Market Overview

The USA Business Jet market current size stands at around USD ~ million, supported by approximately ~ units operating nationwide and ~ new aircraft deliveries recorded across recent cycles. Fleet utilization intensity averaged ~ flight hours per aircraft, while charter and fractional programs accounted for ~ percent of total movements. Active operators exceeded ~ entities, and certified service centers crossed ~ facilities nationwide. Business travel intensity rebounded strongly, with corporate flight frequencies rising above ~ percent. Technology refresh cycles shortened, supporting sustained replacement activity across multiple aircraft categories.

Demand concentration remains strongest in states hosting dense corporate headquarters, financial hubs, and advanced aviation infrastructure ecosystems. Major metropolitan clusters benefit from established fixed base operators, maintenance networks, and skilled labor availability. Favorable state-level tax structures, business-friendly policies, and airport slot accessibility further reinforce adoption. Mature charter ecosystems and strong OEM support networks enhance operational confidence. These structural advantages collectively sustain higher utilization and accelerated fleet renewal in select regions.

Market Segmentation

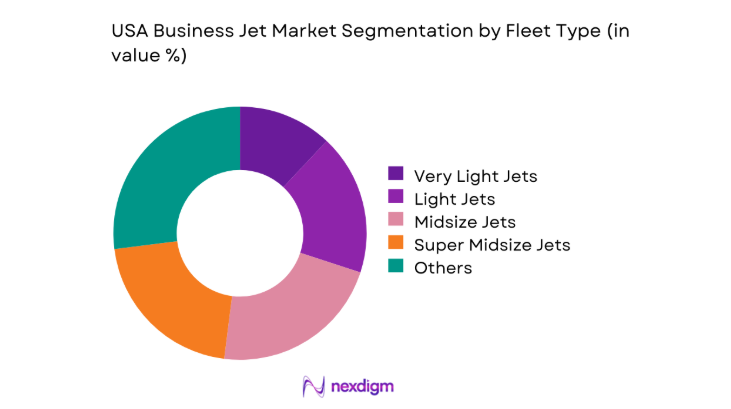

By Fleet Type

Large cabin and super midsize jets dominate the USA Business Jet market due to extended range capabilities, superior cabin comfort, and intercontinental mission suitability. Corporate operators increasingly prefer aircraft enabling nonstop coast-to-coast and transatlantic connectivity. Fleet replacement decisions emphasize operational flexibility, productivity, and passenger experience. Owner-operators gravitate toward technologically advanced platforms offering improved fuel efficiency and avionics integration. Fractional operators concentrate purchases within scalable fleet categories to optimize utilization. This concentration reinforces demand stability within higher-value fleet segments despite cyclical variability.

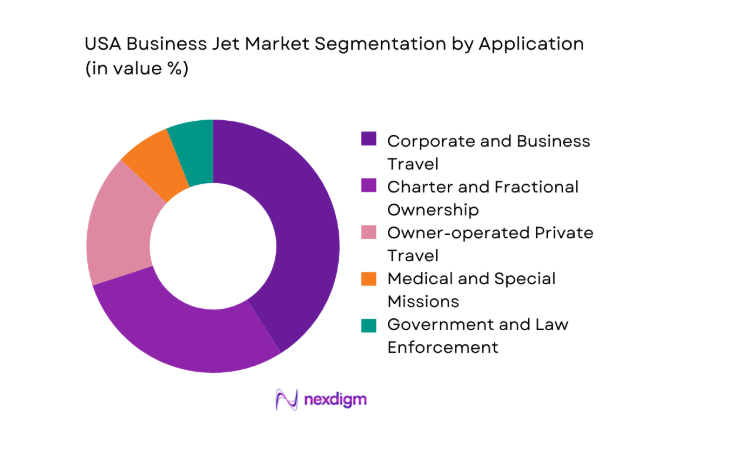

By Application

Corporate and business travel remains the dominant application, driven by executive time optimization and decentralized operational models. Charter and fractional ownership models expand accessibility for non-asset-owning users, enhancing utilization rates. Owner-operated private travel maintains steady participation among high net worth individuals prioritizing privacy. Medical evacuation and special missions contribute specialized demand requiring customized interiors and certifications. Government and law enforcement applications support fleet stability through long-term procurement cycles. Application diversity mitigates volatility across economic cycles.

