Market Overview

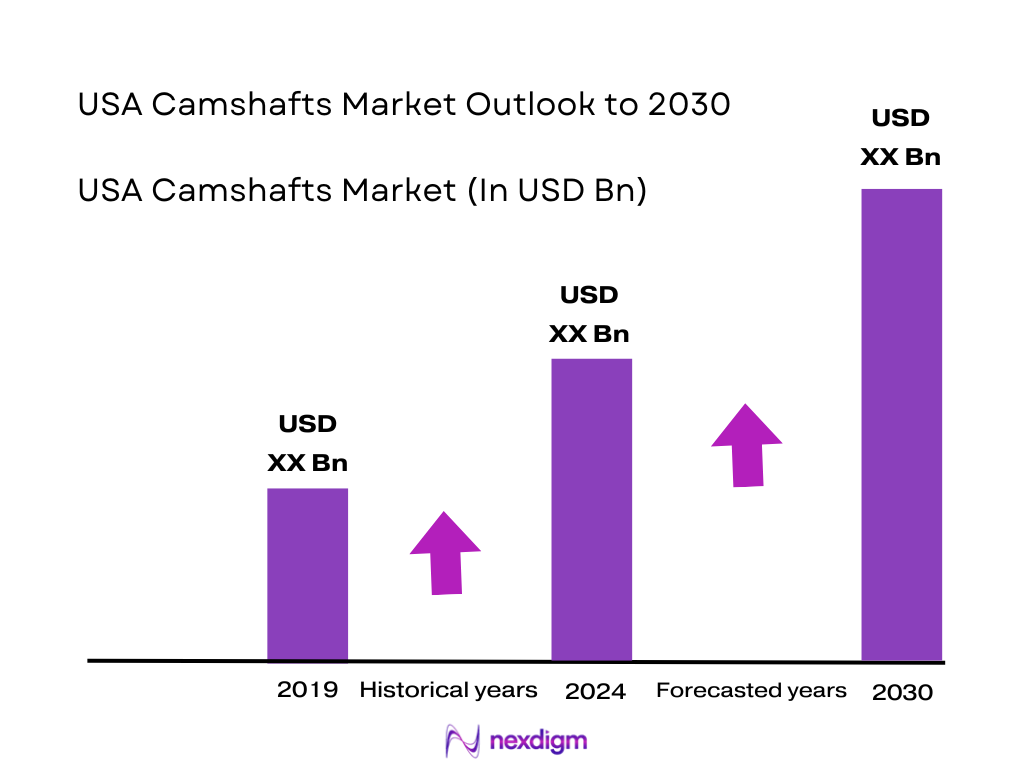

The USA camshafts market is anchored in the global automotive camshaft industry, which estimates at USD ~ billion, with North America contributing about USD ~ billion and led by the United States. Demand is driven by a huge and aging vehicle parc: US light-duty vehicles in operation are around 290 million, up from roughly 285 million at the start of the recent analysis window, with average age above 12.5 years, supporting robust replacement and overhaul activity in valvetrain components such as camshafts. At the same time, light-vehicle production has climbed from roughly ~ million units in the previous production cycle to about ~ million units in the most recent cycle, adding strong OEM pull for new camshafts across passenger cars and trucks.

Within the USA camshafts market, demand is concentrated in Midwest manufacturing hubs and Southern “auto corridor” states, alongside coastal population centers. The Midwest (Michigan, Ohio, Indiana) hosts major engine and powertrain plants plus dedicated camshaft machining facilities in cities such as Jackson and Lansing, providing dense OEM and Tier-1 demand. Southern states including Tennessee, Alabama, South Carolina and Texas host newer assembly plants from global OEMs, each running multi-shift engine programs that consume high volumes of camshafts across pickup trucks, SUVs and crossovers.

