Market Overview

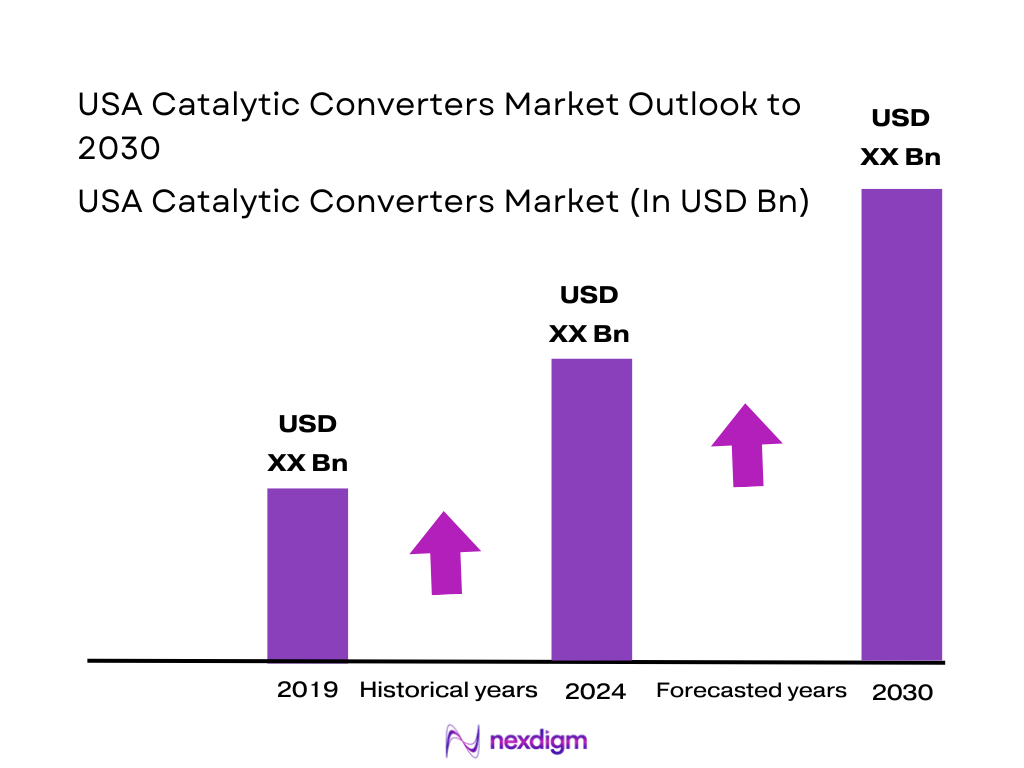

The USA catalytic converters market is valued at roughly USD ~ billion, based on a recent synthesis of converter-system and exhaust-system revenue pools across light and heavy vehicles. Over the latest two-year window, converter demand increased from just below USD ~ billion to the current level, in line with rising light-vehicle sales, which hover around ~ million units annually, and a national vehicle parc exceeding ~ million vehicles. This growth is underpinned by strong miles-driven, a steady ageing of the vehicle fleet, and continual tightening of tailpipe emission limits, which require higher-value, more complex converter bricks.

Within the USA catalytic converters market, demand is anchored in states that dominate vehicle production and registrations. The Upper Midwest “auto alley” (Michigan, Indiana, Ohio and Illinois) accounts for more than 40 percent of North American vehicle production, while the southern auto corridor led by Alabama, Kentucky and other states hosts a large share of foreign OEM plants. On the usage side, California, Texas, Florida, Ohio and Pennsylvania together account for over ~ million registered vehicles, making them critical aftermarket demand centres for replacement catalytic converters and emissions-inspection driven repairs.

