Market Overview

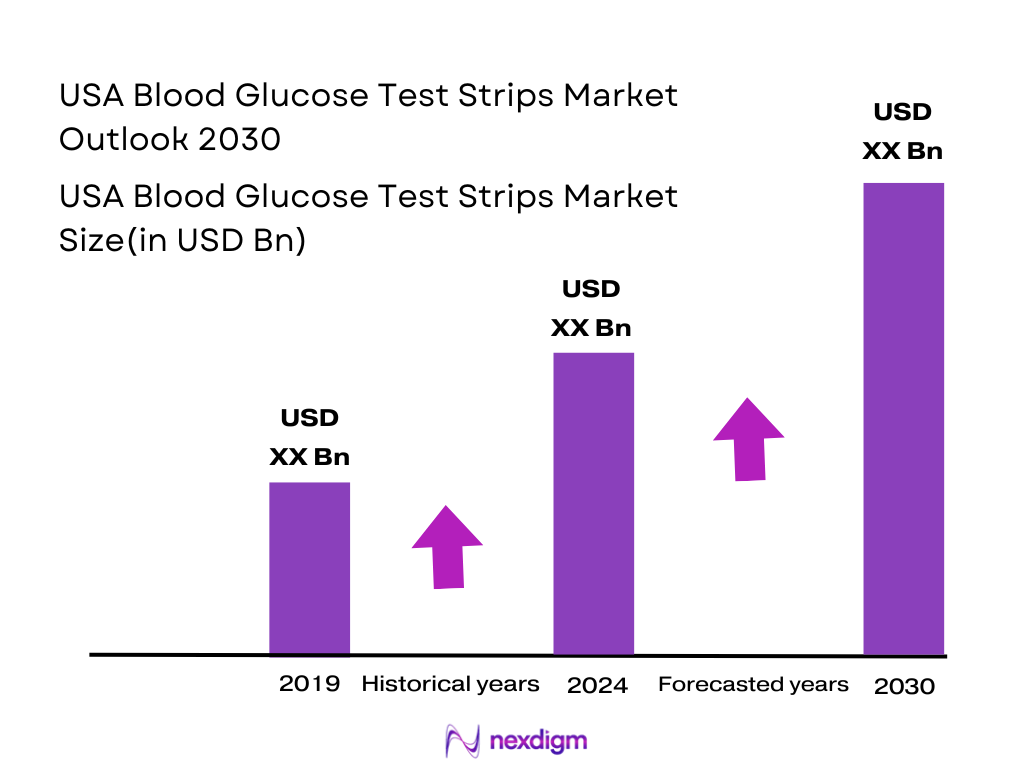

The USA Blood Glucose Test Strips Market is valued at USD ~ billion, with its continued growth being propelled by the rising number of diabetes cases and the increasing adoption of self-monitoring blood glucose (SMBG) systems. A significant factor driving market growth is the widespread awareness of diabetes management and the demand for convenient and efficient monitoring tools. Key drivers also include the aging population, advancements in test strip technology, and the growing shift towards home-based testing. The adoption of diabetes monitoring solutions in the healthcare system is supported by robust reimbursement policies and government initiatives. Increased healthcare expenditures and the focus on preventative care further accelerate the demand for blood glucose test strips.

The USA dominates the blood glucose test strips market due to its large diabetic patient base, supported by a highly advanced healthcare infrastructure. Major urban centers like New York, Los Angeles, and Chicago lead in market share due to their concentration of healthcare facilities, medical professionals, and access to insurance reimbursement. Furthermore, these cities have high populations of individuals with type 1 and type 2 diabetes, contributing to the sustained demand for blood glucose monitoring solutions. Additionally, the presence of leading global healthcare manufacturers and distributors in these cities supports market growth.

