Market Overview

The USA Connected Car Data Services market generated a revenue of USD ~ million in ~, representing the portion of the broader connected car ecosystem that deals specifically with vehicle data generation, transmission, storage, analytics, and API services for enterprise applications. Growth in connected vehicle adoption, increasing demand for telematics data in insurance and fleet management, and expansions in ~ connectivity infrastructure have been the primary growth levers. Over ~ million connected car users are projected in the U.S., supporting strong demand for data-rich services that drive safety, maintenance, and usage-based applications.

Major U.S. cities such as Detroit, Austin, San Francisco, and Seattle dominate the market due to dense automotive OEM ecosystems (Detroit), advanced tech and software integration hubs (San Francisco–Silicon Valley, Seattle), and rapid technology adoption among fleet operators and mobility service providers (Austin). These clusters benefit from proximal access to both automotive manufacturers and digital platforms, accelerating data services deployment and enterprise partnerships.

Market Segmentation

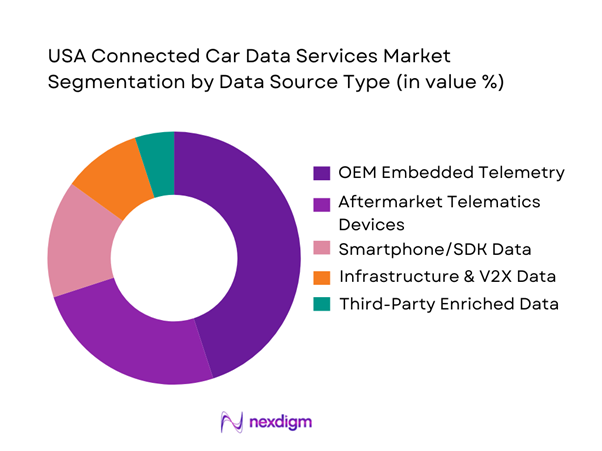

By Data Source Type

The OEM Embedded Telemetry segment holds dominance due to the proliferation of factory-installed telematics in modern vehicles, which provide high-quality, consistent vehicle and driver data streams with lower latency than aftermarket options. OEM embedded systems benefit from direct access to the vehicle network, enabling richer datasets that include sensor telemetry, diagnostics, ADAS events, and secure VIN-level identifiers. These datasets are highly valued by enterprises for predictive analytics and real-time services, driving stronger monetization opportunities for data aggregators and service providers. Aftermarket telematics devices maintain share due to their retrofit capabilities for older fleets. Smartphone/SDK and infrastructure data are rising as supplementary sources, particularly for mobility analytics and smart city applications.

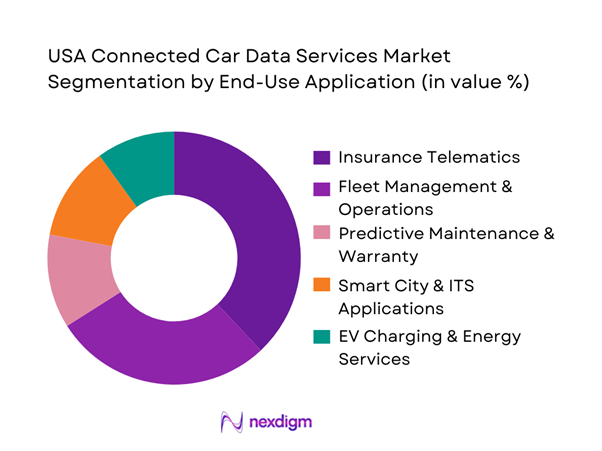

By End-Use Application

Within End-Use Applications, Insurance Telematics leads the connected car data services market due to wide adoption of Usage-Based Insurance programs in the U.S., where insurers rely on continuous driving behavior data to price risk more accurately. Major insurance carriers integrate driver behavior, trip data, and safety scores to reduce loss ratios and offer personalized premiums. Fleet management follows closely, driven by demand for route optimization, utilization analytics, and compliance reporting in commercial logistics fleets. Predictive maintenance services gain traction as OEMs and service networks use vehicle data to forecast parts failures, reduce downtime, and optimize service intervals. Emerging segments such as Smart City traffic optimization and EV charging analytics are gaining momentum but currently represent smaller portions of the overall market.

