Market Overview

The USA child-resistant pharmaceutical packaging market is closely tied to the global ecosystem, where child-resistant pharmaceutical packaging is valued at about USD ~ billion in the latest period, up from USD ~ billion at the start of the recent cycle, based on a five-year historical analysis. Within this, North America contributes approximately USD 10.2 billion, with the United States as the anchor market, underpinned by rapid growth in pharmaceutical expenditures, which reached USD ~ billion in the most recent period.

The USA dominates child-resistant pharmaceutical packaging demand because it concentrates both drug consumption and manufacturing. National health expenditure stands around USD ~ trillion, with prescription drug spending alone near USD ~ billion, reflecting intense medication usage across chronic and specialty therapies. Key pharma manufacturing and export hubs such as New Jersey, California, Indiana, North Carolina, Pennsylvania, Illinois and Puerto Rico each handle pharmaceutical trade in the USD 8–22 billion range annually, making them prime clusters for high-value, regulated child-resistant packaging solutions.

Market Segmentation

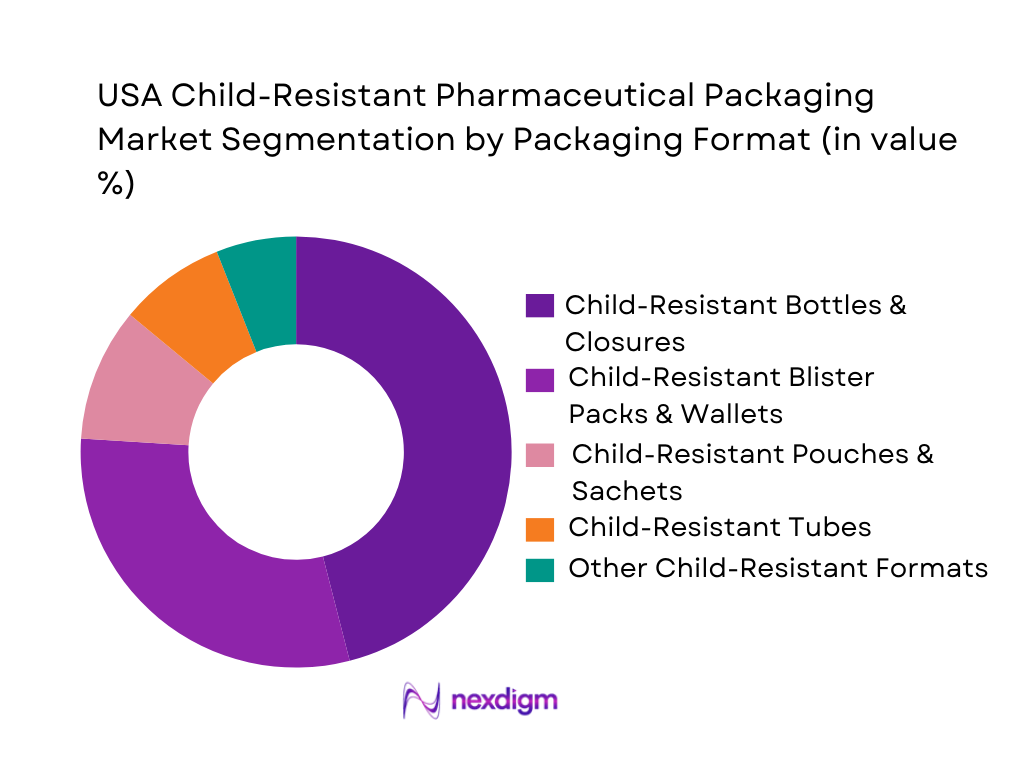

By Packaging Format

The USA child-resistant pharmaceutical packaging market is segmented into bottles & closures, blister packs & wallets, pouches & sachets, tubes and other specialized CR formats. Child-resistant bottles and closures hold a dominant share because they are the default format for a large portion of solid-dose prescriptions, OTC pain relief, cough and cold medicines, and nutraceuticals dispensed through retail pharmacies and mail-order channels. High prescription drug expenditure of USD ~ billion and total pharmaceutical spending of USD ~ billion translate into enormous volumes of pill and liquid medication bottles requiring PPPA-compliant caps and liners. The format is deeply entrenched in U.S. pharmacy workflows, is compatible with automated filling lines, and is supported by a mature supply base of closure, liner and bottle suppliers offering certified ISO 8317 and 16 CFR 1700.20 combinations.

