Market Overview

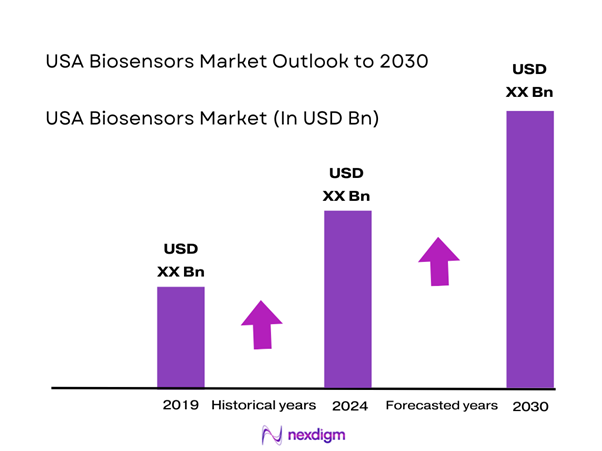

The USA Biosensors Market is valued at USD ~ billion, driven by the increased adoption of these sensors in healthcare diagnostics, environmental monitoring, and the food industry. Demand is primarily generated from the growing need for real-time, non-invasive monitoring solutions, particularly in chronic disease management such as diabetes and cardiovascular health. The rise of wearable devices and advancements in sensor technology such as miniaturization and integration with smartphones have significantly expanded market opportunities. Additionally, governmental and regulatory initiatives focusing on healthcare innovations have also played a pivotal role in fostering market growth.

Regions such as Silicon Valley, Boston, and Chicago dominate the USA Biosensors Market. These cities host leading players in the biosensor industry, particularly in healthcare and biotechnology sectors, due to their advanced technological infrastructure and proximity to major research institutions. The USA’s leadership in biosensor technology development, particularly in medical diagnostics and environmental sensing, positions it as a key player globally. Additionally, international players like Siemens Healthineers, Abbott Laboratories, and Medtronic significantly influence the market with their advanced product offerings and strategic collaborations.

Market Segmentation

By Type of Biosensor

Electrochemical biosensors hold a dominant position in the USA Biosensors Market, primarily due to their widespread use in medical diagnostics, especially for glucose monitoring in diabetes care. Their relatively low cost, ease of use, and high sensitivity make them the preferred choice for wearable devices and point-of-care diagnostics. As technology has improved, electrochemical sensors have become more accurate, further cementing their dominance in the medical sector. The continued growth in the number of diabetic patients and increasing adoption of health-monitoring wearables also fuels the demand for electrochemical biosensors.

By Application

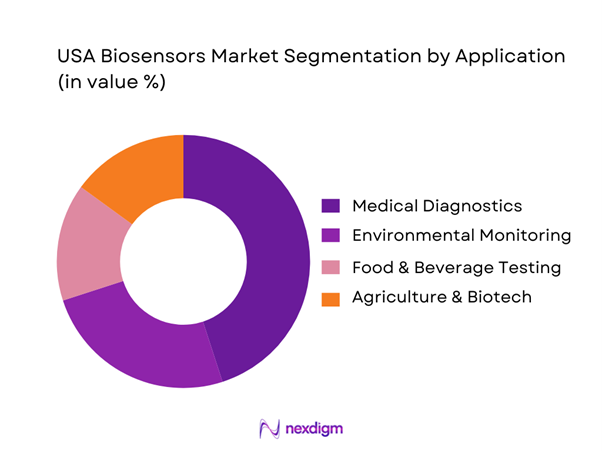

Medical diagnostics is the leading application segment for biosensors in the USA. This sector benefits significantly from the growing demand for real-time, non-invasive diagnostic tools, especially for chronic disease management such as diabetes, cardiovascular diseases, and cancer. With the increased adoption of portable diagnostic devices, the medical diagnostics sub-segment is expected to continue its dominance. The integration of biosensors with wearable health devices has further propelled their usage, offering patients and healthcare providers efficient, real-time data. Moreover, government and healthcare policies promoting personalized medicine enhance market growth in this segment.

