Market Overview

The USA commercial aircraft leasing market is valued at approximately USD ~ billion based on a recent historical assessment, driven by the increasing demand for air travel, particularly from low-cost carriers. This market continues to expand due to the rise in demand for leasing aircraft, providing flexible financing options for airlines and freight operators. Furthermore, the rising trend of fleet modernization and the rapid growth in air cargo transport are fueling this market’s growth, making it a vital sector in the aviation industry.

Dominant cities and countries, such as New York, Los Angeles, and Chicago, are leading the USA commercial aircraft leasing market due to their proximity to major international airports and bustling economic activities. The presence of key airlines and leasing companies in these locations strengthens their dominance in the market. Furthermore, global airports in these cities continue to see a rise in air traffic, further driving demand for leased aircraft, contributing to the USA’s market leadership in this sector.

Market Segmentation

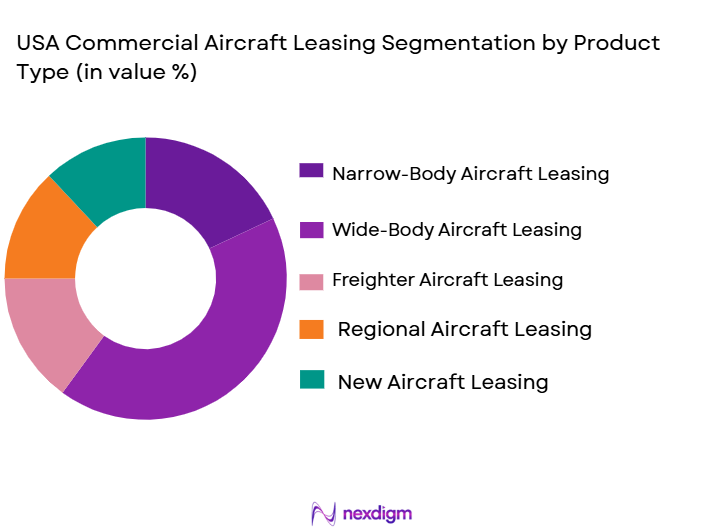

By Product Type:

The USA commercial aircraft leasing market is segmented by system type into narrow-body aircraft, wide-body aircraft, freighter aircraft, regional aircraft, and business jets. Recently, narrow-body aircraft have a dominant market share due to demand patterns from budget airlines and their cost-effectiveness in short-haul flights. The substantial number of low-cost carriers and regional airlines heavily favor narrow-body aircraft as they provide the optimal balance between cost, efficiency, and demand for domestic routes. The high frequency of short-distance flights and the need for fuel-efficient models make narrow-body aircraft highly sought after, accounting for a significant market share in the USA.

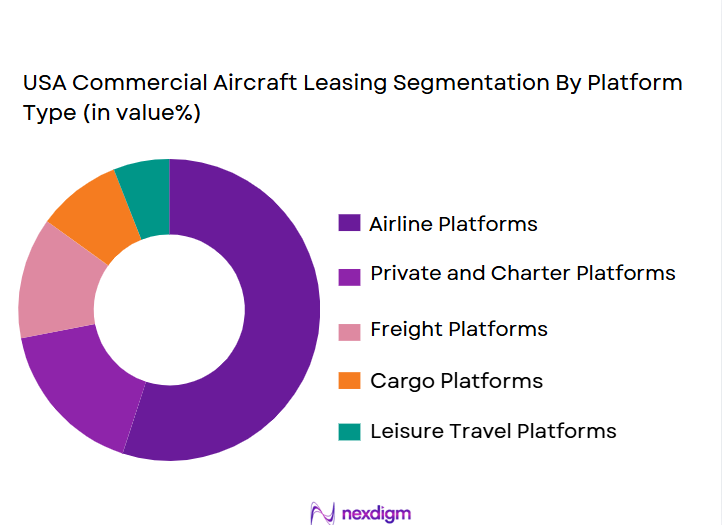

By Platform Type:

The USA commercial aircraft leasing market is segmented by platform type into airlines, leasing companies, airports, freight operators, and private operators. Leasing companies hold a dominant market share due to their centralized role in aircraft procurement and distribution to various airlines. Leasing companies’ ability to maintain large fleets and offer flexible leasing options for both short and long-term requirements positions them as a key player in the market. The demand for leasing services from airlines, especially for low-cost carriers and large freight operators, significantly contributes to the strong position of leasing companies.

