Market Overview

The USA Commercial Aircraft Landing Gear MRO market is valued at approximately USD ~ billion based on a recent historical assessment. It is primarily driven by the continuous expansion of the aviation industry and the need for safe, reliable landing gear systems in commercial aircraft. Factors such as an increase in the number of air traffic passengers, the aging fleet, and rising demand for efficient maintenance, repair, and overhaul services significantly contribute to market growth. The demand for more frequent landing gear maintenance is a direct result of the stringent regulatory standards and increasing focus on safety.

The United States dominates the global commercial aircraft landing gear MRO market due to its large aviation sector, including a significant number of commercial and freight aircraft operators. Key cities such as New York, Chicago, and Los Angeles lead the demand for landing gear MRO services. The presence of major aircraft manufacturers and MRO service providers, along with a robust regulatory framework, drives the demand for landing gear maintenance. Additionally, the U.S. has a strong ecosystem of aviation infrastructure, which supports continuous market growth.

Market Segmentation

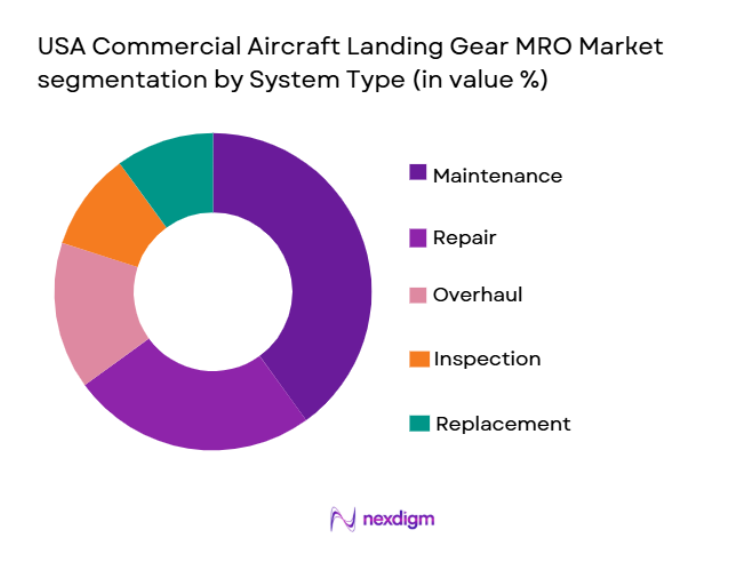

By System Type

USA Commercial Aircraft Landing Gear MRO market is segmented by system type into maintenance, repair, overhaul, inspection, and replacement. Recently, the maintenance sub-segment has a dominant market share due to factors such as the high frequency of required inspections, the importance of ongoing operational safety, and the relatively lower cost compared to overhauls or complete replacements. Maintenance services are also driven by a larger number of aging aircraft in the commercial fleet. These factors, combined with regulatory mandates and increased air travel, are significantly boosting the demand for landing gear maintenance services.

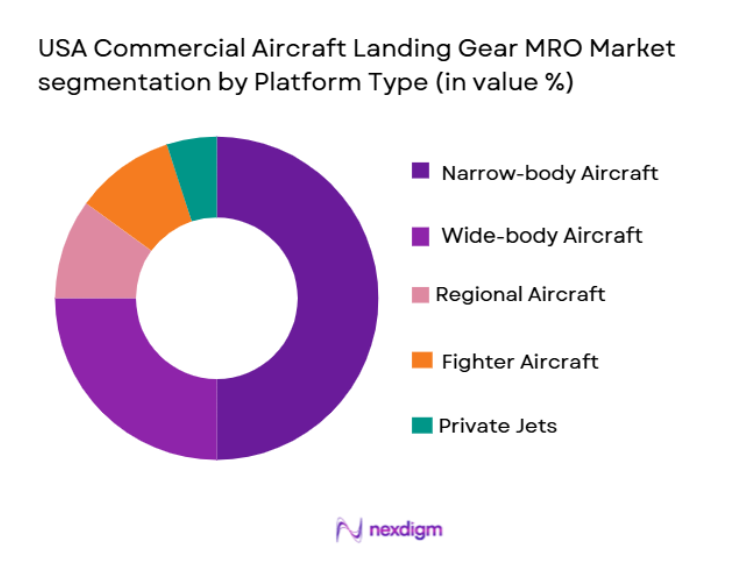

By Platform Type

USA Commercial Aircraft Landing Gear MRO market is segmented by platform type into narrow-body aircraft, wide-body aircraft, regional aircraft, freight aircraft, and private jets. Narrow-body aircraft dominate the market due to their widespread use in both domestic and international routes. Their high utilization rate, coupled with the large fleet of narrow-body aircraft operated by major U.S. airlines, contributes significantly to the market share. The demand for landing gear MRO services for these platforms is primarily driven by the need for frequent and cost-effective maintenance to ensure operational efficiency.

