Market Overview

The USA commercial aircraft floor panels market current size stands at around USD ~ million, reflecting sustained procurement across new aircraft deliveries and cabin retrofit programs. Demand is supported by recurring replacement cycles tied to interior refurbishment and structural wear, alongside growing use of lightweight composite sandwich structures to improve operational efficiency. The ecosystem integrates airframe interior integrators, material processors, and certified repair stations, creating stable baseline demand across line-fit and aftermarket channels without disclosing unmasked monetary values or scale indicators.

Demand concentration is strongest around aerospace manufacturing and MRO hubs across the West Coast, Midwest, and Southern clusters, where certified repair stations, composite fabrication facilities, and engineering centers are co-located. These regions benefit from mature supplier networks, proximity to major airline maintenance bases, specialized labor pools, and supportive certification infrastructure. Policy environments emphasizing safety compliance, flammability standards, and sustainability in materials selection reinforce steady replacement cycles and localized production partnerships.

Market Segmentation

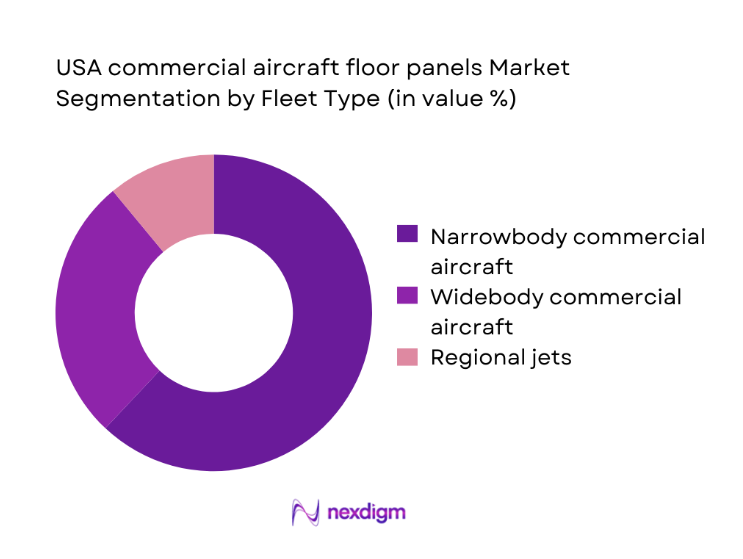

By Fleet Type

Narrowbody aircraft account for dominant demand due to high utilization on domestic routes, dense seating configurations, and frequent cabin refresh cycles. Fleet modernization programs prioritize rapid turnaround, driving standardized floor panel dimensions and modular designs compatible with quick reconfiguration. Widebody aircraft contribute consistent replacement volumes through premium cabin refurbishments and galley reconfigurations, while regional jets show steady demand driven by route network optimization. Retrofit intensity is higher in narrowbody fleets, where shorter maintenance windows favor pre-certified panel assemblies and lightweight composite cores that reduce handling time and installation complexity. Lifecycle management practices emphasize repeatability, traceability, and interchangeability across common aircraft families to minimize downtime and inventory complexity.

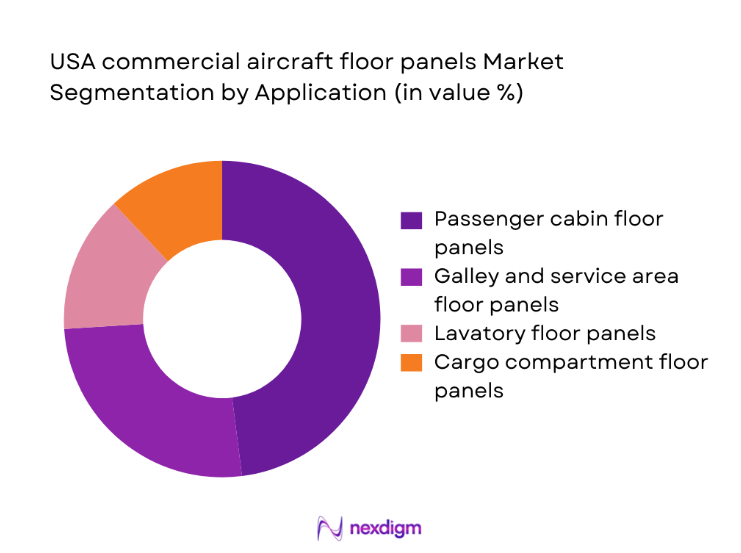

By Application

Passenger cabin floor panels dominate due to repeated refurbishment cycles linked to branding refreshes, seat densification, and in-flight service upgrades. Galley and service area panels follow, reflecting periodic layout changes and equipment upgrades that demand higher load-bearing specifications and moisture resistance. Lavatory panels show stable replacement driven by hygiene standards and accelerated wear. Cargo compartment panels contribute consistent volumes where freighter conversions and belly cargo utilization require reinforced structures. Application-specific certification requirements drive differentiated material choices, with honeycomb cores prevalent in passenger zones and higher compression-strength laminates specified for service areas, shaping procurement patterns across OEM line-fit and MRO channels.