Market Segmentation

By Product Type

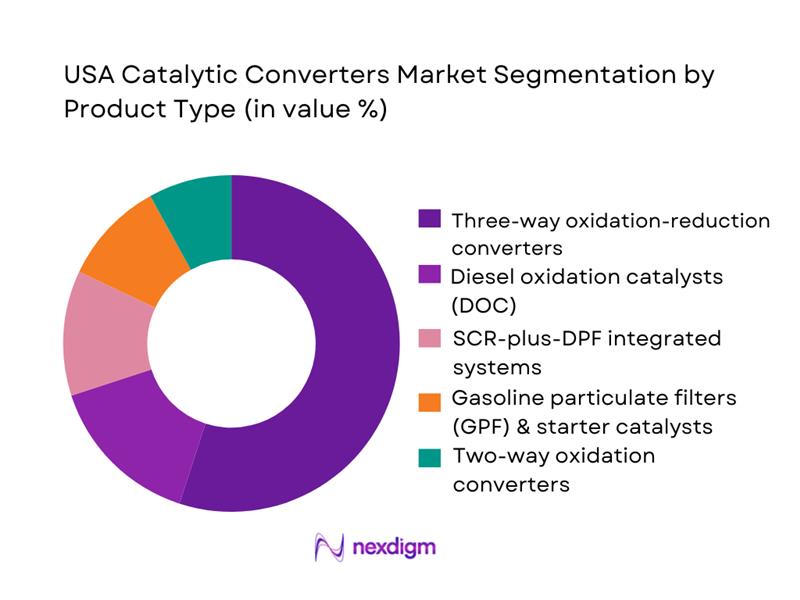

The USA catalytic converters market is segmented by product type into two-way oxidation converters, three-way oxidation-reduction converters, diesel oxidation catalysts, SCR-plus-DPF integrated systems and gasoline particulate filters. In this structure, three-way oxidation-reduction converters hold the largest share because they are standard on the vast installed base of gasoline passenger cars and light trucks. Global research indicates that three-way converters are the leading product class due to their ability to simultaneously reduce NOx, CO and HC emissions on stoichiometric gasoline engines, a configuration that dominates US light-duty powertrains. In addition, the USA’s long history of federal and California emission standards has driven continual upgrades in three-way catalyst performance, increasing the value per converter while preserving their central role in meeting regulatory limits.

