Market Overview

The USA biomarkers market recorded a market size of approximately USD ~ billion based on a recent historical assessment, supported by validated data from the U.S. Food and Drug Administration approvals pipeline, National Institutes of Health funded biomarker programs, and reported revenues of leading diagnostics and life sciences companies operating in the country. Market expansion has been driven by the rapid integration of biomarkers in oncology, cardiology, neurology, and immunology drug development, along with increasing use in clinical diagnostics, companion diagnostics, and precision medicine initiatives supported by federal healthcare and research spending.

The United States dominates the biomarkers market primarily due to the strong presence of advanced healthcare infrastructure across cities such as Boston, San Diego, San Francisco, New York, and Chicago, which collectively host major pharmaceutical companies, biotechnology clusters, and academic medical centers. High R&D spending, early adoption of personalized medicine, favorable regulatory pathways for biomarker qualification, and extensive clinical trial activity have reinforced national leadership. Strong reimbursement frameworks and the presence of global diagnostic manufacturers further support sustained demand across research and clinical applications.

Market Segmentation

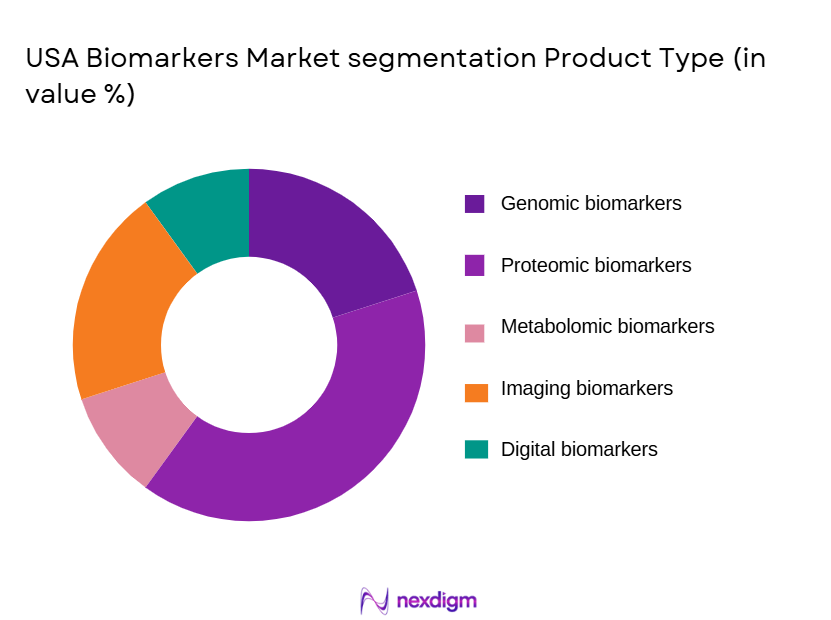

By Product Type

USA Biomarkers market is segmented by product type into genomic biomarkers, proteomic biomarkers, metabolomic biomarkers, imaging biomarkers, and digital biomarkers. Recently, genomic biomarkers have held a dominant market share due to their extensive application in oncology drug development, rare disease diagnostics, and pharmacogenomics-based therapy selection. Strong adoption by pharmaceutical companies for target identification and patient stratification, combined with widespread availability of next-generation sequencing infrastructure, has reinforced their leadership. Continuous federal funding for genomic research, growing use of liquid biopsy solutions, and expanding clinical utility in hereditary and cancer screening programs have further supported dominance. Additionally, increasing regulatory acceptance of genomic biomarkers in companion diagnostics and clinical decision-making has accelerated commercialization, while declining sequencing costs and improved data interpretation tools have enabled broader clinical deployment across hospitals and diagnostic laboratories nationwide.

