Market Overview

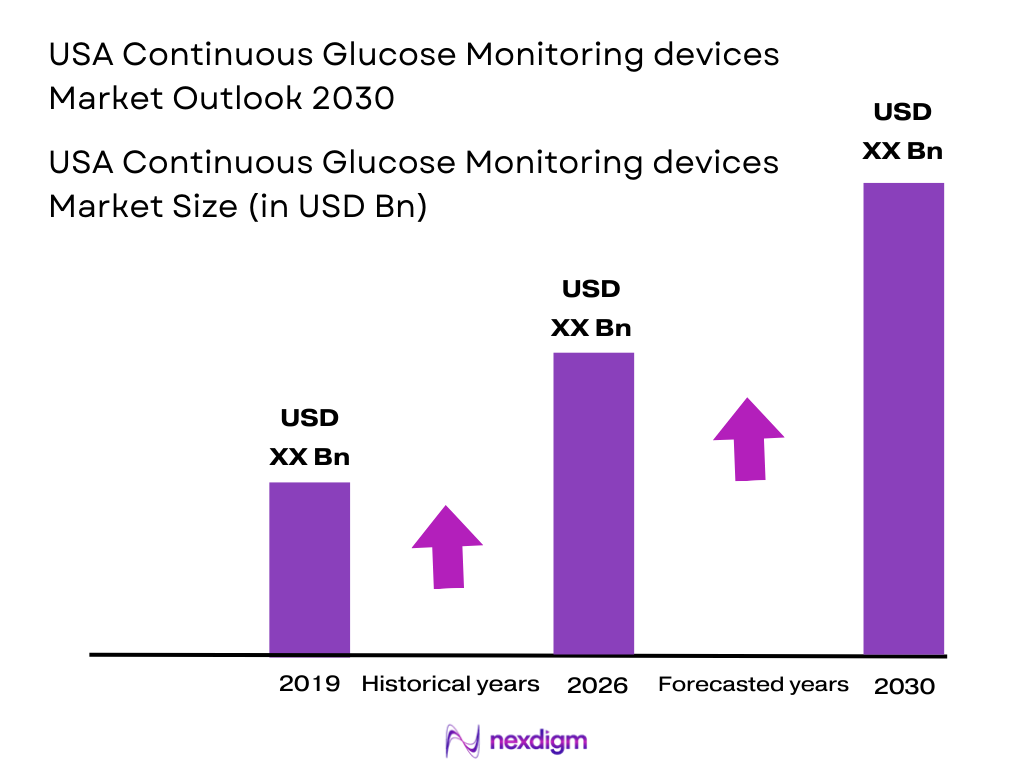

The U.S. Continuous Glucose Monitoring (CGM) devices market is valued at approximately USD ~ billion, driven by increasing diabetes prevalence and the rising demand for personalized healthcare solutions. With over ~ million people diagnosed with diabetes in the U.S. in 2025, the market continues to expand due to the growing adoption of CGM devices among both Type 1 and Type 2 diabetes patients. Additionally, advancements in technology and FDA approvals for over-the-counter (OTC) use have bolstered demand. The shift towards wearable devices and real-time monitoring solutions is expected to further fuel market growth, as these devices offer enhanced glucose control and better disease management compared to traditional methods.

The United States dominates the CGM market due to its extensive healthcare infrastructure and widespread adoption of advanced medical technologies. Key cities like New York, Los Angeles, and Chicago are major hubs for healthcare innovation, research, and access to specialized medical care. The market is also influenced by high patient awareness, the availability of insurance coverage for CGM devices, and regulatory support from entities such as the FDA. In addition to strong demand from major urban centers, the rural areas are also seeing increasing penetration of CGM devices due to the expansion of telemedicine and digital health initiatives.