Competitive Landscape

The competitive landscape of the USA Connected Car Data Services market is consolidated around a mix of OEM-owned platforms, telematics specialists, and data-centric analytics firms. These key players leverage proprietary datasets, large, connected vehicle installed bases, and extensive partner networks to compete.

| Company | Est. Year | Headquarters | Primary Focus | Data Access Type | Enterprise Customer Reach | API/Platform Capabilities | Connectivity Partnerships |

| General Motors (OnStar) | 1995 | Detroit, USA | ~ | ~ | ~ | ~ | ~ |

| Ford (Ford Pro) | 1903 | Detroit, USA | ~ | ~ | ~ | ~ | ~ |

| Toyota Connected North America | 2018 | Plano, USA | ~ | ~ | ~ | ~ | ~ |

| Verizon Connect | 2016 | USA | ~ | ~ | ~ | ~ | ~ |

| Geotab | 2000 | Canada/USA | ~ | ~ | ~ | ~ | ~ |

USA Connected Car Data Services Market Analysis

Growth Drivers

OEM data commercialization

U.S. OEM data monetization is accelerating because the addressable “data exhaust” is now tied to a very large driving base: Americans drove ~ billion miles in the latest full-year federal traffic trend reporting, which translates into billions of location, speed, braking, and environmental telemetry events that can be productized into safety, mapping, EV routing, diagnostics, and residual value signals. At the same time, the macro capacity to pay for data products remains strong: the U.S. economy is listed at USD ~ billion in nominal output with USD ~ income per person in the IMF WEO database, enabling OEMs to position data services as a recurring B2B line item across insurers, fleets, media, and public-sector users. OEMs are also pushed by compliance economics: federal safety investigations and defect-management cycles increasingly expect faster detection, traceability, and field performance evidence, and connected telemetry supports early-warning and campaign efficiency at scale (especially for software-defined vehicles and OTA update ecosystems). Together, very high national driving activity measured in miles, strong macro output/income base, and higher governance expectations for data-backed safety operations are making OEM data commercialization a core profit lever rather than a pilot initiative.

Fleet digital transformation

Fleet demand is pulling connected car data services from “nice-to-have” into daily operations because U.S. mobility is still extremely large in absolute usage: federal traffic trends show ~ billion miles traveled in the year, meaning fleets are managing routing, idle time, utilization, maintenance, and driver risk across an enormous mileage footprint where small per-mile improvements translate into meaningful operational wins. Macro conditions also support continued spend on productivity tooling: the IMF WEO database places U.S. nominal output at USD ~ billion and unemployment at ~, which typically correlates with tight labor availability and higher motivation to digitize dispatch, compliance, and vehicle health to “do more with the same headcount.” Data services are increasingly used to evidence compliance and reduce downtime: predictive maintenance and remote diagnostics reduce unscheduled shop events, while geofencing, analytics, and incident reconstruction help manage safety programs and liability exposure. Finally, U.S. public investment is modernizing the digital backbone that fleets connect into, creating more incentive to subscribe to data products that integrate with public programs and municipal platforms. Overall, very high national miles traveled, productivity pressure reflected in macro conditions, and expanding ITS modernization funding are directly amplifying fleet-led demand for connected vehicle data services.

Challenges

Privacy and consent friction

Privacy and consent are a frontline constraint for connected car data services in the U.S. because enforcement has become real and public: actions tied to alleged sharing or sale of sensitive location and driver behavior data raise perceived risk for OEMs, data brokers, and downstream buyers and force program redesign around explicit permissioning, minimization, and auditable governance. This friction directly affects revenue velocity: enterprises slow procurement when they fear reputational or regulatory exposure, even if the data could reduce crashes or improve underwriting accuracy. The macro picture matters here too: the IMF WEO database lists U.S. inflation at ~ and unemployment at ~, pushing organizations to prioritize initiatives with clear compliance certainty and measurable ROI, not programs that might trigger consent disputes or customer backlash. Another practical hurdle is consent UX: connected vehicle consent often spans in-vehicle prompts, mobile apps, dealer paperwork, and third-party terms, creating a multi-surface journey where drop-off or confusion is common. When consent is not cleanly recorded, buyers cannot safely use data for underwriting, marketing, or location analytics.

Opt-out complexity

Opt-out complexity is a serious operational barrier because U.S. connected data programs frequently require honoring different opt-out rights across states, channels, and identity contexts. This is no longer theoretical: a growing set of state consumer privacy laws is taking effect across multiple states, which increases the compliance surface area for any nationwide data product. The scale challenge is amplified by the sheer usage base: Americans drive ~ billion miles annually, meaning opt-out handling is not a niche workflow—if even a small fraction of drivers change preferences, the event volume is large and must be reflected downstream in partner datasets and analytics models quickly to avoid misuse. Macro conditions also matter: with U.S. nominal output at USD ~ billion and per-capita income at USD ~, consumer expectations around digital rights, transparency, and recourse tend to be higher, and complaints can scale fast through legal and media channels. Practically, opt-out complexity forces vendors to build identity resolution across devices, preference propagation across multi-tenant data pipelines, and audit trails that prove suppression was applied. It also creates data gaps that can bias models if opt-out is correlated with demographics or geography, raising both fairness and performance concerns. So even though opt-out is a consumer right, the implementation burden is a meaningful brake on market speed.

