Market Overview

The USA blockchain in automotive market is valued at USD ~ billion in 2023. The market is primarily driven by increasing demand for transparency in supply chains, secure vehicle identity management, and smart contract integration. Blockchain technology is increasingly being adopted to improve the efficiency and security of automotive operations, such as supply chain management, vehicle history tracking, and even autonomous vehicle communication. Major OEMs and Tier-1 suppliers are actively investing in blockchain-based solutions to enhance their operations, meet regulatory standards, and improve customer trust. Additionally, blockchain is expected to play a key role in the growing automotive ecosystem of electric vehicles (EVs) and connected car services.

The USA leads the blockchain in automotive market due to its vast automotive manufacturing base, with Detroit, Michigan, being a key hub for automotive innovation. Furthermore, Silicon Valley and other tech-forward regions in California continue to drive blockchain adoption in the automotive sector, as they offer technological advancements and proximity to key players like Tesla and Google. The regulatory environment in the USA also supports the development of blockchain applications in the automotive industry, including compliance with data privacy standards and autonomous vehicle testing regulations.

Market Segmentation

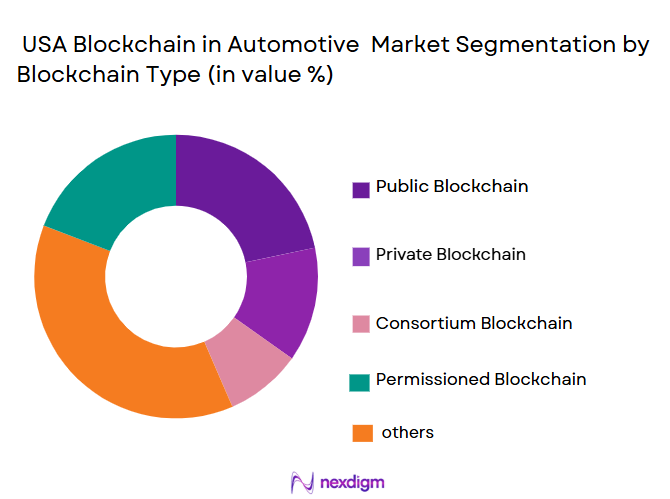

By Blockchain Type

The blockchain in automotive market is segmented by blockchain type into public, private, and consortium blockchains. In the USA, the private blockchain segment dominates the market, owing to its robust security features, scalability, and control over access to sensitive data, which is a key consideration for automotive OEMs and suppliers. Private blockchains offer the benefits of decentralization while ensuring compliance with stringent data privacy and security standards, making them ideal for applications in supply chain management, vehicle history tracking, and fleet management. Leading automotive players, such as General Motors and Ford, are integrating private blockchain solutions for secure and transparent data sharing across the supply chain.

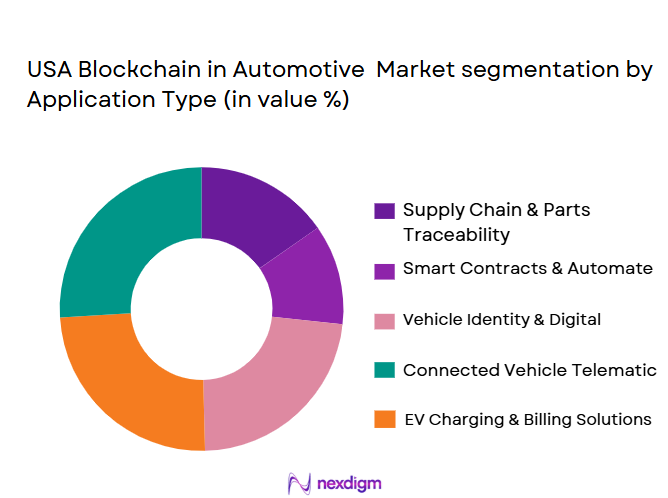

By Application Type

The blockchain in automotive market is also segmented by application into supply chain management, vehicle identity and history tracking, smart contracts, connected vehicle services, and electronic vehicle (EV) charging and payments. The supply chain management application segment holds the largest market share in the USA, driven by the need for greater transparency, traceability, and efficiency in the automotive supply chain. Blockchain technology enables end-to-end tracking of parts and materials, reducing fraud, counterfeiting, and logistical errors. Leading automotive manufacturers and suppliers are adopting blockchain to enhance the accuracy of their supply chain data and streamline their operations.