Competitive Landscape

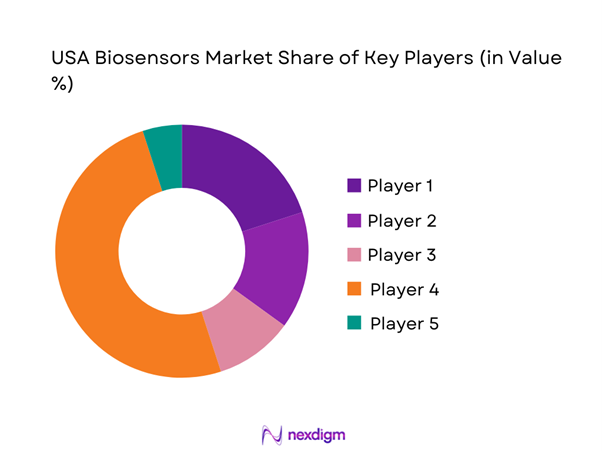

The USA Biosensors market is dominated by a few major players, including Abbott Laboratories and global brands like Medtronic, Thermo Fisher Scientific, and GE Healthcare. This consolidation highlights the significant influence of these key companies.

| Company | Establishment Year | Headquarters | R&D Investment | Key Product Segments | Market Focus | Strategic Alliances |

| Abbott Laboratories | 1888 | Chicago, IL | ~ | ~ | ~ | ~ |

| Medtronic | 1949 | Minneapolis, MN | ~ | ~ | ~ | ~ |

| Thermo Fisher Scientific | 1956 | Waltham, MA | ~ | ~ | ~ | ~ |

| GE Healthcare | 1892 | Chicago, IL | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Erlangen, Germany | ~ | ~ | ~ | ~ |

USA Biosensors Market Analysis

Growth Drivers

Increased Healthcare Applications

The healthcare sector is one of the primary growth drivers for the biosensors market. With the rising prevalence of chronic diseases such as diabetes, cardiovascular conditions, and cancer, the demand for advanced diagnostic tools has significantly increased. Biosensors enable continuous, real-time health monitoring, improving disease management and early detection. Technologies like glucose monitors, wearable ECG monitors, and point-of-care testing devices are gaining widespread adoption. The convenience and non-invasive nature of biosensors also contribute to their growth, providing accurate and cost-effective solutions for both healthcare professionals and patients, ultimately enhancing patient outcomes and healthcare efficiency.

Rising Demand for Real-time Monitoring in Environmental & Agriculture Sectors

The increasing focus on environmental sustainability and agricultural efficiency is driving the demand for biosensors. In the environmental sector, biosensors are crucial for monitoring water quality, detecting pollutants, and ensuring sustainable practices. With growing concerns about climate change and environmental degradation, biosensors are being used for real-time monitoring of air, soil, and water conditions. In agriculture, biosensors are enhancing crop management and food safety by detecting pathogens, contaminants, and soil health indicators. This real-time monitoring allows for data-driven decision-making, optimizing resource use, and increasing productivity in both environmental and agricultural practices, driving market growth.

Market Challenges

Regulatory and Compliance Constraints

Biosensors, particularly those used in medical and environmental applications, face stringent regulatory and compliance challenges. Regulatory bodies require that biosensors meet rigorous standards to ensure their safety, accuracy, and efficacy. The approval process can be lengthy and costly, hindering the speed at which new technologies are introduced to the market. Furthermore, varying regulations across different regions complicate the global distribution of biosensor products. Compliance with data privacy and security laws, especially in healthcare applications, also adds an additional layer of complexity. These regulatory hurdles create delays in market entry and can increase the overall cost of biosensor development.

High Development Costs for Biosensors

The development and manufacturing of biosensors can be resource-intensive, requiring substantial investment in research and development. The costs associated with designing, testing, and scaling biosensor technology, especially for medical and environmental applications, are high. These expenses are driven by the need for advanced materials, precise manufacturing processes, and compliance with stringent regulatory standards. Smaller companies and startups may struggle to secure the necessary funding to bring their innovations to market, limiting competition and slowing the pace of innovation. Moreover, the high production costs can lead to higher product prices, limiting accessibility for consumers and healthcare providers.

Opportunities

Growing Need for Personalized Healthcare Solutions

Personalized healthcare is an emerging trend that presents significant opportunities for biosensor technologies. As the demand for individualized treatment grows, biosensors offer a way to continuously monitor patients’ health in real-time, allowing for tailored therapies and interventions. Biosensors are already being integrated into wearable devices, enabling the monitoring of various health parameters such as glucose levels, blood pressure, and heart rate. This shift toward personalized care ensures that treatments are better aligned with patients’ unique health profiles, improving outcomes and patient satisfaction. The rise in chronic diseases, aging populations, and consumer health consciousness further fuels this demand.

