Market Overview

The USA commercial aircraft air management system market current size stands at around USD ~ million, reflecting the installed base of environmental control systems across narrowbody, widebody, and regional fleets operating in domestic and transborder routes. Demand is anchored in line-fit deliveries, retrofit cycles aligned with heavy maintenance checks, and reliability-driven component replacements across packs, valves, and control electronics. The ecosystem is shaped by OEM integration pathways and aftermarket service frameworks, with certification-led qualification cycles guiding technology refresh and lifecycle support strategies.

The market is concentrated around aviation clusters with dense airline operations, aircraft assembly activity, and mature MRO ecosystems, notably in the Pacific Northwest, Southern California, Texas aviation corridors, and the Southeast maintenance hubs. These regions benefit from airport infrastructure depth, proximity to aircraft manufacturing and engineering talent pools, and established regulatory engagement capacity. Demand concentration follows route density, fleet utilization intensity, and the presence of specialized overhaul facilities capable of handling environmental control and bleed management subsystems.

Market Segmentation

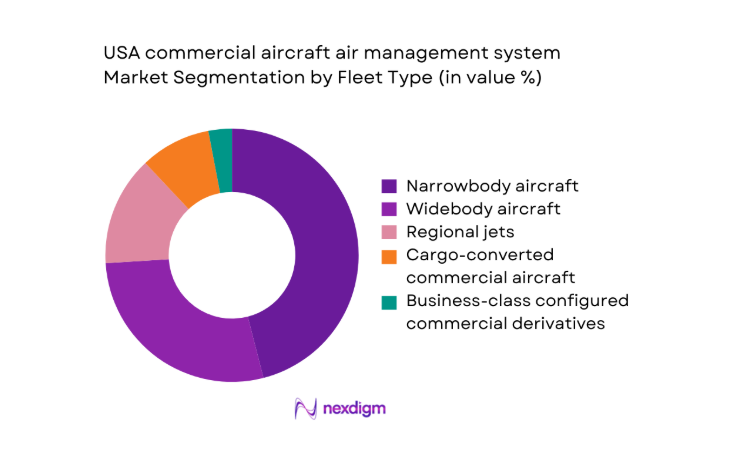

By Fleet Type

Narrowbody aircraft dominate demand due to high utilization rates on domestic routes, frequent maintenance cycles, and standardized environmental control architectures that enable scalable retrofit programs. Fleet renewal among single-aisle operators prioritizes reliability improvements and incremental efficiency gains, supporting steady line-fit volumes. Widebody demand remains structurally important for long-haul operations with complex pack configurations, while regional jets contribute recurring aftermarket demand due to shorter maintenance intervals. Cargo-converted commercial aircraft are increasingly relevant, driven by utilization intensity and thermal management needs in high-cycle operations. Business-class configured commercial derivatives remain niche but require high-specification systems aligned with premium cabin requirements.

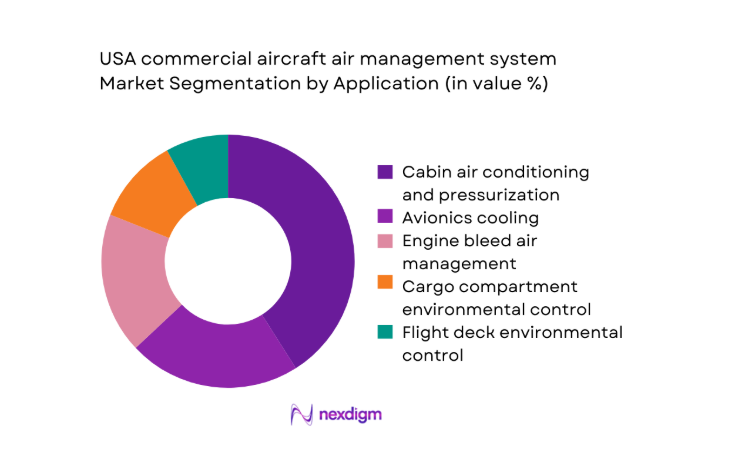

By Application

Cabin air conditioning and pressurization account for the largest share of deployments due to regulatory requirements, passenger comfort standards, and system redundancy needs across commercial fleets. Avionics cooling demand is structurally growing as electronic density increases in flight decks and mission systems, raising thermal management requirements. Engine bleed air management remains relevant across legacy platforms, while cargo compartment environmental control is expanding with higher utilization of converted freighters. Flight deck environmental control maintains stable demand linked to safety, crew performance standards, and certification mandates, with retrofit programs targeting reliability improvements during heavy checks.