Market Segmentation

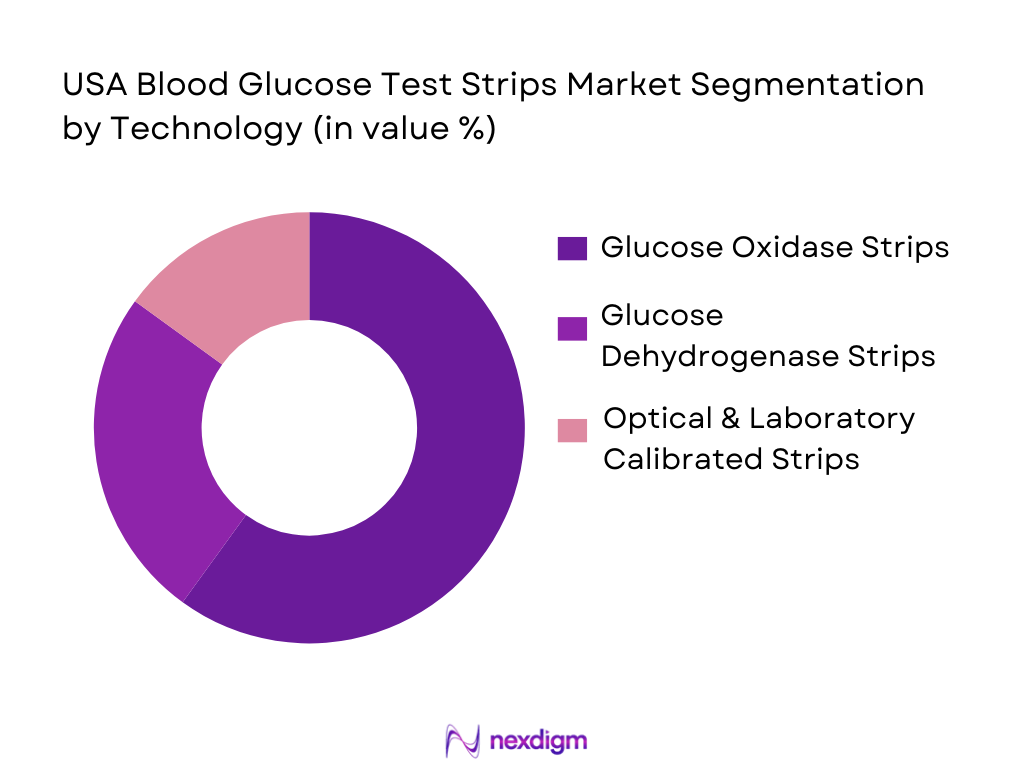

By Technology

The blood glucose test strips market in the USA is primarily segmented by technology into glucose oxidase strips, glucose dehydrogenase strips, and optical & laboratory-calibrated strips. The glucose oxidase strips segment has the dominant market share in the USA, owing to their long-established history and high accuracy in glucose measurement. This technology is widely recognized for its efficiency and reliability, which is why it has been the preferred choice for both home users and healthcare professionals. The segment is also well-supported by continuous innovation in enzyme-based chemistry that enhances test precision and reliability. Furthermore, it aligns well with regulatory requirements for product approval.