By Vehicle Type

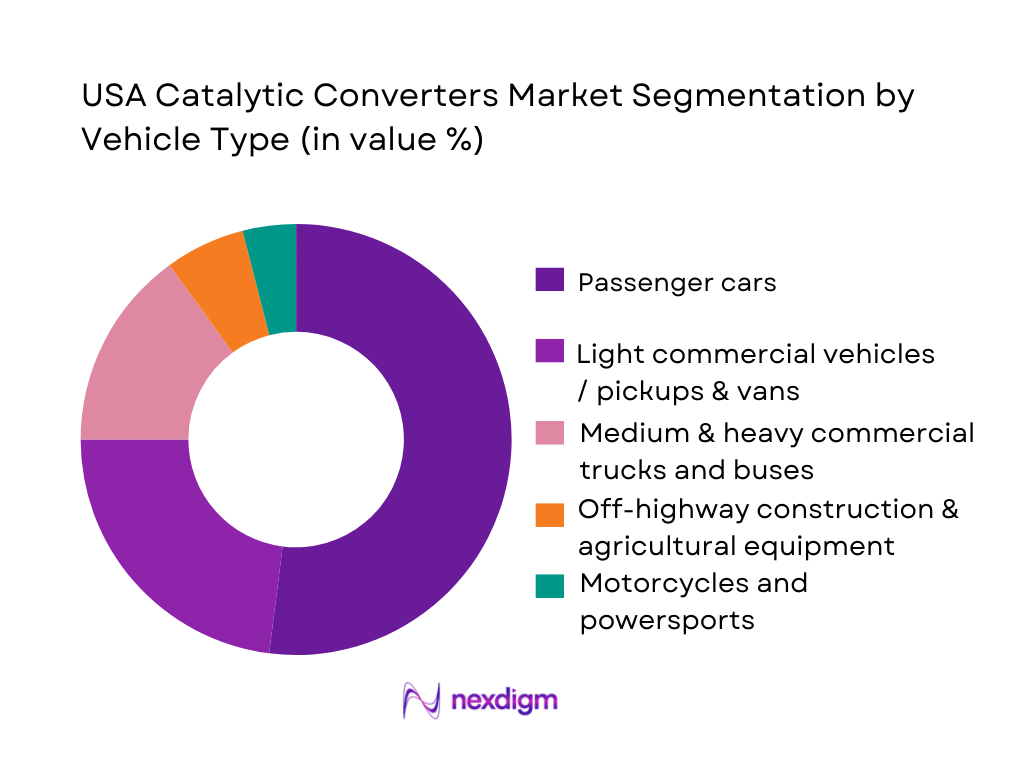

The USA catalytic converters market is segmented by vehicle type into passenger cars, light commercial vehicles, medium and heavy commercial trucks and buses, off-highway equipment and motorcycles/powersports. Among these, passenger cars form the largest demand pool, reflecting both high annual sales and an enormous installed base. Recent registration statistics show that states such as California, Texas and Florida together have more than ~ million registered vehicles, most of them passenger cars and light trucks requiring one or more three-way converters per vehicle. The predominance of privately owned light vehicles, combined with stringent inspection and maintenance regimes in populous states, keeps passenger-car converter replacement volumes structurally higher than those for heavy commercial and off-highway sectors.

Competitive Landscape

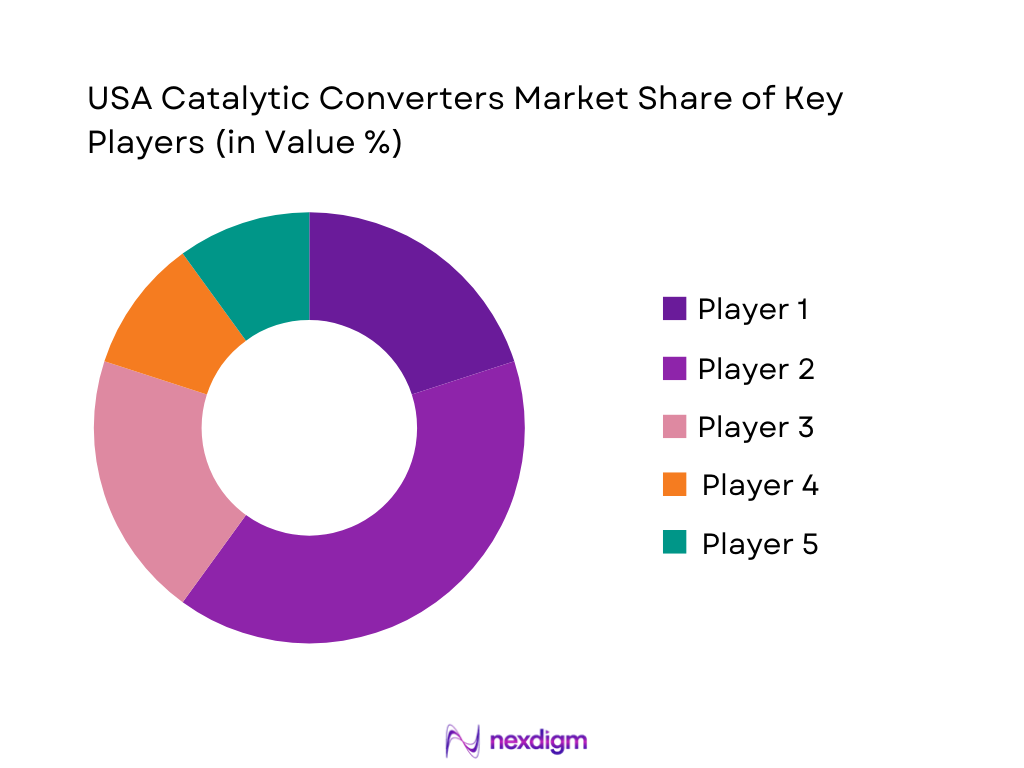

The USA catalytic converters market is characterised by a concentrated group of Tier-1 exhaust and emissions-control suppliers serving global and domestic OEMs, alongside specialist catalyst manufacturers and aftermarket brands. International research consistently identifies Faurecia (FORVIA), Tenneco, Eberspächer, Bosal, Benteler, Futaba, Yutaka Giken, Sango and Johnson Matthey among the leading players in catalytic converters and exhaust after-treatment, supported by PGM and catalyst specialists such as Umicore and BASF. These firms combine broad OEM nomination portfolios, North American manufacturing footprints and deep know-how in catalyst formulation and converter canning, giving them scale advantages versus smaller regional suppliers.