Competitive Landscape

The competitive environment is shaped by platform-level integration depth, long-term aftermarket support commitments, and certification track records aligned with airworthiness requirements. Differentiation is anchored in system reliability, modularity for retrofit, and digital health monitoring integration, with distribution reach across MRO networks influencing lifecycle service penetration and operator preference.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Honeywell Aerospace | 1906 | Charlotte, NC | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | Charlotte, NC | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran Aerosystems | 2005 | Irvine, CA | ~ | ~ | ~ | ~ | ~ | ~ |

| Parker Aerospace | 1917 | Cleveland, OH | ~ | ~ | ~ | ~ | ~ | ~ |

| Liebherr-Aerospace | 1949 | Saline, MI | ~ | ~ | ~ | ~ | ~ | ~ |

USA commercial aircraft air management system Market Analysis

Growth Drivers

Rising narrowbody deliveries driven by fleet renewal cycles

Fleet renewal cycles accelerated as operators inducted 2024 and 2025 narrowbody deliveries to replace aircraft with 20 to 25 years of service. FAA registry updates recorded 2024 additions exceeding 400 units across single-aisle categories, while retirements surpassed 300 airframes with higher unscheduled removal rates for environmental control packs. Domestic route frequency increased above 2019 baselines, raising utilization beyond 10 flight hours per day for core fleets. Higher cycle counts increased pack removal intervals below 6000 cycles, driving component replacements, line-fit volumes, and spares provisioning across US hubs.

Expansion of US-based low-cost carriers and route density

Low-cost carrier route density expanded across secondary airports in 2024 and 2025, with published schedules adding over 120 new domestic city pairs. Gate utilization rose above 12 turns per day at key bases, increasing thermal load cycles on cabin conditioning systems. Fleet utilization exceeded 11 block hours daily for high-frequency operators, elevating wear on valves and heat exchangers. Airport infrastructure upgrades at 30 facilities improved turnaround efficiency, compressing maintenance windows and favoring modular air management assemblies. Higher daily cycles increased deferred defect thresholds and maintenance planning intensity across domestic networks.

Challenges

OEM production rate volatility impacting line-fit demand visibility

Production rate adjustments across single-aisle programs during 2024 and 2025 created variability in monthly delivery slots, with changes of 5 to 8 aircraft per month reported by airframe assembly lines. Supplier planning cycles shortened below 90 days, constraining forecast accuracy for pack and valve subassemblies. Work-in-progress buffers fell below 3 weeks at several Tier 2 facilities, raising schedule risk for line-fit kits. Certification rework for configuration changes added 14 to 21 days of lead time per modification, complicating synchronization with final assembly and acceptance flight schedules.

High certification and qualification costs for system upgrades

System upgrade programs required extensive qualification testing aligned with FAA guidance, including 250 to 300 environmental endurance cycles and thermal shock sequences. Test cell availability remained constrained in 2024 and 2025, with booking lead times exceeding 120 days. Engineering change approvals involved 6 to 9 document revision rounds per subsystem, extending program timelines beyond 18 months. Additional conformity inspections averaged 40 hours per unit for modified valves and controllers, increasing program overhead and delaying entry into service for retrofit kits aligned with heavy maintenance windows.

Opportunities

Aftermarket retrofit programs for air quality and efficiency upgrades

Aftermarket retrofit demand expanded as operators targeted cabin air quality improvements during 2024 and 2025 heavy checks, with over 60 percent of C-check events bundling environmental control upgrades. Cabin utilization levels above 85 percent increased odor and particulate complaints logged through maintenance reporting systems, prompting filtration module replacements at intervals below 24 months. FAA airworthiness directives on bleed air monitoring drove sensor retrofits across fleets exceeding 200 aircraft per operator. Maintenance downtime targets under 72 hours favored modular kits, enabling rapid installation and broader program adoption.

Digital health monitoring add-ons for air management subsystems

Digital health monitoring adoption accelerated as airlines deployed aircraft health management interfaces across 2024 and 2025, with data ingestion frequencies above 1 Hz for pack performance parameters. Integration with onboard maintenance systems enabled fault isolation within 15 minutes, reducing unscheduled ground time below 4 hours per event. Data lake deployments across 3 major US maintenance hubs supported trend analysis across 1000 plus pack removal events annually. Predictive thresholds reduced no-fault-found rates by 12 units per 100 removals, improving spares planning and maintenance scheduling outcomes.

Future Outlook

Through 2035, the market will be shaped by sustained fleet renewal, deeper penetration of more-electric architectures, and tighter integration of digital health monitoring into maintenance planning. Regulatory emphasis on cabin air quality and system reliability will steer retrofit programs, while MRO capacity expansion across regional hubs will influence adoption timelines. Platform standardization and modular ECS designs are expected to streamline certification cycles and accelerate aftermarket uptake across domestic fleets.

Major Players

- Honeywell Aerospace

- Collins Aerospace

- Safran Aerosystems

- Parker Aerospace

- Liebherr-Aerospace

- Eaton Aerospace

- Moog Inc.

- Triumph Group

- Senior Aerospace

- AMETEK Aerospace

- Crane Aerospace & Electronics

- Woodward Inc.