Market Segmentation

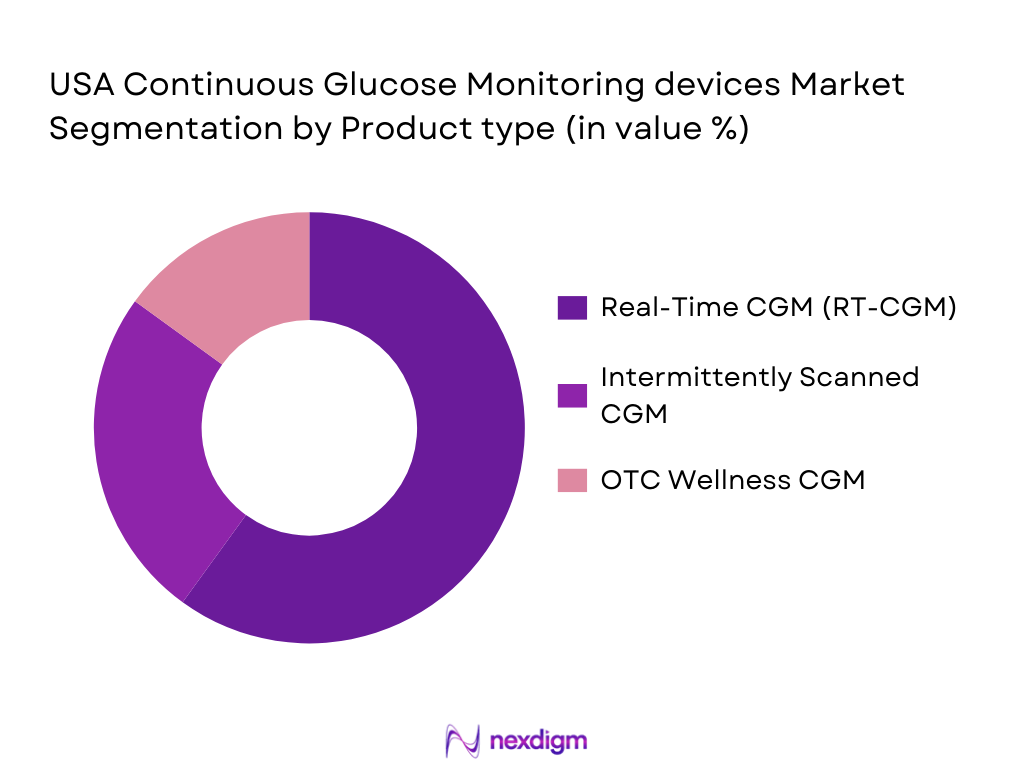

By Product Type

The U.S. CGM market is segmented by product type into Real-Time CGM (RT-CGM), Intermittently Scanned CGM (iCGM), and Over-the-Counter (OTC) Wellness CGM devices. The RT-CGM devices dominate the market due to their real-time glucose monitoring capabilities and integration with insulin pumps, making them particularly useful for individuals managing Type 1 diabetes. The increasing approval for OTC devices is gradually gaining market traction as more individuals use CGMs for lifestyle and wellness purposes. Real-time monitoring has shown considerable advantages in terms of glycemic control, driving the preference for these products.

