Market Overview

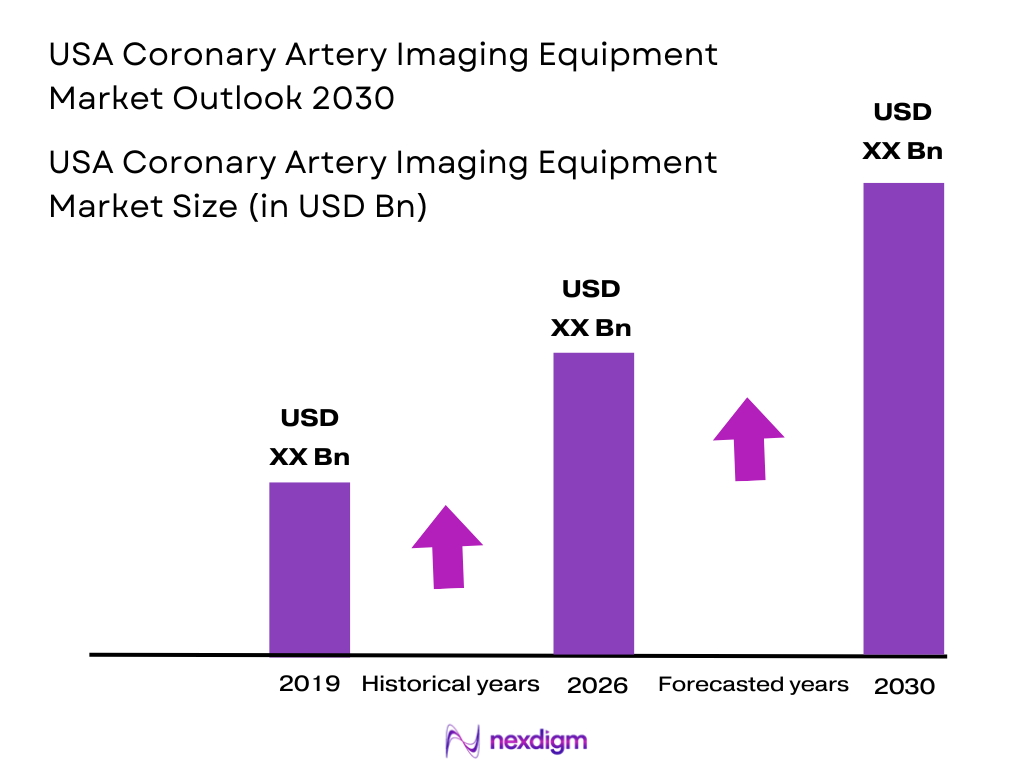

The USA Coronary Artery Imaging Equipment Market is valued at approximately USD ~ billion. The market’s growth is driven by the increasing prevalence of coronary artery disease (CAD), technological advancements in imaging modalities such as CT angiography, MRI, and intravascular ultrasound (IVUS), and the growing adoption of non-invasive diagnostic tools. The expanding healthcare infrastructure, particularly in hospitals and ambulatory surgical centers (ASCs), also propels the demand for these imaging devices. Moreover, initiatives for preventive healthcare and early diagnosis through improved imaging solutions are contributing significantly to the market’s expansion.

The USA market for coronary artery imaging is primarily dominated by regions such as New York, California, and Texas, which have robust healthcare facilities and advanced diagnostic infrastructure. The prominence of these states is due to their large urban population, high healthcare spending, and concentration of top-tier medical institutions. States like California also benefit from significant government funding in healthcare technology and innovation, leading to early adoption of advanced imaging modalities. The healthcare ecosystems in these regions provide a conducive environment for the growth of the coronary artery imaging market.

