Market Overview

The USA commercial aircraft avionic systems market current size stands at around USD ~ million, reflecting sustained procurement across new aircraft programs and steady retrofit activity across aging fleets. Demand remains anchored in safety-critical navigation, communication, and surveillance systems, supported by ongoing compliance programs and modernization cycles. Capital allocation continues across cockpit upgrades, connectivity integration, and modular architectures, with spending patterns distributed between linefit installations and aftermarket retrofits, while lifecycle support, certification, and software assurance remain integral components of purchasing decisions.

Activity is concentrated around major airline hubs and aerospace manufacturing clusters, including Seattle, Southern California, Dallas–Fort Worth, Atlanta, and Phoenix. These locations benefit from dense MRO networks, proximity to OEM engineering centers, established certification capabilities, and skilled avionics labor pools. Infrastructure maturity, high fleet utilization rates, and strong airline operational bases sustain demand. Policy alignment with NextGen airspace initiatives and FAA modernization priorities further reinforce regional concentration across major commercial aviation corridors.

Market Segmentation

By Fleet Type

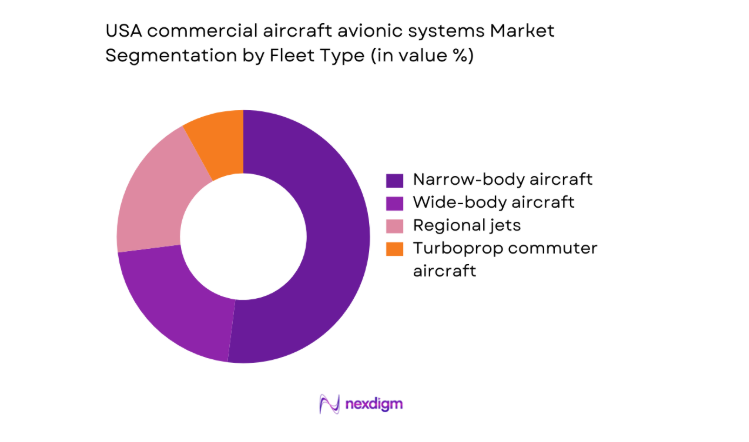

Narrow-body aircraft dominate avionics demand due to high utilization intensity, dense route networks, and frequent upgrade cycles driven by cockpit standardization and connectivity integration. Regional jets follow, reflecting continued fleet renewal by commuter carriers and network optimization by major airlines. Wide body aircraft account for concentrated demand linked to long-haul connectivity, advanced surveillance, and redundancy requirements, while turboprop commuter aircraft contribute smaller but consistent retrofit volumes in essential air service routes. Fleet age profiles, utilization rates, and retrofit cycles shape procurement timing, with narrow-body platforms benefiting most from standardized avionics suites across multi-aircraft orders.

By Application

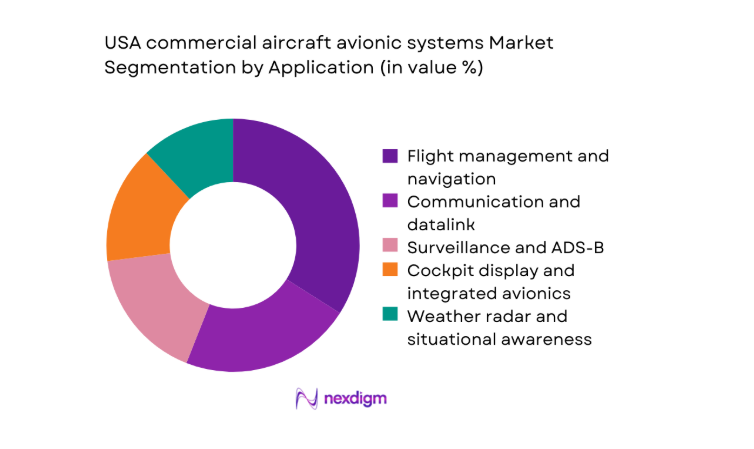

Flight management and navigation systems lead demand as airlines prioritize fuel efficiency, trajectory optimization, and performance-based navigation compliance. Communication and datalink systems expand with operational digitization and real-time aircraft-to-ground coordination. Surveillance and ADS-B upgrades remain embedded in compliance programs, while cockpit display and integrated avionics upgrades support pilot workload reduction and standardization. Weather radar and situational awareness systems gain traction for operational resilience, especially across weather-disrupted corridors. Application-driven procurement reflects safety imperatives, operational efficiency objectives, and regulatory compliance, with integrated suites increasingly replacing federated architectures across retrofit programs.

