Market Overview

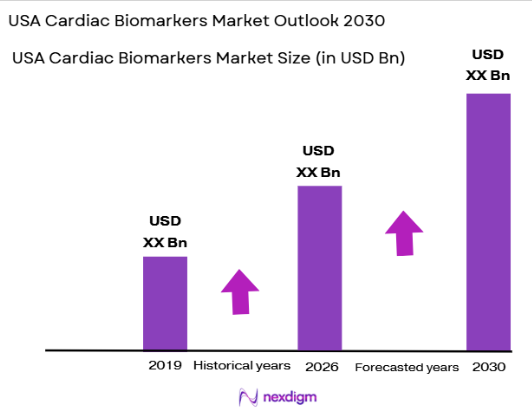

The USA Cardiac Biomarkers market has experienced significant growth, valued at USD ~ billion in 2025. The market is primarily driven by the increasing prevalence of cardiovascular diseases and technological advancements in diagnostic solutions. The adoption of rapid, point-of-care testing and the integration of artificial intelligence in diagnostic tools further contribute to market expansion. This market’s growth is expected to continue, bolstered by rising consumer demand for early detection, personalized treatments, and the expansion of healthcare infrastructure

In the USA, regions such as California, New York, and Texas dominate the Cardiac Biomarkers market due to their advanced healthcare systems and large populations. These states house numerous healthcare institutions, research centers, and diagnostic laboratories that prioritize cardiac health. New York’s medical infrastructure and California’s tech-driven healthcare innovation provide ideal environments for the widespread implementation of cardiac biomarkers, contributing to the market’s dominance in these regions.

Market Segmentation

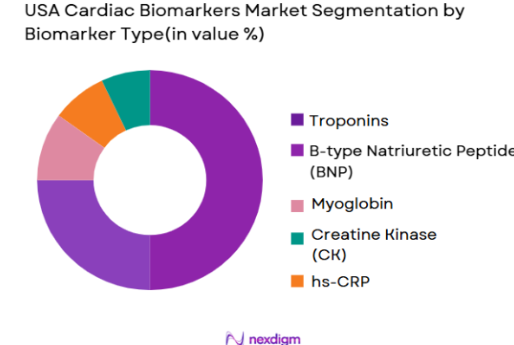

By Biomarker Type

The USA Cardiac Biomarkers market is segmented by biomarker types into Troponins, B-type Natriuretic Peptide (BNP), Myoglobin, Creatine Kinase (CK), and High-sensitivity C-Reactive Protein (hs-CRP). Troponins dominate the market due to their high specificity and sensitivity for detecting cardiac events such as acute myocardial infarctions (AMIs). Troponins have established themselves as the gold standard in diagnosing heart attacks, with hospitals and diagnostic labs relying on them for accurate and timely diagnoses. This dominance is attributed to their proven clinical utility and widespread adoption across both traditional laboratory and point-of-care settings.

By Diagnostic Method

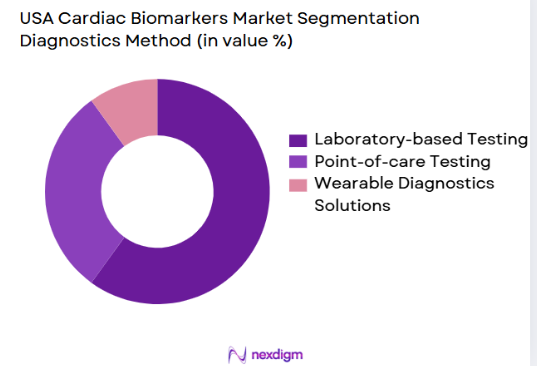

The market is segmented into laboratory-based testing, point-of-care (POC) testing, and wearable diagnostic solutions. Laboratory-based testing remains the dominant method, primarily due to its high accuracy and comprehensive results, which are vital for the precise diagnosis of cardiac conditions. However, POC testing is rapidly gaining traction, especially in emergency care settings, as it provides faster results. The shift towards POC testing is driven by the increasing demand for rapid diagnostics in urgent care scenarios and home healthcare environments.

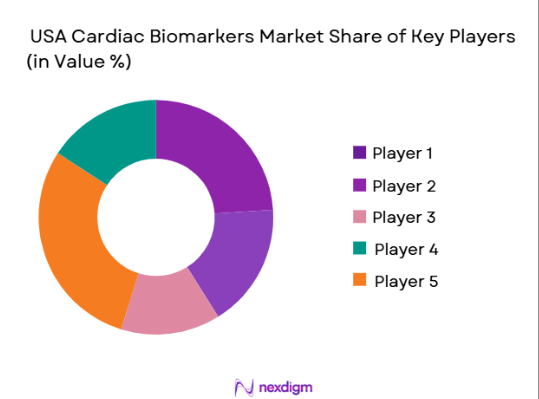

Competitive Landscape

The USA Cardiac Biomarkers market is dominated by a few major players, including global healthcare giants and specialized diagnostics companies. Companies such as Abbott Laboratories, Siemens Healthineers, and Roche Diagnostics lead the market with their advanced cardiac biomarker solutions and widespread distribution networks. This consolidation highlights the significant influence of these key players, who continue to innovate and capture market share through product differentiation, strategic partnerships, and aggressive marketing strategies.

