Market Overview

The USA commercial aircraft evacuation system market current size stands at around USD ~ million, reflecting sustained demand for certified slide and raft systems across in-service fleets and new aircraft integration programs. Procurement cycles prioritize compliance-driven replacements, reliability upgrades, and configuration changes tied to cabin densification. Spending is distributed across original equipment integration and aftermarket provisioning through authorized maintenance networks. Capital deployment emphasizes safety-critical assemblies, testing services, and spares pooling to ensure continuous operational readiness across domestic carriers.

Deployment is concentrated around major aviation hubs and manufacturing clusters where fleet density, maintenance infrastructure, and certification expertise converge. Strong airline operational bases, mature supplier ecosystems, and proximity to certification authorities support faster retrofit cycles and service responsiveness. Regions with dense route networks benefit from higher utilization, driving frequent inspection and overhaul needs. Policy alignment with safety mandates, coupled with established MRO capacity and logistics corridors, sustains regional leadership in system upgrades and fleet standardization.

Market Segmentation

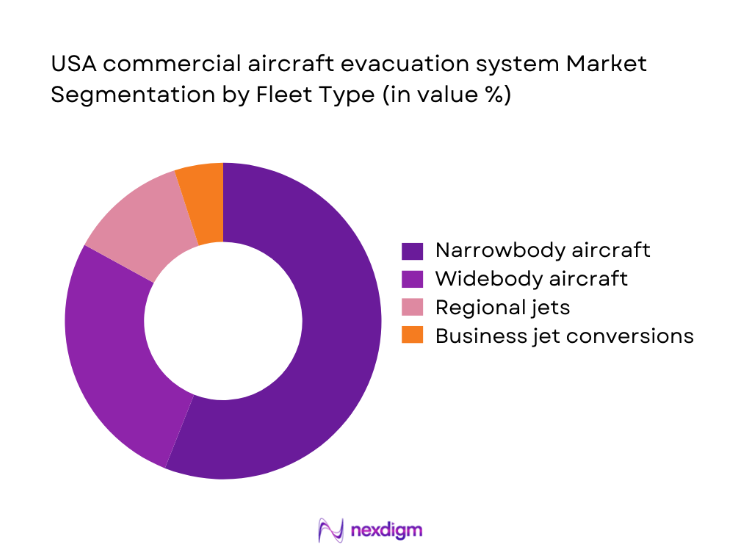

By Fleet Type

Narrowbody platforms dominate procurement due to dense domestic route utilization and higher cycle frequencies that accelerate replacement and overhaul of evacuation slides and door-mounted assemblies. Widebody fleets contribute steady demand tied to periodic heavy checks and cabin reconfigurations, while regional jets sustain aftermarket volumes through standardized kits and operator commonality programs. Fleet age profiles and configuration diversity shape procurement cadence, with narrowbody reconfiguration cycles driving recurring orders across linefit and retrofit programs. Leasing-driven fleet transfers further amplify standardization requirements, reinforcing demand for certified, interchangeable evacuation components that reduce downtime and simplify inventory pooling across operators and maintenance bases.

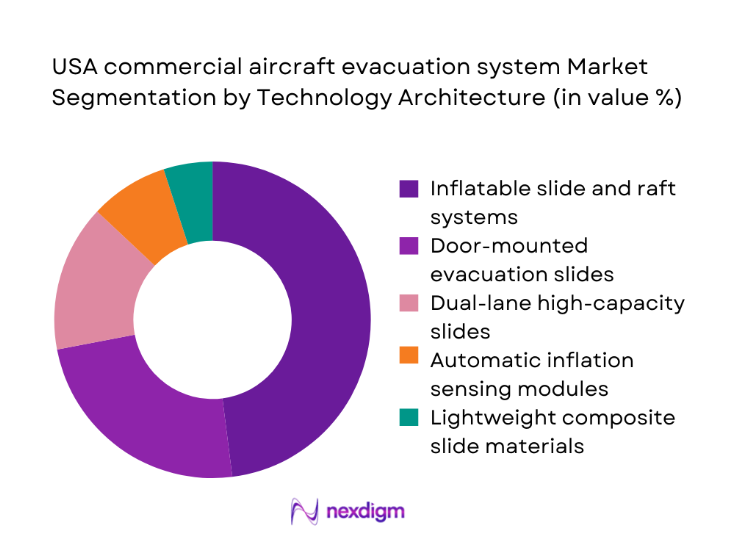

By Technology Architecture

Inflatable slide and raft systems lead adoption due to certification maturity and compatibility with multiple door configurations. Dual-lane high-capacity designs are gaining traction as cabin densification raises evacuation throughput requirements. Door-mounted modular assemblies streamline maintenance, while lightweight composite fabrics reduce stowage mass and handling complexity. Automatic inflation sensing improves deployment reliability and maintenance planning. Technology selection reflects a balance between certification readiness, lifecycle serviceability, and operator preference for modular replacements that minimize aircraft downtime. Integration with condition monitoring interfaces is emerging to support predictive maintenance, inventory planning, and faster return-to-service during scheduled checks.

