Market Overview

The USA commercial aircraft air data systems market current size stands at around USD ~ million, reflecting sustained demand across airline fleet upgrades, retrofit programs, and line-fit installations on newly delivered aircraft. Market activity is supported by stable order backlogs, recurring maintenance cycles, and regulatory-driven upgrades for redundancy and safety assurance. Procurement is anchored in long-term supply agreements with avionics integrators, while aftermarket replacements and spares sustain continuous demand across active fleets and maintenance schedules nationwide.

Demand concentration is highest around major aviation hubs and aerospace clusters in the Pacific Northwest, Southern California, Texas, and the Southeast, where dense airline operations, MRO capacity, and OEM integration centers coexist. These regions benefit from mature certification ecosystems, proximity to component manufacturing and repair capabilities, and strong policy alignment with safety modernization initiatives. Concentrated airline headquarters, fleet engineering teams, and FAA oversight infrastructure further reinforce sustained adoption and upgrade cycles.

Market Segmentation

By Fleet Type

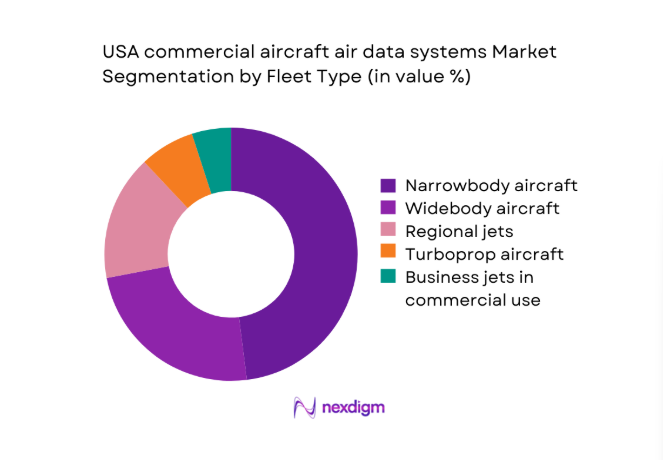

Narrowbody aircraft dominate system installations due to high utilization rates, short-haul network density, and frequent maintenance intervals that drive sensor replacements and digital upgrades. Widebody fleets contribute steady demand through scheduled heavy checks and long-haul reliability requirements, while regional jets and turboprops maintain consistent retrofit needs driven by aging fleets. Business jets used in commercial operations show targeted demand for performance and redundancy enhancements. Fleet age profiles, utilization intensity, and route economics shape replacement cycles and upgrade timing, with narrowbody fleets experiencing faster technology refresh due to high dispatch reliability requirements and tighter operational margins across domestic networks.

By Technology Architecture

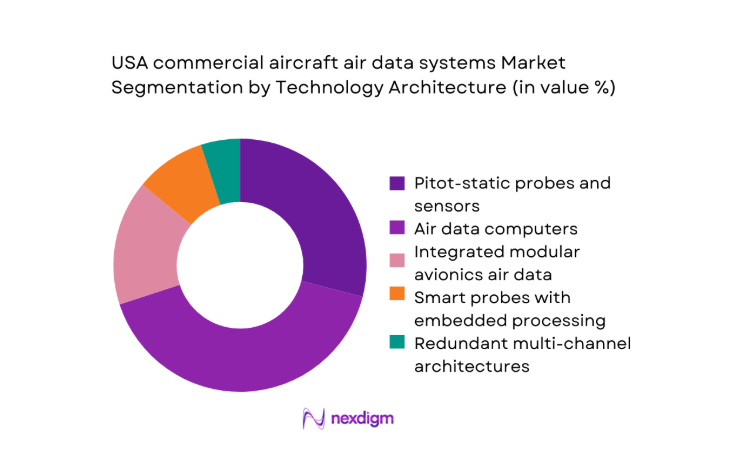

Air data computers remain the dominant architecture due to their integration with flight control systems and digital avionics suites, while pitot-static probes drive recurring aftermarket demand from wear, contamination, and icing exposure. Integrated modular avionics-based air data functions are gaining traction as fleets modernize, enabling software-defined redundancy and diagnostics. Smart probes with embedded processing support condition monitoring and fault detection, reducing unscheduled maintenance. Redundant multi-channel architectures are increasingly specified for safety assurance in high-utilization fleets. Technology choice is shaped by certification compatibility, integration with legacy avionics, maintenance practices, and airline reliability targets.