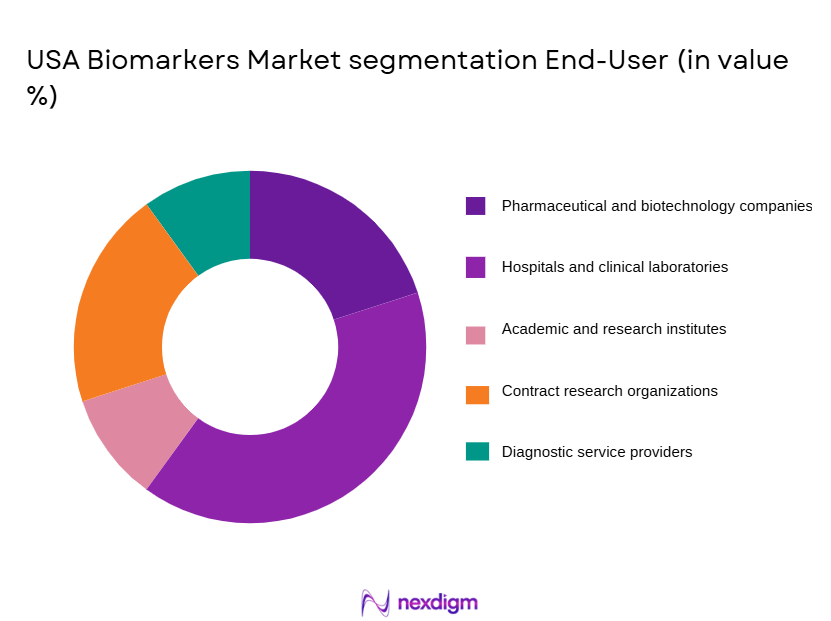

By End User

USA Biomarkers market is segmented by end user into pharmaceutical and biotechnology companies, hospitals and clinical laboratories, academic and research institutes, contract research organizations, and diagnostic service providers. Recently, pharmaceutical and biotechnology companies have dominated the market due to their central role in biomarker-driven drug discovery, clinical trial optimization, and regulatory submissions. High R&D investments, extensive use of predictive and prognostic biomarkers, and growing reliance on companion diagnostics have sustained demand from this segment. Strategic collaborations with diagnostics firms, increased outsourcing of biomarker validation activities, and strong venture funding for precision medicine pipelines have further reinforced leadership. Additionally, the growing complexity of biologics and targeted therapies has increased biomarker integration across development stages, making pharmaceutical and biotechnology firms the largest contributors to overall biomarker spending in the United States.

Competitive Landscape

The USA biomarkers market is moderately consolidated, with a mix of global diagnostics leaders and specialized biotechnology firms controlling critical technologies and validation capabilities. Major players benefit from strong intellectual property portfolios, regulatory expertise, and long-standing relationships with pharmaceutical companies and healthcare providers. High entry barriers related to regulatory compliance, clinical validation, and data integration limit new entrants, while strategic acquisitions and partnerships continue to shape competitive positioning across genomics, proteomics, and digital biomarker platforms.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Primary Application Focus |

| Thermo Fisher Scientific | 1956 | USA | ~ | ~

|

~

|

~

|

~

|

| Roche Diagnostics | 1896 | Switzerland | ~

|

~

|

~

|

~

|

~

|

| Illumina | 1998 | USA | ~

|

~

|

~

|

~

|

~

|

| Abbott Laboratories | 1888 | USA | ~

|

~

|

~

|

~

|

~

|

| Qiagen | 1984 | Netherlands | ~

|

~

|

~

|

~

|

~

|

USA Biomarkers Market Analysis

Growth Drivers

Precision medicine adoption across clinical and research ecosystems

Precision medicine adoption across clinical and research ecosystems has emerged as a critical growth driver for the USA biomarkers market as healthcare providers and pharmaceutical companies increasingly rely on biomarker-based insights to tailor therapies to individual patients. This approach has gained traction due to improved treatment outcomes, reduced adverse drug reactions, and enhanced clinical trial efficiency. The expanding use of biomarkers in oncology, immunology, and neurology has accelerated integration into routine clinical workflows. Federal initiatives supporting personalized healthcare and value-based care models have reinforced adoption across public and private health systems. Advancements in sequencing technologies and bioinformatics have further improved biomarker accuracy and clinical relevance. Growing patient awareness and demand for targeted therapies have also contributed to sustained uptake. Pharmaceutical companies increasingly embed biomarkers throughout drug development pipelines to reduce late-stage failures. Hospitals and diagnostic laboratories continue investing in biomarker-enabled platforms to support precision diagnostics. Together, these factors have positioned precision medicine adoption as a long-term structural driver of market expansion.

