Market Overview

The USA Business Jet MRO Market market current size stands at around USD ~ million, reflecting stable maintenance demand driven by active fleets, utilization intensity, and operational readiness requirements. The market supports ~ aircraft with recurring scheduled inspections, unscheduled events, and modernization programs. Maintenance visits average ~ events annually per aircraft, while labor utilization rates exceeded ~ percent. Fleet activity cycles remained consistent, with dispatch reliability targets above ~ percent and average hangar turnaround durations near ~ days across major service categories.

The market is highly concentrated across major aviation hubs including Dallas–Fort Worth, Wichita, Savannah, Phoenix, and South Florida. These regions benefit from dense airport infrastructure, skilled technician availability, OEM proximity, and established supplier ecosystems. Strong charter activity, corporate flight department clustering, and favorable state-level aviation policies further reinforce demand. Mature regulatory oversight, robust MRO capacity, and integrated logistics networks enable these hubs to attract both domestic and transient aircraft maintenance activity consistently.

Market Segmentation

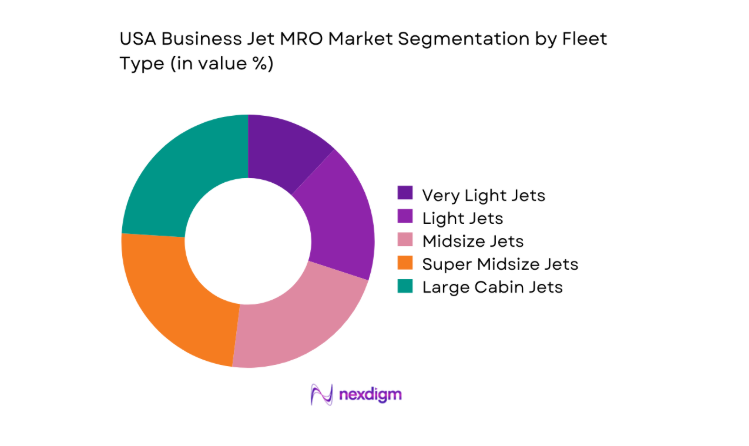

By Fleet Type

Large cabin and super midsize business jets dominate the USA Business Jet MRO Market due to higher utilization, longer flight cycles, and complex maintenance requirements. These aircraft undergo more frequent heavy checks, engine overhauls, and avionics upgrades compared to light categories. Corporate and fractional operators prioritize uptime and reliability, driving consistent MRO engagement. Light and very light jets contribute volume but generate lower per-visit service depth. Aging midsize fleets further sustain demand through structural inspections, component replacements, and cabin refurbishments. Overall, fleet mix skews toward higher value maintenance profiles rather than sheer aircraft count, shaping revenue concentration patterns across service providers nationwide.

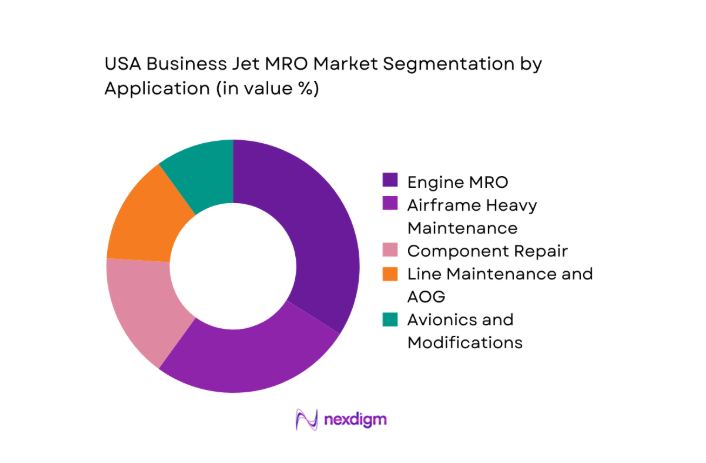

By Application

Engine MRO and airframe heavy maintenance represent the most dominant applications within the USA Business Jet MRO Market. Engines require periodic shop visits, life-limited part replacements, and performance restorations, making them critical cost and downtime drivers. Airframe checks, including structural inspections and corrosion control, remain mandatory as fleets age. Avionics upgrades have grown in importance due to connectivity and compliance requirements. Line maintenance and AOG support provide steady volume but lower complexity. Component repair sustains demand through rotable exchanges and reliability programs, supporting continuous operational readiness across diverse operator profiles.