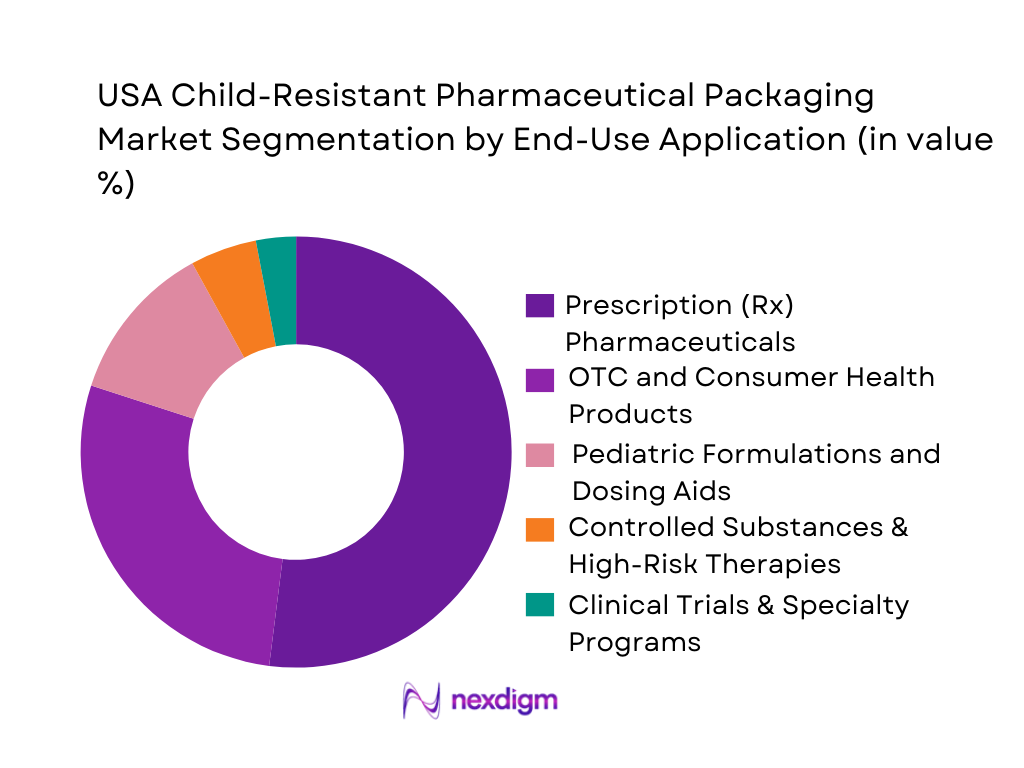

By End-Use Application

The USA child-resistant pharmaceutical packaging market is segmented into prescription pharmaceuticals, OTC and consumer health products, pediatric formulations, controlled substances and clinical trial/specialty programs. Prescription pharmaceuticals dominate because they account for the largest portion of medicine utilization and expenditure: overall U.S. pharmaceutical expenditures are around USD 805.9 billion, and prescription medicine days of therapy total roughly 215 billion annually, driving the need for robust, compliant packaging at scale. Mandatory PPPA compliance for oral prescription drugs and stringent CPSC and FDA expectations around child-resistant yet senior-friendly formats create high technical and regulatory barriers, favoring specialized Rx packaging such as CR bottles, adherence blister wallets and unit-dose systems.