Market Segmentation

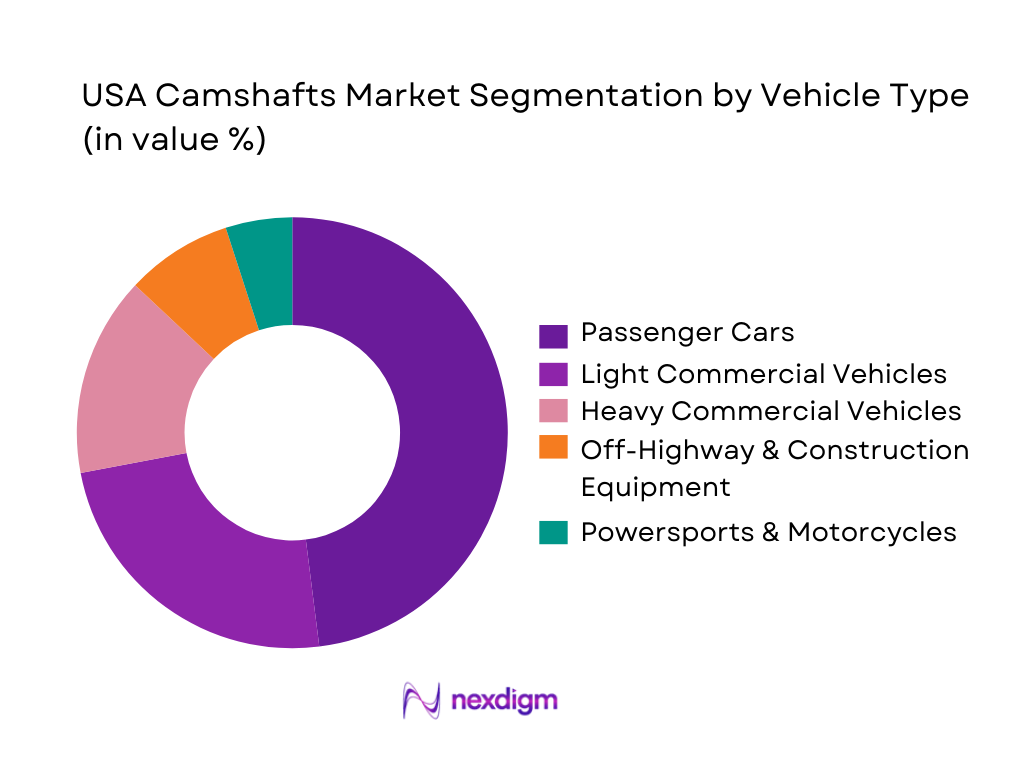

By Vehicle Type

The USA camshafts market is segmented by vehicle type into passenger cars, light commercial vehicles, heavy commercial vehicles, off-highway & construction equipment, and powersports & motorcycles. Passenger cars hold the dominant share because of their sheer volume in the parc and in annual production. US factories build over 10 million light vehicles per year and retail sales exceed 15 million units, heavily skewed toward car- and SUV-based platforms that use multi-cylinder gasoline engines with DOHC/SOHC camshaft configurations. With around 290 million vehicles on the road and an average age above 12 years, passenger cars represent the largest installed base of valvetrain-intensive engines, generating recurring OEM and aftermarket demand for replacement and performance camshafts, especially in mainstream four- and six-cylinder engines that dominate US commuting and suburban usage.