Market Segmentation

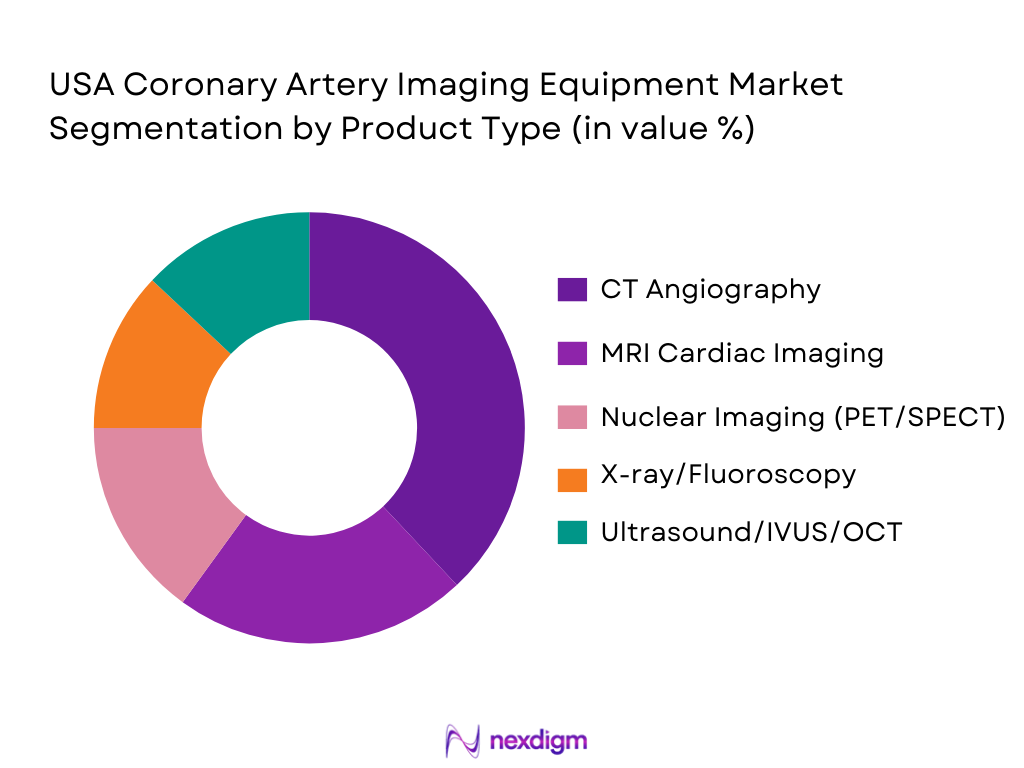

By Product Type

The USA coronary artery imaging equipment market is segmented by product type into major diagnostic imaging systems, including CT angiography (CCTA), MRI cardiac imaging, nuclear imaging (PET and SPECT), X-ray/fluoroscopy, and ultrasound (including IVUS and OCT). Among these, CT angiography holds a dominant position, accounting for a substantial share of the market in 2024. This dominance is attributed to its non-invasive nature, high resolution, and effectiveness in detecting coronary artery diseases early, particularly in emergency settings. Hospitals and diagnostic centers prefer CT angiography systems due to their fast-imaging capabilities and accurate coronary artery visualization, making it the first choice for clinicians.