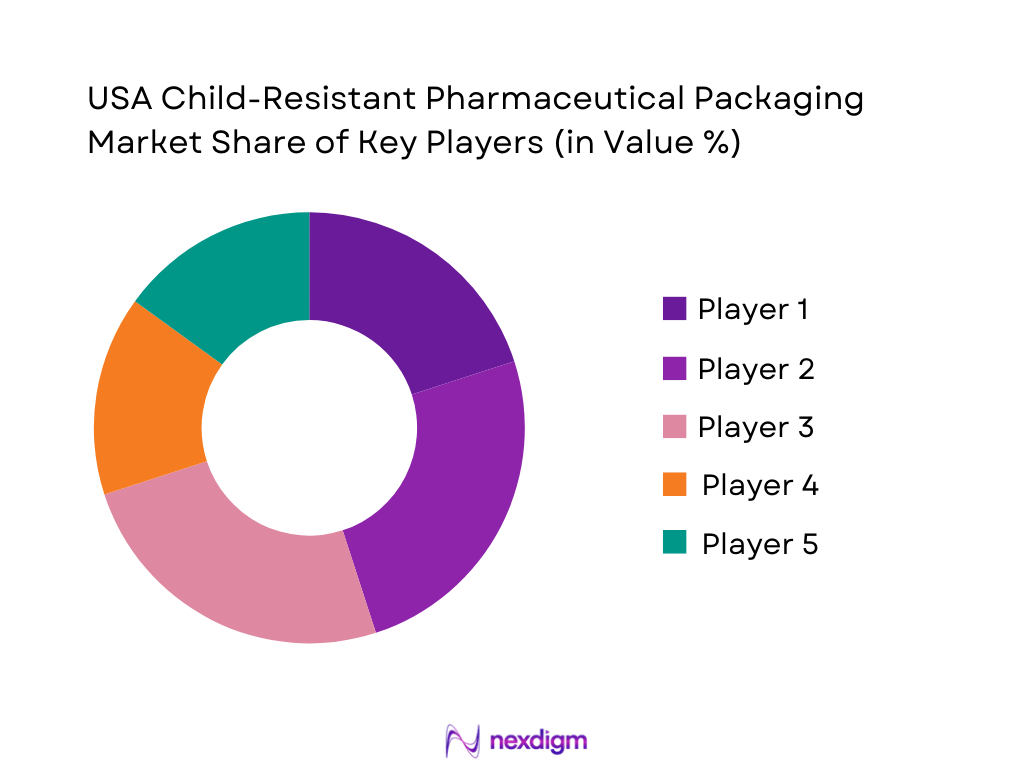

Competitive Landscape

The USA child-resistant pharmaceutical packaging market is moderately consolidated around global packaging multinationals and specialized healthcare converters with strong regulatory pedigrees. These players combine certified child-resistant and senior-friendly designs with deep knowledge of PPPA, CPSC and FDA expectations, and maintain long-term supply agreements with innovative pharma and generic manufacturers. Many operate integrated networks of molding, glass forming, coating, printing and carton converting plants in the United States, often co-located near major pharma belts in New Jersey, Pennsylvania, Indiana, North Carolina and California – regions that collectively export tens of billions of dollars of pharmaceutical products.

| Company | Establishment Year | Headquarters (Global) | Core CR Pharma Offerings | Key Material Focus (Market Specific) | U.S. Manufacturing / Converting Footprint | Primary End-Use Focus (Rx / OTC / Clinical) | Technology & Certification Strengths (Market Specific) | Sustainability / Innovation Focus (Market Specific) |

| Berry Global Group | 1967 | Evansville, Indiana, U.S. | ~ | ~ | ~ | ~ | ~ | ~ |

| AptarGroup | 1992 | Crystal Lake, Illinois, U.S. | ~ | ~ | ~ | ~ | ~ | ~ |

| West Pharmaceutical Services | 1923 | Exton, Pennsylvania, U.S. | ~ | ~ | ~ | ~ | ~ | ~ |

| Amcor | 1860s | Zurich, Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Gerresheimer | 1864 | Düsseldorf, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

USA Child-Resistant Pharmaceutical Packaging Market Analysis

Growth Drivers

Rising prescription volumes in high-risk drug classes

Rising prescription exposure in high-risk drug classes is a core driver for the USA child-resistant pharmaceutical packaging market. Retail prescription drug spending in the country reached USD ~ billion for retail medicines in one recent year and then grew to USD ~ billion the following year, indicating a sharp increase in medication use that must be controlled through secure packaging. Within that spend, pharmacy-dispensed opioid, buprenorphine and naloxone prescriptions totalled about ~ million fills in a single year, showing the continuing scale of exposure to dependence-forming and overdose-risk molecules.

