Market Overview

The USA Business Aviation Services market current size stands at around USD ~ million, supported by consistent fleet utilization and diversified service demand. Activity levels during 2024 and 2025 reflected stable charter movements, managed aircraft growth, and incremental service contracts. Operational intensity remained high across light, midsize, and large cabin fleets, while service providers focused on reliability and scheduling efficiency. Demand resilience was evident despite capacity constraints, reinforcing the role of business aviation in time-critical mobility.

Service concentration remains strongest across the Northeast, South, and West regions, where airport density, corporate headquarters presence, and premium traveler demand intersect. Mature FBO networks, advanced maintenance infrastructure, and supportive state-level aviation policies underpin ecosystem stability. Secondary airports near financial and technology hubs benefit from reduced congestion and faster turnaround. Regional specialization also reflects air medical activity, leisure travel corridors, and government usage patterns.

Market Segmentation

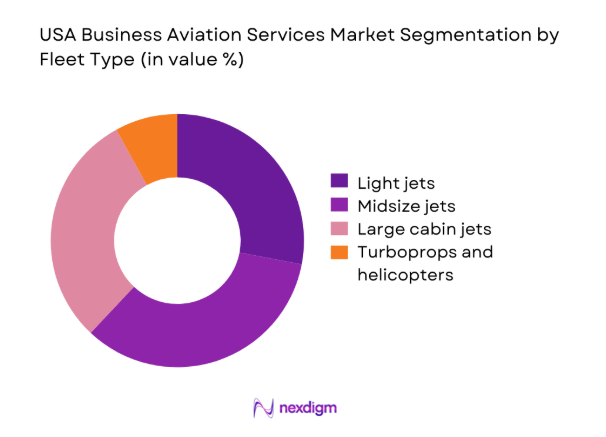

By Fleet Type

Large cabin and midsize jets dominate service value due to longer mission profiles, higher onboard service intensity, and complex maintenance requirements. These aircraft support transcontinental and international travel favored by corporate leaders and high net worth individuals. Light jets and turboprops retain relevance for short-haul regional connectivity, particularly serving secondary airports. Fleet mix decisions increasingly balance operating efficiency, cabin comfort, and runway accessibility. Operators strategically align fleet composition with utilization optimization, contract stability, and evolving client expectations.

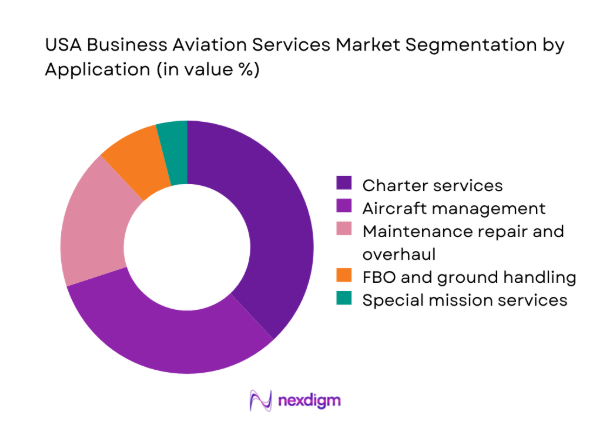

By Application

Charter and aircraft management services account for the majority of value creation, reflecting outsourcing preferences and flexible access models. Maintenance, repair, and overhaul services contribute steadily, driven by regulatory compliance and aging fleet support. Fixed base operations and ground handling services benefit from traffic concentration at premium airports. Special mission services, including medical and government operations, provide stable countercyclical demand. Application mix evolution mirrors client priorities around reliability, safety, and service integration.

Competitive Landscape

The competitive landscape features a mix of large integrated operators and specialized regional providers. Differentiation centers on fleet scale, service breadth, digital capability, and regulatory compliance maturity.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| NetJets | 1964 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Wheels Up | 2013 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Flexjet | 1995 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Jet Aviation | 1967 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Signature Aviation | 1992 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

USA Business Aviation Services Market Analysis

Growth Drivers

Rising corporate travel efficiency requirements

Corporations increasingly prioritize time efficiency, driving demand for business aviation services supporting flexible scheduling and direct route accessibility. Executive travel frequency increased across multiple industries, reinforcing reliance on private aviation solutions for productivity optimization. Flight time savings of ~ hours per trip significantly influence corporate mobility strategies. Business aviation reduces dependency on congested commercial hubs, improving schedule reliability. Decision-makers value operational control, privacy, and route customization benefits. Corporate travel departments increasingly integrate aviation services into mobility planning frameworks. Operational agility supports faster deal execution and site visits. Business aviation aligns with decentralized work patterns and multi-city operational footprints. Service providers adapt offerings to enterprise travel policies. Efficiency-focused demand remains resilient during moderate economic fluctuations.