| Company | Year Established | Headquarters | R&D Investment | Product Portfolio | Distribution Network | Key Partnerships |

| Abbott Laboratories | 1888 | Chicago, IL | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Erlangen, Germany | ~ | ~ | ~ | ~ |

| Roche Diagnostics | 1896 | Basel, Switzerland | ~ | ~ | ~ | ~ |

| Thermo Fisher Scientific | 1956 | Waltham, MA | ~ | ~ | ~ | ~ |

| BioMérieux | 1963 | Marcy-l’Étoile, France | ~ | ~ | ~ | ~ |

USA Cardiac Biomarkers Market Analysis

Growth Drivers

Urbanization

Urbanization in the United States continues to increase, with the urban population expected to reach ~% by 2025. The increasing urban population leads to a higher prevalence of cardiovascular diseases due to lifestyle factors such as poor diet, sedentary behavior, and stress. According to the World Health Organization (WHO), the urban population has seen consistent growth, directly impacting the demand for healthcare services and diagnostic tools, including cardiac biomarkers. This rising urbanization directly drives the need for more accurate and accessible cardiac diagnostic solutions in urban healthcare settings.

Industrialization

The ongoing industrialization in the United States has significantly increased the number of individuals working in high-stress and physically demanding environments, contributing to a higher incidence of cardiovascular diseases. As industrial sectors expand, stress-related conditions are becoming more common, leading to an increased demand for diagnostic testing, such as cardiac biomarkers, to monitor heart health. In 2025, the United States had more than~million people employed in manufacturing and construction sectors, areas that are notably associated with higher cardiovascular risks. This growth in industrial employment is a significant driver for the cardiac biomarkers market.

Restraints

High Initial Costs

One of the main barriers to the widespread adoption of cardiac biomarkers in the USA is the high initial cost of advanced diagnostic equipment. The cost of acquiring high-end testing systems such as troponin assays and B-type natriuretic peptide (BNP) tests can exceed several thousand dollars. For instance, the cost of a troponin assay test ranges between USD~ and USD ~ per test. This price point can be prohibitive, especially for smaller healthcare facilities, and may delay the implementation of advanced diagnostic tools in certain regions, hindering market growth.

Technical Challenges

The USA cardiac biomarkers market faces several technical challenges, particularly in terms of maintaining accuracy and consistency across various testing methods. One of the key difficulties is the integration of new biomarkers into existing diagnostic frameworks. The lack of standardized protocols for testing and quality control leads to discrepancies in results. In fact, according to the FDA, issues related to test reliability have been a significant concern, with some tests showing variable results across different laboratories. This inconsistency hinders the widespread acceptance of certain cardiac biomarkers for routine diagnostics.

Opportunities

Technological Advancements

Technological advancements in cardiac biomarker diagnostics are opening up new opportunities for the market, particularly in point-of-care (POC) testing. The USA healthcare sector has seen substantial investment in developing POC diagnostic devices, such as handheld devices for cardiac biomarker testing, which allow for faster results at lower costs. In 2025, over ~% of the healthcare facilities in the US were using POC diagnostic devices, and the trend is expected to increase. These innovations are crucial in expanding the availability of cardiac biomarkers to underserved areas, where traditional lab-based testing may not be feasible.

International Collaborations

International collaborations are creating significant growth opportunities for the USA cardiac biomarkers market by providing access to cutting-edge technologies and expanding the availability of diagnostic tools. For example, partnerships between American diagnostics companies and European firms have allowed for faster development of next-generation cardiac biomarkers, including those targeting multiple cardiovascular conditions. In 2025, several U.S. companies signed agreements with European biotechnology firms to enhance research into innovative biomarkers. This collaboration ensures the rapid adoption and integration of novel cardiac biomarker technologies, positioning the USA market for long-term growth.

Future Outlook

Over the next few years, the USA Cardiac Biomarkers market is expected to show consistent growth, driven by technological advancements in diagnostic methods, particularly the expansion of point-of-care (POC) testing and wearable devices. Government support for healthcare infrastructure improvements, as well as the growing focus on personalized medicine, will further accelerate market growth. Additionally, as cardiovascular disease rates continue to rise, demand for accurate and rapid diagnostic tools will become more critical.

Major Players

- Abbott Laboratories

- Siemens Healthineers

- Roche Diagnostics

- Thermo Fisher Scientific

- BioMérieux

- Ortho Clinical Diagnostics

- Quidel Corporation

- Medtronic

- Becton, Dickinson and Company

- Danaher Corporation

- Philips Healthcare

- Hologic Inc.