Competitive Landscape

The USA blockchain in automotive market is dominated by several global and regional players, ranging from tech giants to automotive OEMs. The market landscape features companies such as IBM, Microsoft, and Accenture, along with leading automotive manufacturers like Ford and General Motors, which are either developing their blockchain solutions or collaborating with tech providers for system integration.

| Company Name | Establishment Year | Headquarters | Blockchain Type | Key Focus Areas | Strategic Partnerships | Annual Revenue (USD) |

| IBM Corporation | 1911 | Armonk, NY | ~ | ~ | ~ | ~ |

| Microsoft | 1975 | Redmond, WA | ~ | ~ | ~ | ~ |

| Accenture | 1989 | Dublin, Ireland | ~ | ~ | ~ | ~ |

| Ford Motor Company | 1903 | Dearborn, MI | ~ | ~ | ~ | ~ |

| General Motors | 1908 | Detroit, MI | ~ | ~ | ~ | ~ |

Usa Air Quality Monitoring System Market Analysis

Growth Drivers

Urbanization

Usa’s rapid urbanization is a major driver of the growing demand for air quality monitoring systems. The urban population in Usa is expected to increase significantly, with the number of people living in urban areas projected to surpass ~ million by 2025, which is about ~% of the total population. As urban areas become more populated, pollution levels rise, pushing for better monitoring systems. Jakarta, Usa’s capital, is among the most polluted cities globally, and urbanization trends make air quality management crucial. The government’s urban planning and development are increasingly focused on monitoring air quality as part of public health initiatives.

Industrialization

Usa’s industrial sector has experienced substantial growth, contributing to increasing air pollution. Manufacturing, particularly in the mining, textiles, and automotive industries, has expanded, driving the demand for air quality monitoring systems. According to the World Bank, Usa’s industrial production grew by ~% in 2022, and sectors like mining, oil, and gas have become key contributors to the economy. As industrial activities rise, emissions from factories, power plants, and transportation sectors worsen air quality, thereby driving the demand for advanced monitoring systems. Industrial zones across the country, especially in Java, are witnessing increased air pollution, prompting regulations for better monitoring and reporting systems.

Challenges

Several technical challenges

Usa faces several technical challenges in the deployment of air quality monitoring systems. These include difficulties in maintaining calibration of monitoring sensors, limited internet connectivity in rural areas, and the need for data integration across various monitoring platforms. The technical skills required to manage and maintain these systems are also a barrier, as many regions lack the necessary expertise. The remote monitoring and continuous data collection needed for real-time air quality analysis are challenging in some parts of Usa, especially in the islands, where infrastructure is less developed.

Source: Usan Ministry of Communication and Information Technology

Lack of Skilled Workforce

One of the significant barriers to air quality monitoring in Usa is the shortage of skilled workers in environmental technology and data analysis. The rapid growth in demand for air quality monitoring systems has outpaced the available technical expertise in managing these systems. According to the Usan Ministry of Labor, the country’s workforce is not fully prepared for the challenges associated with deploying and managing advanced monitoring systems, including interpreting complex environmental data and maintaining the technology. This lack of qualified professionals delays the adoption and expansion of air quality monitoring networks.

Opportunities

Technological Advancements

Technological advancements present a significant opportunity for the expansion of air quality monitoring systems in Usa. Innovations in Internet of Things (IoT) and artificial intelligence (AI) are improving the efficiency and affordability of air quality monitoring systems. Real-time data collection and analysis through IoT sensors are now more accessible and accurate, allowing for better integration of air quality monitoring into smart city projects. The Usan government has expressed interest in adopting AI-driven air quality prediction models that can provide insights into future pollution trends and mitigate environmental risks. These advancements are expected to drive the growth of air quality monitoring systems in the coming years.

International Collaborations

International collaborations are opening new avenues for growth in the Usan air quality monitoring market. The government has partnered with global entities such as the World Bank and the United Nations Environment Programme (UNEP) to improve air quality monitoring. These collaborations provide Usa with access to advanced technologies, expertise, and funding that facilitate the development and expansion of air quality monitoring systems. Furthermore, international companies are increasingly entering the market, bringing in new technologies and solutions tailored to Usa’s environmental needs.

Future Outlook

Over the next five years, the USA blockchain in automotive market is poised for significant growth, driven by advances in blockchain technology and an increasing number of use cases. These include blockchain’s role in autonomous vehicles, supply chain traceability, and electric vehicle (EV) infrastructure. Government regulations, especially regarding data privacy and vehicle history management, are expected to further propel adoption. Partnerships between technology firms and automotive manufacturers are likely to become more prominent, ensuring robust growth in blockchain solutions for the automotive sector.