Competitive Landscape

The competitive landscape is shaped by long-term OEM relationships, certification depth across aircraft platforms, and strong aftermarket service networks. Differentiation centers on system reliability, integration with digital avionics, certification coverage, and service responsiveness across airline maintenance ecosystems.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Honeywell International | 1906 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran Electronics & Defense | 1965 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Garmin | 1989 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

USA commercial aircraft air data systems Market Analysis

Growth Drivers

Fleet modernization and next-generation narrowbody deliveries

Domestic carriers inducted 182 new narrowbody aircraft during 2024, with 164 entering active service by 2025 across high-frequency domestic routes. FAA certification amendments released in 2023 expanded acceptance of integrated avionics architectures, accelerating adoption of digital air data computers across new deliveries. Average daily utilization reached 9.6 flight hours on high-density corridors in 2024, increasing exposure cycles for probes and sensors. Major hub throughput exceeded 54 million passenger movements in 2025, driving dispatch reliability targets. Maintenance intervals shortened from 900 to 750 flight hours for critical sensing components in heavy-use fleets, reinforcing replacement demand.

Rising retrofit demand for aging narrowbody fleets

The in-service narrowbody population exceeded 3,400 aircraft in 2024, with 1,280 operating beyond 15 years, intensifying retrofit programs for reliability and redundancy. FAA airworthiness directives issued in 2022 and 2023 mandated enhanced pitot-static inspection regimes, increasing scheduled component replacements. Unscheduled maintenance events linked to sensor contamination rose to 4.2 incidents per 10,000 flight cycles during winter operations in 2024, elevating operator focus on upgraded probes. Cargo conversion programs inducted 96 airframes in 2025, each requiring full air data system refurbishment. Heavy-check intervals averaged 18 months, aligning retrofit installation windows with fleet planning cycles.

Challenges

Certification timelines and FAA approval complexity

Type certification supplements for avionics modifications averaged 14 months during 2023–2024, extending installation lead times for upgraded air data architectures. FAA engineering review cycles increased to 210 days for complex redundancy changes in 2025, delaying fleet-wide rollouts. Supplemental type certificate queues reached 38 active applications across multiple aircraft variants in 2024, creating bottlenecks for retrofit programs. Compliance documentation requirements expanded to 460 pages for integrated avionics changes, raising engineering workload for operators. Recurrent conformity inspections increased to 3 per installation program in 2025, adding schedule risk to maintenance planning and deferring operational benefits.

Supply chain constraints for precision sensors and semiconductors

Lead times for aviation-grade pressure sensors extended from 26 weeks in 2022 to 41 weeks in 2024 due to constrained foundry capacity. Semiconductor allocation for safety-critical microcontrollers averaged 72 percent fulfillment across avionics programs in 2023, improving to 81 percent in 2025 but remaining below planning assumptions. Component lot rejection rates reached 1.8 per 100 units in 2024 due to contamination and calibration drift, increasing rework cycles. Logistics dwell time at ports averaged 11 days in 2025 for certified components, disrupting maintenance schedules and driving aircraft-on-ground events during peak travel periods.

Opportunities

Aftermarket upgrades with smart probes and digital air data computers

Adoption of embedded diagnostics increased fault isolation rates to 92 cases per 100 events in 2024, reducing no-fault-found removals across domestic fleets. Condition monitoring programs cut unscheduled sensor removals by 28 units per 1,000 flight cycles during 2025 heavy-usage seasons. FAA guidance updates in 2023 enabled streamlined approval for software-enabled diagnostics, accelerating retrofit eligibility. Fleet engineering teams reported 36 percent reduction in troubleshooting time using digital fault logs in 2024. MRO shop throughput improved by 14 aircraft per quarter after toolchain digitization in 2025, improving turnaround time for air data system upgrades.

Retrofit programs for freighter conversions and life-extension

Freighter conversion activity inducted 96 aircraft in 2025, each requiring multi-point sensing refurbishment to meet revised operational envelopes. Structural life-extension programs targeted 420 narrowbody aircraft in 2024, aligning air data system replacements with heavy maintenance events. Cargo route utilization averaged 11.2 flight hours daily in 2025, increasing sensor duty cycles and replacement frequency. FAA operational approvals for extended-range cargo operations expanded to 17 routes in 2024, raising redundancy requirements for air data architectures. Maintenance planning systems integrated 24 new inspection tasks per aircraft during life-extension checks, creating bundled upgrade opportunities.

Future Outlook

The market outlook to 2035 reflects steady fleet renewal, rising retrofit penetration across aging narrowbody platforms, and deeper integration of digital avionics. Regulatory emphasis on redundancy and reliability will continue shaping upgrade cycles. Cargo conversion momentum and life-extension programs will sustain aftermarket demand. Software-enabled diagnostics and modular avionics architectures are expected to accelerate adoption across high-utilization domestic fleets.