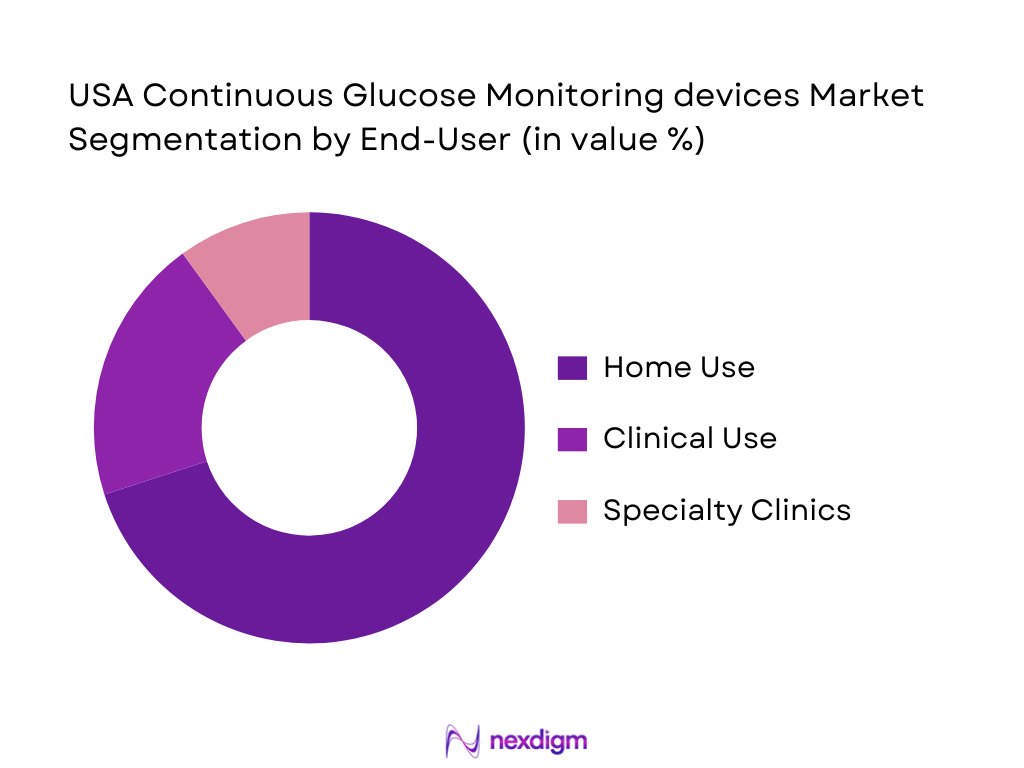

By End-User

The end-user segmentation of the U.S. CGM market consists of home use, clinical use, and specialty clinics. Home use devices hold the largest share, as patients prefer the convenience of monitoring glucose levels from the comfort of their homes. The increased number of diabetes patients managing their condition through home care is a key factor in the dominance of this segment. Clinical use, particularly in hospitals and healthcare settings, is also significant but tends to be more focused on acute care management. Specialty clinics, especially those focused on endocrinology, contribute a smaller, but growing share due to their specialized care.

