aviation maintenance operations

Growing outsourcing of maintenance activities to specialized MRO providers - Market Challenges

High initial implementation and integration costs for legacy fleets

Data security and cybersecurity concerns in cloud-based MRO platforms

Complexity of integrating MRO software with existing airline IT ecosystems

Resistance to digital transformation among smaller MRO operators

Shortage of skilled personnel capable of managing advanced MRO software systems - Market Opportunities

Expansion of AI-driven predictive maintenance software across commercial fleets

Growing demand for mobile and remote maintenance management applications

Increased adoption of integrated MRO software by defense and government aviation - Trends

Shift toward cloud-native and SaaS-based MRO software solutions

Growing use of real-time aircraft health monitoring systems

Adoption of digital twins for lifecycle management of aircraft components

Increased interoperability between OEM platforms and third-party MRO software

Emphasis on data-driven decision-making in maintenance planning - Government Regulations & Defense Policy

Federal aviation regulations promoting digitization of maintenance records

Defense aviation modernization programs supporting advanced MRO software adoption

Government initiatives to enhance aircraft safety through digital compliance systems - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Maintenance Management Systems

Enterprise Asset Management Software

Inventory and Spare Parts Management Software

Fleet Health Monitoring and Analytics Software

Compliance and Documentation Management Software - By Platform Type (In Value%)

Cloud-based MRO Software

On-premise MRO Software

Hybrid Deployment Platforms

Mobile-enabled MRO Applications

Web-based MRO Management Platforms - By Fitment Type (In Value%)

Line Maintenance Software Solutions

Base Maintenance Software Solutions

Component Maintenance Software Solutions

Engine Maintenance Software Solutions

Heavy Maintenance and Overhaul Software - By EndUser Segment (In Value%)

Commercial Airlines

Cargo and Freight Operators

Independent MRO Service Providers

Military and Government Aviation Units

Business and General Aviation Operators - By Procurement Channel (In Value%)

Direct Vendor Contracts

System Integrator Procurement

Aviation OEM Partner Programs

Third-party Software Resellers

Government and Defense Procurement Channels - By Material / Technology (in Value %)

Artificial Intelligence-based Maintenance Analytics

Predictive Maintenance Algorithms

Digital Twin Technology

Blockchain-enabled Maintenance Records

IoT-integrated Maintenance Platforms

- Cross Comparison Parameters (Product Portfolio Depth, Deployment Model Flexibility, Integration Capability, Regulatory Compliance Support, Analytics and AI Features, Scalability, Customer Support Strength, Pricing Flexibility, Defense Certification Readiness)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Ramco Systems

IFS

IBM

Oracle

SAP

Honeywell Aerospace

RTX Collins Aerospace

Lufthansa Technik

Trax

Swiss AviationSoftware

GE Aerospace

IFS Maintenix

Ultramain Systems

EmpowerMX

AMOS by Swiss-AS

- Commercial airlines focus on reducing aircraft downtime and maintenance costs

- MRO service providers prioritize scalable and multi-fleet software capabilities

- Defense aviation users emphasize secure and compliance-driven MRO platforms

- Business aviation operators seek cost-efficient and user-friendly maintenance solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035