Expansion of biomarker-driven drug development pipelines

Expansion of biomarker-driven drug development pipelines has significantly influenced market growth as pharmaceutical and biotechnology companies intensify focus on targeted therapies and biologics. Biomarkers are now integral to target validation, patient stratification, and endpoint selection across clinical trials. This shift has reduced development risk while improving regulatory success rates. Increasing complexity of disease pathways has made traditional one-size-fits-all therapies less effective. Biomarkers enable companies to demonstrate therapeutic efficacy in well-defined patient populations. Regulatory agencies have also encouraged biomarker integration through accelerated approval pathways. Growing venture capital investment in biomarker-enabled startups has strengthened innovation capacity. Strategic collaborations between drug developers and diagnostics firms continue to expand commercial applications. As pipelines mature, recurring demand for validated biomarkers sustains long-term market momentum.

Market Challenges

Regulatory complexity and validation requirements

Regulatory complexity and validation requirements present a major challenge for the USA biomarkers market as companies must navigate stringent approval processes to demonstrate analytical validity, clinical validity, and clinical utility. Compliance with FDA biomarker qualification programs demands extensive datasets and long development timelines. Smaller firms often face financial constraints when pursuing multi-phase validation studies. Differences in regulatory expectations across therapeutic areas further complicate commercialization strategies. Data reproducibility and standardization remain persistent issues across laboratories. Evolving regulatory guidelines require continuous investment in compliance capabilities. Delays in approval can slow time-to-market and impact return on investment. These challenges increase operational risk and discourage rapid innovation. As a result, regulatory burden remains a critical constraint on market scalability.

Data integration and interoperability limitations

Data integration and interoperability limitations challenge efficient biomarker deployment due to fragmented healthcare IT systems and diverse data formats. Biomarker data often originates from genomics, imaging, clinical records, and wearable devices, creating integration complexity. Lack of standardized data frameworks hinders seamless analysis and clinical interpretation. Healthcare providers face difficulties incorporating biomarker insights into electronic health records. Cybersecurity and patient privacy regulations further restrict data sharing. Limited interoperability increases operational costs for diagnostics providers. Analytical inconsistencies can reduce clinician confidence in biomarker outputs. Addressing these issues requires significant investment in digital infrastructure. Until resolved, data integration challenges will constrain full market potential.

Opportunities

Artificial intelligence enabled biomarker discovery

Artificial intelligence enabled biomarker discovery presents a major opportunity by accelerating identification of complex biomarker patterns from large datasets. Machine learning algorithms can analyze multi-omics data at unprecedented scale. This capability improves predictive accuracy and reduces discovery timelines. AI tools enhance interpretation of genomic and proteomic signals. Pharmaceutical companies increasingly adopt AI to optimize target selection. Diagnostic firms leverage AI to improve assay performance. Integration of AI with real-world evidence expands clinical relevance. Regulatory acceptance of AI-supported analytics is gradually improving. These factors collectively create significant growth opportunities for AI-driven biomarker platforms.

Growth of liquid biopsy and non-invasive testing

Growth of liquid biopsy and non-invasive testing offers substantial opportunity as demand rises for minimally invasive diagnostics. Liquid biopsies enable early disease detection and treatment monitoring. Adoption is increasing across oncology and prenatal testing. Reduced patient discomfort improves screening compliance. Advances in circulating tumor DNA analysis enhance sensitivity. Pharmaceutical trials increasingly use liquid biomarkers for real-time monitoring. Reimbursement support has improved clinical adoption. Expanding clinical evidence strengthens physician confidence. This trend supports sustained market expansion across diagnostic and therapeutic applications.

Future Outlook

The USA biomarkers market is expected to experience steady growth over the next five years, supported by continued expansion of precision medicine, rapid technological advancements, and increasing regulatory clarity. Integration of artificial intelligence, multi-omics platforms, and real-world data is expected to enhance biomarker discovery and validation. Favorable government funding and strong private investment will sustain innovation. Growing demand from pharmaceutical development and clinical diagnostics will continue to drive market expansion.