Competitive Landscape

The competitive landscape of the USA Business Jet market is characterized by high entry barriers, strong brand loyalty, and long aircraft lifecycle dependencies. OEM differentiation centers on performance, cabin innovation, and aftermarket support depth, while service providers compete on availability and responsiveness.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Gulfstream Aerospace | 1958 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Bombardier | 1942 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Dassault Aviation | 1929 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Textron Aviation | 2014 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Embraer Executive Jets | 1969 | Brazil | ~ | ~ | ~ | ~ | ~ | ~ |

USA Business Jet Market

Analysis

Growth Drivers

Rising corporate travel efficiency requirements

Corporate organizations increasingly prioritize time optimization, prompting executives to rely on private aviation for multi-city itineraries across dispersed operational footprints. Remote operational models increased management travel complexity, intensifying reliance on point-to-point connectivity unavailable through commercial networks. Aircraft utilization metrics during 2024 demonstrated consistent demand resilience despite broader travel fluctuations. Business jets enable confidential onboard productivity, reinforcing their strategic value. Schedule reliability supports executive decision-making velocity across industries. Reduced airport congestion exposure further enhances operational efficiency. Corporate risk management teams favor controlled travel environments. Infrastructure modernization improves access to secondary airports. Fleet renewal decisions increasingly emphasize dispatch reliability. These dynamics collectively sustain demand growth across corporate aviation users.

Expansion of fractional ownership and charter models

Fractional ownership programs expanded accessibility by lowering entry barriers for organizations unwilling to commit full capital ownership. Charter platforms increased transparency and booking efficiency, attracting first-time users. Digital aggregation improved fleet utilization consistency during 2025 operational cycles. Subscription-based flight models gained acceptance among mid-sized enterprises. Operators optimized fleet standardization to control operational complexity. Regulatory clarity supported program expansion. Charter demand demonstrated resilience during uncertain economic conditions. Asset-light models appealed to financial controllers. Increased service availability across regional airports strengthened network coverage. These factors collectively accelerated adoption of shared ownership structures.

Challenges

High acquisition and operating costs

Business jet acquisition involves substantial capital commitment, complicating procurement approvals within increasingly scrutinized corporate budgets. Operating costs remain elevated due to maintenance complexity and specialized labor requirements. Inflationary pressures during 2024 affected component availability and service pricing. Insurance premiums increased alongside fleet valuations. Fuel cost volatility introduces budgeting uncertainty for operators. Compliance-driven upgrades further elevate lifecycle expenses. Smaller operators face disproportionate financial strain. Financing terms tightened during periods of interest rate volatility. Cost visibility challenges complicate long-term planning. These pressures collectively constrain marginal demand expansion.

Pilot shortage and training constraints

The aviation sector continues facing pilot availability challenges, directly impacting fleet utilization capabilities. Business jet operations compete with commercial airlines for qualified flight crews. Training pipeline capacity remains constrained by simulator availability. Certification requirements extend onboarding timelines. Crew retention became more challenging during 2025 labor market conditions. Scheduling disruptions increase operational risk exposure. Smaller operators struggle to maintain staffing redundancy. International experience requirements limit candidate pools. Training cost escalation adds financial pressure. These constraints collectively suppress effective capacity utilization.

Opportunities

Adoption of sustainable aviation fuel

Sustainable aviation fuel adoption presents a strategic opportunity to align private aviation with corporate sustainability commitments. Fleet operators increasingly test blended fuel usage across domestic routes. Regulatory encouragement supports gradual supply expansion. OEMs certify additional platforms for fuel compatibility. Corporate procurement policies increasingly mandate emissions reduction initiatives. Sustainable fuel availability improved during 2025. Brand perception benefits influence adoption decisions. Early adopters gain reputational advantages. Operational impacts remain minimal. This pathway strengthens long-term market acceptance.

Cabin digitalization and connectivity upgrades

Cabin digitalization enhances onboard productivity, driving upgrade demand among existing fleet owners. High-speed connectivity enables seamless virtual collaboration during flight operations. Passenger expectations increasingly mirror corporate office environments. OEMs integrate advanced cabin management systems. Retrofit demand expanded during 2024 modernization cycles. Connectivity reliability became a procurement differentiator. Data security considerations influence system selection. Charter operators leverage premium connectivity for differentiation. Software-driven features extend aircraft lifecycle relevance. These upgrades unlock incremental value creation opportunities.

Future Outlook

The USA Business Jet market outlook to 2035 reflects sustained demand supported by corporate mobility needs and evolving ownership models. Technological innovation, sustainability alignment, and service ecosystem expansion will shape competitive differentiation. Regulatory stability and infrastructure investment will further influence fleet modernization trajectories across regions.