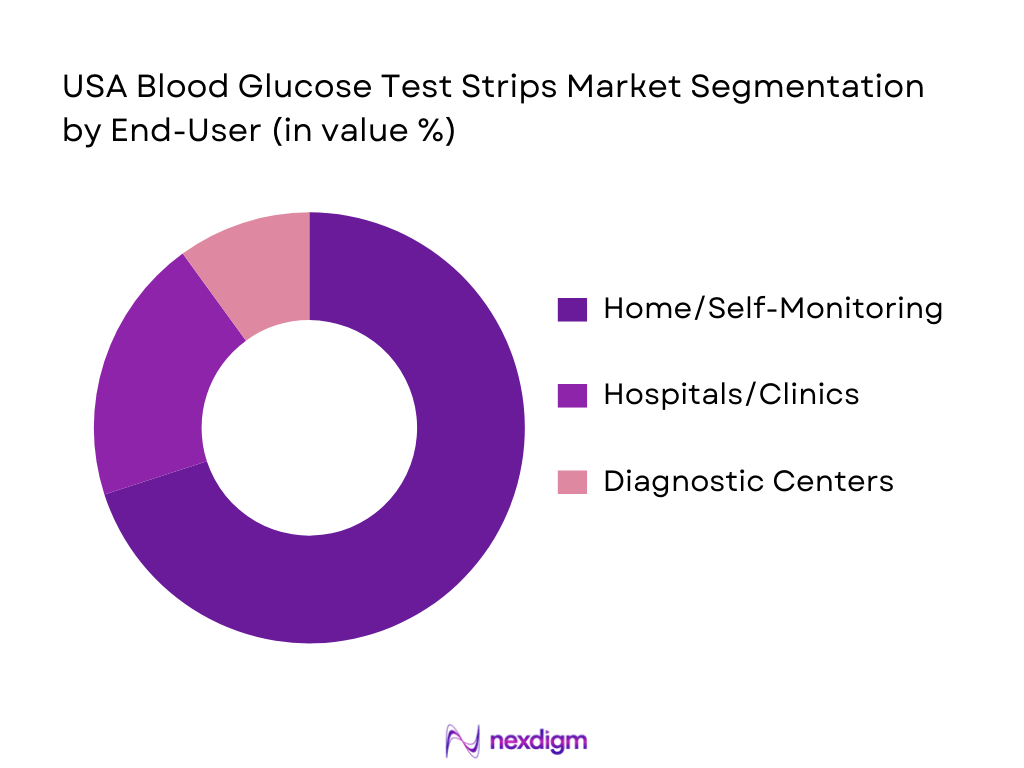

By End User

The market is also segmented by end users, including home/self-monitoring, hospitals/clinics, and diagnostic centers. Home/self-monitoring is the dominant segment, reflecting the increasing trend of diabetic patients taking control of their disease through at-home testing. The convenience of using blood glucose test strips at home, paired with improved accessibility and affordability, has greatly contributed to this growth. With the rise in chronic diseases like diabetes and a more health-conscious population, home-based monitoring solutions have seen considerable uptake across urban and rural populations. The increasing availability of private insurance plans also supports this segment’s dominance.

Competitive Landscape

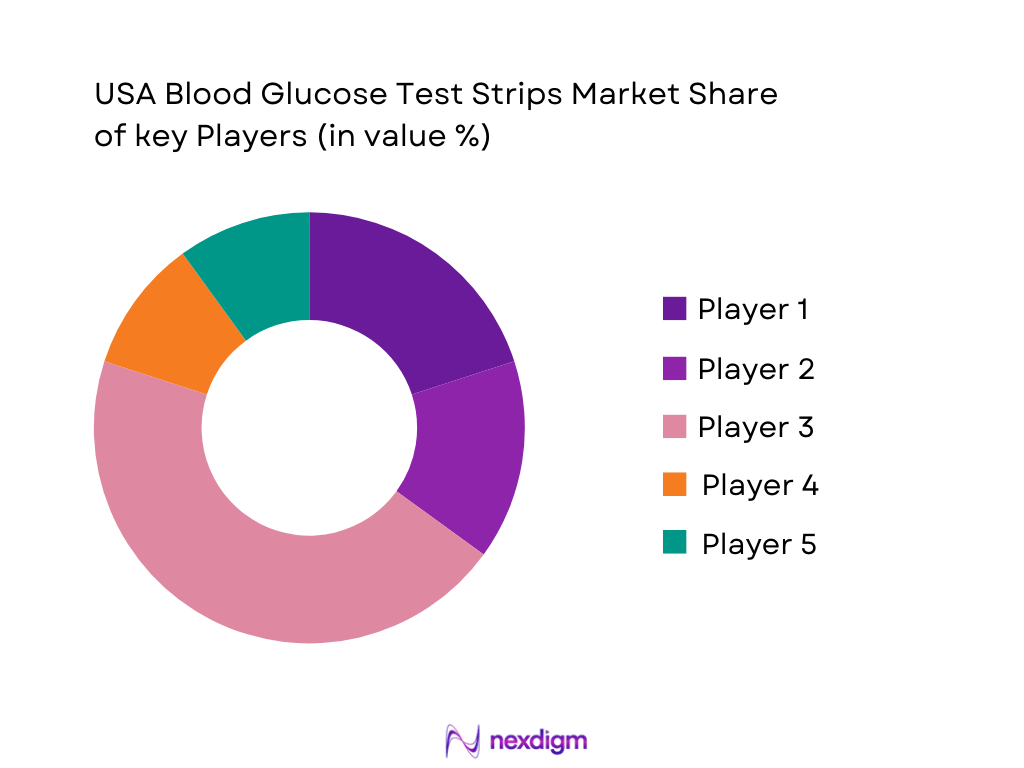

The USA blood glucose test strips market is highly competitive, with several key players dominating the market. Some of the major players include Abbott Laboratories, Roche Diagnostics, LifeScan (Johnson & Johnson), Ascensia Diabetes Care, and ARKRAY. These companies maintain a strong presence due to their established product portfolios, widespread distribution networks, and ongoing innovation in glucose monitoring technologies. Moreover, their strategic partnerships with healthcare providers and insurance companies strengthen their market position, allowing them to address the growing demand for blood glucose test strips.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Market Strategy | R&D Investment | Distribution Reach | Pricing Strategy |

| Abbott Laboratories | 1888 | USA | ~ | ~ | ~ | ~ | ~ |

| Roche Diagnostics | 1896 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| LifeScan (Johnson & Johnson) | 1981 | USA | ~ | ~ | ~ | ~ | ~ |