- Johnson & Johnson

- Idexx Laboratories

- LabCorp

Key Target Audience

- Healthcare Providers

- Medical Equipment Manufacturers

- Regulatory Bodies

- Insurance Providers

- Pharmaceutical Companies

- Investment and Venture Capital Firms

- Government Agencies

- Cardiologists and Healthcare Practitioners

Research Methodology

Step 1: Identification of Key Variables

The first step involves defining the critical variables that influence the USA Cardiac Biomarkers market, including market drivers, challenges, and trends. This is done through extensive desk research, using secondary data from credible sources such as industry reports, government publications, and company financial statements.

Step 2: Market Analysis and Construction

This phase includes gathering historical data on the market size, segmentation, and trends. The analysis also covers the evaluation of market penetration and adoption rates of different diagnostic methods, such as POC and laboratory-based testing, to accurately forecast future market potential.

Step 3: Hypothesis Validation and Expert Consultation

Experts from the healthcare industry, including cardiologists, diagnostic lab directors, and R&D heads, will be consulted through interviews and surveys to validate hypotheses regarding market trends, customer needs, and future innovations in cardiac biomarkers.

Step 4: Research Synthesis and Final Output

The final report synthesizes all gathered data into a comprehensive market outlook. Key insights are cross-verified through expert consultations and market data to ensure accuracy. This phase focuses on creating actionable insights for businesses, stakeholders, and regulatory bodies involved in the cardiac biomarkers market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, USA-Specific Terminologies, Abbreviations, Market Sizing Logic, Bottom-Up & Top-Down Validation, Triangulation Framework, Primary Interviews Across Healthcare Providers, Diagnostic Centers, and Industry Experts, Demand-Side & Supply-Side Weightage, Data Reliability Index, Limitations & Forward-Looking Assumptions)

- Definition and Scope

- Market Genesis and Evolution Pathway

- USA Cardiac Biomarkers Industry Timeline

- Cardiac Biomarkers Business Cycle

- Cardiac Biomarkers Supply Chain & Value Chain Analysis

- Key Growth Drivers

Rising Incidence of Cardiovascular Diseases

Technological Advancements in Cardiac Diagnostics

Increasing Adoption of Point-of-Care Testing

Government Initiatives and Awareness Programs - Market Challenges

High Costs of Advanced Biomarker Tests

Regulatory Hurdles and Market Entry Barriers - Key Trends

Shift Towards Non-invasive Diagnostic Approaches

Growing Focus on Biomarker-based Prognostic Tools

Rising Demand for Real-Time Diagnostics and Monitoring

Development of Portable and Wearable Biomarker Devices

Market Opportunities

Expansion of Point-of-Care Testing

Demand for Personalized Medicine in Cardiac Care

Integration of Artificial Intelligence in Diagnostics

Growth of Telemedicine in Cardiac Diagnostics

- Government regulations

FDA Regulations and Approvals for Cardiac Biomarkers

Clinical Lab Standards and Compliance

Reimbursement Policies for Biomarker Testing

Global Regulatory Trends Impacting USA Market - SWOT Analysis

- Porter’s Five Forces Analysis

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price, 2019-2025

- By Biomarker Type Adoption, 2019-2025

- By Diagnostic Method, 2019-2025

- By Region, 2019-2025

- By Biomarker Type (In Value %)

Troponins

B-type Natriuretic Peptide (BNP)

Creatine Kinase (CK)

Myoglobin

High-sensitivity C-Reactive Protein (hs-CRP) - By Diagnostic Method (In Value %)

Laboratory-Based Testing

Point-of-Care Testing

Wearable Diagnostics - By Application (In Value %)

Acute Coronary Syndrome (ACS)

Heart Failure

Myocardial Infarction

Arrhythmias

Cardiovascular Disease Risk Monitoring - By End-User (In Value %)

Hospitals

Diagnostic Laboratories

Research Institutions

Outpatient Centers - By Region (In Value %)

Northeast USA

Midwest USA

South USA

West Coast USA

- Market Share of Major Players

- Cross Comparison Parameters (Product Portfolio Breadth, Technological Advancements, Regulatory Approvals, Manufacturing & Localization Capabilities, R&D Investment & Innovations, Strategic Partnerships & Collaborations, Distribution Footprint, Customer Support & Service Infrastructure)

- SWOT Analysis of Key Players

- Pricing Analysis

Pricing Trends for Major Cardiac Biomarkers

Comparison of Prices Across Diagnostic Providers - Detailed Company Profiles

Abbott Laboratories

Siemens Healthineers

Roche Diagnostics

Thermo Fisher Scientific

Beckman Coulter

BioMérieux

Ortho Clinical Diagnostics

Quidel Corporation

Medtronic

Becton, Dickinson and Company

Danaher Corporation

Philips Healthcare

Hologic Inc.

Johnson & Johnson

Idexx Laboratories

- Hospitals and Cardiac Care Units lead demand due to high patient volumes and acute care needs.

- Diagnostic and Clinical Laboratories drive growth with high-throughput testing services.

- Ambulatory and Outpatient Care Centers use biomarkers for early detection and chronic condition monitoring.

- By Value, 2026-2030

- By Volume, 2026-2030

- By Average Selling Price, 2026-2030