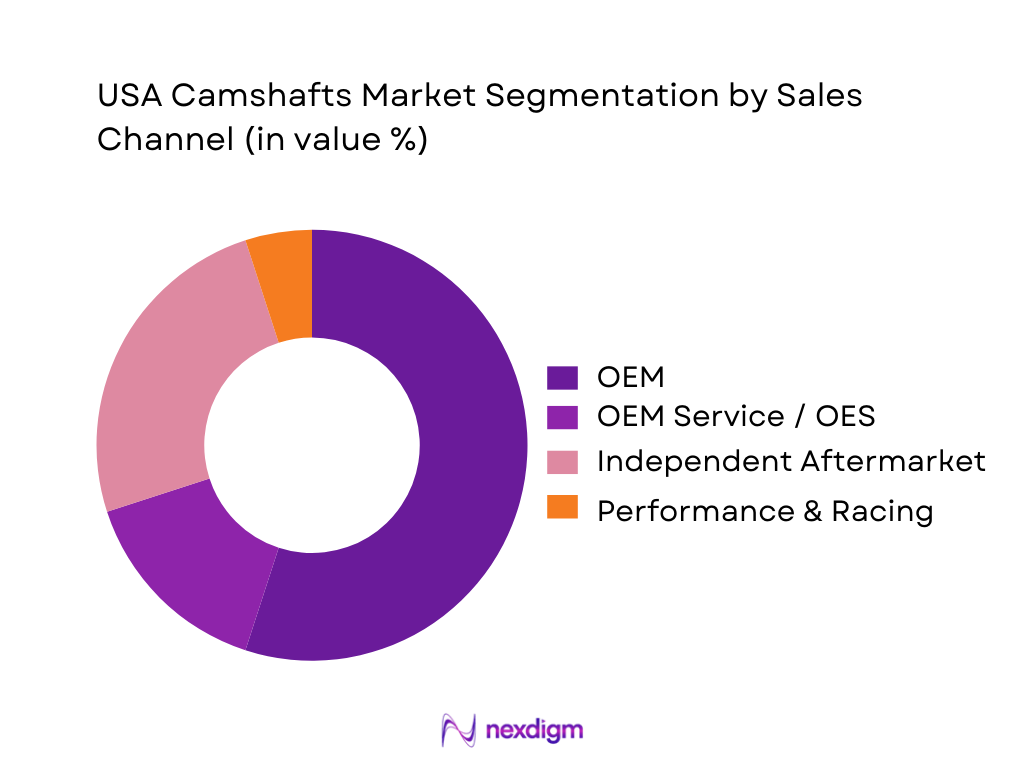

By Sales Channel

The USA camshafts market is segmented by sales channel into OEM, OEM service/OES, independent aftermarket, and performance & racing. OEM dominates this segmentation because every new internal combustion engine leaving a US assembly line requires precisely matched camshafts, often in multiple shafts per engine for DOHC layouts. With roughly ~ million vehicles produced annually in the United States and a global camshaft market valued at over USD ~ billion, OEM contracts represent the highest volume and most stable revenue stream for suppliers. Tier-1 and Tier-2 suppliers embed themselves in long-term supply programs with Detroit-based and transplant OEMs, using just-in-time logistics and dedicated machining cells. While the independent aftermarket benefits from an aging parc of nearly 290 million vehicles and a large engine-rebuild culture, OEM first-fit volumes and pricing power keep the OEM channel in a clear leadership position within camshaft demand.

Competitive Landscape

The USA camshafts market combines global Tier-1 powertrain suppliers and specialist domestic manufacturers. Global groups such as MAHLE, Linamar, Thyssenkrupp, Schaeffler and Musashi Seimitsu provide high-volume cast and forged camshafts to major OEMs, leveraging global foundry networks and long-term sourcing agreements. At the same time, US-based companies like Melling Engine Parts, Camshaft Machine Company, Comp Cams and Crane Cams occupy critical niches: OE and replacement camshafts for American V-8s, diesel truck platforms, and the very large US performance-racing ecosystem. Competitive intensity is high, with supply awards hinging on metallurgical expertise, machining precision, NVH performance, emissions compliance and the ability to support OEM hybrid powertrains and advanced variable-valve-timing strategies.

| Company | Establishment Year | Headquarters (Global) | Core Role in Camshafts (USA) | Primary Channel Focus | Key Engine / Vehicle Coverage | Manufacturing / Machining Footprint (USA) | Technology Focus (Camshafts) | Notable Strength in US Market |

| MAHLE GmbH | 1920 | Stuttgart, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Linamar Corporation | 1966 | Guelph, Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Melling Engine Parts | 1946 | Jackson, Michigan, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Comp Cams (Competition Cams) | 1976 | Memphis, Tennessee, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Camshaft Machine Company | 1986 | Jackson, Michigan, USA | ~ | ~ | ~ | ~ | ~ | ~ |

USA Camshafts Market Analysis

Growth Drivers

Vehicle Parc Expansion

The USA camshafts market is underpinned by a very large and still-growing internal-combustion vehicle parc. Registered road vehicles in the country reached 283,400,986 in 2022 and 284,614,269 in 2023, reinforcing a replacement-driven demand base for valve-train components. S&P Global Mobility reports more than 284,000,000 vehicles in operation, while FHWA data show all motor vehicles generated 3,284,669 million person-miles of travel in 2022, keeping engine duty cycles high. This massive parc continues to require OE camshafts for new build engines and a steady stream of replacement and performance upgrades.