Major Players

- IBM Corporation

- Microsoft

- Accenture

- Ford Motor Company

- General Motors

- Tesla

- Toyota

- Nissan

- Daimler AG

- Audi AG

- Volkswagen Group

- BMW

- Honda

- SAP

- Oracle Corporation

Key Target Audience

- Automotive Original Equipment Manufacturers (OEMs)

- Tier 1 Automotive Suppliers

- Electric Vehicle Manufacturers

- Autonomous Vehicle Technology Providers

- Fleet Operators & Mobility Service Providers

- Government and Regulatory Bodies

- Investment and Venture Capitalist Firms

- Blockchain Technology Providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing key stakeholders, including automotive OEMs, suppliers, technology firms, and government agencies. This is achieved through desk research utilizing proprietary and secondary databases to identify and define the critical variables that influence the adoption of blockchain in automotive applications.

Step 2: Market Analysis and Construction

In this phase, historical market data is compiled and analyzed, covering areas such as market penetration of blockchain technologies, adoption rates by key automotive players, and application in supply chain management and vehicle identity tracking. Revenue generation data is also evaluated to understand the contribution of blockchain adoption across various segments.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses will be validated through interviews with industry experts, including executives from leading automotive companies and technology providers. These expert consultations will offer valuable insights into the operational and financial aspects of blockchain adoption in the automotive sector.

Step 4: Research Synthesis and Final Output

The final phase involves validating and refining the data gathered in previous steps through direct engagement with stakeholders in the automotive and technology sectors. Detailed insights into product segments, sales performance, and regulatory factors will be integrated into the final analysis, ensuring comprehensive market understanding.

- Executive Summary

- Research Methodology (Market Definitions and Scope Clarification, Market Sizing & Forecasting Approach, Primary vs. Secondary Data Sources, Industry Validation Panels, Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM), Data Normalization & Inflation Adjustments, Limitations and Projection Assumptions)

- Definition and Scope

- Market Genesis & Evolution of Blockchain Adoption in U.S. Automotive

- Timeline of Major Deployments & Standards Initiatives

- Automotive Value Chain Integration with Blockchain

- (OEMs → Suppliers → Dealers)

Blockchain Layers - (Infrastructure, Middleware, Services, Applications)

- Growth Drivers

Rising need for secure and transparent automotive supply chains

Growth of connected and data-driven vehicle ecosystems

Increasing adoption of digital transactions and smart contracts - Market Challenges

Lack of standardization and interoperability

High implementation complexity and integration costs

Regulatory and data governance uncertainties - Market Opportunities

Blockchain adoption in vehicle data monetization

Expansion of usage-based insurance and mobility services

Integration with EV charging and energy trading platforms - Trends

Formation of automotive blockchain consortiums

Integration of blockchain with IoT and AI technologies

Growing focus on vehicle identity and digital twin solutions

- By Value, 2019-2025

- Volume, 2019-2025

- Average Price, 2019-2025

- By System Type (In Value%)

Blockchain-based supply chain management systems

Vehicle identity and lifecycle management platforms

Smart contract-based mobility and leasing systems

Blockchain-enabled data security and sharing solutions

Payment and transaction management blockchain systems - By Platform Type (In Value%)

Passenger vehicles

Commercial vehicles

Electric vehicles

Autonomous and connected vehicles

Shared mobility and ride-hailing platforms - By Fitment Type (In Value%)

OEM-integrated blockchain platforms

Cloud-based blockchain services

Hybrid on-premise and cloud blockchain systems

Aftermarket blockchain integration solutions

Third-party managed blockchain platforms - By EndUser Segment (In Value%)

Automotive OEMs

Tier I and Tier II suppliers

Fleet operators and mobility service providers

Dealers and aftermarket service providers

Insurance and financial service companies - By Procurement Channel (In Value%)

Direct OEM technology partnerships

Software licensing and subscription models

Cloud service provider contracts

System integrator and consultancy procurement

Consortium-based and industry alliance adoption

- Market Share Analysis

- Cross Comparison Parameters

[Technology maturity, Scalability, Integration capability, Security features, Pricing model] - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

IBM

Microsoft

Amazon Web Services

Oracle

SAP

Accenture

Bosch

Continental

Harman International

VeChain

Consensys

R3

Guardtime

Fetch.ai

IOTA

- OEMs focus on traceability and lifecycle transparency

- Suppliers leverage blockchain for provenance and compliance

- Fleet operators adopt blockchain for cost and data optimization

- Insurers use blockchain for fraud reduction and claims efficiency

- Forecast Market Value 2025–2030

- Forecast Installed Units 2025–2030

- Price Forecast by System Tier 2025–2030

- Future Demand by Platform 2025–2030