Market Overview

The USA commercial aircraft interior lighting market has been experiencing robust growth, driven by factors such as the increasing demand for advanced lighting systems that enhance the passenger experience. Based on recent historical assessments, the market size is projected to reach approximately USD ~ billion by the end of the year, fueled by the expansion of the global airline fleet, technological advancements in LED and OLED lighting systems, and growing consumer preferences for customized in-flight experiences. The market is further propelled by the need for energy-efficient lighting solutions that reduce operational costs for airlines while improving overall cabin aesthetics.

The dominant players in the market are located primarily in North America and Europe, with the USA emerging as a leader in the adoption and manufacturing of advanced interior lighting systems. Key cities like Los Angeles, New York, and Seattle host the main aviation hubs and major aircraft manufacturers, contributing to the demand for cutting-edge lighting technologies. These regions benefit from strong infrastructure, a high volume of air travel, and significant investments in commercial aviation innovation. The prevalence of major players in the USA is also influenced by robust regulations and a continuous push for greener, more sustainable lighting solutions within the airline industry.

Market Segmentation

By Product Type

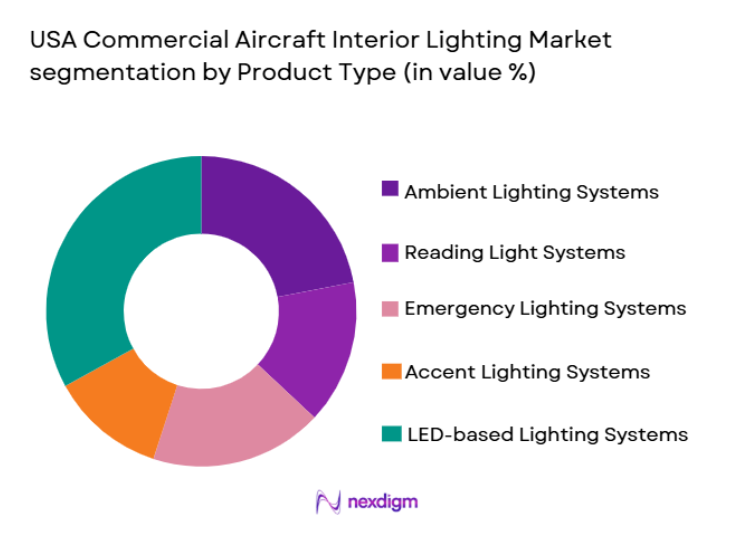

USA commercial aircraft interior lighting market is segmented by product type into ambient lighting systems, reading light systems, emergency lighting systems, accent lighting systems, and LED-based lighting systems. Recently, LED-based lighting systems have a dominant market share due to their energy efficiency, longer lifespan, and reduced maintenance costs. Airlines are increasingly opting for LED lighting because it offers flexibility in design, improves passenger comfort, and enhances the overall ambiance of the cabin. Additionally, LED systems can be integrated with smart technologies, allowing for dynamic adjustments to lighting settings based on flight conditions. This makes LED-based lighting systems the preferred choice for both retrofit and new installations.

By Platform Type

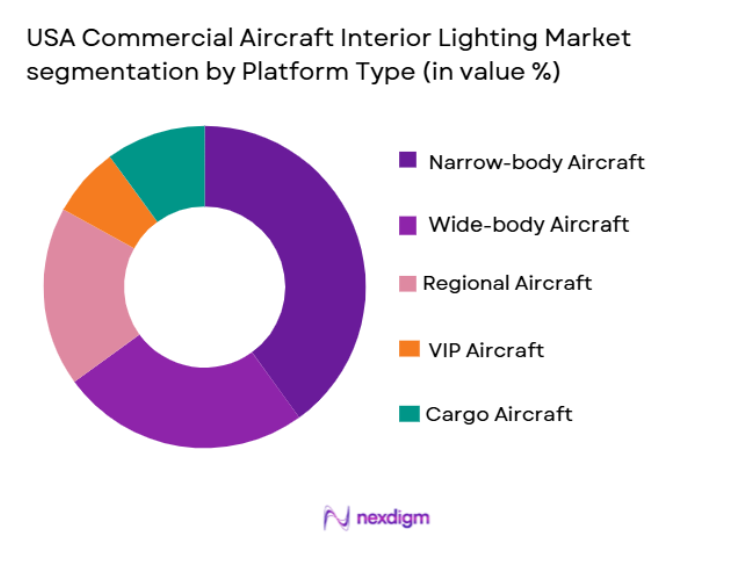

USA commercial aircraft interior lighting market is segmented by platform type into narrow-body aircraft, wide-body aircraft, regional aircraft, VIP aircraft, and cargo aircraft. Recently, narrow-body aircraft have a dominant market share due to the growing demand for cost-effective and fuel-efficient planes among low-cost carriers. Narrow-body aircraft are the most commonly used in short to medium-haul routes, with a higher frequency of passenger turnover, thus driving the need for lighting systems that provide both functionality and aesthetic appeal. Additionally, the increasing number of narrow-body aircraft deliveries from major manufacturers like Boeing and Airbus has further boosted the market share of this segment.