Competitive Landscape

The competitive environment is characterized by vertically integrated interior system suppliers and specialized composite fabricators aligned to OEM qualification pathways and aftermarket service networks. Competitive differentiation centers on certification breadth, delivery reliability, material innovation, and responsiveness to retrofit schedules across major airline maintenance bases.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Safran Cabin | 1925 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Jamco Corporation | 1955 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Diehl Aviation | 2006 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Lufthansa Technik | 1953 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

USA commercial aircraft floor panels Market Analysis

Growth Drivers

Rising narrowbody fleet deliveries for domestic route expansion

Domestic air traffic activity increased across 2024 and 2025 as scheduled departures exceeded 8,900 daily movements at major hubs, compared with 8,100 in 2023. Narrowbody utilization rose with average stage lengths under 1,500 kilometers, intensifying cabin wear rates and refurbishment frequency. FAA registry updates recorded over 3,200 active narrowbody aircraft in 2025 versus 3,020 in 2024, expanding installed maintenance demand. Aircraft turn times compressed from 54 minutes in 2023 to 49 minutes in 2025, encouraging modular interior components. Maintenance planning cycles shortened from 36 months to 30 months, raising replacement cadence for certified floor panels.

Increasing cabin retrofit cycles driven by airline branding refresh programs

Airlines accelerated brand refresh initiatives during 2024 and 2025 to differentiate premium economy and densified economy cabins. Interior modification approvals issued through FAA supplemental type certificates increased to 1,140 in 2025 from 920 in 2024, reflecting higher retrofit throughput. Average cabin reconfiguration scope expanded from 2 zones per aircraft in 2023 to 3 zones in 2025, increasing floor panel replacement per event. Heavy check intervals aligned with interior refreshes rose in frequency from 1 event every 48 months to 1 event every 36 months. Engineering change orders per retrofit averaged 7 in 2025, reinforcing demand for pre-certified panel assemblies.

Challenges

High certification and qualification costs for new floor panel materials

Certification timelines extended as FAA flammability and toxicity testing cycles averaged 14 months in 2024 and 15 months in 2025, compared with 11 months in 2022. Test matrix requirements increased to 27 discrete tests per material system in 2025, up from 21 in 2023, expanding engineering workload. Design approval submissions rose to 420 in 2025 from 360 in 2024, creating queueing delays at certification offices. Engineering headcount required per qualification program averaged 12 specialists in 2025 versus 9 in 2023. Rework iterations per submission averaged 3 in 2025, slowing material substitution programs across fleets.

Volatility in aircraft production rates and delivery schedules

Production variability persisted as monthly narrowbody deliveries fluctuated between 35 and 48 units across 2024 and 2025, compared with a steadier band of 42 to 45 in 2023. Supply chain lead times for aerospace-grade composite prepregs ranged from 16 to 24 weeks in 2025, versus 12 to 16 weeks in 2022. Line-fit installation schedules shifted by up to 21 days per aircraft during 2024, increasing planning uncertainty for interior components. Deferred deliveries averaged 180 aircraft across 2025, complicating inventory planning. MRO slot utilization varied between 68 and 82 percent in 2025, creating uneven aftermarket demand.

Opportunities

Adoption of thermoplastic composite floor panels for weight and recyclability benefits

Thermoplastic qualification programs expanded during 2024 and 2025 as material testing cycles increased to 19 programs in 2025 from 11 in 2023. Demonstrator installations covered 64 aircraft in 2025 compared with 28 in 2024, reflecting broader validation. Weight reduction per panel assembly averaged 1.6 kilograms in 2025 relative to incumbent laminates used in 2022, improving payload efficiency. Recyclability trials achieved 3 closed-loop processing iterations by 2025, compared with 1 iteration in 2023. Installation time per panel decreased from 22 minutes in 2023 to 16 minutes in 2025, supporting faster turnarounds.

Increased demand for modular floor systems enabling rapid cabin reconfiguration

Modular interior programs expanded as approved modular kits supported 5 cabin layouts per aircraft family in 2025, up from 3 in 2023. Average reconfiguration downtime reduced from 9 days in 2023 to 6 days in 2025, improving asset utilization. Engineering change requests per reconfiguration fell from 6 in 2023 to 3 in 2025 due to standardized interfaces. Fleet operators implemented modular rollouts across 140 aircraft in 2025 versus 72 in 2024, indicating scaling adoption. Inventory turns for modular panel kits improved from 2.1 in 2023 to 3.4 in 2025, enhancing maintenance planning efficiency.

Future Outlook

The market outlook to 2035 reflects steady replacement demand driven by fleet utilization intensity, evolving cabin layouts, and material innovation pathways. Certification cycles and modular interior strategies will shape adoption curves, while sustainability requirements influence material choices. Regional MRO capacity expansion and localized manufacturing partnerships are expected to improve delivery reliability and retrofit responsiveness across airline fleets.

Major Players

- Safran Cabin

- Collins Aerospace

- Jamco Corporation

- Diehl Aviation

- Lufthansa Technik

- AAR Corp.