Opportunities

Privacy-preserving data collaboration

A major near-term opportunity is to scale privacy-preserving collaboration models, where OEMs, insurers, fleets, and cities can extract value from connected data without exposing raw personal traces. The trigger is clear: enforcement actions tied to connected-vehicle data practices increase the cost of traditional sharing, which pushes the ecosystem toward minimization, aggregation, and controlled analysis methods that keep sensitive data compartmentalized. This opportunity is backed by scale economics: the U.S. travel base of ~ billion miles annually means even aggregated analytics can be statistically powerful without identifying individuals, creating room for compliant products that still deliver high utility. The macro environment supports the necessary platform investment: IMF WEO reports U.S. per-capita income at USD ~ and nominal output at USD ~ billion, enabling large enterprises to fund secure collaboration infrastructure, third-party audits, and governance tooling as part of procurement. Public-sector ITS modernization is another accelerator, creating more safe use cases where privacy-preserving aggregation is a default expectation. Providers that package privacy-by-design as a product feature can win faster approvals and expand into regulated buyers that are currently cautious.

Clean-room based insurer/OEM programs

Clean-room style programs are a high-potential opportunity in the U.S. because they directly address consent, opt-out, and cross-state compliance friction while still enabling underwriting and claims insights. The demand is fueled by regulatory reality: connected-vehicle data enforcement signals raise the risk of open-ended sharing, making analyze-without-exposing architectures commercially attractive to both OEMs and insurers. Scale makes clean rooms worth it: annual U.S. travel totals of ~ billion miles mean that even restricted-scope analysis can generate highly stable models if governance is robust. Macro indicators support near-term buyer readiness: IMF WEO shows unemployment at ~ and inflation at ~, conditions that generally push insurers to pursue efficiency gains without taking on compliance surprises. Clean rooms can also incorporate jurisdiction-specific rules, allowing a single insurer/OEM partnership to operate nationally while enforcing state-level restrictions in code. That reduces legal overhead and increases speed-to-scale. The providers that win here will be those who combine cryptographic governance and access logging, standardized telematics feature definitions across OEMs, and integration into insurer decision workflows without ever positioning the product as data resale.

Future Outlook

The USA Connected Car Data Services Market is poised for robust expansion as vehicle connectivity becomes ubiquitous and data monetization models mature. Growth will be driven by the shift from basic telematics to data-driven value services, including predictive maintenance, real-time risk scoring, EV charging optimization, and smart infrastructure integration. Increasing deployment of ~, enhanced privacy-compliant data sharing frameworks, and expanding partnerships between OEMs, insurers, and technology platforms will catalyze higher adoption of data services. A continued focus on cybersecurity and data governance will shape market structures, with value migrating toward firms offering secure, interoperable data ecosystems. Integrations of AI/ML for predictive insights and clean-room data collaboration will enable deeper enterprise insights while safeguarding consumer privacy.

Major Market Players

- General Motors

- Ford

- Toyota Connected North America

- Verizon Connect

- Geotab

- AT&T IoT/Connected Car

- Samsara Inc.

- Otonomo Mobility Data Platform

- High Mobility

- HERE Technologies

- TomTom Telematics

- LexisNexis Risk Solutions

- Arity

- Bosch Connected Mobility Solutions

Key Target Audience

- Automobile OEM Product Strategy Teams

- Insurance & Reinsurance Risk/Data Leaders

- Commercial Fleet Digital Transformation Heads

- Telecom Operators & IoT Connectivity Strategy

- Automotive Software & Mobility Platform Product Leaders

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Smart City Implementation & Transportation Agencies

Research Methodology

Step 1: Identification of Key Variables

We mapped the ecosystem of connected car data, defining variables such as data sources, connectivity technologies, enterprise applications, and regulatory frameworks. Secondary sources and proprietary databases provided foundational data for segmentation classification.

Step 2: Market Analysis and Construction

Historical revenue data for the connected car and telematics services were compiled using validated industry reports. We de-constructed overall connected vehicle revenues to isolate the data services market. Market sizing was triangulated using bottom-up revenue models from OEM data monetization, telematics subscription counts, and enterprise service fees.