- Heico Corporation

- SKF Aerospace

- Meggitt

Key Target Audience

- Commercial passenger airlines

- Cargo airlines and integrators

- Aircraft leasing companies

- MRO service providers

- Aircraft OEMs and system integrators

- Tier 1 and Tier 2 aerospace component suppliers

- Investments and venture capital firms

- Government and regulatory bodies with agency names

Research Methodology

Step 1: Identification of Key Variables

System boundaries were defined across packs, valves, controllers, and filtration modules aligned with ATA Chapter 21. Platform scope was mapped by fleet type and application context across domestic operations. Demand drivers were structured around utilization intensity, maintenance cycles, and regulatory triggers.

Step 2: Market Analysis and Construction

Supply chain mapping covered line-fit and aftermarket channels, certification pathways, and MRO touchpoints. Scenario construction integrated production cadence variability, retrofit timing with heavy checks, and regional maintenance capacity distribution to structure demand pathways.

Step 3: Hypothesis Validation and Expert Consultation

Operational hypotheses were validated through structured consultations with maintenance planners, reliability engineers, and certification specialists. Feedback loops refined assumptions on removal intervals, retrofit feasibility during checks, and digital monitoring adoption constraints.

Step 4: Research Synthesis and Final Output

Findings were synthesized into coherent market narratives linking demand drivers, constraints, and opportunity pathways. Cross-validation reconciled operational indicators with regulatory frameworks and ecosystem readiness to ensure actionable, implementation-focused insights.

- Executive Summary

- Research Methodology (Market Definitions and ATA Chapter 21 subsystem scope alignment, Platform-level segmentation by narrowbody widebody and regional jets, Bottom-up fleet-driven market sizing using FAA registry and OEM delivery schedules, Revenue attribution by line-fit and retrofit contract value mapping, Primary interviews with airline MRO directors and aircraft systems integrators)

- Definition and Scope

- Market evolution

- Aircraft environmental control and bleed air usage pathways

- OEM–Tier 1–MRO ecosystem structure

- Line-fit and aftermarket supply chain structure

- FAA certification and airworthiness regulatory environment

- Growth Drivers

Rising narrowbody deliveries driven by fleet renewal cycles

Expansion of US-based low-cost carriers and route density

Shift toward more-electric aircraft architectures in new platforms

Increased regulatory emphasis on cabin air quality and safety

Growth in retrofit demand for aging in-service fleets

Higher MRO spending on reliability-driven component replacement - Challenges

OEM production rate volatility impacting line-fit demand visibility

High certification and qualification costs for system upgrades

Supply chain constraints for aerospace-grade valves and sensors

Extended airline capex deferrals during traffic cyclicality

Complex integration with aircraft environmental control systems

Long aftermarket sales cycles tied to maintenance check intervals - Opportunities

Aftermarket retrofit programs for air quality and efficiency upgrades

Digital health monitoring add-ons for air management subsystems

Partnerships with US MROs for turnkey retrofit offerings

Lightweight and energy-efficient pack technology development

Growth in cargo fleet conversions driving environmental control upgrades

Lifecycle service contracts and power-by-the-hour models - Trends

Adoption of no-bleed architectures on next-generation platforms

Integration of predictive maintenance analytics for ECS components

Use of advanced filtration and antimicrobial cabin air modules

Increased standardization across narrowbody fleet platforms

Modularization of packs and valves for faster line replacement

Rising localization of Tier 1 manufacturing in North America - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrowbody aircraft

Widebody aircraft

Regional jets

Business-class configured commercial derivatives

Cargo-converted commercial aircraft - By Application (in Value %)

Cabin air conditioning and pressurization

Avionics cooling

Engine bleed air management

Cargo compartment environmental control

Flight deck environmental control - By Technology Architecture (in Value %)

Bleed air-based environmental control systems

More-electric no-bleed architectures

Hybrid bleed and electric architectures

Integrated pack and valve management systems

Advanced filtration and air quality modules - By End-Use Industry (in Value %)

Commercial passenger airlines

Cargo airlines and integrators

Leasing companies

Government-operated commercial fleets

Charter and ACMI operators - By Connectivity Type (in Value %)

Non-connected standalone systems

Aircraft health monitoring integrated systems

Real-time connected predictive maintenance systems

Condition-based monitoring enabled systems - By Region (in Value %)

West Coast

Southwest

Midwest

Northeast

Southeast

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Product breadth and ECS portfolio depth, Line-fit presence with Boeing platforms, Aftermarket MRO network coverage in the US, Technology differentiation in no-bleed architectures, Pricing competitiveness across fleet types, Certification track record with FAA, Digital health monitoring integration capability, Lifecycle service and PBH contract offerings)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Honeywell Aerospace

Collins Aerospace

Safran Aerosystems

Parker Aerospace

Liebherr-Aerospace

Eaton Aerospace

Meggitt

Moog Inc.

Triumph Group

Senior Aerospace

AMETEK Aerospace

Crane Aerospace & Electronics

Woodward Inc.

Heico Corporation

SKF Aerospace

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035