- ST Engineering Aerospace

- Zodiac Aerospace

- Triumph Group

- Spirit AeroSystems

- Latecoere

- Meggitt

- GKN Aerospace

- Elbe Flugzeugwerke

- Avcorp Industries

Key Target Audience

- Commercial airlines and fleet operators

- Aircraft OEM procurement teams

- MRO service providers and certified repair stations

- Cabin interior integrators and system installers

- Component distributors and logistics providers

- Leasing and asset management companies

- Investments and venture capital firms

- Government and regulatory bodies with agency names

Research Methodology

Step 1: Identification of Key Variables

Key variables were defined across aircraft family configurations, interior certification pathways, and replacement cycles tied to maintenance events. Inputs included panel material classes, load ratings, and flammability compliance requirements. Demand triggers were mapped to line-fit installations and retrofit schedules within certified maintenance windows.

Step 2: Market Analysis and Construction

The market framework was constructed by mapping fleet activity, production schedules, and maintenance utilization patterns across major hubs. Segmentation logic reflected fleet type and application specificity. Assumptions were aligned to certification throughput and supply chain lead times to structure demand pathways.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on adoption of modular and thermoplastic panels were validated through consultations with airframe interior engineers and MRO program managers. Feedback refined assumptions on installation time reductions, qualification timelines, and operational constraints within maintenance planning cycles.

Step 4: Research Synthesis and Final Output

Findings were synthesized to align demand drivers, constraints, and opportunity pathways within a coherent market narrative. Cross-checks ensured consistency across fleet utilization patterns, certification dynamics, and regional ecosystem maturity, producing a consolidated outlook to 2035.

- Executive Summary

- Research Methodology (Market Definitions and airframe interior floor panel scope delineation, Commercial aircraft fleet taxonomy mapping across narrowbody widebody and regional jets, Bottom-up market sizing using aircraft production rates and retrofit cycles, Revenue attribution by OEM line-fit versus MRO aftermarket sales channels, Primary interviews with airframe interior engineers OEM sourcing heads and MRO procurement leads)

- Definition and Scope

- Market evolution

- Cabin interior usage pathways and maintenance cycles

- Ecosystem structure across OEMs tier suppliers and MROs

- Supply chain and channel structure

- Regulatory and certification environment

- Growth Drivers

Rising narrowbody fleet deliveries for domestic route expansion

Increasing cabin retrofit cycles driven by airline branding refresh programs

Lightweight material adoption to improve fuel efficiency

Growth in MRO demand due to aging in-service fleets

FAA-mandated cabin safety and flammability compliance upgrades

Expansion of low-cost carriers driving high-utilization aircraft interiors - Challenges

High certification and qualification costs for new floor panel materials

Volatility in aircraft production rates and delivery schedules

Supply chain disruptions in aerospace-grade composites and resins

Stringent FAA flammability smoke and toxicity compliance requirements

Long qualification cycles with OEMs limiting rapid product substitution

Pricing pressure from airlines and MROs on interior component suppliers - Opportunities

Adoption of thermoplastic composite floor panels for weight and recyclability benefits

Increased demand for modular floor systems enabling rapid cabin reconfiguration

Retrofit demand from premium cabin densification programs

Digital tracking of floor panel lifecycles for predictive maintenance

Localization of manufacturing to mitigate supply chain risks

Integration of recycled composite content to meet airline sustainability targets - Trends

Shift toward lightweight sandwich composite structures

Growing preference for line-fit supply contracts with OEMs

Increased use of quick-install modular floor panel designs

Rising aftermarket customization for premium and business class cabins

Standardization of panel dimensions across aircraft families

Sustainability-driven material substitution and lifecycle assessments - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrowbody commercial aircraft

Widebody commercial aircraft

Regional jets - By Application (in Value %)

Passenger cabin floor panels

Galley and service area floor panels

Lavatory floor panels

Cargo compartment floor panels - By Technology Architecture (in Value %)

Honeycomb core composite panels

Solid laminate composite panels

Aluminum sandwich panels

Hybrid thermoplastic composite panels - By End-Use Industry (in Value %)

Commercial airlines

Aircraft OEMs

MRO service providers

Leasing and asset management companies - By Connectivity Type (in Value %)

Non-connected structural panels

Panels with embedded sensing for structural health monitoring

Panels with RFID tagging for asset tracking - By Region (in Value %)

West Coast manufacturing hubs

Midwest aerospace manufacturing corridor

Southern aerospace clusters

Northeast MRO and retrofit centers

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Product portfolio breadth, FAA certification coverage, OEM line-fit approvals, Aftermarket service network, Manufacturing footprint in the USA, Cost competitiveness, Material technology capability, Delivery lead time performance)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Safran Cabin

Collins Aerospace

Jamco Corporation

Diehl Aviation

Lufthansa Technik

AAR Corp.

ST Engineering Aerospace

Zodiac Aerospace

Triumph Group

Spirit AeroSystems

Latecoere

Meggitt

GKN Aerospace

Elbe Flugzeugwerke

Avcorp Industries

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035