Aging ICE Fleet

Camshaft demand is reinforced by an aging internal-combustion fleet that requires more frequent engine rebuilds and valvetrain replacements. S&P Global Mobility estimates the average age of light vehicles in operation at 12.2 years in 2022, rising to 12.5 years in 2023 and 12.6 years in 2024. Associated analysis highlights that around 70 percent of vehicles on U.S. roads are more than six years old, pushing more units beyond OEM powertrain warranties. With over 284,000,000 vehicles in operation, this structural aging amplifies demand for remanufactured and upgraded camshafts to maintain drivability and emissions compliance in high-mileage ICE engines.

Market Challenges

Shift Toward Electrification

Accelerating electrification is a structural headwind for new-build ICE valvetrain content, even as the legacy parc remains large. The U.S. Department of Energy’s Transportation Fact of the Week reports cumulative plug-in light-duty vehicle sales since 2010 reaching 4,700,000 in 2023, with 1,402,371 plug-in vehicles sold that year alone. Argonne National Laboratory data indicate more than 1,500,000 plug-in vehicles sold in 2024, and thought-leadership analysis citing Argonne figures notes over 6,700,000 plug-in EVs sold cumulatively by early 2025. As EVs climb in new-vehicle mix, fewer new ICE engines – and therefore fewer factory-installed camshafts – are produced, shifting camshaft demand increasingly toward replacement, heavy-duty, industrial and performance niches.

Material Cost Volatility

Camshaft manufacturers are highly exposed to ferrous-metal and alloy price swings, which affect casting, forging and machining economics. World Bank Pink Sheet data show the benchmark iron ore price series at an index value of about 120.6 in 2022, easing to 109.4 in 2023 and further toward 99.9 in early 2024, but quarter-to-quarter volatility remains pronounced. The broader World Bank metals and minerals index also records large fluctuations over 2022–2024, reflecting geopolitical disruptions and demand swings from construction and manufacturing. For camshaft suppliers, these oscillations complicate long-term pricing to OEMs and distributors, compress margins on fixed-price contracts and push many players to diversify sourcing and adopt scrap-based or near-net manufacturing routes to stabilize material input costs.

Opportunities

Lightweighting Programs

Ongoing lightweighting and fuel-efficiency programs in ICE and hybrid vehicles are opening opportunities for advanced camshaft materials and hollow or assembled designs. DOE and FHWA data show that model-year 2022 light-duty vehicles sold in the U.S. achieved an average fuel economy of 26.4 miles per gallon, with policy frameworks pushing further efficiency gains. EPA and NHTSA GHG rules for light-duty vehicles require continuous CO₂ and fuel-economy improvements through the mid-2030s, and electric-drive reports highlight EV electricity use of 7.6 million MWh in 2023, rising to 1.58 million MWh in just the first two months of 2024. In response, OEMs are trimming mass in remaining ICE and hybrid platforms via high-strength steels, hollow shafts and assembled cam modules. This creates room for suppliers that can design weight-optimized camshafts, apply advanced surface treatments and integrate with variable-valve-timing (VVT) phasers without compromising durability.

Variable Valve Timing Integration

Tightening emissions and drivability requirements are accelerating the use of variable valve timing and advanced valvetrain strategies on the remaining ICE parc, increasing the technical content of camshaft assemblies. EPA automotive-trends reporting shows rising penetration of turbocharged and downsized gasoline engines in the early 2020s, while DOE and EPA GHG rules for 2023 and later model years require automakers to use more sophisticated combustion-control strategies to meet CO₂ targets. Federal rulemaking documents explicitly discuss higher uptake of exhaust-gas recirculation, variable valve timing and other technologies in response to standards such as the Revised 2023 and Later Model Year Light-Duty Vehicle GHG Standards. As OEMs extend these strategies across mass-market platforms in 2022–2025, camshaft suppliers that can co-design lobes, phasing features and oil-control interfaces with OEM valvetrain and E/E teams are positioned to capture higher value-add, even in a flat ICE production environment.