Competitive Landscape

The USA commercial aircraft interior lighting market is highly competitive, with major players continuously innovating and consolidating their position. Leading manufacturers dominate the landscape by introducing advanced lighting solutions that meet airline demands for energy efficiency, durability, and passenger comfort. These companies collaborate with airlines and OEMs to create custom lighting solutions that improve the overall passenger experience. As competition intensifies, companies are focusing on integrating smart lighting technology and sustainable materials, while also exploring partnerships with aircraft manufacturers to supply lighting systems for new and retrofit aircraft.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD Billion) | Technology Integration |

| Diehl Aerospace | 1909 | Germany | ~ | ~ | ~ | ~ | ~ |

| Zodiac Aerospace | 1896 | France | ~ | ~ | ~ | ~ | ~ |

| B/E Aerospace | 1999 | USA | ~ | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | USA | ~ | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | USA | ~ | ~ | ~ | ~ | ~ |

USA Commercial Aircraft Interior Lighting Market Analysis

Growth Drivers

Growing Demand for Enhanced Passenger Experience

Airlines are increasingly focusing on improving the overall passenger experience to attract and retain customers. Advanced interior lighting systems, such as customizable LED and OLED lighting, play a significant role in enhancing the comfort and ambiance of the cabin. This demand is driven by consumer preferences for more dynamic and personalized lighting solutions, which improve overall cabin aesthetics, reduce fatigue during long-haul flights, and increase passenger satisfaction. Additionally, airlines are adopting more energy-efficient lighting systems to meet sustainability goals, reduce operational costs, and comply with environmental regulations. The growing demand for premium services and amenities among travelers has also encouraged airlines to invest in modern lighting systems that offer a more luxurious and customized cabin environment.

Technological Advancements in Lighting Solutions

The commercial aircraft interior lighting market is being driven by continuous advancements in lighting technologies, particularly the development of energy-efficient and smart lighting solutions. LED and OLED lighting systems have gained significant market share due to their long lifespan, reduced energy consumption, and flexibility in terms of design and functionality. These lighting solutions can be integrated with intelligent systems, allowing airlines to create customizable lighting settings for different flight stages, such as takeoff, cruising, and landing. Additionally, the integration of lighting systems with other cabin features such as mood lighting, entertainment, and HVAC systems has further propelled the adoption of advanced lighting solutions. As technology continues to evolve, these systems are expected to become more cost-effective and versatile, further driving their growth in the market.

Market Challenges

High Initial Investment Costs

Despite the growing demand for advanced lighting systems, a significant challenge for airlines and aircraft manufacturers remains the high upfront cost associated with installing or retrofitting commercial aircraft with new lighting systems. LED and OLED lighting technologies, while energy-efficient and long-lasting, require significant capital investment. The costs involved in redesigning existing lighting systems, especially for retrofit projects, can be prohibitive for smaller airlines and operators with limited budgets. This financial burden, combined with the need to adhere to strict safety standards and certifications, can deter some airlines from adopting the latest lighting technologies, particularly for older aircraft models. Additionally, the availability of cheaper, less efficient lighting alternatives in the market poses a challenge to the widespread adoption of advanced systems.

Regulatory and Certification Barriers

The commercial aircraft interior lighting market faces several regulatory hurdles that can impact the speed and scope of market growth. Lighting systems for aircraft are subject to stringent regulations set by aviation authorities such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). These regulations are intended to ensure that lighting systems meet the required safety standards for both passengers and flight crews, including compliance with emergency lighting requirements. However, navigating these regulatory requirements can be time-consuming and expensive for manufacturers and airlines. The complex certification process and the need for continuous updates to meet evolving standards can lead to delays in product development and market entry, limiting the overall growth of the market.

Opportunities

Integration of Smart Lighting Systems

One of the key opportunities in the USA commercial aircraft interior lighting market lies in the integration of smart lighting technologies. Airlines are increasingly looking for lighting systems that can provide more than just illumination. Smart lighting systems, which use sensors and connectivity to adjust the lighting based on factors such as time of day, passenger mood, or flight conditions, offer a unique value proposition. These systems not only improve passenger experience but also help airlines reduce energy consumption by adjusting lighting according to actual needs. Moreover, the integration of smart lighting with other cabin systems, such as HVAC and entertainment, can create a fully connected and optimized cabin environment. This trend towards IoT-enabled lighting solutions is expected to open up significant growth opportunities for manufacturers in the coming years.