| Ascensia Diabetes Care | 2016 | Germany | ~ | ~ | ~ | ~ | ~ |

| ARKRAY | 1948 | Japan | ~ | ~ | ~ | ~ | ~ |

USA Blood Glucose Test Strips Market Analysis

Growth Drivers

Urbanization

Urbanization plays a critical role in the growth of the USA Blood Glucose Test Strips Market. The increase in urban population directly correlates with higher diabetes incidence due to lifestyle changes such as poor diet and reduced physical activity. As of 2025, the U.S. urban population reached approximately ~ % of the total population, as reported by the World Bank. This urbanization is leading to a rise in healthcare spending and greater demand for home-based healthcare solutions. Increased healthcare infrastructure and higher access to medical products in cities drive the use of blood glucose test strips. With growing urban density, the number of individuals needing diabetes management tools has escalated, thus enhancing the market demand for glucose test strips.

Industrialization

Industrialization has significantly impacted healthcare access in the United States, particularly with the increase in disposable incomes and the availability of advanced healthcare technologies. The industrial growth in the U.S. has stimulated economic growth, and as of 2025, the industrial sector contributed ~ % to the nation’s GDP, as per IMF data. This has increased consumer spending power, particularly for healthcare products like blood glucose test strips. Additionally, industrial growth has led to better healthcare infrastructure, more hospitals, clinics, and retail pharmacies, all of which contribute to the greater availability and distribution of diabetes management products like glucose monitoring systems.

Restraints

High Initial Costs

One of the primary restraints on the USA Blood Glucose Test Strips Market is the high initial costs of both the test strips and the accompanying devices. While the price of test strips has been reduced in some cases, the upfront cost remains high, which limits the adoption of glucose monitoring systems, particularly in lower-income populations. For example, the average cost of a box of test strips can range from USD ~ to USD ~. Furthermore, the initial investment in glucose meters can be as high as USD ~ to USD ~ , creating financial barriers for some individuals to regularly monitor their glucose levels. The rising healthcare costs in the U.S., which reached USD ~ trillion in 2025, have compounded these challenges, reducing the affordability of these health tools for a wider population.

Technical Challenges

The blood glucose test strip market also faces technical challenges, such as the need for consistent innovation in sensor technology and reliability in test results. Despite advancements, existing glucose test strips still face issues like calibration errors and user difficulty in obtaining accurate readings, especially in patients with fluctuating blood glucose levels. Technical challenges are amplified by the rapid changes in technology, with new devices and sensors requiring high regulatory oversight. Moreover, regulatory hurdles for new product approval have grown more stringent, particularly after recent FDA guidelines for diabetic monitoring products. The FDA’s tightened regulations on medical devices have led to slower product rollouts and greater compliance costs for companies developing advanced glucose monitoring systems.

Opportunities

Technological Advancements

Technological advancements offer significant growth opportunities for the blood glucose test strips market. The development of more accurate, cost-effective, and user-friendly test strips is one of the main factors that could propel future growth. In recent years, the development of continuous glucose monitoring (CGM) devices and the integration of smartphones with glucose monitoring systems has been a game changer. These advancements are expected to make blood glucose management more accessible, especially for individuals with Type 2 diabetes. Currently, there are over 35 million people with diabetes in the United States, and the widespread use of CGMs and smartphone-integrated systems provides an opportunity to capture a larger market share in the coming years. Technological progress in non-invasive glucose monitoring systems, which bypass traditional skin pricking, also holds great promise for expanding the market and reducing pain points for users.

International Collaborations

International collaborations represent a significant opportunity for the USA Blood Glucose Test Strips Market. With the U.S. being a hub for innovation in healthcare technologies, partnerships with global manufacturers and distributors can facilitate the expansion of blood glucose test strips in international markets, particularly in emerging economies where diabetes prevalence is rising. For instance, as of 2025, diabetes rates in regions like Southeast Asia have been growing rapidly, with over ~ million people affected by the disease. The U.S. could benefit from collaborations with companies in Asia to provide affordable and effective glucose monitoring tools. Furthermore, such collaborations help bring in diverse technological innovations, providing U.S.-based manufacturers with new solutions to expand their product offerings. This dynamic global engagement opens the door to new revenue streams and broader market penetration.

Future Outlook

Over the next 5 years, the USA blood glucose test strips market is expected to show significant growth driven by continuous advancements in glucose monitoring technologies, the increasing prevalence of diabetes, and expanding insurance coverage. The adoption of more convenient, accurate, and affordable blood glucose test strips, coupled with a rising focus on preventive healthcare, will fuel the demand for these devices. Technological advancements such as smartphone integration and remote patient monitoring are also expected to drive the market, offering new avenues for growth. Additionally, the growing emphasis on chronic disease management and personalized healthcare will further bolster the adoption of blood glucose monitoring devices.