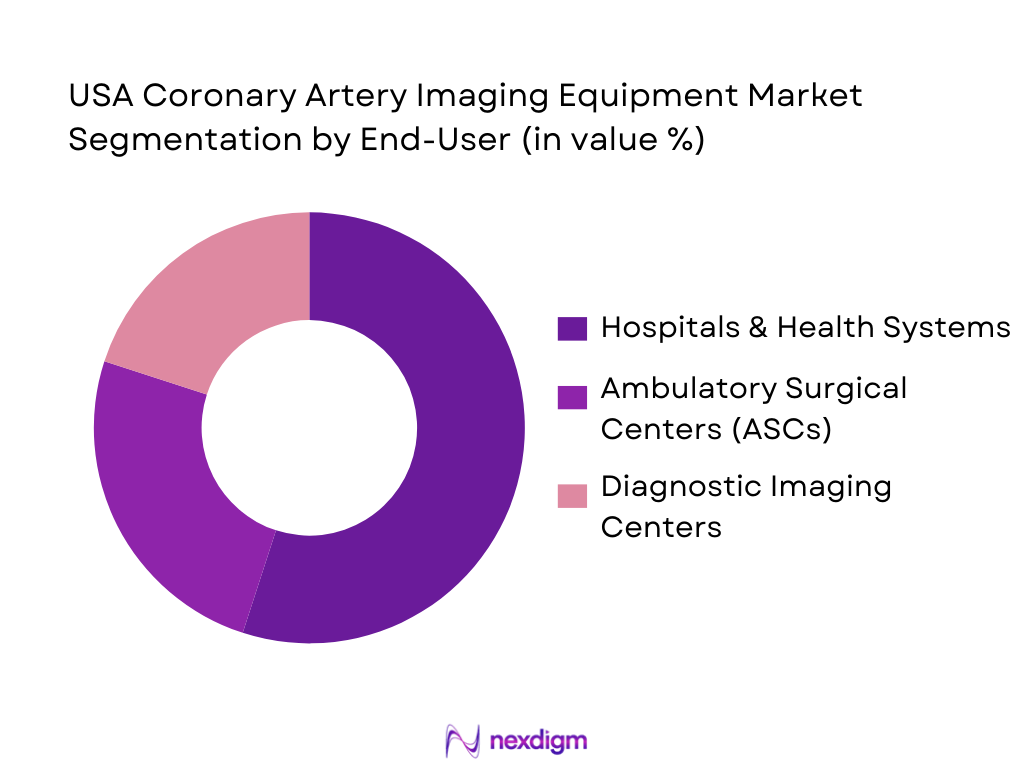

By End-User

The USA market for coronary artery imaging equipment is predominantly driven by hospital settings, followed by ambulatory surgical centers (ASCs) and diagnostic imaging centers. Hospitals account for the largest share due to their capacity to house multiple imaging modalities and the large patient volumes they handle. The advanced infrastructure, 24/7 availability of trained staff, and comprehensive patient management systems in hospitals make them the most significant end-user segment. Additionally, the increasing trend of cardiovascular disease diagnosis in outpatient settings, such as ASCs, is driving growth in the latter segment.