Competitive Landscape

The USA Commercial Aircraft Landing Gear MRO market is highly competitive, with a mix of global and local players offering a wide range of services. Consolidation in the sector has led to a few major players having a significant influence on the market, setting high standards for service quality, safety, and innovation. These major players leverage technological advancements, expansive service networks, and strong relationships with airlines to maintain dominance. The market remains dynamic, with ongoing investments in new technologies and the expansion of service offerings by key players.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Service Network Size |

| United Technologies | 1934 | Farmington, CT | ~ | ~ | ~ | ~ | ~ |

| Liebherr-Aerospace | 1949 | Lindenberg, Germany | ~ | ~ | ~ | ~ | ~ |

| Safran Landing Systems | 2005 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1934 | Charlotte, NC | ~ | ~ | ~ | ~ | ~ |

| AAR Corporation | 1955 | Wood Dale, IL | ~ | ~ | ~ | ~ | ~ |

USA Commercial Aircraft Landing Gear MRO Market Analysis

Growth Drivers

Increasing Air Traffic and Fleet Expansion

The growing demand for commercial air travel is one of the primary drivers for the USA Commercial Aircraft Landing Gear MRO market. As passenger air traffic continues to rise, airlines are increasing their fleet size, which, in turn, creates a higher demand for landing gear maintenance, repair, and overhaul services. This trend is especially prominent as older aircraft in service require more frequent maintenance and inspections. Additionally, with rising demand for both domestic and international air travel, U.S. airlines are expanding their operations and acquiring more aircraft, which further drives the need for landing gear services. The U.S. remains a key player in the global aviation market, and as airlines strive to maintain operational safety, the demand for landing gear MRO services is expected to increase. With stringent regulations on aircraft safety and maintenance, this growth driver shows no sign of slowing down. The increased air traffic also necessitates faster turnaround times, which enhances the focus on efficient maintenance processes, benefiting companies specializing in MRO services.

Technological Advancements in Aircraft Landing Gear Systems

Technological advancements in landing gear systems are playing a significant role in driving growth in the USA Commercial Aircraft Landing Gear MRO market. As newer landing gear systems are designed to be more efficient and durable, the need for advanced maintenance technologies and techniques has become more critical. Modern landing gear systems now incorporate advanced materials such as composites and titanium, which require specialized tools and knowledge for maintenance. Moreover, the integration of automation, AI-based predictive maintenance, and digital technologies for fault detection and monitoring is further transforming the MRO landscape. These innovations are making the maintenance process more efficient, reducing downtime, and lowering the overall cost of maintenance. Airlines and MRO providers are investing in new technologies to stay competitive and meet regulatory requirements, thereby propelling the growth of this market. The ongoing development of electric landing gear systems also opens new avenues for growth by reducing weight and improving energy efficiency.

Market Challenges

High Operational and Maintenance Costs

One of the biggest challenges faced by the USA Commercial Aircraft Landing Gear MRO market is the high cost of aircraft landing gear maintenance, repair, and overhaul services. Maintaining, repairing, and replacing landing gear components is an expensive process due to the complex nature of the systems and the need for high-quality materials and precision engineering. Furthermore, the requirement for advanced technologies, specialized labor, and certifications adds additional layers of cost. For airlines, these high maintenance expenses can significantly impact profitability, especially as the competition in the airline industry remains fierce, and operating margins are under constant pressure. MRO providers also face challenges in meeting the cost-efficiency demands of airlines while maintaining the necessary standards of safety and performance. These high operational and maintenance costs may also hinder the entry of smaller players into the market, making it more difficult for new entrants to compete with established players who can benefit from economies of scale.

Shortage of Skilled Labor in the MRO Industry

The shortage of skilled labor in the USA Commercial Aircraft Landing Gear MRO market is another major challenge. The MRO industry requires highly skilled technicians and engineers to perform the complex maintenance tasks required for commercial aircraft landing gear systems. However, the supply of skilled labor is not keeping pace with the demand, leading to a talent shortage. The high level of expertise needed to service landing gear systems, combined with the aging workforce in the MRO sector, has resulted in a significant skills gap. This shortage is further exacerbated by the increasing complexity of landing gear technologies and the need for continuous training and upskilling. The lack of qualified workers affects the ability of MRO providers to meet the growing demand for services and compromises their ability to deliver timely maintenance solutions. Airlines are also experiencing difficulty finding qualified technicians, which could result in delays and operational inefficiencies.

Opportunities

Adoption of Predictive Maintenance Technologies

The adoption of predictive maintenance technologies represents a major opportunity for growth in the USA Commercial Aircraft Landing Gear MRO market. Predictive maintenance solutions leverage data analytics, artificial intelligence, and IoT sensors to monitor landing gear systems in real-time. By analyzing data from various sensors, these technologies can predict potential failures or maintenance needs before they occur, allowing airlines and MRO providers to schedule maintenance proactively. This helps to minimize downtime, reduce costs, and enhance the overall reliability of the landing gear system. The growing interest in these technologies is driven by the need to optimize operational efficiency and improve safety standards. As airlines and MRO providers continue to adopt predictive maintenance technologies, the market for advanced MRO services is expected to expand, providing a new revenue stream for service providers. This opportunity also allows MRO providers to position themselves as leaders in a rapidly changing market by offering cutting-edge services that enhance customer satisfaction.

