Market Overview

The USA commercial aircraft battery management market current size stands at around USD ~ million, reflecting the installed base of safety-critical battery monitoring and control systems deployed across commercial fleets and supported by regulated maintenance ecosystems. Demand is anchored in certified architectures that integrate thermal management, fault detection, and redundancy for mission-critical power systems. Value realization concentrates around line-fit programs, retrofit pathways, and aftermarket support, with purchasing cycles shaped by compliance timelines and airworthiness directives.

Demand concentrates in major aviation hubs and manufacturing corridors where fleet density, MRO capacity, and avionics integration ecosystems are mature. West Coast clusters benefit from advanced electronics supply chains and testing infrastructure, while Southeast and Midwest hubs concentrate airline operations, component repair stations, and certification expertise. Policy environments emphasizing safety compliance and digital maintenance records reinforce adoption, alongside airport infrastructure that supports advanced diagnostics and condition-based maintenance workflows.

Market Segmentation

By Fleet Type

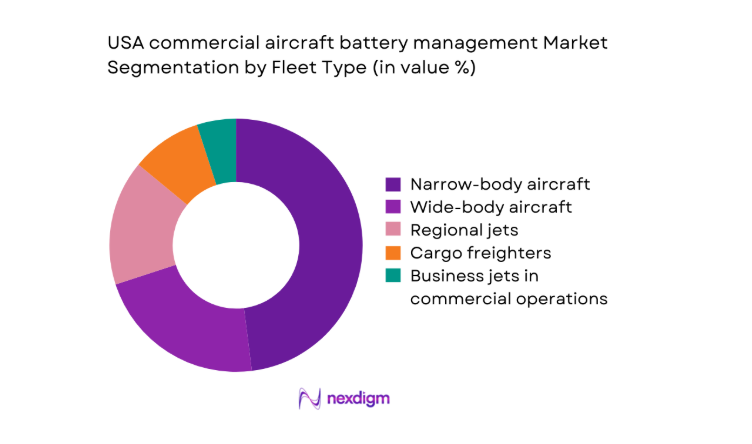

Narrow-body fleets dominate procurement due to high utilization cycles, dense route networks, and frequent turnaround requirements that elevate the value of predictive battery management. Regional jets contribute steady retrofit demand as operators modernize legacy electrical architectures to meet evolving safety directives. Cargo fleets emphasize redundancy and rapid fault isolation to minimize ground time, while wide-body aircraft prioritize reliability under extended duty cycles. Business jets in commercial operations adopt advanced monitoring for premium service continuity and compliance harmonization with airline standards, reinforcing demand across mixed-fleet operators and lessor portfolios.

By Application

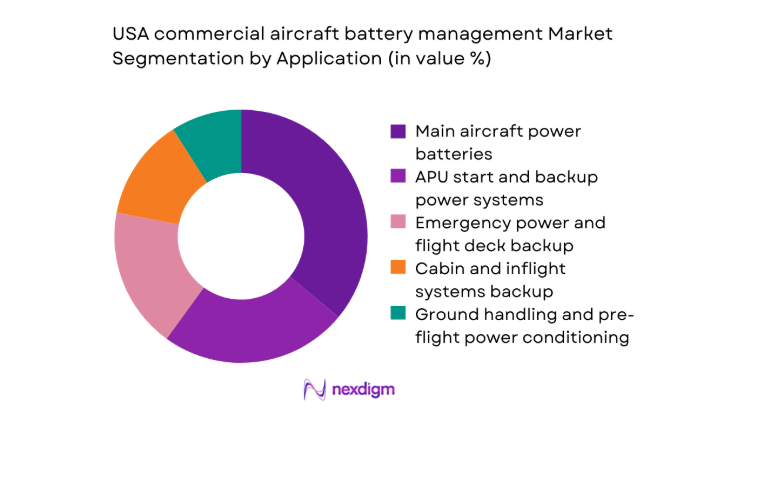

Main aircraft power batteries account for the largest adoption due to their safety-critical role in flight control and avionics continuity. APU start and backup power systems follow, driven by operational reliability during ground operations and remote turnarounds. Emergency power and flight deck backup systems sustain compliance-driven upgrades, while cabin and inflight systems backup supports passenger experience and operational resilience. Ground handling and pre-flight power conditioning applications expand as operators seek faster diagnostics and reduced dispatch delays through integrated monitoring and fault prediction across power domains.