Future Outlook

Over the 2024–2030 horizon, the USA camshafts market is expected to expand in line with global automotive camshaft trends, where Nexdigm projects a 3.87% CAGR from 2024 to 2032. While pure battery-electric vehicles (which do not use camshafts) are growing, internal combustion engines and hybrids will still dominate the US parc through 2030, with around 290 million vehicles on the road and vehicle age continuing to creep upward. That combination of a large, aging fleet and steady new-vehicle production underpins a resilient camshaft demand base.

Increasing pickup and SUV mix in US light-vehicle sales, elevated annual miles driven for logistics and last-mile delivery fleets, and continued federal and state emissions standards will push OEMs toward more sophisticated valvetrain architectures, including DOHC and variable-valve-timing camshafts. At the same time, camshaft suppliers must manage a gradual structural shift: as EV penetration rises, they will need to pivot toward hybrid powertrains, high-performance niches and export opportunities, while deploying more advanced materials and composite camshafts to meet OEM light-weighting and friction-reduction targets.

Major Players

- Aichi Forge Co., Ltd.

- Camshaft Machine Company

- Comp Cams

- Crane Cams

- Estas Camshaft

- Linamar Corporation

- MAHLE GmbH

- Melling Engine Parts

- Musashi Seimitsu Industry Co., Ltd.

- Precision Camshafts Ltd.

- Riken Corporation

- Schaeffler AG

- Thyssenkrupp AG

- Elgin Industries

Key Target Audience

- Automotive OEM Powertrain & Engine Engineering Teams

- Tier-1 & Tier-2 Engine Component Suppliers

- Independent Engine Rebuilders, Machine Shops & Performance Tuners

- Automotive Aftermarket Distributors & Retailers

- Fleet Operators and Large Vehicle Owners

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Industry Associations and Trade Bodies

Research Methodology

Step 1: Identification of Key Variables

The first step involved mapping the complete ecosystem of the USA camshafts market, covering global camshaft manufacturers, US-based engine plants, aftermarket distributors, engine rebuilders and performance tuners. Extensive desk research was conducted using secondary sources such as Credence Research’s global automotive camshaft study, OEM annual reports, US vehicle production data, and VIO statistics from aftermarket and financial research publications. This phase defined critical variables including engine production volumes, parc age, valvetrain technology mix and regional manufacturing footprints.

Step 2: Market Analysis and Construction

Historical and current data on vehicle production, sales and vehicles in operation in the United States were compiled from industry bodies and government disclosures. A bottom-up approach (engine volumes × camshafts per engine × content per unit) was combined with a top-down cross-check (regional revenue allocations from global camshaft studies) to construct a coherent market structure by channel and vehicle type.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary hypotheses on segment shares (e.g., dominance of passenger cars and OEM channel, role of performance aftermarket) were tested through qualitative interviews with professionals from engine component suppliers, rebuilders, and performance camshaft specialists. Insights from publicly available commentary by US aftermarket associations and investor presentations from listed component suppliers were used as proxies where direct interviews were not accessible. This ensured that assumptions about channel mix, replacement cycles and regional demand clusters aligned with operational realities.

Step 4: Research Synthesis and Final Output

The final stage consolidated quantitative sizing benchmarks (global and North American camshaft revenues, CAGR projections) with qualitative insights on technology trends, regulatory drivers and powertrain mix. The resulting picture was stress-tested against scenarios for EV adoption, hybrid penetration and regulatory tightening through 2030. This synthesis produced an integrated view of the USA camshafts market, including segmentation by vehicle type and sales channel, competitive landscape mapping, and a directional growth outlook anchored in published global forecasts but tuned to US-specific parc and production dynamics.

- Executive Summary

- Research Methodology (Market Definition & Scope, Powertrain Component Classification, Camshaft Functional Architecture, Assumptions & Boundary Conditions, Supply-Side & Demand-Side Sampling Logic, OEM–Aftermarket Split Estimation, Engine Platform Mapping, Multi-Variate Forecasting Models, Validation Through Tier-1 & Engine Builders Interviews, Limitations)

- Definition & Scope

- Market Evolution & Technology Genesis

- Engine Architecture Shifts (Pushrod, SOHC, DOHC)