Pediatric safety focus

Pediatric safety remains a structural driver for CR formats in prescription and OTC packaging. The United States has around ~ million children under 18 years, representing a large cohort at risk of accidental exposure if medicines are not adequately secured. Consumer Product Safety Commission (CPSC) statistics show an estimated 68,600 emergency-department-treated poisoning injuries among children under five in one recent year alone, up from 62,600 injuries the year before, with medications a major contributor. CPSC also reports unintentional pediatric poisoning deaths in this age group rising to 90 fatalities in a recent year, largely linked to narcotics and psychodysleptics, which are precisely the categories governed by the Poison Prevention Packaging Act (PPPA) and its CR packaging mandates for around 30 medicine and hazardous product categories.

Market Challenges

Balancing child-resistance with senior-friendliness

One of the most acute challenges in the USA child-resistant pharmaceutical packaging market is reconciling pediatric protection with accessibility for ageing patients. U.S. Census data indicate that the population aged 65 and over reached ~ million people, while the population under 18 stood at ~ million, meaning pack designers must serve two very large and physiologically distinct groups simultaneously. In many states, older adults now outnumber children, and federal profiling shows that nearly 19.2 percent of Americans 65+ are working or seeking work, extending medicine use into very old age with declining grip strength and dexterity.

Cost and complexity of CR tooling

The cost and complexity associated with CR tooling, multi-component closures and validated line trials is another major constraint. National health expenditure reached USD ~ trillion in a recent year, with private health insurance spending USD 1,464.6 billion and out-of-pocket spending USD 505.7 billion, leaving limited room in drug-pricing envelopes to absorb higher packaging conversion costs. According to FDA-linked analyses, 166 manufacturing sites were associated with 912 drug recalls in one fiscal year, the highest in five years, while a broader review of FDA data over 2012-2023 found an average of 330 drug recalls per year, many tied to current good manufacturing practice and packaging issues.

Market Opportunities

Premiumization of CR solutions

Premiumization of child-resistant packaging is a major opportunity as stakeholders seek to differentiate therapies and improve safety outcomes. With overall U.S. health spending at USD ~ trillion and out-of-pocket costs at USD ~ billion, payers and patients have strong incentives to back packaging that prevents misuse, improves adherence and reduces avoidable hospitalizations, even if the upfront pack cost is higher. OTC economic studies show that every dollar spent on OTC medicines yields about USD 7.33 in system savings, with total annual savings of USD 167.1 billion, largely through reduced clinic visits and cheaper therapies—logic that readily extends to premium, adherence-driven CR packaging for chronic Rx categories.

Migration to advanced blisters and wallets

Migration from simple bottles to advanced CR blisters and wallet packs is another strong growth avenue. National statistics on pediatric poisonings—68,600 ED-treated injuries among under-five children in a recent year and rising deaths associated with narcotics—have sharpened regulatory and payer focus on per-dose containment and calendarized dosing, both of which are better served by CR blisters than by bulk vials. Economic modelling of blister packaging for chronic drugs suggests potential healthcare cost reductions of USD 0.73, USD 0.29, USD 0.07 and USD 0.10 per member per month across major cardiometabolic therapy classes when adherence improves, reinforcing the financial case for unit-dose CR formats.