Major Players

- Honeywell International

- Collins Aerospace

- Safran Electronics & Defense

- Thales Group

- Garmin

- L3Harris Technologies

- Astronics

- Meggitt

- Parker Aerospace

- Crane Aerospace & Electronics

- TransDigm Group

- Woodward

- Ametek

- UTC Aerospace Systems

- TE Connectivity

Key Target Audience

- Commercial airline operators and fleet engineering teams

- Cargo and logistics airline operators

- Aircraft leasing companies and asset managers

- Maintenance, repair, and overhaul providers

- Aircraft OEM program management teams

- Tier-one avionics system integrators

- Investments and venture capital firms

- Government and regulatory bodies with agency names

Research Methodology

Step 1: Identification of Key Variables

The study defined platform scope across narrowbody, widebody, regional jet, turboprop, and commercial-use business jet fleets, mapping air data system components across probes, sensors, and computing units. Regulatory compliance requirements and installation pathways were identified to frame system boundaries. Fleet age profiles and utilization intensity were established to define replacement cycles.

Step 2: Market Analysis and Construction

Fleet induction, retirement, and conversion activity were mapped to installation and replacement events. Maintenance schedules, heavy-check intervals, and retrofit windows were aligned with system demand patterns. Regulatory directives and certification pathways were incorporated to structure adoption timing and deployment constraints.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on technology adoption, maintenance-driven demand, and retrofit acceleration were validated through structured consultations with airline engineering leaders, MRO planners, and certification specialists. Feedback loops refined assumptions around installation timing, reliability thresholds, and operational constraints.

Step 4: Research Synthesis and Final Output

Findings were synthesized across fleet operations, regulatory dynamics, and technology pathways to develop integrated insights. Scenario framing considered operational intensity, certification timelines, and maintenance practices. The final output consolidated structural drivers, constraints, and opportunity pathways for forward-looking assessment.

- Executive Summary

- Research Methodology (Market Definitions and air data system scope for commercial aircraft platforms, Aircraft fleet taxonomy by narrowbody, widebody, regional jet, turboprop and business jet inclusion rules, Bottom-up market sizing from OEM shipsets and retrofit STC installations with revenue attribution to probes, computers and spares, Price-volume reconciliation using OEM contract pricing, aftermarket MRO pricing and shipset ASP normalization)

- Definition and Scope

- Market evolution

- Usage and avionics integration pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Fleet modernization and next generation narrowbody deliveries

Rising retrofit demand for aging narrowbody fleets

Increasing safety mandates for redundant sensing architectures

Growth in domestic air traffic and utilization rates

Digital avionics upgrades in line with NextGen initiatives

Expansion of cargo operations and freighter conversions - Challenges

Certification timelines and FAA approval complexity

Supply chain constraints for precision sensors and semiconductors

Integration complexity with legacy avionics architectures

Cost sensitivity among regional and low-cost carriers

Maintenance burden and probe icing susceptibility

Long aircraft delivery cycles impacting near-term volumes - Opportunities

Aftermarket upgrades with smart probes and digital air data computers

Predictive maintenance solutions tied to air data sensor health

Retrofit programs for freighter conversions and life-extension

Integration with health monitoring and analytics platforms

OEM line-fit content growth on next-generation aircraft programs

Standardization opportunities through modular avionics adoption - Trends

Shift toward integrated modular avionics air data functions

Adoption of heated and ice-detection smart probes

Increasing redundancy and fault-tolerant architectures

Data fusion with inertial and GNSS sources

Growth of condition-based maintenance in sensor systems

Greater supplier consolidation among tier-one avionics providers - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrowbody aircraft

Widebody aircraft

Regional jets

Turboprop aircraft

Business jets used in commercial operations - By Application (in Value %)

Primary flight control and airspeed sensing

Flight management system inputs

Autopilot and flight director integration

Aircraft health monitoring and diagnostics

Cabin pressurization and environmental control inputs - By Technology Architecture (in Value %)

Pitot-static probes and sensors

Air data computers

Integrated modular avionics-based air data

Smart probes with embedded processing

Redundant multi-channel architectures - By End-Use Industry (in Value %)

Passenger airlines

Cargo and logistics operators

Charter and ACMI operators

Regional airline operators

Aircraft leasing companies - By Connectivity Type (in Value %)

ARINC 429-based connectivity

ARINC 664/AFDX connectivity

CAN aerospace connectivity

Ethernet-based avionics networks

Hybrid legacy-modern interfaces - By Region (in Value %)

Northeast USA

Midwest USA

South USA

West USA

Pacific and Mountain states

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Portfolio breadth across probes and air data computers, Certification coverage across FAA TSO and STC programs, Installed base penetration in US airline fleets, Aftermarket service footprint and spares availability, Pricing competitiveness across line-fit and retrofit channels, Integration compatibility with major avionics suites, Production scalability and lead time performance, Digital health monitoring and analytics capabilities)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Honeywell International

Collins Aerospace

Safran Electronics & Defense

Thales Group

Garmin

L3Harris Technologies

Astronics

Meggitt

Parker Aerospace

Crane Aerospace & Electronics

TransDigm Group

Woodward

Ametek

UTC Aerospace Systems (legacy programs)

TE Connectivity

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035