Competitive Landscape

The USA commercial aircraft leasing market is competitive, with major players forming a consolidated landscape that holds a significant share of the market. The influence of large leasing companies, such as AerCap and Air Lease Corporation, is evident in their expansive fleets and international market reach. These companies offer various financing models and have extensive client bases across commercial airlines and cargo operators. Consolidation in the market has occurred as larger firms acquire smaller players to broaden their fleet offerings and increase global market coverage.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Fleet Size |

| AerCap | 1995 | Dublin, Ireland | ~ | ~ | ~ | ~ | ~ |

| Air Lease Corporation | 2010 | Los Angeles, USA | ~ | ~ | ~ | ~ | ~ |

| SMBC Aviation Capital | 2010 | New York, USA | ~ | ~ | ~ | ~ | ~ |

| Avolon | 2010 | Dublin, Ireland | ~ | ~ | ~ | ~ | ~ |

| BOC Aviation | 1993 | Hong Kong, China | ~ | ~ | ~ | ~ | ~ |

USA Commercial Aircraft Leasing Market Analysis

Growth Drivers

Increasing Demand for Air Travel:

The USA commercial aircraft leasing market is experiencing a surge due to the robust demand for air travel, particularly from budget and regional airlines. The economic recovery post-pandemic, along with increased disposable income and growing tourism, is driving airlines to expand their fleets to meet the needs of rising passenger numbers. This demand for affordable air travel directly impacts the leasing market, with airlines turning to leasing companies for more flexible, cost-effective solutions. Additionally, international air cargo growth is propelling leasing companies to acquire more freighter aircraft to meet logistical demands. Airlines prefer leasing over purchasing due to lower upfront costs, ensuring this growth driver sustains the market. Leasing companies’ ability to offer diverse fleet options for airlines, coupled with low-interest rates and flexible leasing terms, creates a favorable environment for market expansion. As global trade grows, the aviation industry’s need for efficient air transport, including leased aircraft, will continue to drive long-term growth.

Fleet Modernization and Technological Advancements:

Another key growth driver in the USA commercial aircraft leasing market is the ongoing fleet modernization trend. Airlines are increasingly looking to replace older aircraft models with newer, more fuel-efficient options, such as the Boeing 737 MAX and the Airbus A320neo. These aircraft are equipped with advanced avionics and offer lower fuel consumption, making them highly attractive to airlines focused on operational cost reduction and sustainability goals. Leasing companies are capitalizing on this trend by providing airlines with access to these cutting-edge aircraft, which often come with flexible leasing structures. As airlines are under increasing pressure to comply with stringent environmental regulations and achieve sustainability targets, the need to modernize fleets has intensified. Leasing provides an attractive option, enabling airlines to avoid the capital expense of purchasing new aircraft while maintaining a fleet that meets modern requirements for efficiency, safety, and environmental impact.

Market Challenges

High Capital Investment Requirements:

The high capital investment required for aircraft procurement remains a significant challenge for the USA commercial aircraft leasing market. Aircraft are expensive assets, often costing hundreds of millions of dollars per unit. This creates a barrier for smaller airlines and leasing companies seeking to expand their fleets or enter the market. The cost of maintaining and servicing aircraft further adds to financial burdens. As a result, leasing companies must secure large amounts of capital, either through debt or equity financing, to acquire aircraft, which can be difficult in periods of economic uncertainty. Smaller leasing companies are particularly affected as they may not have the same access to capital as larger players. In addition, the long payback periods associated with aircraft leases mean that leasing companies must carefully manage their financial risk, which can be challenging in volatile markets. Despite this, the leasing model remains attractive due to the flexibility it offers airlines in terms of financing, allowing them to adapt to market conditions without making large upfront investments.

Regulatory and Compliance Constraints:

The USA commercial aircraft leasing market faces significant regulatory and compliance challenges, particularly as airlines and leasing companies must comply with a complex array of national and international regulations. For example, stringent emissions regulations and environmental policies mandate that airlines operate fuel-efficient and low-emission aircraft. Leasing companies must ensure that their fleets comply with these regulations, which may require substantial investment in fleet upgrades or the acquisition of newer models. Additionally, the regulatory environment governing aircraft safety, maintenance, and airworthiness requires leasing companies to adhere to strict guidelines, which can increase operational costs and administrative burdens. Moreover, international aviation agreements and trade restrictions can impact the ability of leasing companies to operate in certain regions, limiting their market opportunities. These regulatory constraints can complicate the leasing process, increase costs for lessors and lessees, and reduce the flexibility that airlines and leasing companies need to operate in an increasingly complex and highly regulated environment.

Opportunities

Growth in Low-Cost Carriers and Regional Airlines:

The rapid expansion of low-cost carriers (LCCs) and regional airlines presents a significant opportunity for the USA commercial aircraft leasing market. These airlines rely heavily on leased aircraft due to the lower upfront cost and flexibility leasing offers. As the demand for budget-friendly travel continues to rise, LCCs are increasingly expanding their fleets to cater to new routes and destinations, particularly in underserved regions. Regional airlines also benefit from leasing, as it allows them to scale their operations quickly without the substantial capital investment required to purchase aircraft. This trend is expected to continue as both low-cost and regional carriers expand their services, especially with the increasing consumer preference for affordable travel options. Leasing companies will continue to benefit from this growing market segment, as airlines look to diversify their fleets and meet the rising demand for budget-friendly air travel.