Competitive Landscape

The USA Business Jet MRO Market features a mix of OEM-affiliated service centers and independent specialists competing on capability depth, turnaround efficiency, and geographic access.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Duncan Aviation | 1956 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| StandardAero | 1911 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Jet Aviation | 1967 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| West Star Aviation | 1947 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Gulfstream Aerospace Services | 1958 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

USA Business Jet MRO Market Analysis

Growth Drivers

Expanding US business jet fleet and utilization intensity

Expanding fleet numbers continue increasing maintenance demand as more business jets remain operational across diverse mission profiles nationwide. Utilization intensity rose as charter, fractional, and corporate flying hours increased across domestic and transcontinental routes. Higher dispatch frequency accelerates wear cycles on engines, components, and airframes requiring consistent inspection and corrective actions. Operators increasingly prioritize reliability metrics, pushing maintenance schedules toward proactive rather than deferred servicing approaches. Fleet expansion also introduces newer aircraft requiring specialized tooling, training, and OEM-aligned maintenance practices across facilities. Increased flight activity elevates unscheduled maintenance probability, strengthening demand for responsive MRO capacity nationwide. Maintenance planning complexity grows with mixed fleets, driving reliance on professional MRO providers for compliance assurance. Utilization-driven maintenance needs remain insensitive to macroeconomic short-term volatility across established operator segments. Operational readiness expectations enforce tighter maintenance intervals across high-cycle aircraft categories consistently. This driver structurally underpins long-term service demand stability within the USA Business Jet MRO Market.

Aging aircraft driving heavy maintenance demand

A significant portion of the active fleet exceeds traditional midlife thresholds, intensifying heavy maintenance requirements across structures and systems. Aging aircraft require more frequent inspections for fatigue, corrosion, and system obsolescence management. Heavy checks become unavoidable as flight hours accumulate regardless of ownership or operational model. Older avionics and cabin systems necessitate upgrades to maintain operational relevance and compliance. Engine performance restoration cycles shorten as components approach life limits under accumulated utilization. Operators increasingly face higher downtime risks without comprehensive maintenance planning and execution. Aging fleets amplify demand for specialized repair capabilities and engineering expertise within MRO facilities. Parts availability challenges further increase maintenance complexity for legacy aircraft platforms. Regulatory oversight becomes more stringent as aircraft age, increasing documentation and inspection scope. This aging dynamic consistently elevates service depth and visit duration across the market.

Challenges

Technician shortages and skilled labor constraints

Skilled technician shortages remain a critical constraint affecting maintenance throughput and turnaround reliability across facilities. Certification requirements limit rapid workforce scaling despite rising maintenance demand from expanding and aging fleets. Competition for experienced technicians intensifies among MROs, OEM centers, and airline maintenance organizations. Training pipelines require long lead times, constraining immediate capacity expansion options. Labor availability directly impacts hangar utilization efficiency and appointment scheduling flexibility. Technician attrition risks increase due to retirement demographics and cross-industry mobility. Workforce shortages elevate operational risk during peak maintenance seasons and unscheduled event surges. Specialized skill gaps affect advanced composites, avionics, and engine disciplines disproportionately. Labor constraints can extend aircraft ground times beyond planned maintenance windows. This challenge structurally limits service scalability within the USA Business Jet MRO Market.

High downtime costs during heavy maintenance events

Extended aircraft downtime during heavy maintenance imposes operational disruptions for charter and corporate operators. Lost availability directly affects mission continuity, charter scheduling, and fleet utilization planning. Heavy checks often uncover additional findings, increasing scope and prolonging ground time unpredictably. Operators face logistical challenges repositioning aircraft to alternative providers when capacity constraints emerge. Downtime sensitivity increases for fractional programs managing tight fleet availability margins. Maintenance planning buffers grow, reducing effective operational aircraft counts. Coordination complexity across parts suppliers and engineering approvals further extends event durations. Aircraft substitution costs escalate when downtime exceeds forecasted maintenance windows. Downtime risk influences operator preferences toward proven MROs with predictable performance. This challenge pressures providers to balance thoroughness with speed consistently.

Opportunities

Digital MRO platforms and data-driven maintenance planning

Digital platforms enable predictive maintenance planning by leveraging aircraft health monitoring and historical performance datasets. Data-driven insights improve fault anticipation, reducing unscheduled maintenance and optimizing parts provisioning strategies. Digital workscoping enhances labor planning accuracy and turnaround predictability across maintenance events. Integrated platforms strengthen coordination between operators, engineers, and suppliers during maintenance execution. Documentation automation improves regulatory compliance efficiency and audit readiness. Digital records support lifecycle tracking across mixed fleets and ownership transitions. Adoption remains uneven, creating differentiation opportunities for technologically advanced MRO providers. Data integration supports continuous improvement in maintenance processes and reliability outcomes. Operators increasingly value transparency enabled by digital dashboards and progress tracking. This opportunity enhances both efficiency and customer retention potential.

Expansion of independent MRO networks across secondary airports

Secondary airports offer cost advantages, capacity availability, and reduced congestion compared to primary aviation hubs. Independent MROs can expand geographically to capture underserved regional demand effectively. Proximity reduces ferry time and operational disruption for regional operators. Localized facilities support faster AOG response and line maintenance coverage. Expansion enables specialization by fleet type or service category at lower infrastructure cost. Regional growth aligns with increasing domestic business aviation activity dispersion. Independent networks can form partnerships with operators seeking flexible service options. Secondary locations ease labor recruitment challenges through localized workforce pools. Expansion supports resilience against capacity saturation at major hubs. This opportunity strengthens competitive diversity within the market.