Competitive Landscape

The competitive environment is shaped by long certification cycles, high switching costs, and deep integration of avionics into aircraft platforms. Market positioning reflects breadth of certified product portfolios, retrofit program depth, and aftermarket service coverage across major airline hubs. Differentiation centers on system reliability, software upgrade cadence, and lifecycle support, with competitive dynamics influenced by airline fleet commonality strategies and regulatory compliance capabilities.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Honeywell Aerospace | 1885 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| RTX Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Garmin Aviation | 1989 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

USA commercial aircraft avionic systems Market Analysis

Growth Drivers

Fleet modernization driven by next-generation narrow-body deliveries

U.S. airlines expanded narrow body operations across domestic routes as delivery activity accelerated in 2024 and 2025, adding 438 aircraft into service across major carriers. FAA aircraft registry records show 1,912 active narrow body airframes certified for Part 121 operations in 2025, creating sustained requirements for certified avionics suites aligned with standardized cockpit configurations. Increased aircraft utilization days per year reached 332 in 2024, elevating demand for reliability-driven upgrades. Airport infrastructure modernization programs across 38 major hubs enabled integration of performance-based navigation, reinforcing avionics adoption linked to route density and operational tempo nationwide.

FAA mandates for ADS-B Out and performance-based navigation upgrades

Regulatory compliance requirements continued to influence retrofit activity as FAA surveillance performance mandates applied to 19 controlled airspace zones nationwide in 2024, covering terminal and en route operations. FAA compliance audits in 2025 identified 286 aircraft requiring avionics upgrades to maintain operational authorization across Class B and C airspace. The expansion of Required Navigation Performance procedures to 44 metro airports increased dependence on certified navigation and flight management systems. Institutional emphasis on safety compliance, supported by 2024 FAA modernization program allocations for airspace infrastructure, sustained upgrade cycles across mixed fleets operating in congested corridors.

Challenges

High certification and recertification costs under FAA regulations

FAA Technical Standard Order approvals and Supplemental Type Certificate processes impose extended timelines on avionics integration across commercial fleets. In 2024, FAA certification backlogs affected 73 modification projects across Part 121 operators, delaying aircraft return to service. The average certification review cycle extended to 14 months for complex avionics retrofits, constraining maintenance planning windows. Limited availability of designated engineering representatives across 26 approved organizations further slowed throughput. Regulatory documentation requirements expanded across software assurance levels, increasing administrative burdens and creating operational friction for airlines managing multi-fleet upgrade schedules within constrained maintenance cycles.

Long avionics retrofit cycles and aircraft downtime constraints

Aircraft downtime associated with avionics retrofits disrupts fleet availability, particularly for high-utilization narrow body operations. In 2025, average heavy maintenance visit durations reached 21 days for aircraft undergoing cockpit modernization, reducing available seat capacity across peak demand periods. MRO slot constraints across 64 FAA-certified facilities in the continental United States intensified scheduling bottlenecks. Airlines operating with utilization exceeding 10 flight hours per day face tighter maintenance windows, limiting retrofit throughput. These constraints elevate operational risk, complicate network planning, and delay benefits from upgraded navigation, communication, and surveillance capabilities across active fleets.

Opportunities

Retrofit programs for aging narrow-body and regional jet fleets

Aging fleets remain central to avionics demand as 1,146 narrow body aircraft in active U.S. service exceeded 15 years of operation in 2024, according to FAA registry age profiles. Regional jet fleets showed ~ airframes above similar age thresholds in 2025, sustaining retrofit cycles aligned with safety compliance and operational efficiency objectives. Maintenance scheduling windows across 52 heavy check facilities enable phased cockpit upgrades, supporting adoption of modern navigation and connectivity systems. Institutional emphasis on extending asset life while maintaining regulatory compliance positions retrofit programs as a stable growth pathway through fleet renewal cycles.

Transition to open avionics architectures enabling multi-vendor ecosystems

Airline IT and engineering organizations advanced open avionics adoption to reduce integration risk and improve lifecycle flexibility. In 2024, 17 U.S. carriers initiated open architecture evaluations across mixed fleets, supported by FAA guidance on modular certification pathways. The number of certified interface standards approved for cockpit integration increased to 11 in 2025, facilitating interoperability across navigation, display, and communication systems. Airport modernization programs across 38 hubs support digital data exchange requirements, aligning with airline initiatives to decouple hardware refresh cycles from software updates, strengthening vendor diversity and long-term system scalability.

Future Outlook

Through 2035, avionics demand in the United States will remain shaped by fleet renewal cycles, FAA modernization initiatives, and digital cockpit integration. The transition toward modular architectures and connected operations is expected to accelerate retrofit programs alongside new aircraft deliveries. Regulatory alignment with NextGen airspace will continue to influence procurement priorities, while airline operational resilience strategies will elevate demand for integrated navigation, surveillance, and connectivity systems.

