Market Overview

The USA commercial aircraft landing gear market is valued at USD ~ billion based on a recent historical assessment, driven by the growing demand for air travel and technological advancements in aircraft systems. The market is primarily influenced by the aerospace industry’s expansion, as airlines and aircraft manufacturers are increasingly investing in more efficient, durable, and lightweight landing gear systems. These systems are critical for ensuring the safety and performance of aircraft, making them a focal point in aviation infrastructure development.

The market’s dominance in the USA is attributed to its robust aviation infrastructure, along with the presence of major aircraft manufacturers and MRO service providers. The United States, with its large fleet of commercial aircraft and ongoing investment in fleet upgrades, remains a leader in both commercial aviation and landing gear technology. Additionally, the strong regulatory framework governing safety standards and technological innovation in aerospace supports the growth of this market.

Market Segmentation

By System Type

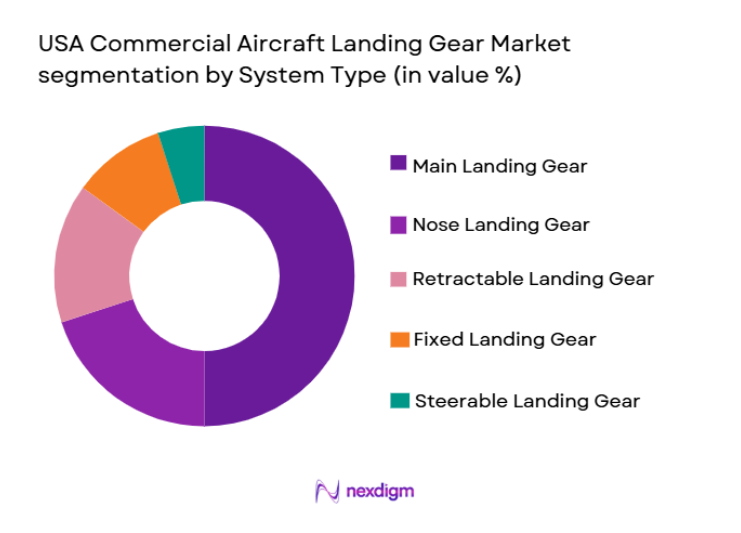

The USA commercial aircraft landing gear market is segmented by system type into main landing gear, nose landing gear, retractable landing gear, fixed landing gear, and steerable landing gear. Recently, main landing gear has a dominant market share due to its essential role in providing the primary support and stability for aircraft during takeoff and landing. The growth of commercial aviation, particularly the rise in narrow-body and wide-body aircraft usage, directly increases the demand for main landing gear systems. As airlines focus on improving aircraft performance and durability, manufacturers prioritize the development of advanced main landing gear systems that enhance safety, reduce weight, and improve fuel efficiency, further cementing its position as the market leader.

By Platform Type

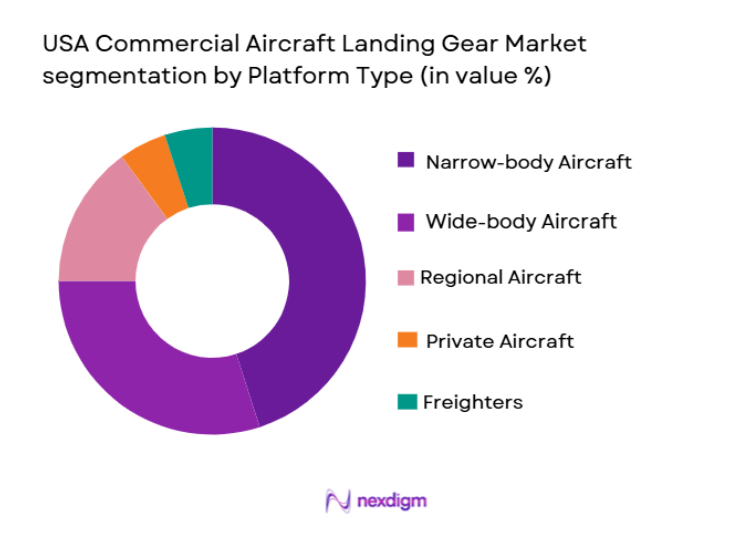

The market is segmented by platform type into narrow-body aircraft, wide-body aircraft, regional aircraft, private jets, and freighters. Narrow-body aircraft have recently emerged as the dominant platform type in the USA commercial aircraft landing gear market. This dominance is driven by the increasing demand for short and medium-haul flights, which rely heavily on narrow-body aircraft. Airlines favor these aircraft due to their operational efficiency and lower operational costs. As the demand for budget airlines and regional air travel grows, the adoption of narrow-body aircraft increases, propelling the demand for landing gear solutions tailored to these platforms. Narrow-body aircraft typically require lightweight yet durable landing gear systems that are cost-effective, driving innovation in landing gear technology and bolstering its market share.