Future Outlook

The USA Business Jet MRO Market is expected to remain structurally resilient through 2035, supported by fleet aging, utilization intensity, and digital adoption. Consolidation and network expansion will reshape competitive dynamics. Workforce development and technology integration will define long-term differentiation across providers.

Major Players

- Duncan Aviation

- StandardAero

- Jet Aviation

- West Star Aviation

- Gulfstream Aerospace Services

- Textron Aviation Service

- Bombardier Aviation Services

- Dassault Falcon Jet Services

- Lufthansa Technik

- STS Aviation Group

- ExecuJet MRO Services

- Flying Colours Corp

- AAR Corp

- HEICO

- AMFAero

Key Target Audience

- Business jet operators and fleet owners

- Charter and fractional aircraft operators

- Corporate flight departments

- Aircraft management companies

- OEM-authorized service partners

- Aviation-focused investments and venture capital firms

- Federal Aviation Administration and state aviation authorities

- Defense and government special mission operators

Research Methodology

Step 1: Identification of Key Variables

This step involved mapping fleet categories, maintenance types, utilization patterns, and regulatory compliance requirements specific to business jet operations. Emphasis was placed on differentiating scheduled, unscheduled, and heavy maintenance drivers across fleet classes. Regulatory and certification variables influencing maintenance scope and timelines were also identified.

Step 2: Market Analysis and Construction

This step focused on structuring service workflows, demand drivers, and maintenance event frequency across aircraft classes and operational models. Interactions between fleet age, utilization intensity, and maintenance depth were analyzed. The structure reflected real-world MRO operating and planning practices.

Step 3: Hypothesis Validation and Expert Consultation

This step included structured discussions with maintenance planners, engineers, and operational managers to validate assumptions. Expert inputs were used to test maintenance frequency logic, capacity constraints, and operational bottlenecks. Feedback helped refine service segmentation and demand assumptions.

Step 4: Research Synthesis and Final Output

This step integrated validated findings into a coherent analytical framework aligned with operational realities and industry practices. Insights were synthesized to ensure internal consistency across segments, drivers, and challenges. The final output reflects practical decision-making perspectives of market participants.

- Executive Summary

- Research Methodology (Market Definitions and USA business jet MRO scope boundaries, Fleet classification and service taxonomy mapping across light to large cabin jets, Bottom-up market sizing using maintenance events and labor-hour normalization, Revenue attribution by airframe, engine, component, and line maintenance streams, Primary interviews with US MRO executives)

- Definition and Scope

- Market evolution

- Usage and maintenance pathways

- Ecosystem structure

- Supply chain and service channel structure

- Regulatory environment

- Growth Drivers

Expanding US business jet fleet and utilization intensity

Aging aircraft driving heavy maintenance demand

Rising adoption of predictive maintenance technologies

OEM service program expansion in North America

Growth in charter and fractional operations

Increasing avionics modernization requirements - Challenges

Technician shortages and skilled labor constraints

High downtime costs during heavy maintenance events

Rising labor and parts inflation

Capacity bottlenecks at leading US MRO hubs

Supply chain volatility for critical components

Regulatory compliance and certification complexity - Opportunities

Digital MRO platforms and data-driven maintenance planning

Expansion of independent MRO networks across secondary airports

Engine and component service specialization

Sustainability-driven retrofits and efficiency upgrades

Strategic partnerships with OEMs and fleet managers

AOG rapid-response service differentiation - Trends

Shift toward bundled maintenance service contracts

Increased outsourcing by corporate flight departments

Growth of mobile and on-wing maintenance services

Integration of AI-driven diagnostics in MRO workflows

Consolidation among independent US MRO providers

Rising demand for avionics and connectivity upgrades - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Maintenance Event Volume, 2020–2025

- By Active Business Jet Fleet Installed Base, 2020–2025

- By Average Revenue per Aircraft, 2020–2025

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Service portfolio breadth, Fleet coverage capability, Geographic footprint, Turnaround time performance, Digital MRO capability, OEM authorizations, Pricing flexibility, Customer retention rate)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Textron Aviation Service

Gulfstream Aerospace Services

Bombardier Aviation Services

Dassault Falcon Jet Services

StandardAero

AAR Corp

HEICO

STS Aviation Group

Jet Aviation

Lufthansa Technik

West Star Aviation

Flying Colours Corp

Duncan Aviation

ExecuJet MRO Services

AE Industrial Partners Portfolio Companies

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Maintenance Event Volume, 2026–2035

- By Active Business Jet Fleet Installed Base, 2026–2035

- By Average Revenue per Aircraft, 2026–2035