Step 3: Hypothesis Validation and Expert Consultation

We conducted interviews with industry professionals in OEM connectivity teams, fleet services, telematics providers, and insurer data analytics leads to validate assumptions about adoption rates, data-usage patterns, and pricing models. These expert insights were used to refine forecasts and segment weightings.

Step 4: Research Synthesis and Final Output

Quantitative data, expert inputs, and trend analysis were consolidated to produce a validated market projection. Sensitivity analysis tested variations in adoption curves, regulatory impacts, and technological shifts to ensure robust forecasting.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Scope Boundary for “Connected Car Data Services”, Market Engineering and Triangulation Approach, OEM/Telematics Partner Mapping, Data Monetization Value-Chain Mapping, Primary Interviews Across OEMs–MNOs–Insurers–Fleets–Data Platforms, Validation Using Public Filings/Regulatory Releases/Standards Bodies, Limitations and Confidence Scoring)

- Definition and Scope

- Market Genesis and Evolution of Vehicle Data Monetization

- Connected Vehicle Data Value Chain and Stakeholder Roles

- Business Cycle and Demand Cyclicality Drivers

- Data Supply Chain and Value Chain Analysis

- Growth Drivers

OEM data commercialization

Fleet digital transformation

Insurer telematics underwriting

EV telemetry growth

ITS modernization - Challenges

Privacy and consent friction

Opt-out complexity

Cross-state compliance

Data quality and standardization gaps

OEM gating and walled gardens - Opportunities

Privacy-preserving data collaboration

Clean-room based insurer/OEM programs

EV charging + energy services datasets

ADAS safety analytics

Municipal data partnerships - Trends

Shift from “data sales” to “outcome-as-a-service”

Rise of OEM-owned DaaS arms

API-first marketplaces

Real-time streaming

Synthetic/aggregated mobility products - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- By Value, 2019–2024

- Installed Base, 2019–2024

- Installed Base, 2019–2024

- By Value, 2019–2024

- Installed Base, 2019–2024

- By Technology Architecture (in Value %)

OEM embedded telematics

Aftermarket OBD-II dongles

Smartphone SDK/app-derived

Roadside/RSU infrastructure feeds

Third-party enrichment datasets

Satellite/IoT hybrid feeds - By Application (in Value %)

Data aggregation and normalization

VIN-specific consented data access

Anonymized/blurred mobility intelligence

Real-time streaming APIs

Batch data products

Analytics and modeling

Data marketplace brokerage

Identity resolution and matching - By Application (in Value %)

Usage-based insurance and risk scoring

Claims and FNOL enablement

Fleet operations and compliance

Predictive maintenance and warranty analytics

EV charging/energy optimization - By End-Use Industry (in Value %)

OEMs and captive finance

Insurers and reinsurers

Commercial fleets and fleet managers

Mobility platforms and marketplaces

Government and transportation agencies - By Connectivity Type (in Value %)

4G LTE

5G

Wi-Fi/cellular hybrid

C-V2X cellular sidelink

DSRC legacy deployments - By Technology Architecture (in Value %)

REST APIs

Webhooks/event streams

SDK integrations

Secure file transfer/batch

Clean-room mediated sharing - By Region (in Value %)

Northeast

Midwest

South

West

Cross-state regulatory hotspots and large-fleet corridors

- Market Structure and Competitive Intensity

- Cross Comparison Parameters (OEM connectivity coverage and partner access breadth, VIN-consented data capability and consent UX, data freshness/latency and streaming readiness, normalization depth and schema interoperability, enrichment stack and analytics/model library depth, privacy-preserving sharing controls and auditability, cybersecurity posture and certifications, commercial model flexibility and contracting SLAs)

- SWOT Analysis of Major Players

- Partnership and Alliance Map

- Pricing and Packaging Benchmarks

- Detailed Profiles of Major Companies

OnStar

Ford Pro

Mobilisights

Toyota Connected North America

Aeris Communications

Verizon Connect

AT&T Connected Car / AT&T IoT

Geotab

Samsara

HERE Technologies

TomTom

Urgently

High Mobility

LexisNexis Risk Solutions

- Demand and Utilization Patterns

- Budget Ownership and Spend Centers

- Key Buying Criteria

- Needs, Desires, and Pain Points

- Decision-Making Process

- By Value, 2025–2030

- Installed Base, 2025–2030

- Installed Base, 2025–2030

- By Value, 2025–2030

- Installed Base, 2025–2030