Competitive Landscape

The competitive environment is characterized by long certification cycles, high compliance barriers, and entrenched supplier relationships across OEM and aftermarket channels. Differentiation centers on certification breadth, platform coverage, service responsiveness, and lifecycle support models that reduce aircraft downtime. Partnerships with maintenance networks and integration into linefit programs shape channel access and renewal cycles.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Safran Aerosystems | 1924 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Meggitt | 1947 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| Astronics Corporation | 1968 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Survitec Group | 1854 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

USA commercial aircraft evacuation system Market Analysis

Growth Drivers

Fleet expansion of narrowbody aircraft in domestic networks

Domestic route growth has driven higher narrowbody utilization across major hubs, increasing cycle exposure for evacuation slides and door-mounted assemblies. In 2024, recorded departures at primary domestic hubs exceeded 1,200,000, while average daily cycles per narrowbody surpassed 5 on high-frequency corridors. Aircraft deliveries in 2025 added over 900 narrowbody units to active service nationally, raising installed equipment counts per aircraft to 8 evacuation exits on typical configurations. FAA certification audits recorded more than 3,000 compliance checks across evacuation components during scheduled maintenance intervals in 2023 and 2024. Elevated utilization accelerates inspection intervals, refurbishment throughput, and replacement cadence across MRO networks.

FAA-mandated evacuation performance and certification requirements

Regulatory compliance intensifies replacement and testing demand as certification protocols mandate evacuation performance within 90 seconds under defined conditions. In 2023 and 2024, over 1,100 conformity inspections were logged for evacuation assemblies across linefit and retrofit programs. Type certification and supplemental certification submissions exceeded 240 filings in 2024, reflecting door configuration changes and densification programs. Compliance requires recurrent deployment tests after major cabin modifications, increasing shop visits by more than 2 per aircraft annually in high-utilization fleets. Regulatory updates issued across 2022–2025 expanded documentation requirements and conformity evidence, increasing test cycles, traceability records, and approved part replacements across domestic operators.

Challenges

Lengthy FAA certification and supplemental type certification timelines

Certification pathways create schedule risk for new slide variants and door integrations. Between 2022 and 2024, average supplemental certification cycles extended beyond 210 days for modified evacuation assemblies tied to cabin densification programs. Documentation packages exceeded 1,500 pages per application, requiring multiple conformity inspections and witnessed tests. Test facility availability constrained throughput, with fewer than 40 approved domestic test slots available annually for full-scale evacuation demonstrations. Engineering change approvals required coordination across OEM design authorities and operators, extending aircraft downtime by 6 to 9 maintenance days per modification. These delays compress linefit integration windows and defer retrofit schedules, impacting fleet planning and shop capacity utilization.

High unit costs and certification testing expenses

Evacuation systems require specialized materials, inflation mechanisms, and destructive testing, increasing certification expense burdens on program schedules. Full-scale deployment tests per configuration can exceed ~ per test event, excluding engineering labor and conformity documentation. In 2024, operators scheduled more than 420 deployment tests nationwide to support cabin reconfiguration programs, stressing laboratory availability and logistics. Material qualification cycles require multiple environmental tests across temperature ranges from -40 to 70, extending lead times beyond 180 days for new fabric variants. High testing intensity constrains parallel development programs and pressures maintenance budgets, leading to phased retrofits and deferred non-mandatory upgrades across mixed fleets.

Opportunities

Aftermarket retrofit programs for legacy fleets

Legacy fleets operating beyond 15 service years present retrofit demand driven by wear, compliance updates, and cabin reconfiguration. In 2024, over 2,800 narrowbody aircraft in domestic service exceeded 12 years of operation, with average evacuation system overhaul intervals of 3 to 5 years depending on utilization. MRO capacity expanded across 9 additional domestic hangars between 2022 and 2025, enabling higher throughput for slide refurbishment and replacement kits. Retrofit campaigns typically bundle door seals, inflation canisters, and slide packs per aircraft, increasing shop visit scope. Fleet transfer activity added over 600 aircraft to secondary operators in 2025, amplifying standardization-driven retrofit demand.

Lightweight materials to reduce aircraft operating weight

Material innovation offers operational efficiency benefits through mass reduction and durability improvements. Composite-coated fabrics tested between 2023 and 2025 achieved weight reductions of 8 to 12 per assembly compared with legacy textiles, while maintaining abrasion resistance across 10,000 deployment cycles. Environmental chamber testing across 120 samples validated performance across humidity and thermal extremes. Adoption supports payload optimization and handling efficiency during maintenance events, reducing technician lift times by 15 to 20 minutes per unit. Certification-ready material sets progressed through conformity testing in 2024, enabling broader platform applicability. These advancements align with operator goals to improve handling safety, reduce maintenance time, and extend refurbishment intervals.