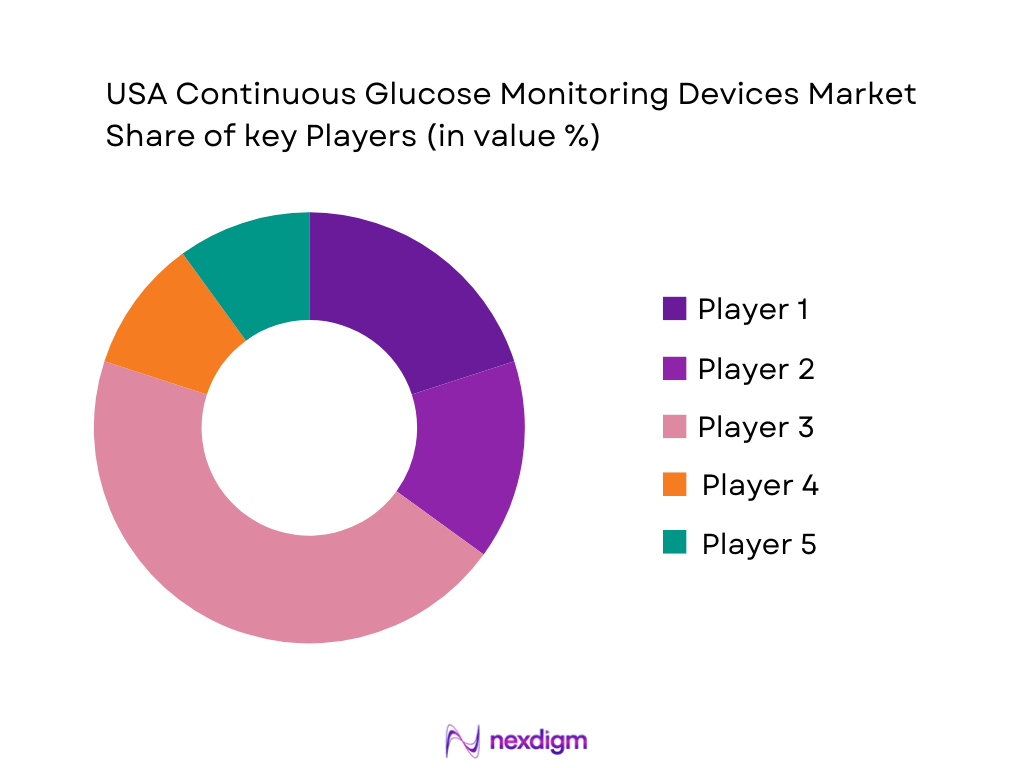

Competitive Landscape

The U.S. CGM market is competitive, with several dominant players driving innovation and market growth. Major players like Dexcom, Abbott, and Medtronic have established strong positions due to their technological advancements, brand recognition, and extensive distribution networks. These companies continue to invest in research and development to enhance the accuracy, wearability, and affordability of CGM devices, keeping them ahead of emerging competitors. Smaller players, such as Senseonics and i-SENS, are also focusing on niche innovations like sensor longevity and integration with fitness devices to capture emerging demand from non-diabetic users.

| Company | Establishment Year | Headquarters | Product Portfolio | Market Focus | Technological Innovations |

| Dexcom | 1999 | San Diego, California | ~ | ~ | ~ |

| Abbott | 1888 | Abbott Park, Illinois | ~ | ~ | ~ |

| Medtronic | 1949 | Minneapolis, Minnesota | ~ | ~ | ~ |

| Senseonics | 2004 | Germantown, Maryland | ~ | ~ | ~ |

| i-SENS | 2002 | Seoul, South Korea | ~ | ~ | ~ |

USA Continuous Glucose Monitoring Devices Market Analysis

Growth Drivers

Urbanization

The U.S. has witnessed rapid urbanization, with over ~ % of its population residing in urban areas in 2025, as per the World Bank. This urban shift plays a critical role in the increased demand for healthcare technologies like continuous glucose monitoring (CGM). Urbanization brings about higher disposable income, increased healthcare access, and a greater concentration of healthcare providers, facilitating better adoption of advanced medical devices. Urban residents are also more likely to embrace health-conscious lifestyles and technologies, such as CGMs, to manage chronic diseases like diabetes. The rise in the urban population directly supports the demand for CGM devices in cities where healthcare infrastructure is robust and highly accessible.

Industrialization

Industrialization has been a driving force for the U.S. healthcare sector, particularly in the development and adoption of medical technologies such as CGMs. The expansion of manufacturing industries and technological infrastructure in the U.S. supports research and innovation in health devices. The U.S. industrial sector is expected to grow at an annual rate of ~ % in 2025 according to the International Monetary Fund (IMF). This growth not only contributes to the economy but also supports the healthcare industry by fostering innovation and the production of advanced healthcare solutions like CGMs. Moreover, industrialization has facilitated the increased availability of advanced diagnostics and health monitoring devices, which directly benefits diabetes patients in terms of easier access to CGM systems.

Restraints

High Initial Costs

The high initial costs associated with CGM devices continue to pose a restraint for widespread adoption in the U.S. market. According to the Centers for Medicare and Medicaid Services (CMS), in 2025, the average price of a CGM sensor kit is approximately USD ~ for a 90-day supply. Although the U.S. government supports CGM use through Medicare for qualifying patients, the upfront costs remain prohibitive for those without insurance or under private plans. This financial barrier limits the broader adoption of CGM devices among middle-income groups, despite their increasing popularity. With rising healthcare costs in the U.S., this barrier is expected to continue limiting access for a significant portion of the population.

Technical Challenges

Technical challenges also hinder the growth of the CGM market. While CGMs are highly effective for real-time glucose monitoring, issues such as sensor calibration errors, signal interference, and battery life limitations persist. According to the Food and Drug Administration (FDA), there have been recalls for certain CGM models due to inaccuracies and reliability concerns, which can undermine consumer trust. Moreover, sensor wear-time is limited, with most CGMs requiring replacements every 7-14 days. These technical limitations slow the widespread adoption of CGMs, as patients and healthcare providers seek solutions with greater accuracy and longevity. Addressing these challenges remains a crucial focus for manufacturers in the coming years.