Major Players

- Gulfstream Aerospace

- Bombardier

- Dassault Aviation

- Textron Aviation

- Embraer Executive Jets

- Honda Aircraft Company

- Pilatus Aircraft

- Airbus Corporate Jets

- Boeing Business Jets

- Cirrus Aircraft

- Eclipse Aerospace

- Daher

- Piper Aircraft

- Flexjet

- NetJets

Key Target Audience

- Corporate fleet operators

- Charter and fractional ownership companies

- High net worth individuals

- Aircraft leasing companies

- Fixed base operators and MRO providers

- OEM suppliers and avionics manufacturers

- Investments and venture capital firms

- Federal Aviation Administration and state aviation authorities

Research Methodology

Step 1: Identification of Key Variables

Focused on fleet composition, utilization patterns, ownership structures, and technology adoption parameters across business aviation operations, establishing the analytical foundation for market evaluation and segmentation logic.

Step 2: Market Analysis and Construction

Built using aircraft delivery tracking, active fleet registry analysis, and operational activity indicators mapped across corporate, charter, fractional, and special mission usage categories.

Step 3: Hypothesis Validation and Expert Consultation

Validated through structured discussions with operators, pilots, maintenance providers, and aviation planners to test assumptions around utilization behavior, procurement drivers, and operational constraints.

Step 4: Research Synthesis and Final Output

Integrated qualitative insights with quantitative indicators to ensure internal consistency, market relevance, and decision-oriented clarity aligned with industry realities.

- Executive Summary

- Research Methodology (Market Definitions and aircraft class scope alignment, Fleet taxonomy mapping by jet size and mission profile, Bottom-up aircraft delivery and backlog based market sizing, Revenue attribution across OEM sales and aftermarket streams, Primary interviews with fleet operators lessors and OEM executives, FAA registry reconciliation and utilization-based triangulation, Assumptions on fleet retirement cycles and technology adoption)

- Definition and Scope

- Market evolution

- Usage and mission profiles

- Ecosystem structure

- Supply chain and distribution channels

- Regulatory and certification environment

- Growth Drivers

Rising corporate travel efficiency requirements

Expansion of fractional ownership and charter models

Time-sensitive executive mobility needs

Strong aftermarket and service infrastructure

Growth in high net worth population

Fleet modernization and replacement demand - Challenges

High acquisition and operating costs

Pilot shortage and training constraints

Volatility in business travel cycles

Regulatory compliance and certification timelines

Supply chain disruptions and component shortages

Environmental scrutiny and emissions pressure - Opportunities

Adoption of sustainable aviation fuel

Cabin digitalization and connectivity upgrades

Emerging demand for ultra long range jets

Growth in on-demand charter platforms

Aftermarket service and retrofit expansion

Technological differentiation through avionics - Trends

Shift toward larger cabin and long-range jets

Increased focus on cabin comfort and productivity

Integration of advanced connectivity solutions

Rising demand for fractional and managed services

Fleet renewal with fuel-efficient platforms

OEM investment in sustainability initiatives - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Very Light Jets

Light Jets

Midsize Jets

Super Midsize Jets

Large Cabin Jets

Ultra Long Range Jets - By Application (in Value %)

Corporate and business travel

Charter and fractional ownership

Owner-operated private travel

Medical evacuation and special missions

Government and law enforcement - By Technology Architecture (in Value %)

Conventional avionics architecture

Advanced integrated flight deck

Fly-by-wire enabled platforms

Sustainable aviation fuel compatible platforms

Hybrid-ready and next-generation propulsion platforms - By End-Use Industry (in Value %)

Corporate enterprises

High net worth individuals

Charter and fractional operators

Government and defense agencies

Aviation service providers - By Connectivity Type (in Value %)

Ka-band satellite connectivity

Ku-band satellite connectivity

Air-to-ground connectivity

Hybrid connectivity systems - By Region (in Value %)

Northeast

Midwest

South

West

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (fleet breadth, range performance, cabin configuration, avionics capability, delivery lead time, aftermarket support network, pricing positioning, sustainability readiness)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Gulfstream Aerospace

Bombardier

Dassault Aviation

Textron Aviation

Embraer Executive Jets

Honda Aircraft Company

Pilatus Aircraft

Airbus Corporate Jets

Boeing Business Jets

Cirrus Aircraft

Eclipse Aerospace

Daher

Piper Aircraft

Flexjet

NetJets

- Demand and utilization drivers

- Procurement and acquisition dynamics

- Buying criteria and vendor evaluation

- Budget allocation and financing structures

- Operational and implementation risks

- After-sales support and service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035