Future Outlook

Through the late 2020s into the early 2030s, regulatory rigor and domestic fleet utilization are expected to sustain recurring replacement and certification-driven demand. Platform commonality and densification programs will continue to shape technology selection and retrofit cadence. Integration of monitoring capabilities should improve maintenance planning and service responsiveness. Policy stability and MRO capacity expansion will support steady modernization cycles across domestic fleets.

Major Players

- Safran Aerosystems

- Collins Aerospace

- Meggitt

- Astronics Corporation

- Survitec Group

- Diehl Aviation

- Parker Hannifin

- AmSafe Bridport

- GKN Aerospace

- TransDigm Group

- Nordam Group

- EAM Worldwide

- AVIC Cabin Systems

- Air Cruisers Company

- Zodiac Aerospace

Key Target Audience

- Commercial airlines and network carriers

- Charter and ACMI operators

- Aircraft lessors and leasing platforms

- Maintenance, repair, and overhaul providers

- Aircraft manufacturers and completion centers

- Parts distributors and logistics integrators

- Investments and venture capital firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Variables include fleet age distribution, utilization intensity, door configuration diversity, certification pathways, and maintenance intervals across domestic operations. Inputs capture regulatory compliance triggers, retrofit cadence, and material qualification requirements specific to evacuation assemblies.

Step 2: Market Analysis and Construction

Analysis constructs demand from linefit and aftermarket workflows using platform counts, maintenance events, and certification-driven replacement cycles. Scenario building incorporates utilization profiles, retrofit programs, and test facility throughput constraints.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are validated through technical workshops with certification engineers, MRO planners, and safety compliance leads to reconcile deployment cycles, testing bottlenecks, and retrofit feasibility across platforms.

Step 4: Research Synthesis and Final Output

Findings are synthesized into platform-specific demand pathways, risk factors, and opportunity areas, with triangulation across regulatory records, maintenance activity logs, and operational indicators to ensure consistency.

- Executive Summary

- Research Methodology (Market Definitions and evacuation system scope for FAA Part 25/121 commercial aircraft, Fleet and platform taxonomy by narrowbody widebody and regional jets, Bottom-up sizing using aircraft deliveries and retrofit cycles, Revenue attribution across OEM linefit and aftermarket MRO channels, Primary validation with airline safety engineering leads and evacuation system suppliers)

- Definition and Scope

- Market evolution

- Usage and operational pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Fleet expansion of narrowbody aircraft in domestic networks

FAA-mandated evacuation performance and certification requirements

Increased retrofit cycles from aging fleet modernization

Post-incident safety investments by major airlines

Higher passenger density configurations driving high-capacity slides

Rising MRO outsourcing and parts replacement cycles - Challenges

Lengthy FAA certification and supplemental type certification timelines

High unit costs and certification testing expenses

Supply chain constraints for coated fabrics and inflation gas canisters

Complex integration with door systems across aircraft variants

Maintenance burden and periodic overhaul requirements

Pressure on airline capex during traffic volatility - Opportunities

Aftermarket retrofit programs for legacy fleets

Lightweight materials to reduce aircraft operating weight

Digital health monitoring for predictive maintenance of slides

Linefit contracts with next-generation narrowbody programs

Partnerships with MROs for pooled inventory programs

Standardization across fleet types to lower lifecycle costs - Trends

Shift toward dual-lane high-capacity evacuation slides

Adoption of eco-compliant materials for coatings and inflators

Integration of condition monitoring sensors in evacuation systems

Long-term service agreements bundled with OEM supply

Increased testing automation and digital certification documentation

Supplier consolidation through strategic acquisitions - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrowbody aircraft

Widebody aircraft

Regional jets

Business jet conversions for charter operators - By Application (in Value %)

Passenger cabin evacuation

Crew evacuation systems

Overwing exit evacuation

Special mission reconfiguration kits - By Technology Architecture (in Value %)

Inflatable slide and raft systems

Door-mounted evacuation slides

Dual-lane high-capacity slides

Automatic inflation and sensing modules

Lightweight composite slide materials - By End-Use Industry (in Value %)

Commercial airlines

Charter and ACMI operators

Leasing companies

Aircraft OEMs and completion centers - By Connectivity Type (in Value %)

Standalone mechanical systems

Embedded sensor-enabled systems

Condition-monitoring enabled systems

Maintenance data interface connected systems - By Region (in Value %)

Northeast

Midwest

South

West

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Certification portfolio breadth, Linefit versus aftermarket revenue mix, Slide and raft technology depth, MRO partnership coverage, Unit pricing and lifecycle cost, Delivery lead times, Warranty and service terms, Compliance with FAA TSO standards)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Safran Aerosystems

Collins Aerospace

Meggitt

Astronics Corporation

AVIC Cabin Systems

Air Cruisers Company

EAM Worldwide

Survitec Group

Zodiac Aerospace

Diehl Aviation

Nordam Group

Parker Hannifin

AmSafe Bridport

GKN Aerospace

TransDigm Group

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035