Opportunities

Technological Advancements

Technological advancements in CGM devices present a promising opportunity for market growth. As of 2025, more than ~ % of CGM users in the U.S. have access to real-time glucose data through mobile apps integrated with CGM devices, enhancing user experience. These advancements allow patients to monitor their glucose levels in real time, providing immediate feedback on diet, exercise, and insulin management. The integration of artificial intelligence (AI) and machine learning (ML) in CGM devices is poised to enhance the accuracy and predictive capabilities of these devices, further driving adoption. Current technological innovations, such as non-invasive glucose sensors, hold the potential to revolutionize the market, creating new opportunities for growth.

International Collaborations

International collaborations in the healthcare and medical device sectors offer significant growth opportunities for the CGM market. Companies in the U.S. are increasingly partnering with global healthcare providers and research organizations to expand the reach of CGM devices. As of 2025, the U.S. has been engaged in multiple research collaborations with European Union countries and other nations to develop and distribute advanced CGM technologies. These collaborations are expected to boost the market’s global presence, open new avenues for product development, and foster innovation in the diabetes management sector. Furthermore, international partnerships provide access to new markets with growing diabetes rates, creating a broader consumer base for CGM devices.

Future Outlook

Over the next 5 years, the U.S. CGM market is expected to show significant growth driven by continuous advancements in CGM technology, a growing number of diabetes cases, and the increasing shift towards preventive healthcare. The development of more affordable and accessible CGM systems, especially in the OTC segment, will likely expand the addressable market. Additionally, the integration of CGM with other digital health solutions, such as fitness trackers and smartphones, will offer new avenues for both medical and wellness applications.

Major Players in the Market

- Dexcom

- Abbott

- Medtronic

- Senseonics

- i-SENS

- A. Menarini Diagnostics

- Roche Diagnostics

- Ascensia Diabetes Care

- Ypsomed

- F. Hoffmann-La Roche AG

- Tandem Diabetes

- Nova Biomedical

- Trividia Health

- Insulet Corporation

- Arkray Inc.

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (FDA, CDC)

- Healthcare Providers (Hospitals and Clinics)

- Insurance Providers

- Pharmaceutical Companies

- Endocrinology Specialists

- Diabetes Patient Advocacy Groups

- Medical Device Manufacturers

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying the major variables that influence the U.S. CGM market, such as diabetes prevalence, technology adoption rates, and reimbursement policies. Data is gathered from reliable secondary sources including public health organizations and commercial databases, supplemented by insights from expert interviews.

Step 2: Market Analysis and Construction

In this phase, a comprehensive analysis is conducted on historical market data, covering market penetration rates, consumer demographics, and pricing models. This will include evaluating the market dynamics, demand patterns, and assessing the growth drivers and barriers.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses formulated during market analysis are validated through expert interviews, including consultations with diabetes specialists, device manufacturers, and healthcare providers. These insights help refine the market data and add depth to the analysis.

Step 4: Research Synthesis and Final Output

The final phase combines the data from previous steps and gathers direct feedback from key stakeholders in the market. This provides a complete picture of the current market landscape and offers actionable insights for future strategies and investment opportunities.

- Executive Summary

- Research Methodology (Market Definitions & CGM Technology Taxonomy (Invasive, Minimally Invasive, OTC Wellness), Data Sources (Medicare, FDA, Private Payer Claims, Industry Databases), Market Sizing & Forecast Approach (Top‑Down + Bottom‑Up), Estimation Method for Installed Base, Sensor Attachment Penetration, Wear‑Time Value Models, Primary Research Protocol (Physician Panels, Payer Interviews, Patient Journey Mapping), Assumptions & Constraints)

- Market Definition and Scope (CGM vs Traditional BGM vs Flash Monitoring)

- Healthcare Context

- Clinical Efficacy and Quality of Life Metrics

- Value Proposition Analysis (Real‑Time, Alert Latency, Hypo/Hyper Alerts)

- Market Genesis & Evolution (CGM Commercial Lifecycle)