| Company | Establishment Year* | Headquarters* | Key Catalytic Converter Focus (USA) | US Manufacturing / Assembly Footprint | Major OEM / Segment Focus | Technology & PGM Strategy | Aftermarket Presence |

| Tenneco Inc. (Walker Emissions Control) | Early 20th century | Northville, Michigan, USA | ~ | ~ | ~ | ~ | ~ |

| Faurecia SE (FORVIA – Clean Mobility) | Mid-20th century | Nanterre, France | ~ | ~ | ~ | ~ | ~ |

| Eberspächer Group | 19th century | ~ | ~ | ~ | ~ | ~ | ~ |

| BOSAL International | Mid-20th century | Lummen, Belgium | ~ | ~ | ~ | ~ | ~ |

| Johnson Matthey – Autocatalyst Business | 19th century | London, UK | ~ | ~ | ~ | ~ | ~ |

USA Catalytic Converters Market Analysis

Growth Drivers

Emission regulations

Stringent federal emission rules are the primary structural driver for the USA catalytic converters market. Under the Tier 3 light-duty program, fleet-average non-methane organic gas plus NOx limits tighten to 0.03 grams per mile for new cars and light trucks, forcing higher-efficiency three-way catalysts and gasoline particulate filters on every new internal-combustion platform. At the same time, total U.S. greenhouse-gas emissions reached ~million metric tons of CO₂-equivalent in the most recent inventory, with transportation remaining the single largest end-use sector emitter, keeping regulatory pressure on tailpipe pollutants and CO₂. This combination of increasingly tight per-vehicle emission caps and a large, regulated transport emissions base structurally underpins demand for advanced catalytic converter systems across light-duty and commercial vehicles.

Vehicle parc evolution

The USA remains one of the most vehicle-dense markets in the world, which anchors an enormous in-use base of catalytic converters. Federal Highway Administration data show ~ registered motor vehicles nationwide, an all-time high, including passenger cars, light trucks and heavy trucks that rely on three-way or diesel oxidation/SCR after-treatment. With U.S. GDP at about USD ~ trillion in current prices and GDP per capita close to USD ~, motorization remains structurally high, supporting sustained new-vehicle registrations on top of the existing parc. Each additional internal-combustion vehicle sold introduces at least one catalytic converter system, while the large in-use parc requires replacement converters over the vehicle lifetime, making parc size and income levels core demand drivers.

Market Challenges

PGM price volatility

Catalytic converters depend on platinum-group metals (PGMs) such as platinum, palladium and rhodium, whose prices have been highly volatile since 2022. United Nations Conference on Trade and Development analysis notes that strong substitution demand pushed palladium to around USD ~ per troy ounce in December 2022, while platinum traded near USD ~ per troy ounce in the same period. Subsequent precious-metal market reports highlight continued tightness and investor swings, with multi-year deficits periodically reported for platinum and sharp price corrections for palladium and rhodium. Such volatility exposes converter makers and OEMs to large swings in catalyst-brick cost per vehicle, complicating long-term supply contracts, hedging strategies and PGM-loading optimisation, and can pressure margins in both OEM and aftermarket converter sales.

EV substitution risk

Battery-electric vehicles remove the need for exhaust after-treatment and therefore represent a long-run substitution risk for catalytic converters. Cumulative U.S. plug-in electric vehicle sales exceeded ~ million units by late 2025, according to Argonne National Laboratory tracking, and the U.S. Treasury reports ~ million clean vehicles sold in a single recent year after the Inflation Reduction Act incentives took effect. Even if plug-ins still represent a minority of the total parc, this stock is growing off a low base and is concentrated in coastal states with stricter emission policies, directly displacing future converters in those ZIP codes. For converter suppliers, this creates a need to focus on higher-value hybrid, diesel and retrofit applications and to manage long-term capacity and PGM commitments in light of gradually rising EV penetration.

Opportunities

Advanced three-way and GPF systems

The combination of tighter Tier 3 limits and rising gasoline-direct-injection penetration creates a strong opportunity for advanced three-way catalysts (TWC) and gasoline particulate filters (GPF) in the USA. With ~ trillion vehicle-miles driven annually and more than ~ million registered vehicles, even incremental reductions in tailpipe pollutants per mile translate into large absolute emission abatement, incentivising regulators to keep pushing technology. EIA data show that hybrids, plug-in hybrids and battery-electric vehicles together now account for a record share of new light-duty sales, meaning many new gasoline vehicles are highly efficient but require sophisticated after-treatment to manage cold-start and real-world emissions. Catalyst suppliers that can deliver low-PGM-loading TWCs, coated GPFs and integrated under-floor/close-coupled systems tailored to U.S. driving cycles, sulfur levels and durability expectations can capture higher content per vehicle and premium pricing, even as unit ICE volumes gradually plateau.