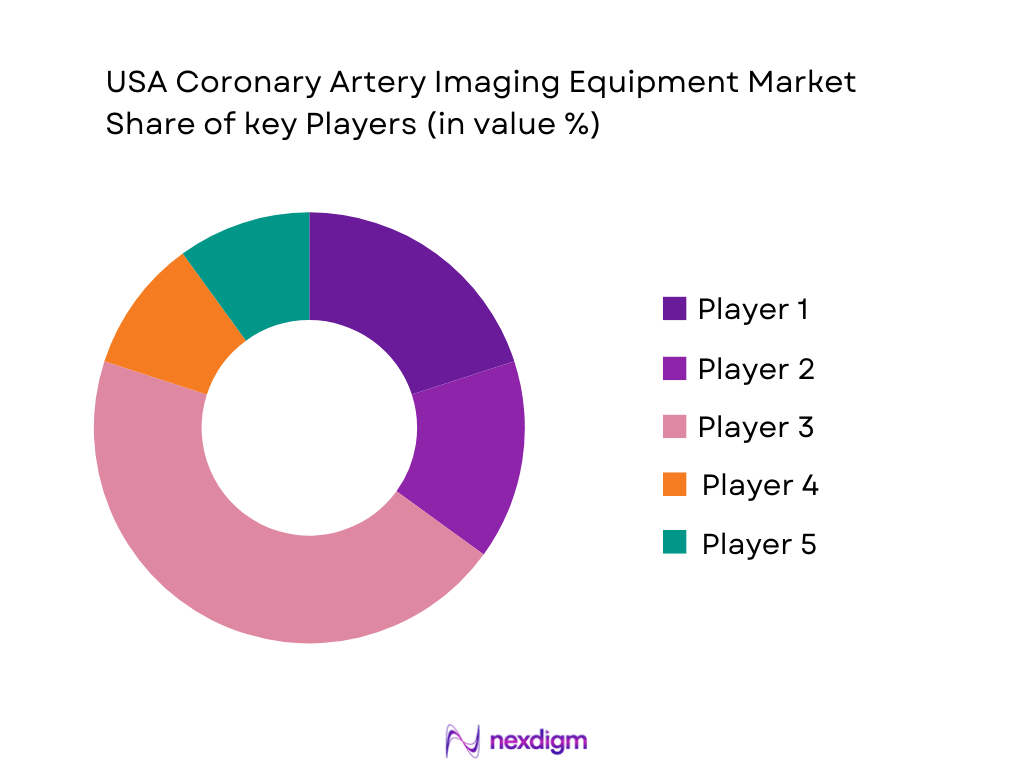

Competitive Landscape

The USA coronary artery imaging equipment market is characterized by a few key players, such as GE HealthCare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems, and Toshiba Medical. These companies dominate the market due to their continuous innovations in imaging technology, large product portfolios, and established distribution channels. Additionally, these players have a strong focus on expanding their presence in both hospitals and outpatient facilities, driving their competitiveness in the market. Moreover, their strong partnerships with healthcare providers and advanced R&D capabilities further consolidate their positions in the market.

| Company Name | Establishment Year | Headquarters | Market Share | Key Product Lines | Technological Advancements | Partnerships & Acquisitions |

| GE HealthCare | 1892 | Chicago, IL | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Erlangen, Germany | ~ | ~ | ~ | ~ |

| Philips Healthcare | 1891 | Amsterdam, Netherlands | ~ | ~ | ~ | ~ |

| Canon Medical Systems | 1933 | Tokyo, Japan | ~ | ~ | ~ | ~ |

| Toshiba Medical Systems | 1875 | Tokyo, Japan | ~ | ~ | ~ | ~ |

USA Coronary Artery Imaging Equipment Market Analysis

Growth Drivers

Urbanization

Urbanization in the United States is a major driver for the coronary artery imaging equipment market. As per the United Nations, the urban population in the U.S. has steadily increased, with over ~ % of the population now residing in urban areas as of 2024. This urban concentration has led to the development of advanced healthcare infrastructure and facilities, enabling greater access to high-quality diagnostic services, including coronary artery imaging. Urban centers like New York, Los Angeles, and Chicago have also seen rising healthcare investments, further expanding the adoption of advanced diagnostic technologies such as CT angiography and MRI. Moreover, urbanization drives the need for fast and efficient healthcare solutions, spurring the demand for imaging technologies that offer accurate, rapid diagnosis for coronary artery disease (CAD) detection.

Industrialization

The industrialization process in the U.S. has significantly contributed to the rise of lifestyle diseases such as coronary artery disease, further fueling the demand for coronary artery imaging equipment. The U.S. Bureau of Economic Analysis highlighted that the industrial sector accounted for approximately ~ % of the GDP in 2024, which is reflective of the ongoing economic growth and increased urbanization. As industries expand, so does the prevalence of sedentary lifestyles, leading to a surge in cardiovascular diseases. The increased number of individuals at risk of CAD has created a need for improved diagnostic technologies, driving the market for coronary artery imaging systems, especially in metropolitan regions where healthcare spending and awareness are higher.

Restraints

High Initial Costs

The high initial costs of coronary artery imaging equipment represent a significant restraint for market growth. According to the U.S. Department of Health and Human Services (HHS), healthcare spending reached ~ trillion in 2024, accounting for approximately ~ % of the U.S. GDP. While this indicates a robust healthcare sector, the adoption of high-tech equipment such as CT angiography systems and MRI machines is hindered by their steep initial costs. Hospitals and smaller healthcare facilities, particularly in rural areas, often face budgetary constraints when it comes to investing in such advanced diagnostic tools. This financial barrier slows down the widespread adoption of imaging systems, especially when lower-cost alternatives or non-invasive diagnostic methods are available.

Technical Challenges

The complexity of modern coronary artery imaging systems poses technical challenges for their widespread adoption. The integration of AI, 3D reconstruction, and hybrid imaging technologies into existing hospital infrastructures requires highly skilled personnel for setup and maintenance. Furthermore, the technology integration process demands significant investment in training programs. The U.S. Department of Labor has reported a growing shortage of skilled healthcare professionals, including radiologists and medical imaging technicians, which hinders the effective utilization of complex imaging systems. As of 2024, the U.S. faces a projected shortfall of over ~ radiologists by 2030, which further complicates the smooth adoption of advanced coronary imaging technologies.