Future Outlook

Over the next several years, the USA child-resistant pharmaceutical packaging market is expected to grow steadily on the back of rising medicine utilization, complex chronic disease management and expanding volumes of high-value specialty therapies. Strong pharmaceutical spending, approaching nearly USD ~ billion for medicines alone, will keep volumes high in both retail and non-retail channels, while regulatory pressure ensures that a large share of oral and topical medicines remain in fully compliant CR/SF formats. At the same time, sustainability commitments and e-commerce will shape design choices, driving demand for recyclable materials, lightweight designs and packaging certified to withstand parcel networks without compromising child resistance.

Major Players

- Berry Global Group

- AptarGroup

- West Pharmaceutical Services

- Amcor

- Gerresheimer

- WestRock

- Silgan Dispensing Systems

- Keystone Folding Box Co.

- Berlin Packaging

- TricorBraun

- SGD Pharma

- Origin Pharma Packaging

- CSP Technologies / specialized active-material CR systems

- O.Berk Company

Key Target Audience

- Global and U.S. Branded Pharmaceutical Manufacturers

- Generic and Biosimilar Drug Manufacturers

- Contract Development and Manufacturing Organizations

- Retail Pharmacy Chains and E-Pharmacies

- Hospitals, Health Systems and Group Purchasing Organizations

- Controlled Substance and Specialty Therapy Manufacturers

- Investment and Venture Capital Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a detailed ecosystem map encompassing all major stakeholders in the USA child-resistant pharmaceutical packaging market, including material suppliers, packaging converters, pharma manufacturers, pharmacies, regulators and standards bodies. Extensive desk research across regulatory databases, pharmaceutical statistics, trade data and packaging technology sources is used to identify critical variables such as packaging format mix, therapeutic-area demand clusters, compliance requirements, and technology adoption patterns.

Step 2: Market Analysis and Construction

In this phase, historical data on global and North American child-resistant pharmaceutical packaging revenue is triangulated with U.S. pharmaceutical expenditure, prescription volumes and production/export statistics to size the USA market. A bottom-up view aggregates volumes across Rx, OTC, pediatric and controlled-substance segments, while a top-down lens benchmarks against broader child-resistant packaging and pharmaceutical packaging categories to ensure internal consistency in revenue and volume estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses around growth rates, segment shares, technology transitions (e.g., vials to blisters), and sustainability premiums are validated through structured interviews with packaging engineers, procurement leaders, regulatory affairs teams and operations managers at pharma manufacturers, CDMOs/CPOs and packaging suppliers. Computer-assisted interviews and targeted surveys capture real-world insights on SKU mix, line changeover constraints, testing and certification timelines, and the economics of switching to newer CR/SF or smart-pack formats, refining both segmentation and forecast assumptions.

Step 4: Research Synthesis and Final Output

The final phase integrates quantitative modeling with qualitative insights to build segment-wise forecasts by packaging format, end-use application, material family and technology cluster. Engagements with key U.S. packaging plants and pharma filling sites help validate throughput, utilization and shift-pattern assumptions, while regulatory and recall case-studies cross-check risk and compliance narratives. The synthesized output is a fully triangulated view of the USA child-resistant pharmaceutical packaging market, including current size, medium-term CAGR, competitive positioning, opportunity pockets and scenario-based outlooks for business decision-makers.

- Executive Summary

- Research Methodology (Market definition – child-resistant pharmaceutical packaging, PPPA-covered drug categories, CPSC test protocol assumptions, FDA container-closure guidance, sampling frame of US Rx/OTC manufacturers, split of primary vs secondary research, triangulation of value and unit volumes, limitations and data caveats)