Growing Adoption of LED and OLED Lighting

As airlines continue to prioritize energy efficiency and passenger comfort, the adoption of LED and OLED lighting technologies is expected to grow rapidly. These advanced lighting systems offer numerous benefits, including lower energy consumption, longer service life, and the ability to be tailored to different cabin configurations. With rising operational costs and the increasing focus on reducing carbon emissions, airlines are turning to energy-efficient lighting solutions to meet their sustainability goals while also improving the passenger experience. Furthermore, the decreasing cost of these technologies, coupled with the ongoing research and development in the field of OLED and LED lighting, is expected to make these systems more affordable and accessible for airlines of all sizes, creating significant opportunities for growth in the market.

Future Outlook

The future outlook for the USA commercial aircraft interior lighting market over the next five years is highly promising. As airlines continue to focus on enhancing the passenger experience and improving operational efficiency, demand for advanced lighting solutions is expected to increase. Technological developments, particularly in the fields of smart lighting and energy-efficient systems, will drive further adoption. Regulatory support for sustainable practices, such as reducing carbon emissions and improving energy efficiency, will also play a significant role in shaping the market. Additionally, the increasing demand for custom lighting options and the need for retrofit solutions will further fuel market growth.

Major Players

- Diehl Aerospace

- Zodiac Aerospace

- B/E Aerospace

- Honeywell International

- Rockwell Collins

- STG Aerospace

- Collins Aerospace

- Soderberg Manufacturing

- Luminator Technology Group

- Astronics Corporation

- AeroLEDs

- Regent Aerospace

- Aviation Lighting International

- Boeing

- Airbus

Key Target Audience

- Airlines

- Aircraft Manufacturers

- Maintenance, Repair, and Overhaul (MRO) Service Providers

- Aircraft Interior Design Companies

- Lighting System Suppliers

- Aviation Regulatory Authorities

- Investors in Aviation Technology

- Aircraft Retrofit Service Providers

Research Methodology

Step 1: Identification of Key Variables

The initial step involves identifying the key market variables, including the technology trends, regulatory standards, and consumer demand patterns that influence the USA commercial aircraft interior lighting market.

Step 2: Market Analysis and Construction

This step involves gathering historical and current market data to construct an accurate market model, including size, segmentation, and future trends.

Step 3: Hypothesis Validation and Expert Consultation

The third step involves validating the initial hypotheses with expert consultations and interviews from industry leaders, airlines, and OEMs to ensure the data accuracy.

Step 4: Research Synthesis and Final Output

The final step synthesizes all findings into a comprehensive report, including all market dynamics, forecasts, and strategic recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Passenger Comfort Demand

Advancements in LED Technology

Growing Trend of Customizable Cabin Experiences

Airline Focus on Energy-efficient Lighting Solutions

Rising Aircraft Fleet Expansion in Emerging Markets - Market Challenges

High Initial Investment Costs

Technological Integration Challenges

Regulatory Compliance for Lighting Systems

Maintenance and Repair Challenges

Limited Availability of Skilled Technicians - Market Opportunities

Shift towards Sustainable Lighting Solutions

Partnerships with Airlines for Cabin Customization

Integration of IoT and Smart Lighting Features - Trends

Shift towards Ambient and Mood Lighting

Increased Demand for Energy-efficient Solutions

Incorporation of Passenger-Centric Lighting

Technological Integration with Smart Cabin Systems

Growing Interest in Customizable Aircraft Interiors - Government Regulations & Defense Policy

FAA Certification and Safety Standards

Greenhouse Gas Emission Regulations

Lighting System Compliance with Aircraft Noise Regulations - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Ambient Lighting Systems

Reading Light Systems

Emergency Lighting Systems

Accent Lighting Systems

LED-based Lighting Systems - By Platform Type (In Value%)

Narrow-Body Aircraft

Wide-Body Aircraft

Regional Aircraft

VIP Aircraft

Cargo Aircraft - By Fitment Type (In Value%)

OEM Installations

Retrofit Installations

Replacement Lighting Systems

Upgraded Lighting Solutions

Integrated Lighting Solutions - By EndUser Segment (In Value%)

Commercial Airlines

Private Jet Operators

Aircraft Manufacturers

Maintenance, Repair, and Overhaul (MRO) Service Providers

Military Aircraft Operators - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Procurement through Aircraft OEMs

Third-party Distributors

Government & Defense Procurement

Online Procurement Platforms - By Material / Technology (in Value%)

LED Lighting Technology

OLED Lighting Technology

Fiber Optic Lighting

Fluorescent Lighting Technology

Smart Lighting Solutions

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Material/Technology, Regulatory Compliance, Cost-effectiveness, Innovation, Customer Support)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Diehl Aerospace

Zodiac Aerospace

B/E Aerospace

Honeywell International

Rockwell Collins

STG Aerospace

Collins Aerospace

Soderberg Manufacturing

Luminator Technology Group

Astronics Corporation

AeroLEDs

Regent Aerospace

Aviation Lighting International

Boeing

Airbus

- Airline Operators’ Focus on Passenger Experience

- Private Jet Operators’ Interest in Customization

- MRO Providers’ Role in Lighting Replacement and Repair

- Aircraft Manufacturers’ Integration of Lighting Systems in New Models

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035