Opportunities

Technological Advancements

Technological advancements in coronary artery imaging systems present significant opportunities for market growth. In 2024, advancements such as artificial intelligence (AI)-driven imaging technologies and enhanced 3D imaging have improved diagnostic accuracy and reduced procedural time for coronary artery disease detection. According to the U.S. National Institutes of Health (NIH), the introduction of AI algorithms in imaging systems has the potential to reduce diagnostic errors and improve the early detection of CAD. The use of AI is also driving the development of more affordable imaging solutions, creating new opportunities for expansion in outpatient clinics and ambulatory surgical centers (ASCs). Furthermore, the rise in demand for hybrid imaging technologies, such as PET/CT and PET/MRI, is reshaping the diagnostic landscape, enabling physicians to make more informed decisions.

International Collaborations

International collaborations between U.S. healthcare providers and foreign imaging technology companies create a significant opportunity for market expansion. The U.S. is home to a large number of leading healthcare providers, many of which are exploring partnerships with international firms for the development of next-generation imaging technologies. For example, the U.S. healthcare system has seen a rise in collaboration agreements with European imaging firms, particularly in the area of non-invasive coronary artery imaging. Such collaborations not only bring in advanced technologies but also enhance the knowledge transfer between nations, thus accelerating the pace of innovation. Additionally, global alliances also facilitate the integration of state-of-the-art equipment into healthcare systems, thereby driving market growth.

Future Outlook

Over the next five years, the USA coronary artery imaging equipment market is expected to experience notable growth, driven by technological advancements in imaging devices and the increasing demand for non-invasive diagnostic solutions. The transition towards hybrid imaging systems, enhanced by AI and machine learning, is expected to streamline clinical workflows and improve diagnostic accuracy. Furthermore, increasing awareness of cardiovascular health and the rising burden of heart disease will continue to fuel demand for advanced coronary artery imaging solutions. As healthcare facilities adopt more efficient imaging technologies, the market is poised for a steady increase in market size.

Major Players in the market

- GE HealthCare

- Siemens Healthineers

- Philips Healthcare

- Canon Medical Systems

- Toshiba Medical Systems

- Hitachi Medical Corporation

- Samsung Medison

- Fujifilm Holdings Corporation

- Carestream Health

- Shimadzu Corporation

- Bracco Imaging

- Hologic

- Analogic Corporation

- Boston Scientific

- Terason

Key Target Audience

- Healthcare Providers (Hospitals, Cardiac Centers, Diagnostic Imaging Centers)

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (FDA, CDC)

- Private and Public Health Insurance Providers

- Medical Device Manufacturers

- Medical Equipment Distributors

- Cardiologists & Radiologists

- Cardiovascular Imaging Equipment Procurement Managers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the coronary artery imaging market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the coronary artery imaging market. This includes assessing market penetration, the ratio of equipment sales to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple coronary artery imaging equipment manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the coronary artery imaging market.

- Executive Summary

- Research Methodology (Market Definitions and Scope Boundary (Diagnostic vs Interventional Imaging), Abbreviations and Terminology (CAD, CCTA, IVUS, OCT, PET MPI, SPECT), Data Sources and Quality Controls, Market Sizing & Forecasting Methods (Bottom‑Up & Top‑Down Integration), Primary Research Coverage (Clinicians, OEMs, Radiology Centers), Validation & Triangulation Approach, Assumptions and Limitations)

- Core Market Definition (Devices for Visualization & Diagnosis of Coronary Artery Disease)

- Market Genesis (Clinical Advances & Epidemiology of CAD)

- Technological Paradigm Shifts

- Regulatory Landscape

- Supply Chain Architecture (Manufacturers, Distributors, Service Providers)

- Reimbursement Ecosystem & Coding

- Adoption Barriers (Clinical Training, Capital Budget Constraints)