Major Players

- Honeywell Aerospace

- RTX Collins Aerospace

- Garmin Aviation

- Thales Group

- BAE Systems

- L3Harris Technologies

- Elbit Systems

- Safran Electronics & Defense

- Universal Avionics

- Astronics Corporation

- Curtiss-Wright Defense Solutions

- GE Aerospace

- Viasat

- Iridium Communications

- Gogo Business Aviation

Key Target Audience

- Commercial passenger airlines and fleet operators

- Cargo and logistics airlines

- Aircraft leasing companies

- FAA and Department of Transportation regulatory bodies

- FAA-certified maintenance, repair, and overhaul providers

- Aircraft OEM procurement and engineering teams

- Investments and venture capital firms

- Airline operations and safety management organizations

Research Methodology

Step 1: Identification of Key Variables

Key variables included fleet age profiles, retrofit cycles, certification pathways, and avionics system categories relevant to U.S. commercial operations. Regulatory drivers and operational integration requirements were mapped across Part 121 and Part 135 operators. Demand indicators were aligned to utilization intensity and maintenance cycles.

Step 2: Market Analysis and Construction

The analytical framework mapped avionics demand across linefit and aftermarket channels, integrating fleet composition, utilization patterns, and regulatory compliance requirements. System categories were structured by application and technology architecture. Regional operational hubs and MRO capacity were incorporated to reflect procurement timing dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through structured consultations with airline avionics leads, FAA-certified MRO managers, and airspace modernization stakeholders. Operational constraints, certification timelines, and retrofit feasibility were reviewed. Insights were reconciled against regulatory updates and fleet registry trends to refine demand pathways.

Step 4: Research Synthesis and Final Output

Findings were synthesized into coherent demand narratives aligned with regulatory, operational, and infrastructure drivers. Scenario development reflected fleet renewal, retrofit pacing, and architectural transition dynamics. Final outputs integrated ecosystem interactions across airlines, MROs, and regulatory frameworks to ensure decision relevance.

- Executive Summary

- Research Methodology (Market Definitions and avionics system scope across U.S. commercial fleets, Fleet and platform taxonomy aligned to Part 121 and Part 135 operations, Bottom-up shipment and retrofit-based market sizing by avionics line-replaceable units, OEM and aftermarket revenue attribution across linefit and MRO channels, Primary interviews with U.S. airlines avionics leads and FAA-certified MROs)

- Definition and Scope

- Market evolution

- Usage and operational integration pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Fleet modernization driven by next-generation narrow-body deliveries

FAA mandates for ADS-B Out and performance-based navigation upgrades

Rising adoption of connected cockpit and real-time data applications

Operational efficiency and fuel optimization through advanced FMS

Growth in cargo fleet utilization and night operations

Increased safety compliance and situational awareness requirements - Challenges

High certification and recertification costs under FAA regulations

Long avionics retrofit cycles and aircraft downtime constraints

Interoperability issues across mixed fleet architectures

Supply chain constraints for semiconductors and certified components

High switching costs and vendor lock-in for integrated avionics suites

Cybersecurity and software assurance compliance burdens - Opportunities

Retrofit programs for aging narrow-body and regional jet fleets

Transition to open avionics architectures enabling multi-vendor ecosystems

Expansion of SATCOM-enabled cockpit connectivity for real-time ops

Adoption of predictive maintenance and health monitoring avionics

NextGen airspace integration and performance-based navigation upgrades

Digital flight deck upgrades for cargo and ACMI operators - Trends

Shift from federated to integrated modular avionics

Rising penetration of software-defined avionics functions

Increased use of data analytics and connected cockpit solutions

Convergence of flight deck and airline operations center data flows

Growing demand for lightweight, power-efficient avionics hardware

Partnerships between OEMs and connectivity service providers - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrow-body aircraft

Wide-body aircraft

Regional jets

Turboprop commuter aircraft - By Application (in Value %)

Flight management and navigation

Communication and datalink

Surveillance and ADS-B

Cockpit display and integrated avionics

Weather radar and situational awareness

Flight control and guidance systems - By Technology Architecture (in Value %)

Federated avionics

Integrated modular avionics

Open avionics architecture

Software-defined avionics - By End-Use Industry (in Value %)

Passenger airlines

Cargo and logistics operators

Regional and commuter carriers

Charter and ACMI operators - By Connectivity Type (in Value %)

VHF/UHF line-of-sight communications

Satellite communications

Air-to-ground broadband

Hybrid connectivity architectures - By Region (in Value %)

Northeast U.S.

Midwest U.S.

South U.S.

West U.S.

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product portfolio breadth, FAA certification depth, installed base across U.S. fleets, retrofit program capabilities, software upgrade cadence, connectivity ecosystem partnerships, pricing and lifecycle cost structure, MRO support network coverage)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Honeywell Aerospace

RTX Collins Aerospace

Garmin Aviation

Thales Group

BAE Systems

L3Harris Technologies

Elbit Systems

Safran Electronics & Defense

Universal Avionics

Astronics Corporation

Curtiss-Wright Defense Solutions

GE Aerospace

Viasat

Iridium Communications

Gogo Business Aviation

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035