Expansion of MRO Services for Emerging Aircraft Fleets

Another significant opportunity in the USA Commercial Aircraft Landing Gear MRO market is the expansion of MRO services for emerging aircraft fleets, including new models from major manufacturers such as Boeing and Airbus. As airlines modernize their fleets with next-generation aircraft, the demand for specialized MRO services for these newer models will grow. These modern aircraft come equipped with advanced landing gear systems that require specialized maintenance and repair expertise. MRO providers who are able to offer tailored services for the latest aircraft models stand to benefit from increased business. Additionally, the growing trend of leasing aircraft rather than purchasing them outright presents opportunities for MRO providers to establish long-term relationships with airlines and aircraft leasing companies. By offering comprehensive maintenance packages for newer fleets, MRO providers can tap into a lucrative and expanding segment of the market, positioning themselves as key players in the evolving aviation landscape.

Future Outlook

The future outlook for the USA Commercial Aircraft Landing Gear MRO market is positive, with steady growth expected over the next few years. Increasing air traffic, fleet expansion, and the ongoing need for enhanced safety measures will drive the demand for landing gear maintenance services. Technological innovations, such as predictive maintenance and the adoption of new materials, will also create growth opportunities for MRO providers. Furthermore, regulatory support for maintaining high safety standards will continue to bolster the market. The increasing emphasis on sustainability and eco-friendly solutions in aircraft design will further shape the direction of the market in the coming years, creating additional avenues for growth.

Major Players

- United Technologies Corporation

- Liebherr-Aerospace

- Safran Landing Systems

- Collins Aerospace

- AAR Corporation

- GE Aviation

- Boeing

- Airbus

- Thales Group

- Honeywell

- Rockwell Collins

- Meggitt

- Zodiac Aerospace

- SKF Aerospace

- Hella

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airlines

- Aircraft operators

- Maintenance service providers

- Aerospace manufacturers

- Military and defense contractors

- Aircraft leasing companies

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying critical variables that influence the USA Commercial Aircraft Landing Gear MRO market, such as market demand, technological advancements, regulatory changes, and consumer behavior patterns.

Step 2: Market Analysis and Construction

Data is collected from reliable sources, including industry reports, market surveys, and expert consultations, to construct a comprehensive analysis of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market trends, challenges, and growth opportunities are validated by consulting experts in the field, including MRO service providers, airlines, and aviation industry professionals.

Step 4: Research Synthesis and Final Output

The research findings are synthesized, with key insights and actionable recommendations provided to stakeholders in the USA Commercial Aircraft Landing Gear MRO market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Demand for Air Travel

Technological Advancements in Landing Gear Systems

Rising Aircraft Fleet Size and Modernization Efforts - Market Challenges

High Cost of Maintenance and Parts

Complexity in Material Integration

Regulatory Compliance and Safety Standards - Market Opportunities

Expansion of MRO Services in Emerging Markets

Development of Eco-friendly and Lightweight Landing Gear Systems

Technological Advancements in Predictive Maintenance - Trends

Adoption of AI and IoT for Maintenance Operations

Increase in Fleet Modernization and Replacement

Integration of Lightweight Materials in Landing Gear Systems - Government Regulations & Defense Policy

Regulatory Focus on Environmental Impact and Emissions

Government Funding for Aerospace Modernization

Safety and Maintenance Standards for Civil Aviation - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Main Landing Gear

Nose Landing Gear

Tail Landing Gear

Tricycle Landing Gear

Bogie Landing Gear - By Platform Type (In Value%)

Narrow-body Aircraft

Wide-body Aircraft

Regional Aircraft

Freighter Aircraft

Helicopters - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Replacement Fitment

Upgraded Fitment

Modified Fitment - By EndUser Segment (In Value%)

Commercial Airlines

Cargo Airlines

Aircraft Manufacturers

MRO Service Providers

Military Operators - By Procurement Channel (In Value%)

Direct Procurement

Third-party Procurement

MRO Procurement

Online Bidding Platforms

OEM Procurement - By Material / Technology (in Value%)

Steel Landing Gear

Titanium Landing Gear

Aluminum Landing Gear

Composite Material Landing Gear

Hybrid Material Landing Gear

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Material / Technology, Growth Drivers, Challenges, Opportunities, Trends)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Safran Landing Systems

GE Aviation

Collins Aerospace

Meggitt PLC

Heroux-Devtek

Liebherr Aerospace

United Technologies

Aerospace Industrial Development Corporation

Rockwell Collins

Stelia Aerospace

Fokker Technologies

AAR Corporation

Sikorsky Aircraft

Boeing

Raytheon Technologies

- Commercial Airlines’ Focus on Operational Efficiency

- Cargo Airlines’ Investment in Reliable Landing Gear Systems

- MRO Service Providers’ Shift Toward Advanced Technologies

- Military Operators’ Demand for Robust Maintenance Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035