Competitive Landscape

The USA commercial aircraft landing gear market is highly competitive, with several major players leading the industry. These players are focusing on innovation and partnerships with aircraft OEMs and MRO providers to supply high-performance landing gear systems. As demand for lightweight, energy-efficient, and cost-effective landing gear solutions increases, these companies are investing in R&D to stay ahead in the competitive landscape. Furthermore, strategic mergers and acquisitions have consolidated market share and improved the technological capabilities of leading players.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Key Aircraft Manufacturer Partnerships |

| Safran Landing Systems | 2005 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | Charlotte, USA | ~ | ~ | ~ | ~ | ~ |

| UTC Aerospace Systems | 2012 | Windsor Locks, USA | ~ | ~ | ~ | ~ | ~ |

| Liebherr Aerospace | 1949 | Lindenberg, Germany | ~ | ~ | ~ | ~ | ~ |

| Heroux Devtek | 1951 | Longueuil, Canada | ~ | ~ | ~ | ~ | ~ |

USA Commercial Aircraft Landing Gear Market Analysis

Growth Drivers

Increased Aircraft Production

One of the key growth drivers for the USA commercial aircraft landing gear market is the significant increase in aircraft production. As demand for air travel continues to rise, airlines are expanding their fleets, especially with the rise of low-cost carriers and the global expansion of regional airlines. Aircraft manufacturers are responding by ramping up production, and with it, the need for reliable, durable, and efficient landing gear systems grows. As both narrow-body and wide-body aircraft dominate the market, demand for landing gear systems that meet the specific operational needs of these platforms is also on the rise. Moreover, the shift towards more fuel-efficient and environmentally friendly aircraft has led to an increase in demand for lightweight landing gear solutions. Manufacturers are thus focusing on developing landing gear systems that not only improve safety and reliability but also reduce weight and enhance fuel efficiency, contributing to the growth of this market. Increased aircraft production, along with the rise of new airlines and fleet upgrades, is expected to continue driving the growth of the landing gear market in the USA.

Technological Advancements in Aircraft Landing Gear

Technological advancements in aircraft landing gear systems have played a significant role in the market’s growth. The focus is on developing lighter, more durable, and energy-efficient systems that reduce maintenance costs and improve fuel efficiency for airlines. The advancement of materials such as titanium, composites, and other alloys has allowed landing gear manufacturers to create systems that are not only stronger but also significantly lighter than traditional materials. Furthermore, innovations in landing gear design, such as steerable nose gear and retractable systems, have enhanced the flexibility and adaptability of landing gear systems. The integration of advanced sensors and monitoring systems in landing gear also contributes to predictive maintenance, reducing downtime and improving aircraft availability. As the demand for safer, more efficient, and cost-effective landing gear systems grows, technological innovations will continue to drive market growth. The development of landing gear systems that meet the growing demand for energy efficiency, sustainability, and higher performance standards will further contribute to the market’s expansion.

Market Challenges

High Maintenance and Replacement Costs

One of the significant challenges in the USA commercial aircraft landing gear market is the high cost of maintenance and replacement. Landing gear systems are subjected to significant wear and tear due to the stresses encountered during takeoff and landing. As a result, regular maintenance and replacement of parts are essential for ensuring the safe operation of aircraft. However, the costs associated with these maintenance activities can be quite high, particularly for older aircraft that require retrofitting with modern landing gear systems. Airlines, especially those operating older fleets, face financial challenges in maintaining their landing gear systems while ensuring compliance with regulatory standards. Additionally, the rising cost of raw materials, such as titanium and other specialized metals used in the manufacture of landing gear, further adds to the overall cost burden. The high maintenance and replacement costs present a barrier to the widespread adoption of advanced landing gear systems and can affect the profitability of airlines and operators.

Regulatory Compliance and Safety Standards

Another challenge for the commercial aircraft landing gear market is the need to comply with stringent regulatory and safety standards. Landing gear systems must meet rigorous safety requirements set by aviation authorities such as the FAA (Federal Aviation Administration) and EASA (European Union Aviation Safety Agency). These regulations ensure that landing gear systems are durable, reliable, and capable of operating under extreme conditions. While these standards are necessary to ensure the safety of air travel, they can create challenges for manufacturers in terms of design, testing, and certification. The lengthy approval processes and high costs associated with regulatory compliance can slow down the introduction of new technologies in the market. Moreover, any modifications or upgrades to landing gear systems on existing aircraft require approval from regulatory bodies, further complicating the process. Compliance with safety standards adds complexity to the design and maintenance of landing gear systems, making it a significant challenge for players in the market.

Opportunities

Growth in Commercial Aviation Fleet

An important opportunity for the USA commercial aircraft landing gear market is the growth in the commercial aviation fleet. As global air travel continues to recover and expand, the demand for commercial aircraft is expected to increase. This growth is driven by rising disposable incomes, increasing tourism, and the expansion of global trade. As more airlines expand their fleets to cater to this growing demand, there is an increasing need for landing gear systems that are durable, efficient, and capable of supporting a higher volume of aircraft. Additionally, the adoption of next-generation aircraft that require advanced landing gear systems presents an opportunity for landing gear manufacturers to innovate and provide cutting-edge solutions. With many airlines modernizing their fleets with newer aircraft models, the demand for high-quality landing gear systems is poised for continued growth. The increasing number of aircraft and the need for fleet upgrades create a promising opportunity for players in the commercial aircraft landing gear market to tap into.