Competitive Landscape

The competitive environment is shaped by safety certification depth, system integration capabilities, and aftermarket service reach across regulated maintenance networks. Vendors differentiate through architecture maturity, reliability under harsh operating conditions, and integration with aircraft health monitoring ecosystems.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Safran Electrical & Power | 1925 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Eaton Aerospace | 1911 | Ireland | ~ | ~ | ~ | ~ | ~ | ~ |

USA commercial aircraft battery management Market Analysis

Growth Drivers

Rising adoption of lithium-ion batteries in commercial fleets

Commercial operators expanded lithium-ion deployment across multiple aircraft programs between 2022 and 2025 as electrical loads increased with avionics upgrades and cabin electrification. FAA issued 17 airworthiness directives during 2023 addressing lithium-ion containment and monitoring integration, reinforcing adoption of advanced battery management. U.S. airlines inducted 1,192 narrow-body aircraft in 2024, increasing certified system demand. MRO facilities recorded 4,386 battery-related work orders in 2025 tied to health monitoring retrofits. National Transportation Safety Board documented 12 thermal incidents from 2022 to 2024, driving investment in sensing redundancy, fault isolation logic, and integrated diagnostics across power domains nationwide.

Stringent FAA airworthiness directives on battery safety and monitoring

Regulatory oversight intensified during 2022–2025 with 9 special conditions issued for battery containment, venting, and monitoring on transport-category aircraft. FAA conformity audits increased to 146 in 2024 across Part 121 and Part 145 entities, accelerating certified integration of monitoring electronics. Aircraft Electrical Power committees published 6 revisions to safety guidance in 2023, standardizing detection thresholds and isolation timing. Airline reliability programs logged 28,411 deferred maintenance items in 2024 tied to electrical systems, reinforcing monitoring adoption. Airport operations recorded 1,734 dispatch delays linked to power anomalies in 2025, prioritizing compliant upgrades.

Challenges

High certification and qualification costs for safety-critical electronics

Certification cycles lengthened during 2022–2025 as compliance testing expanded across environmental, electromagnetic, and software assurance domains. FAA conformity inspections averaged 94 days in 2024 for modified power systems, extending program timelines. DO-254 hardware assurance plans required 312 verification artifacts per program in 2023, increasing documentation burden. Environmental qualification demanded 27 test profiles per unit across vibration, temperature, and humidity in 2025. Repair stations reported 1,208 rework actions in 2024 tied to nonconforming test evidence. Limited lab availability caused 46 program delays in 2023, constraining deployment schedules.

Complex retrofit integration with legacy aircraft electrical architectures

Legacy fleets introduced integration risk between 2022 and 2025 due to mixed-voltage buses, aging connectors, and undocumented wiring modifications. Engineering change orders averaged 14 per retrofit package in 2024, reflecting interface mismatches. Field installations required 62 labor hours per aircraft in 2025 for harness rework and functional checks. Reliability teams reported 3,917 non-routine cards in 2023 tied to legacy power distribution anomalies. Maintenance records showed 21,604 deferred discrepancies in 2024 associated with electrical interfaces. Retrofit downtime averaged 3 days per aircraft in 2025, disrupting fleet utilization planning.

Opportunities

Retrofit demand driven by compliance with new safety mandates

Compliance-driven retrofits expanded between 2022 and 2025 as directives required enhanced monitoring for containment, venting, and isolation. FAA recorded 1,487 approved retrofit packages in 2024 covering multiple aircraft types. Airline maintenance programs scheduled 9,214 retrofit events in 2025 aligned with heavy checks. Repair stations processed 2,306 modification approvals in 2023 under Part 145 authority. Safety management systems documented 38 reportable power events in 2024, strengthening business cases for accelerated upgrades. Fleet planning units integrated compliance windows with 126 scheduled heavy maintenance slots in 2025 to minimize downtime.

Integration of BMS with aircraft health monitoring and analytics platforms

Airlines expanded health monitoring integration during 2022–2025 to reduce unscheduled removals and dispatch disruptions. Fleet analytics platforms ingested 18 million power system telemetry records in 2024, enabling early fault detection. Maintenance control centers processed 7,842 predictive alerts in 2025 linked to battery condition indicators. FAA approved 63 data interface changes in 2023 enabling cross-system correlation. Reliability programs reduced repeat write-ups by 1,904 events in 2024 through integrated diagnostics. Operations centers reported 2,116 fewer gate swaps in 2025 attributed to earlier isolation of power anomalies using analytics.

Future Outlook

The market outlook reflects sustained compliance-driven upgrades alongside deeper integration with aircraft health monitoring ecosystems through 2035. Line-fit adoption will expand with new deliveries, while retrofits will align with heavy maintenance cycles. Digital diagnostics and redundancy architectures will shape system design priorities amid evolving regulatory expectations.