Emerging Demand in Smart Wearables and IoT for Biosensors

The integration of biosensors into smart wearables and the Internet of Things (IoT) is creating new opportunities for market expansion. Smart devices, such as fitness trackers, smartwatches, and health monitors, are increasingly incorporating biosensors to track vital health metrics. These devices are gaining popularity due to their convenience, ease of use, and real-time data analysis. The IoT ecosystem allows for seamless connectivity between devices, enabling the monitoring of multiple parameters simultaneously. This interconnectivity not only enhances user experience but also fosters a deeper understanding of health trends, contributing to better health management and early detection of medical conditions.

Future Outlook

In the coming years, the USA Biosensors Market is expected to witness robust growth driven by technological advancements and the increasing integration of biosensors in healthcare devices. The continued push towards personalized medicine and early disease detection, combined with the rapid evolution of wearable technology, will play a critical role in the market’s expansion. Moreover, government policies supporting innovation in healthcare and environmental sustainability will provide further momentum, positioning the biosensors market as a key player in the advancement of health and safety solutions.

Major Players

- Abbott Laboratories

- Medtronic

- Thermo Fisher Scientific

- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Biosensors International Group

- Honeywell International

- SensiQ Technologies

- Bio-Rad Laboratories

- Nova Biomedical

- Integrated Sensing Systems

- Keren Biomaterials

- Roche Diagnostics

- Danaher Corporation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies (FDA, EPA)

- Healthcare providers (hospitals, diagnostic centers)

- Biotechnology and pharmaceutical companies

- Agricultural companies focused on precision farming

- Environmental monitoring organizations

- Food and beverage manufacturers

- Research institutions and universities

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping all relevant stakeholders in the USA Biosensors Market, identifying critical variables such as technological advancements, healthcare trends, and regulatory requirements that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data and market trends are analyzed to construct a comprehensive model of the USA Biosensors Market. This includes evaluating market penetration and sector-specific revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through interviews with industry experts and key stakeholders to refine the data and ensure the analysis accurately reflects current market conditions.

Step 4: Research Synthesis and Final Output

The final step synthesizes all collected data, including primary and secondary research, into a comprehensive report. Engagement with major biosensor manufacturers helps finalize the market analysis, ensuring it is accurate and actionable.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Biosensors Usage / Value-Chain / Care-Continuum Mapping

- Business Cycle and Demand Seasonality

- USA Industry / Service / Delivery Architecture

- Growth Drivers

Increased Healthcare Applications

Rising Demand for Real-time Monitoring in Environmental & Agriculture Sectors

Advancements in Biosensor Technology - Market Challenges

Regulatory and Compliance Constraints

High Development Costs for Biosensors

Shortage of Skilled Professionals in Biosensor Manufacturing - Opportunities

Growing Need for Personalized Healthcare Solutions

Emerging Demand in Smart Wearables and IoT for Biosensors

Rising Application in Disease Diagnostics and Monitoring - Trends

Integration of AI and Machine Learning with Biosensors

Wearable Biosensor Devices for Continuous Health Monitoring

Increased Focus on Non-invasive Biosensing Technologies - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- Installed Base / Active Usage Metric, 2019–2024

- Service / Revenue Mix, 2019–2024

- By Type of Biosensors (In Value %)

Electrochemical Biosensors

Optical Biosensors

Piezoelectric Biosensors

Thermal Biosensors

Electrochemical & Optical Hybrid Biosensors - By Application (In Value %)

Medical Diagnostics

Environmental Monitoring

Food & Beverage Testing

Agriculture & Biotech - By End-User Industry (In Value %)

Healthcare & Pharmaceuticals

Food & Beverage

Environmental & Waste Management

Agricultural and Biotechnology Sectors - By Region (In Value %)

East Coast

West Coast

Central Region

Midwest - By Distribution Channel (In Value %)

Direct Sales

Online Retail

Distributors & Dealers

- Competition ecosystem overview

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Biosensor, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value Offering, and Others)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Abbott Laboratories

Siemens Healthineers

Medtronic

Thermo Fisher Scientific

Danaher Corporation

Roche Diagnostics

GE Healthcare

Honeywell International

Philips Healthcare

Biosensors International Group

SensiQ Technologies

Nova Biomedical

Bio-Rad Laboratories

Integrated Sensing Systems

Keren Biomaterials

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- Installed Base / Active Usage Metric, 2025–2030

- Service / Revenue Mix, 2025–2030