Diesel retrofits

The size and duty cycle of the U.S. commercial-vehicle fleet creates meaningful scope for diesel emission-control retrofits and upgrades. Industry and federal data indicate roughly ~ million trucks registered in the country, with about ~ million tractor-trailers and ~ million single-unit trucks, and truck travel totaling around ~ billion miles annually. At the same time, analysis of new heavy-duty registrations shows approximately 120,000 new heavy-duty vehicles added in just the first half of one recent year, of which only 1,381 were zero-emission. This leaves a very large installed base of legacy diesel trucks and buses that will remain in service for a decade or longer and must meet tightening urban NOx and particulate limits. Programs that retrofit older fleets with diesel oxidation catalysts, wall-flow diesel particulate filters and selective catalytic reduction systems, particularly in ports, logistics hubs and attainment-nonattainment corridors, represent a sustained opportunity pool for converter and after-treatment specialists.

Future Outlook

Over the next several years, the USA catalytic converters market is expected to grow steadily despite the structural shift towards battery-electric vehicles. North America’s catalytic converter demand is projected to rise from roughly USD ~ billion to more than USD ~ billion at the regional level, with the United States remaining the largest single country market due to its high vehicle parc and stringent regulatory framework. While EVs progressively displace converters on some new vehicles, internal combustion engines still dominate light-duty sales and the on-road fleet, and a significant share of future powertrains will be hybrids that continue to require sophisticated three-way and GPF systems.

From a technology perspective, growth will be tilted towards high-cell-density three-way catalysts, GPFs, and integrated SCR-DPF bricks for heavy-duty diesel. Global analyses highlight the rising role of three-way oxidation-reduction converters and advanced after-treatment in meeting tightening emission standards worldwide, a trend mirrored in the US as federal and California programmes ratchet down limits on NOx and particulates. At the same time, PGM price volatility and sustainability pressures are pushing suppliers into low-PGM, tri-metal and high-recycling designs, with US recyclers and refiners increasingly important in capturing value from spent converters.

Major Players

- Tenneco Inc.

- Faurecia SE

- Eberspächer Group

- BOSAL International

- Benteler International AG

- Friedrich Boysen GmbH & Co. KG

- Futaba Industrial Co. Ltd.

- Yutaka Giken Company Limited

- Sango Co. Ltd.

- Sejong Industrial Co. Ltd.

- Johnson Matthey

- Umicore

- BASF SE

- Katcon Global

Key Target Audience

- Global and regional automotive OEM powertrain and exhaust engineering teams

- Tier-1 exhaust and after-treatment suppliers’ strategy and business development leaders

- Precious-metal refiners, recyclers and PGM trading desks

- Fleet operators and leasing companies

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aftermarket distribution groups and national service chains

- Industrial and off-highway equipment manufacturers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map for the USA catalytic converters market, covering light-duty and heavy-duty OEMs, Tier-1 exhaust suppliers, PGM refiners, recyclers, distributors and installers. This step is driven by extensive desk research using global market reports on automotive catalytic converters and exhaust systems, along with regulatory databases from the EPA and CARB. The objective is to define critical variables such as vehicle parc by class, emission standard coverage, converter content per vehicle and replacement cycles.

Step 2: Market Analysis and Construction

In this phase, historical and current data on vehicle production, registrations, average miles driven and exhaust-system revenues are compiled from automotive industry associations, government statistics and leading market-research firms. Converter unit volumes are derived from vehicle build rates and replacement ratios, while value pools are allocated by product type and channel using OEM bill-of-material benchmarks and aftermarket pricing studies. This yields a reconciled top-down and bottom-up picture of the USA catalytic converters market.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses—such as the dominance of three-way converters, the growth trajectory of GPFs and SCR-DPF systems, and the impact of EV penetration on converter demand—are tested through structured interviews with OEM powertrain planners, exhaust-system Tier-1s, PGM suppliers and large distributors. These consultations are conducted via phone and virtual meetings, capturing insights on platform pipelines, technology roadmaps and pricing dynamics. Feedback from experts is then reconciled with secondary-data trends to refine segment shares, growth rates and competitive positioning.