- Timeline of Major USA & Global Camshaft Manufacturers

- Powertrain Value Chain & Component Flow Mapping

- Growth Drivers

Vehicle Parc Expansion

Aging ICE Fleet

Heavy-Duty Engine Demand Stability

Performance Aftermarket Growth

Remanufacturing Penetration - Market Challenges

Shift Toward Electrification

Material Cost Volatility

Precision Machining Requirements

Import Competition

OEM Platform Consolidation - Opportunities

Lightweighting Programs

Variable Valve Timing Integration

Modular Camshaft Designs

EV-Range Extender Engines

Additive Manufacturing Adoption - Trends

Surface Engineering Enhancements

Assembled Camshaft Adoption

High-Lift Profiles Demand

Increased CNC Machining Automation

Telematics-Based Predictive Maintenance Driving Replacements - Regulatory Landscape

- SWOT Analysis

- Stakeholder Ecosystem Mapping

- Porter’s Five Forces Analysis

- Competition Ecosystem

- By Value, 2019-2024

- By Volume, 2019-2024

- By Engine Build Rate, 2019-2024

- By Engine Displacement Bands, 2019-2024

- By Material Mix, 2019-2024

- By Engine Type (in Value %)

Gasoline

Diesel

CNG/LPG

Flex-Fuel

High-Performance/Drag - By Manufacturing Process (in Value %)

As-Cast

Forged

Billet-Machined

Assembled/Hybrid

3D-Printed / Additive-Manufactured Shafts - By Vehicle Category (in Value %)

Passenger Cars

Light Commercial Vehicles

Heavy Trucks

Off-Highway / Construction Equipment

Powersports / Motorcycles - By End-Use Channel (in Value %)

OEM Production

OEM Service / OES

Independent Aftermarket

Performance & Racing Segment

Remanufacturing Sector - By Material Technology (in Value %)

Chilled Cast Iron

Ductile Iron

Hardened Steel

Composite / Lightweight Materials

Coated & Surface-Engineered Camshafts - By Distribution Channel (in Value %)

Dealer Networks

Performance Retailers

Online B2C

Engine Machine Shops

Wholesale Distributors

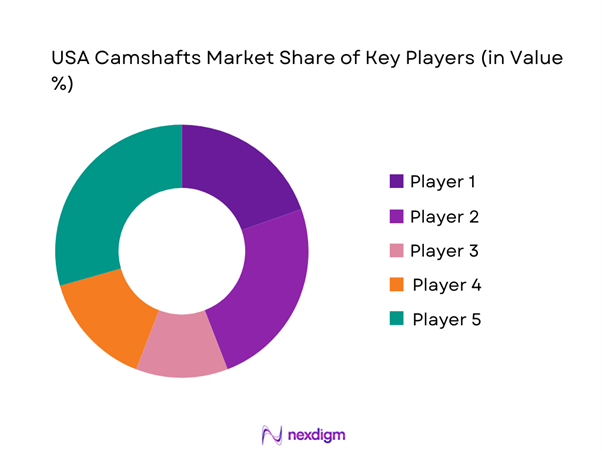

- Market Share of Major Players (Value & Volume)

Market Share by Manufacturing Process

Market Share by Engine Type - Cross-Comparison Parameters (Engine Platform Coverage Depth, Camshaft Material & Metallurgy Capabilities, Precision Machining & CNC Infrastructure, Performance/Racing Portfolio Strength, OEM vs. Aftermarket Revenue Split, Distribution Footprint & Installer Touchpoints, Innovation in Surface Treatments / Coatings, Remanufacturing & Sustainability Programs)

- SWOT Analysis of Major Players

- Pricing Architecture Analysis

- Detailed Profiles of Major Companies

Federal-Mogul/DRiV

MAHLE

Comp Cams / Edelbrock Group

Crower Cams & Equipment

Lunati Cams

Howard’s Cams

Crane Cams

Melling Engine Parts

Elgin Industries

Engine Power Components (EPC)

ISKY Racing Cams

Cam Motion

Texas Speed & Performance

Colt Cams

- Demand Utilization Matrix

- Fleet Maintenance Cycles

- Engine Overhaul Behavior

- Reliability Requirements

- Performance Segment Needs

- By Value, 2025-2030

- By Volume, 2025-2030

- By Engine Build Rate, 2025-2030

- By Engine Displacement Bands, 2025-2030

- By Material Mix, 2025-2030