Major Players

- Thermo Fisher Scientific

- Roche Diagnostics

- Illumina

- Abbott Laboratories

- Qiagen

- Agilent Technologies

- Bio-Rad Laboratories

- Danaher Corporation

- Bruker Corporation

- PerkinElmer

- Merck KGaA

- Becton Dickinson

- Siemens Healthineers

- Exact Sciences

- Guardant Health

Key Target Audience

- Pharmaceutical companies

- Biotechnology firms

- Diagnostic laboratories

- Hospitals and healthcare providers

- Contract research organizations

- Medical device manufacturers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key market variables including technology adoption, regulatory pathways, end-user demand, and pricing dynamics were identified through secondary research and expert interviews to define the analytical framework.

Step 2: Market Analysis and Construction

Market size and structure were constructed using validated financial disclosures, healthcare spending data, and technology adoption indicators to ensure accuracy and consistency.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through consultations with industry experts, clinicians, and regulatory specialists to confirm assumptions and refine insights.

Step 4: Research Synthesis and Final Output

All data points and qualitative insights were synthesized into a cohesive market narrative, ensuring reliability, clarity, and relevance for decision-makers.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising adoption of precision medicine and personalized therapies

Expansion of biomarker driven drug development pipelines

Increasing chronic disease burden requiring early diagnosis - Market Challenges

High validation and regulatory compliance costs

Complexity in biomarker standardization and reproducibility

Data integration and interpretation challenges across platforms - Market Opportunities

Integration of artificial intelligence in biomarker discovery

Growth of companion diagnostics in oncology and immunology

Expansion of liquid biopsy and non invasive testing solutions - Trends

Shift toward multi omics biomarker approaches

Increased use of real world evidence in biomarker validation

Growing adoption of digital and wearable biomarkers - Government Regulations

FDA biomarker qualification and validation frameworks

Clinical laboratory improvement amendments compliance

Data privacy and patient safety regulations

- By Market Value 2019-2025

- By Installed Units 2019-2025

- By Average System Price 2019-2025

- By System Complexity Tier 2019-2025

- By System Type (In Value%)

Genomic biomarkers

Proteomic biomarkers

Metabolomic biomarkers

Imaging biomarkers

Digital and wearable biomarkers - By Platform Type (In Value%)

Next generation sequencing platforms

Mass spectrometry platforms

Immunoassay platforms

Medical imaging platforms

Bioinformatics and data analytics platforms - By Fitment Type (In Value%)

Research laboratory-based biomarkers

Clinical diagnostic biomarkers

Point of care biomarkers

Companion diagnostic biomarkers

Remote monitoring biomarker solutions - By EndUser Segment (In Value%)

Pharmaceutical and biotechnology companies

Hospitals and clinical laboratories

Academic and research institutes

Contract research organizations

Diagnostic service providers - By Procurement Channel (In Value%)

Direct manufacturer procurement

Long term supply agreements

Research grant funded procurement

Group purchasing organizations

Public health and government tenders

- Market Share Analysis

- CrossComparison Parameters (Technology breadth, Regulatory readiness, Clinical validation strength, Data analytics capability, Geographic presence)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

- Thermo Fisher Scientific

Roche Diagnostics

Agilent Technologies

Illumina

Abbott Laboratories

Qiagen

Danaher Corporation

Bio Rad Laboratories

Bruker Corporation

PerkinElmer

Merck KGaA

Becton Dickinson

Siemens Healthineers

Exact Sciences

Guardant Health

- Pharmaceutical companies focusing on target validation and trial optimization

- Hospitals adopting biomarkers for early diagnosis and therapy selection

- Research institutes driving innovation through translational studies

- CROs supporting outsourced biomarker development activities

- Forecast Market Value 2026-2030

- Forecast Installed Units 2026-2030

- Price Forecast by System Tier 2026-2030

- Future Demand by Platform 2026-2030