Expanding Cargo Aircraft Leasing Market:

Another significant opportunity for the USA commercial aircraft leasing market lies in the growing demand for cargo aircraft. With the rise of e-commerce and global trade, the demand for air freight has surged, especially in sectors such as pharmaceuticals, electronics, and consumer goods. Airlines and logistics companies are increasingly seeking to expand their air cargo fleets to meet the growing demand for fast and efficient delivery services. Leasing companies have the opportunity to cater to this need by offering specialized freighter aircraft on lease. Additionally, the ongoing trend of converting passenger aircraft into freighters presents another growth avenue for leasing companies. As e-commerce continues to expand globally, the air cargo sector’s growth will drive demand for leased freighter aircraft, providing leasing companies with a lucrative opportunity to enhance their portfolios and increase revenue.

Future Outlook

Over the next five years, the USA commercial aircraft leasing market is expected to continue its growth trajectory, driven by factors such as the ongoing recovery of global air travel, increasing fleet modernization, and rising demand for low-cost and regional carriers. Technological advancements in aircraft design, including the use of fuel-efficient engines and sustainable materials, will shape the future of leasing. Regulatory support for sustainability and environmental concerns will also play a key role, as airlines and leasing companies adapt to stricter emissions standards. As the global aviation industry rebounds from recent challenges, the demand for both passenger and cargo aircraft leasing is expected to remain strong, with leasing companies focusing on fleet diversification and service flexibility to meet evolving market needs.

Major Players

- AerCap

- Air Lease Corporation

- SMBC Aviation Capital

- Avolon

- BOC Aviation

- GECAS

- Nordic Aviation Capital

- ICBC Leasing

- Orix Aviation

- FPG Amentum

- Macquarie AirFinance

- Airstream Leasing

- Wells Fargo Leasing

- AWAS

- Hainan Airlines Leasing

Key Target Audience

- Airlines

- Leasing companies

- Aircraft manufacturers

- Freight operators

- Private jet operators

- Investment firms

- Government agencies

- Financial institutions

Research Methodology

Step 1: Identification of Key Variables

Aircraft leasing market dynamics are analyzed by identifying key drivers, challenges, and opportunities in both the leasing and airline sectors.

Step 2: Market Analysis and Construction

Comprehensive market sizing, segmentation, and growth estimation are carried out using historical and current data.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts validate findings through interviews, surveys, and consultations.

Step 4: Research Synthesis and Final Output

Data is synthesized to generate a clear and concise report based on market insights and expert input.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Air Travel Demand

Rise in Global Cargo Transport

Technological Advancements in Aircraft Efficiency

Government Support for Aviation Infrastructure

Expanding Low-Cost Carrier Fleet - Market Challenges

Fluctuating Fuel Prices

High Operational Costs for Leasing Companies

Regulatory Compliance and Environmental Regulations

Changing Geopolitical Tensions Affecting Airline Operations

Shortage of Skilled Workforce in Aircraft Maintenance - Market Opportunities

Expansion in Emerging Markets

Technological Integration for Fuel Efficiency

Increased Demand for Sustainable Aircraft Leasing - Trends

Growth of Aircraft Fleet Management Solutions

Integration of AI in Aircraft Leasing Operations

Demand for Flexible Leasing Terms

Rise of Sustainable Aviation Solutions

Technological Innovation in Aircraft Leasing Practices - Government Regulations & Defense Policy

Aircraft Environmental Regulations

Safety Standards and Compliance

Aviation Taxation and Subsidies - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Narrow-Body Aircraft Leasing

Wide-Body Aircraft Leasing

Freighter Aircraft Leasing

Regional Aircraft Leasing

New Aircraft Leasing - By Platform Type (In Value%)

Airline Platforms

Private and Charter Platforms

Freight Platforms

Cargo Platforms

Leisure Travel Platforms - By Fitment Type (In Value%)

Standard Fitment Solutions

Customized Aircraft Leasing Solutions

High-Capacity Leasing Solutions

Aircraft Fleet Leasing Solutions

Short-Term Leasing Solutions - By EndUser Segment (In Value%)

Commercial Airlines

Cargo Operators

Private and Charter Operators

Leisure Travel Providers

Government and Military Agencies - By Procurement Channel (In Value%)

Direct Procurement

Fleet Management Companies

Leasing Firms

Third-Party Aviation Brokers

Airline Partnerships - By Material / Technology (In Value%)

Composite Materials

Advanced Avionics Systems

Aerodynamic Enhancements

Fuel-Efficient Technologies

Flight Control Systems

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Material, Leasing Duration, Fleet Management, Financial Solutions, Aircraft Condition) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

AerCap

Avolon

GECAS

SMBC Aviation Capital

BOC Aviation

Air Lease Corporation

Nordic Aviation Capital

Dae Capital

ICBC Leasing

Avation PLC

Engine Lease Finance

Aviation Capital Group

AWAS

Gama Aviation

Wheels Up

- Increased Demand from Low-Cost Carriers

- Growth of Air Cargo Operations

- Private Charter and Leisure Travel Market Expansion

- Government and Military Use of Leased Aircraft

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035