Growth in high net worth population and private travel demand

High net worth individuals increasingly favor private aviation services for privacy, comfort, and personalized travel experiences. Private travel demand expanded steadily as wealth diversification supported discretionary mobility spending. Ownership alternatives such as charter and fractional programs lower entry barriers. Leisure travel patterns increasingly overlap with business aviation utilization. Seasonal travel intensity supports consistent service demand. Personalized cabin configurations enhance user experience differentiation. Family office travel managers actively contract long-term service agreements. Private aviation supports access to remote leisure destinations. Demand stability benefits from diversified wealth sources. Service providers tailor premium offerings accordingly.

Challenges

High operating and maintenance costs

Operating complexity drives elevated maintenance requirements across diverse aircraft fleets and mission profiles. Parts availability constraints increase service planning challenges. Maintenance downtime impacts aircraft availability and service continuity. Fuel price volatility introduces budgeting uncertainty for operators. Insurance and compliance costs remain structurally high. Infrastructure costs at premium airports affect margins. Specialized labor requirements increase overhead intensity. Fleet aging amplifies maintenance frequency. Cost pressures influence pricing flexibility. Operators pursue efficiency optimization initiatives.

Pilot and skilled labor shortages

Pilot availability constraints affect fleet utilization and service reliability across the market. Training pipelines struggle to meet demand growth. Maintenance technician shortages impact turnaround times. Workforce aging intensifies replacement challenges. Competition with commercial aviation increases attrition risks. Regulatory qualification requirements limit rapid workforce expansion. Scheduling inefficiencies emerge from staffing gaps. Service scalability becomes constrained during peak demand. Operators invest in retention programs. Labor challenges persist despite automation efforts.

Opportunities

Digitalization of fleet management and operations

Digital platforms enable real-time monitoring of aircraft performance and scheduling optimization. Predictive maintenance analytics reduce unplanned downtime events. Integrated dispatch systems improve asset utilization efficiency. Data-driven insights enhance cost control visibility. Client-facing digital interfaces improve transparency and experience. Automation reduces administrative workload intensity. Cybersecure systems support regulatory compliance needs. Fleet data standardization enables benchmarking improvements. Digital maturity differentiates competitive positioning. Technology adoption accelerates operational resilience.

Growth in sustainable aviation fuel adoption services

Sustainable aviation fuel integration creates new service differentiation opportunities. Corporate sustainability commitments influence aviation service selection. Fuel logistics coordination services gain strategic importance. Emissions reporting capabilities enhance value propositions. Airport infrastructure adaptation supports gradual fuel availability expansion. Operators develop SAF procurement partnerships. Sustainability-linked contracts attract enterprise clients. Regulatory incentives support adoption momentum. Environmental performance metrics gain prominence. SAF services align with long-term decarbonization pathways.

Future Outlook

The market outlook through 2035 remains constructive as demand fundamentals support steady service utilization. Continued digital adoption, sustainability integration, and workforce development will shape competitive positioning. Regulatory alignment and infrastructure investment are expected to influence regional growth patterns. Operators focusing on resilience and client experience are likely to sustain long-term relevance.