Major Players

- Abbott Laboratories

- Roche Diagnostics

- LifeScan (Johnson & Johnson)

- Ascensia Diabetes Care

- ARKRAY

- i‑SENS, Inc.

- AgaMatrix

- Omron Healthcare

- B. Braun Melsungen

- Nipro Diagnostics

- Terumo Corporation

- SANNUO Medical

- EDAN Instruments

- Infopia Co., Ltd

- Yuwell Group

Key Target Audience

- Healthcare Providers and Institutions

- Investments and Venture Capitalist Firms

- Diabetes Management Centers

- Government and Regulatory Bodies (FDA, CDC)

- Private Insurance Companies

- Medical Device Manufacturers

- Distributors and Retailers

- Payers and Healthcare Policy Makers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Blood Glucose Test Strips Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the USA Blood Glucose Test Strips Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple blood glucose test strip manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA Blood Glucose Test Strips Market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Data Sources, Primary Research Scope, Market Model Framework, Data Validation Logic)

- Definition and Scope

- Epidemiologic Landscape

- Market Genesis & Evolution

- Economic & Healthcare Drivers

- Value Chain & Supply Dynamics

- Growth Drivers

Rising diabetes prevalence and self‑testing adoption

Expanded insurance and reimbursement frameworks

Technological innovation (accuracy, connectivity, app integration)

- Market Challenges

Price sensitivity & reimbursement gaps

Competitive pressure from CGM and non‑invasive monitoring technologies

Regulatory compliance and FDA guidelines for consumables

- Opportunities

Digital health integration & remote patient monitoring

Preventive screening programs in employer health plans

- Emerging Trends

Subscription & bundle pricing models

SKU rationalization and private‑label test strips

- Regulatory, Standards & Compliance

FDA Regulatory Pathways (510(k), CLIA Waived Consumables)

Quality & Accuracy Standards (ISO 15197 Compliance Metrics)

- SWOT & Strategic Framework

- Porter’s Five Forces Analysis

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price of Platforms/Services, 2019-2025

- By Technology (In Value %)

Glucose Oxidase Strips

Accuracy/Interference Index (Cognitive Market Research)

Glucose Dehydrogenase Strips

Battery/Power Efficiency, Hematocrit Tolerance (Valuates Reports)

Optical & Laboratory Calibrated Strips

Precision Benchmarks (The Insight Partners)

- By End User (In Value %)

Home/Self‑Monitoring

Reimbursement Coverage % (Fact.MR)

Hospitals/Clinics

Institutional ASP Contracts (Mordor Intelligence)

Diagnostic Centers

Testing Volume Metrics (Valuates Reports)

- By Distribution Channel (In Value %)

Retail Pharmacies

SKU Reach Index

Online eCommerce

Growth Velocity %

B2B Institutional Supply

Tender/RFP Dynamics

- By Reimbursement Type (In Value %)

Private Insurance

Coverage/Utilization Ratios

Medicare/Medicaid

Formulary Access Metrics

- By Patient Usage Pattern (In Value %)

Daily Testing Regimen

Average Tests per Patient

Episodic Screening

Population Screening Initiatives

- Market Share Matrix – Value & Volume (USA)

- Cross‑Company Comparison Parameters (Market Positioning, R&D Intensity, Price Competitiveness, ASP Distribution, SKU Breadth, Reimbursement Access, Channel Depth, Clinical Accuracy Metrics)

- Detailed Profiles of Major Players

Abbott Laboratories (US)

Roche Diagnostics (CH/US SMBG Business)

LifeScan / Johnson & Johnson (US Legacy)

ARKRAY, Inc. (Japan/US)

Ascensia Diabetes Care (DE/Global)

i‑SENS, Inc. (South Korea)

AgaMatrix (US Specialty Strips)

Omron Healthcare (Meters & Strips)

B. Braun Melsungen (DE Supplies)

Nipro Diagnostics (JP Consumables)

Terumo Corporation (JP)

SANNUO Medical (CN)

EDAN Instruments (CN)

Infopia Co., Ltd (KR)

Yuwell Group (CN)

- Usage Frequency & Patient Behavior Analytics

- Purchase Drivers & Pain Points — Cost, Accuracy, Convenience

- Healthcare Provider Recommendation Trends

- Insurance Claim Patterns & Coverage Penetration

- Future Market Size by Value, 2026-2030

- Future Market Size by Volume, 2026-2030

- Average Frame Cost Outlook, 2026-2030