- Era of Professional CGMs

- Home‑Use Clinical CGMs

- Expansion into Fitness/Wellness (OTC Apps)

- Historical Adoption Timeline (Innovation Milestones)

- U.S. Healthcare Reimbursement & Policy Framework

- Medicare/Medicaid Coverage Analyses

- Private Payer Reimbursement Dynamics

- Regulatory Positioning & FDA Guidance Implications

- Supply Chain/Value Chain Mapping

- OEM → Distributor → Retail/Clinic → End‑User

- Sensor Manufacturing, Calibration, Connectivity, After‑Sales Support

- Growth Drivers

Diabetes Prevalence & Early Diagnosis Trends (Epidemiological Pull)

Medicare Expansion for Non‑Insulin Basal Patients

OTC Approval & Consumer Wellness Adoption

IoT/AI Integration Enablers

Price Erosion & Sensor Reuse Models - Market Challenges

Coverage Limitations in Certain Patient Cohorts

Sensor Accuracy Constraints & FDA Safety Warnings

Competitive Pricing Pressure & Reimbursement Bottlenecks - Opportunities

AI‑Powered Decision Support

Next‑Gen Biomarker Fusion (metabolic health dashboards)

Enterprise Clinical Workflows Integration - Technology & Adoption Trends

Sensor Miniaturization & Wearability

Digital Therapeutics Linkages

Interoperability Standards - Regulatory & Compliance

- FDA Medical vs Low‑Risk Digital Health Classification

- Quality & Post‑Market Surveillance Requirements

- Porter’s Five Forces Analysis

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price of Platforms/Services, 2019-2025

- By Product Category (In Value %)

Real‑Time CGM (RT‑CGM) (Sensor Technology Efficacy)

Intermittently Scanned CGM

Over‑The‑Counter (OTC) Wellness CGM (Consumer Health Stack) - By Component (In Value %)

Sensors (Wearable Biosensor Units)

Transmitters (Wireless Connectivity Modules)

Receivers/Display Devices (Smartphone + Dedicated Readers) - By Wear‑Time Duration Protocol (In Value %)

7‑Day Sensors

10–14‑Day Sensors

15+‑Day Extended Wear - By End User (In Value %)

Home & Personal Use

Clinical/Hospital Use

Specialty Clinics (Endocrinology) - By Demographic (In Value %)

Adult

Pediatric & Adolescent

Wellness/Non‑Diabetes Segment

- Market Share

- Cross‑Comparison Parameters (Regulatory Approvals & Label Expansion (FDA Indications), Sensor Wear‑Time & Accuracy Index, Connectivity Ecosystem (App + API Integration), Reimbursement Footprint & Coverage Codes, Distribution Reach & Channel Depth, Pricing Tiers & ASP Bands, Clinical Evidence & Outcomes Studies Support, Innovation Pipeline & Patent Positioning)

- Competitive Positioning Matrix

- Strength vs Accessibility

- Clinical vs Wellness Focus

- Pricing Benchmarking (SKU Level)

- ASP Ranges by Category & Technology

- Detailed Company Profiles

Dexcom, Inc. (RT‑CGM Accuracy Leadership)

Abbott (FreeStyle Libre & OTC Lingo)

Medtronic plc

Senseonics Holdings, Inc.

Ypsomed AG

A. Menarini Diagnostics S.r.l.

Signos, Inc.

Phillips‑Medisize / Molex

F. Hoffmann‑La Roche Ltd. (Accu‑Chek Portfolio)

Ascensia Diabetes Care

ARKRAY, Inc.

WaveForm Technologies, Inc.

B. Braun Melsungen AG

i‑SENS, Inc.

Oura Labs (Platform Integration Partner)

- Clinical vs Consumer Adoption Patterns

- Utilization Behavior & Patient Compliance Indicators

- Budget Allocation & Payer Decision Models

- Pain Points & Preference Hierarchies

- Future Market Size by Value, 2026-2030

- Future Market Size by Volume, 2026-2030

- Average Frame Cost Outlook, 2026-2030