- Market Growth Drivers

Increasing CAD Prevalence & Clinical Imaging Demand

Shift Toward Non‑Invasive Diagnostics

Technological Innovation (AI, 3D, High‑Resolution CT/MRI)

Reimbursement Enhancements & Preventive Care Initiatives

- Market Challenges

High Capital Expenditure & Operating Costs

Skilled Workforce Shortages

Fragmented Procurement Practices

Regulatory & Quality Assurance Compliance

- Market Opportunities

AI‑Driven Diagnostics & Predictive Analytics

Emergence of Portable & Point‑of‑Care Imaging

Value‑Based Care Models Increasing Imaging Utilization

- Market Trends

Integration of Advanced Analytics & Decision Support

Growth of Hybrid Imaging Platforms

Consolidation & Strategic Partnerships

- Regulatory & Reimbursement

FDA Approvals & CAD Imaging Guidelines

Medicare Advantage & CPT Coding Impact

State‑by‑State Insurance Variability

- Economics & Cost‑Benefit Analysis

Total Cost of Ownership (TCO) Across Modalities

ROI from Early Diagnosis & Intervention Planning

- Custom Analytics

TAM/SAM/SOM Assessment

Clinical Adoption Mapping

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price of Platforms/Services, 2019-2025

- By Imaging Modality (In Value %)

Computed Tomography Angiography (CCTA) (Equipment & Software)

Magnetic Resonance Imaging (MRI) Cardiac Protocols

X‑Ray / Fluoroscopy Angiography

Nuclear Medicine (PET MPI, SPECT MPI)

Ultrasound (Echocardiography & IVUS)

Intravascular Optical Coherence Tomography (OCT)

- By Technology (In Value %)

3D Reconstruction & AI‑Assisted Interpretation

Hybrid Imaging (PET/CT, PET/MRI)

Real‑Time Catheter‑Based Visualization (IVUS / OCT)

Digital DICOM PACS Integration

- By End‑User (In Value %)

Hospitals & Health Systems

Ambulatory Surgical Centers (ASCs)

Cardiac Diagnostic Imaging Centers

Research & Academic Medical Centers

- By Clinical Application (In Value %)

Coronary Artery Disease Screening & Early Diagnosis

Acute Chest Pain Diagnosis

Pre‑Operative & Post‑Intervention Evaluation

Risk Stratification & Preventive Cardiology

- Market Share Analysis (Revenue & Units)

National & Regional Player Footprint

Modality‑Level Market Share Breakdown - Cross‑Company Comparison Parameters (Company Profile & Strategic Position, Modality Breadth (CT, MRI, X‑ray, Nuclear, Ultrasound, IVUS/OCT), Installed Base & Replacement Cycle, Service & Warranty Footprint, Revenue by Modality & Region, R&D Intensity & Innovation Pipeline, End‑User Touchpoints (HS, ASC, Centers), Distribution & Channel Penetration, After‑Sales Service Network, Pricing Strategy vs Value Delivered)

- SWOT of Key Players

Strengths & Strategic Assets

Weaknesses & Market Risks

Opportunity Alignment

Threats from Disruptive Technologies - Pricing & ASP Benchmarking by SKU

- Benchmarking Typical Equipment ASP Across Modalities

- Subscription & Software Revenue Share

- Detailed Company Profiles

GE HealthCare

Siemens Healthineers

Canon Medical Systems

Philips Healthcare

FUJIFILM Healthcare Americas

Hitachi Medical Systems

Samsung Medison

Analogic Corporation

Boston Scientific (IVUS/OCT, Interventional Imaging)

Terason (Ultrasound)

Carestream Health

Shimadzu Medical Systems

Bracco Imaging

Hologic, Inc.

Viatronix

- Clinical Utilization Rates (per 1,000 Patients)

- Decision‑Making Frameworks (Radiologists, Cardiologists, Administrators)

- Procurement Cycles & Budgeting Protocols

- Pain Points (Throughput, Accuracy, Downtime Costs)

- Service & Maintenance Expectations

- Future Market Size by Value, 2026-2030

- Future Market Size by Volume, 2026-2030

- Average Frame Cost Outlook, 2026-2030