Major Players

- NetJets

- Wheels Up

- VistaJet

- Flexjet

- Jet Aviation

- Signature Aviation

- Textron Aviation Services

- StandardAero

- Gama Aviation

- XO

- Jet Linx

- Clay Lacy Aviation

- Million Air

- ExecuJet

- Cirrus Aircraft Services

Key Target Audience

- Corporate travel and mobility managers

- High net worth individuals and family offices

- Fractional ownership program buyers

- Charter brokerage platforms

- Fixed base operators and airport authorities

- Aircraft leasing and management firms

- Investments and venture capital firms

- Federal Aviation Administration and U.S. Department of Transportation

Research Methodology

Step 1: Identification of Key Variables

This step involved identification of key variables shaping business aviation services, including fleet mix, utilization patterns, regulatory requirements, and service models. Operational scope boundaries were defined to clearly distinguish charter, aircraft management, and maintenance activities. Demand-side and supply-side parameters were aligned to reflect real-world operational structures. Assumptions were framed to capture service intensity and utilization dynamics.

Step 2: Market Analysis and Construction

This step focused on market analysis and construction through bottom-up mapping of service demand drivers and operator activity. Segmentation logic was developed across fleet type, application, and regional dimensions. Structural relationships between utilization behavior and service mix were established. Analytical frameworks were applied to ensure internal consistency across segments.

Step 3: Hypothesis Validation and Expert Consultation

This step emphasized hypothesis validation through expert consultation with operators, aviation managers, and regulatory specialists. Qualitative inputs were used to test assumptions around demand resilience, workforce constraints, and digital adoption. Divergent viewpoints were reconciled through iterative review. Market behavior patterns were refined to reflect operational realities.

Step 4: Research Synthesis and Final Output

This step synthesized findings into a coherent narrative integrating qualitative insights and validated trends. Analytical outputs were reviewed for logical continuity across sections. Strategic implications were aligned with observed market behavior. The final output balanced consulting-grade rigor with operational realism.

- Executive Summary

- Research Methodology (Market Definitions and scope alignment for business aviation services, Fleet and service taxonomy mapping across charter management and MRO, Bottom-up flight hour and contract-based market sizing, Revenue attribution by service line and operator business model, Primary interviews with operators fleet managers and FAA-aligned experts, Data triangulation using FAA flight activity datasets and company disclosures, Assumptions on utilization cycles and fleet renewal sensitivity)

- Definition and Scope

- Market evolution

- Usage and operational pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising corporate travel efficiency requirements

Growth in high net worth population and private travel demand

Expansion of fractional ownership and charter models

Increasing aircraft fleet modernization

Operational flexibility compared to commercial aviation

Growth in air medical and special mission operations - Challenges

High operating and maintenance costs

Pilot and skilled labor shortages

Volatility in fuel prices

Stringent regulatory compliance requirements

Cyclicality linked to economic conditions

Airport slot and infrastructure constraints - Opportunities

Digitalization of fleet management and operations

Growth in sustainable aviation fuel adoption services

Expansion of on-demand charter platforms

Increasing outsourcing of aircraft management

Regional airport development

Value-added concierge and premium service offerings - Trends

Shift toward light and midsize jet utilization

Integration of predictive maintenance services

Increased focus on sustainability reporting

Consolidation among service providers

Subscription-based and bundled service models

Enhanced passenger experience personalization - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Light jets

Midsize jets

Large cabin jets

Turboprops

Helicopters - By Application (in Value %)

Charter services

Aircraft management

Maintenance repair and overhaul

FBO and ground handling services

Special mission services - By Technology Architecture (in Value %)

Traditional dispatch and scheduling systems

Integrated digital flight operations platforms

Predictive maintenance and analytics systems

Advanced avionics and flight optimization solutions - By End-Use Industry (in Value %)

Corporate and enterprise users

High net worth individuals

Government and defense agencies

Air medical and emergency services

Tourism and leisure operators - By Connectivity Type (in Value %)

Satellite-based connectivity

Air-to-ground connectivity

Hybrid connectivity solutions - By Region (in Value %)

Northeast

Midwest

South

West

- Market structure and competitive positioning

- Market share snapshot of major players

Cross Comparison Parameters (fleet size under management, geographic coverage, service portfolio depth, pricing model flexibility, digital capability maturity, regulatory compliance track record, customer retention rates, partnership ecosystem strength) - SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

NetJets

Wheels Up

VistaJet

Flexjet

Jet Aviation

Signature Aviation

Textron Aviation Services

StandardAero

Gama Aviation

XO

Jet Linx

Clay Lacy Aviation

Million Air

ExecuJet

Cirrus Aircraft Services

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035