Step 4: Research Synthesis and Final Output

The final stage integrates quantitative models and qualitative insights into a cohesive market narrative, including segmentation views, competitive benchmarking and forward-looking scenarios. Converter value per vehicle, PGM exposure, remanufacturing potential and region-specific regulatory developments are stress-tested under multiple assumptions for ICE, hybrid and EV mix. The outcome is a validated, decision-oriented assessment of the USA catalytic converters market, providing actionable inputs for strategy, investment and go-to-market planning.

- Executive Summary

- Research Methodology

- Definition and Scope

- Market Genesis and Evolution

- Industry Structure and Business Cycle

- Supply Chain and Value Chain Structure

- Technology Landscape

- Growth Drivers

Emission regulations

Vehicle parc evolution

Miles-driven trends

Hybridization

Fleet age - Market Challenges

PGM price volatility

EV substitution risk

Warranty liabilities

Counterfeit parts - Opportunities

Advanced three-way and GPF systems

Diesel retrofits

Remanufacturing

PGM recycling - Trends

Downsized turbo-gasoline engines

Higher cell densities

Tri-metal optimization

Smart OBD monitoring - Regulatory and Standards Landscape

- Stakeholder Ecosystem

- Porter’s Five Forces

- Technology Roadmap and Innovation Hotspots

- Competitive Landscape Synopsis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Converter Content per Vehicle, 2019-2024

- By Product Type (in Value %)

Two-way oxidation converters

Three-way oxidation-reduction converters

Diesel oxidation catalysts (DOC)

SCR-plus-DPF integrated systems for diesel

Gasoline particulate filters (GPF) and close-coupled starters - By Vehicle Type (in Value %)

Passenger cars

Light commercial vehicles / pickups & vans

Medium & heavy commercial trucks and buses

Motorcycles, powersports and recreational vehicles - By Fuel & Powertrain Type (in Value %)

Gasoline internal combustion engines

Diesel internal combustion engines

Hybrid-electric vehicles (HEV/PHEV) with ICE

Flex-fuel and biofuel capable ICE

CNG/LPG and other alternative fuel ICE - By Substrate & Catalyst Material (in Value %)

Ceramic monolith substrates with PGM washcoat

Metallic substrates and high-cell-density designs

Platinum-rich catalytic systems

Palladium-rich catalytic systems

Rhodium-rich and tri-metal formulations - By Sales Channel (in Value %)

OEM / factory-installed converters

Independent aftermarket – direct-fit converters

Performance and specialty exhaust converters

Remanufactured and recycled converters

Fleet retrofit and compliance programs - By Emission Compliance Band (in Value %)

Legacy converters below current light-duty standards

Light-duty converters aligned with current federal standards

California & Section 177 state low-emission / ultra-low-emission converters

Heavy-duty diesel converters aligned with current on-road standards

Off-road and non-road regulated converters

- Market Share of Major Players

- Cross Comparison Parameters (Company overview, USA catalytic converter portfolio breadth, emission standard coverage, US manufacturing & remanufacturing footprint, key OEM and fleet programs, PGM sourcing and recycling strategy, R&D and patent intensity, aftermarket channel and installer relationships)

- SWOT Analysis of Major Players

- Pricing Analysis by Converter Class

- Detailed Profiles of Major Companies

Tenneco Inc.

Faurecia SE

Eberspächer Group

BOSAL International

Benteler International AG

Friedrich Boysen GmbH & Co. KG

Futaba Industrial Co. Ltd.

Yutaka Giken Company Limited

Sango Co. Ltd.

Sejong Industrial Co. Ltd.

Johnson Matthey

Umicore

BASF SE

Katcon Global

- Light-duty OEMs and platform engineering teams

- Heavy-duty truck and bus OEMs

- National and regional fleet operators

- Independent repair shops and exhaust specialists

- Retail chains and online parts aggregators

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Converter Content per Vehicle, 2025-2030