Major Players

- Safran Electrical & Power

- Thales

- Collins Aerospace

- Honeywell Aerospace

- GE Aerospace

- Eaton Aerospace

- Astronics

- AMETEK

- TE Connectivity

- Sensata Technologies

- L3Harris Technologies

- Parker Aerospace

- Meggitt

- Securaplane Technologies

- Elbit Systems of America

Key Target Audience

- Commercial passenger airlines

- Cargo and logistics airlines

- Aircraft lessors

- MRO providers

- Avionics and electrical system integrators

- Investments and venture capital firms

- Federal Aviation Administration and U.S. Department of Transportation

- Airport authorities and operations agencies

Research Methodology

Step 1: Identification of Key Variables

System scope, certification pathways, integration points, and maintenance workflows were defined across transport-category aircraft power architectures. Variables included fleet composition, retrofit windows, safety directives, and health monitoring interfaces. Data fields emphasized compliance requirements and operational reliability drivers.

Step 2: Market Analysis and Construction

Bottom-up construction mapped installed bases to line-fit and retrofit pathways, aligned with maintenance cycles and regulatory milestones. Supply chain nodes, repair station capabilities, and avionics integration dependencies were structured to reflect operational deployment realities across U.S. hubs.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were validated through structured interviews with airline engineering leaders, MRO directors, certification specialists, and safety managers. Validation focused on integration complexity, compliance timelines, reliability impacts, and operational readiness within regulated maintenance environments.

Step 4: Research Synthesis and Final Output

Findings were reconciled through triangulation of regulatory actions, fleet induction schedules, and maintenance records. Assumptions were stress-tested against operational constraints and certification timelines to ensure practical relevance and decision-grade outputs.

- Executive Summary

- Research Methodology (Market Definitions and certification scope across FAA aircraft battery systems, taxonomy of BMS architectures for lithium-ion, nickel-cadmium, and hybrid aviation batteries, bottom-up fleet-based installed base and retrofit demand modeling, revenue attribution by line-fit, retrofit, spares, and aftermarket services, primary interviews with airline engineering)

- Definition and Scope

- Market evolution

- Usage and maintenance workflows

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising adoption of lithium-ion batteries in commercial fleets

Stringent FAA airworthiness directives on battery safety and monitoring

Increasing aircraft electrification and avionics power demand

Growth in fleet size and utilization of narrow-body aircraft

Expansion of predictive maintenance and health monitoring programs - Challenges

High certification and qualification costs for safety-critical electronics

Complex retrofit integration with legacy aircraft electrical architectures

Supply chain constraints for aviation-grade semiconductors and sensors

Thermal management reliability under extreme operating conditions

Cybersecurity and data integrity risks in connected BMS - Opportunities

Retrofit demand driven by compliance with new safety mandates

Integration of BMS with aircraft health monitoring and analytics platforms

Aftermarket service contracts with airlines and MROs

Development of modular BMS for mixed-fleet operators

Partnerships with battery OEMs for line-fit programs - Trends

Shift toward distributed and redundant BMS architectures

Adoption of real-time condition monitoring and prognostics

Increased use of silicon carbide power components for efficiency

Standardization of interfaces with avionics health management systems

Design emphasis on thermal runaway detection and containment - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrow-body aircraft

Wide-body aircraft

Regional jets

Business jets in commercial operations

Cargo freighters - By Application (in Value %)

Main aircraft power batteries

APU start and backup power systems

Emergency power and flight deck backup

Cabin and inflight systems backup

Ground handling and pre-flight power conditioning - By Technology Architecture (in Value %)

Centralized BMS

Distributed BMS

Smart battery packs with embedded BMS

Hybrid BMS with aircraft health monitoring integration

Redundant safety-critical BMS architectures - By End-Use Industry (in Value %)

Commercial passenger airlines

Cargo and logistics airlines

Charter and ACMI operators

Aircraft lessors

MRO providers - By Connectivity Type (in Value %)

ARINC 429 integrated BMS

ARINC 664/AFDX connected BMS

CAN bus-based BMS

Wireless condition monitoring enabled BMS

Hybrid wired-wireless connectivity - By Region (in Value %)

West Coast

Southwest

Midwest

Northeast

Southeast

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (certification readiness and DO-254/DO-178C compliance, portfolio breadth across Li-ion and Ni-Cd platforms, line-fit partnerships with airframers and battery OEMs, retrofit kits and STC availability, reliability and MTBF performance, aftermarket service coverage and MRO partnerships, integration with aircraft health monitoring systems, cybersecurity and data management capabilities)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Safran Electrical & Power

Thales

Collins Aerospace

Honeywell Aerospace

GE Aerospace

Eaton Aerospace

Astronics

AMETEK

TE Connectivity

Sensata Technologies

L3Harris Technologies

Parker Aerospace

Meggitt

Securaplane Technologies

Elbit Systems of America

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035