- Definition, Scope and Taxonomy

- Evolution of Child-Resistant Packaging in the USA

- Role of PPPA, CPSC and FDA in Pharmaceutical Packaging Safety

- Business Cycle, Demand Seasonality and Refill Dynamics

- Supply Chain, Value Chain and Revenue Pool Mapping

- Growth Drivers

Rising prescription volumes in high-risk drug classes

Pediatric safety focus

Increasing OTC self-medication

Unit-dose adherence programs

Pharma risk-management policies) - Market Challenges

Balancing child-resistance with senior-friendliness

Cost and complexity of CR tooling

Design and testing

Line changeover constraints

Recall and liability risks - Opportunities

Premiumization of CR solutions

Migration to advanced blisters and wallets

Conversion from non-CR to CR formats in OTC and generics

Sustainable CR materials

Smart CR packs - Trends

Integration of tamper evidence with CR

Serialization and track-and-trace on CR packs

Lightweighting and downgauging

Mono-material CR solutions

Automation-ready designs - Stakeholder Ecosystem Mapping

- Porter’s Five Forces Analysis

- SWOT Analysis of USA Child-Resistant Pharmaceutical Packaging Market

- By Value, 2019-2024

- By Unit Volume, 2019-2024

- Average Price per Thousand CR Units, 2019-2024

- Installed Child-Resistant Packaging Capacity in the USA, 2019-2024

- Contribution of Child-Resistant Packs to Overall Pharmaceutical Packaging, 2019-2024

- By Packaging Format (in Value %)

CR plastic bottles, CR glass bottles

Blisters & wallet packs

Pouches & sachets

Tubes & stick packs

Unit-dose cards, cartons & outer boxes with CR features - By Dosage Form (in Value %)

Oral solid doses

Oral liquids

Topicals & dermatologicals

Ophthalmic & otic

Inhalation & nasal

pediatric formulations

high-risk narrow-therapeutic-index drugs - By Material (in Value %)

HDPE, PP, PET & other plastics

Type I & II glass

Aluminum foil laminates, paperboard & cartonboard

Flexible laminates & films

Elastomers & closure liners - By Child-Resistance Mechanism (in Value %)

Push-and-turn closures

Squeeze-and-turn closures

Line-up-to-open designs

Peel-push/peel-pull blisters

Slider/wallet CR systems - By End-Use Pharma Segment (in Value %)

Ethical Rx – branded

Generics

OTC & consumer health

Contract development and manufacturing organizations

Specialty & orphan drug manufacturers - By Packaging Type (in Value %)

Primary CR packaging

Secondary CR cartons and wallets

Tertiary shippers with CR features

Clinical-trial

Sample CR kits - By Contracting & Supply Model (in Value %)

Direct supply to pharma

Contract packers & CPOs

Distributor-led supply

Private-label and store-brand programs

Long-term strategic sourcing vs spot contracts - By Region within the USA (in Value %)

Northeast, Midwest, South, West

Regional manufacturing footprint

Consumption distribution

- Market Share Analysis by Value and Unit Volume

- Cross Comparison Parameters (Regulatory and CR Compliance Coverage across PPPA/16 CFR/FDA, Breadth of CR Portfolio by Format and Dosage Form, Depth of CR Mechanism and Closure IP, USA Manufacturing Footprint and Capacity Dedicated to CR Lines, Level of Integration with Pharma Filling & Packaging Lines, Senior-Friendly and Accessibility Performance, Sustainability & Recyclability Attributes of CR Solutions, Co-Development and Custom Design Capabilities with US Pharma and OTC Brands)

- Strategic Landscape and Competitive Moves

- Pricing and Value Positioning Analysis

- Detailed Profiles of Major Companies in USA Child-Resistant Pharmaceutical Packaging

Berry Global Inc.

AptarGroup Inc.

Amcor Plc

Gerresheimer AG

West Pharmaceutical Services Inc.

WestRock Company

Schott AG

Becton, Dickinson and Company (BD)

Constantia Flexibles

Huhtamaki Oyj

Sonoco Products Company

Tekni-Plex Inc.

Sanner GmbH

Keystone Folding Box Company

- Decision-Making Unit and Buying Center Analysis

- Technical and Regulatory Requirements in Supplier Selection

- Pharma Sourcing Models and Contract Structures

- Pain-Point and Unmet-Need Mapping

- By Value, 2025-2030

- By Unit Volume, 2025-2030

- Average Price per Thousand CR Units, 2025-2030

- Installed Child-Resistant Packaging Capacity in the USA, 2025-2030

- Contribution of Child-Resistant Packs to Overall Pharmaceutical Packaging, 2025-2030