Adoption of Advanced Materials in Landing Gear Manufacturing

The shift towards the use of advanced materials in landing gear manufacturing presents another significant opportunity for market growth. Aircraft manufacturers and landing gear suppliers are increasingly turning to lightweight materials such as composites, titanium, and advanced alloys to improve the performance and efficiency of landing gear systems. These materials offer several benefits, including reduced weight, improved durability, and enhanced fuel efficiency, which are critical in meeting the aviation industry’s sustainability goals. As the demand for more fuel-efficient aircraft increases, the adoption of advanced materials will become even more crucial. The use of these materials not only helps reduce aircraft weight but also extends the lifespan of landing gear systems, reducing maintenance costs. Manufacturers who focus on developing landing gear systems using advanced materials can gain a competitive edge in the market by offering more sustainable and cost-effective solutions, creating significant growth potential in the industry.

Future Outlook

The future outlook for the USA commercial aircraft landing gear market is positive, driven by the continued growth in air travel and advancements in landing gear technology. Innovations such as lightweight materials, smart sensors, and energy-efficient systems are expected to shape the market in the coming years. Additionally, the increasing adoption of next-generation aircraft, along with fleet modernization efforts by airlines, will further contribute to the demand for advanced landing gear solutions. Regulatory support and technological advancements will also continue to drive growth, making the market a key segment of the broader aerospace industry.

Major Players

- Safran Landing Systems

- Collins Aerospace

- UTC Aerospace Systems

- Liebherr Aerospace

- Heroux Devtek

- Honeywell Aerospace

- GE Aviation

- AAR Corp

- Rockwell Collins

- Meggitt PLC

- Trelleborg AB

- Boeing

- Lockheed Martin

- Raytheon Technologies

- Embraer

Key Target Audience

- Airlines

- Aircraft Manufacturers

- MRO Companies

- Aircraft Landing Gear Manufacturers

- Aerospace Regulators

- Aviation Supply Chain Partners

- Investors in the Aviation Industry

- Government Agencies

Research Methodology

Step 1: Identification of Key Variables

Understanding the key market drivers, challenges, and opportunities through secondary research and industry reports.

Step 2: Market Analysis and Construction

Gathering data on market size, segmentation, and growth patterns from both primary and secondary sources.

Step 3: Hypothesis Validation and Expert Consultation

Consulting industry experts to validate findings and refine market projections.

Step 4: Research Synthesis and Final Output

Compiling comprehensive data into actionable insights for stakeholders in the USA commercial aircraft landing gear market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Aircraft Production

Technological Advancements in Landing Gear Systems

Growing Demand for Safer Aircraft Operations - Market Challenges

High Maintenance and Replacement Costs

Regulatory Compliance and Safety Standards

Technological Complexity in Landing Gear Design - Market Opportunities

Growth in Commercial Aviation Fleet

Adoption of Advanced Materials in Landing Gear Manufacturing

MRO Market Expansion - Trends

Rise of Electric and Hybrid Aircraft

Increased Automation in Landing Gear Systems

Shift Toward Sustainable Aircraft Designs - Government Regulations & Defense Policy

Landing Gear Safety Standards

Environmental Regulations on Aircraft

Government Funding for Aircraft Innovation - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Main Landing Gear

Nose Landing Gear

Retractable Landing Gear

Fixed Landing Gear

Steerable Landing Gear - By Platform Type (In Value%)

Narrow-body Aircraft

Wide-body Aircraft

Regional Aircraft

Private Jets

Freighters - By Fitment Type (In Value%)

Line-fit Solutions

Retrofit Solutions

OEM Solutions

Upgraded Solutions

Modular Solutions - By EndUser Segment (In Value%)

Commercial Airlines

Private Aviation

OEMs

MRO Providers

Aircraft Interior Manufacturers - By Procurement Channel (In Value%)

Direct Procurement

OEM Partnerships

Third-party Distributors

Online Bidding Platforms

MRO Suppliers - By Material / Technology (In Value%)

Titanium Landing Gear

Steel Landing Gear

Carbon Composite Landing Gear

Alloy-based Landing Gear

Hybrid Technology Landing Gear

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, Material/Technology, EndUser Segment, Growth Drivers, Challenges, Trends, Opportunities)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

UTC Aerospace Systems

Safran Landing Systems

Boeing

Eaton Corporation

Liebherr Aerospace

Meggitt PLC

Honeywell Aerospace

Collins Aerospace

AAR Corp

Heroux Devtek

L3 Technologies

Raytheon Technologies

GE Aviation

Trelleborg AB

Aviation Industries Corporation

- Airlines’ Need for Cost-Effective Landing Gear

- OEM’s Focus on Lightweight, Durable Materials

- MRO’s Role in Landing Gear Maintenance and Upgrades

- Private Aviation Sector’s Demand for Custom Landing Gear Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035