Market Overview

The USA corrugated packaging market is valued at USD 39.2 billion in 2024 with an approximated compound annual growth rate (CAGR) of 3.4% from 2024-2030, showing robust strength as a key contributor to the packaging industry. This market is driven by the increasing demand for sustainable packaging solutions, reflecting a shift towards eco-friendly materials across various industries. The growth is also fueled by the expansion of e-commerce, requiring efficient and versatile packaging options that corrugated products provide.

Major cities such as New York, Los Angeles, and Chicago dominate the USA corrugated packaging market. These locations are significant due to their extensive industrial infrastructure, high consumer population, and the presence of numerous packaging manufacturers. Additionally, proximity to major logistics hubs facilitates the efficient distribution of corrugated products. States like California and Texas also contribute heavily to the market due to their large manufacturing and retail sectors.

As environmental regulations become increasingly stringent, companies are pressured to adopt sustainable packaging practices. The Environmental Protection Agency (EPA) reported that approximately 30% of plastic waste comes from packaging materials, prompting regulatory measures aimed at reducing waste through recycling and reuse. The EPA’s focus on the 2030 Waste Management Plan emphasizes sustainable practices and encourages reducing single-use plastic consumption, bolstering the demand for corrugated packaging as a more eco-friendly alternative.

Market Segmentation

By Product Type

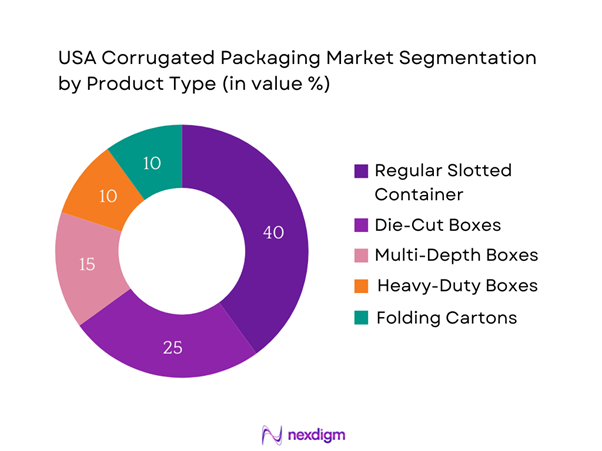

The USA corrugated packaging market is segmented by product type into Regular Slotted Containers (RSC), Die-Cut Boxes, Multi-Depth Boxes, Heavy-Duty Boxes, and Folding Cartons. Among these, Regular Slotted Containers (RSC) dominate the market share. This is primarily due to their versatility, affordability, and strength, making them suitable for various applications, from shipping to retail displays. The reliability of RSC structures ensures that products are well-protected during transit, which is a significant factor in e-commerce and merchandise shipping.

By End User Industry

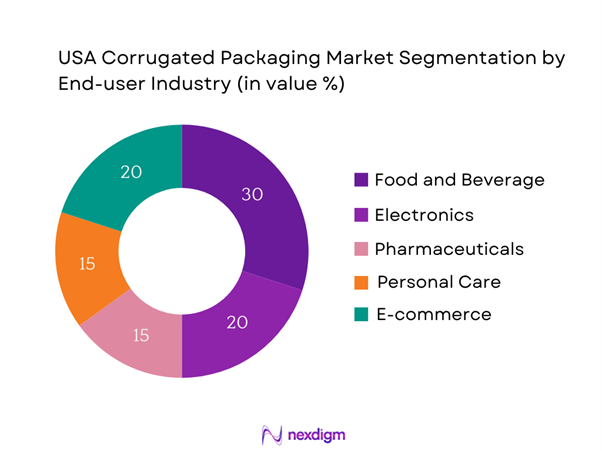

The corrugated packaging market’s segmentation by end user industry includes Food and Beverage, Electronics, Pharmaceuticals, Personal Care, and E-commerce. The E-commerce sector is leading with the largest market share due to the surge in online shopping behaviors, especially during the pandemic. The need for efficient shipping solutions that provide product safety and branding opportunities is driving manufacturers to create innovative corrugated packaging tailored to e-commerce needs.

Competitive Landscape

The USA corrugated packaging market is characterized by a competitive landscape dominated by several major players, each offering a range of innovative solutions. The consolidation of these major players indicates the significant influence they provide within the market. Continuous improvements in the production process and innovations geared towards sustainability are optimizing their positioning. Key companies include:

| Company | Establishment Year | Headquarters | Product Range/Portfolio | Market Presence | Sustainability Initiatives | Innovations and Tech |

| International Paper | 1898 | Memphis, TN | – | – | – | – |

| WestRock | 2015 | Atlanta, GA | – | – | – | – |

| Smurfit Kappa | 1934 | Dublin, Ireland | – | – | – | – |

| Packaging Corporation of America | 1959 | Lake Forest, IL | – | – | – | – |

| Graphic Packaging Holding | 2003 | Atlanta, GA | – | – | – | – |

USA Corrugated Packaging Market Analysis

Growth Drivers

Rise in E-commerce

The rise in e-commerce continues to significantly influence the corrugated packaging market. In 2022, U.S. e-commerce sales reached approximately USD 1.03 trillion, reflecting the shift in consumer purchasing behavior towards online platforms. This trend aligns with the projection that by 2025, e-commerce will account for about 20% of total retail sales, reinforcing demand for efficient and protective packaging solutions that corrugated materials provide. The U.S. Census Bureau has noted that e-commerce sales in the retail sector alone increased by 14.2% from 2021 to 2022, highlighting the ongoing importance of digital shopping.

Innovation in Packaging Solutions

Innovation in packaging solutions has also emerged as a crucial growth driver for the corrugated packaging market. The 2023 report from the Institute of Packaging Professionals indicates a trend where nearly 70% of companies are investing in advanced packaging technologies, including smart packaging solutions and custom designs to meet consumer preferences. Enhanced durability, printability, and versatility offered by new corrugated materials are making them increasingly attractive to various industries, particularly in the food and beverage sector, which is forecasted for expansion.

Market Challenges

Raw Material Price Fluctuations

One of the significant challenges facing the corrugated packaging market is the fluctuation in raw material prices. As reported by the World Bank, in 2022, the prices of timber and recycled paper fluctuated sharply due to supply chain disruptions and increased global demand. Furthermore, the Institute of Scrap Recycling Industries observed that the price per ton of recycled paper has varied widely, reaching highs of USD 220 per ton in mid-2022 before dropping to USD 150 per ton by late 2023 due to market corrections. Such volatility can impact profit margins for corrugated packaging manufacturers.

Competition from Alternative Packaging

The corrugated packaging market also faces competition from alternative packaging solutions, such as plastic and biodegradable materials. In a recent study, the Packaging Association forecasted an increase in the market share of flexible packaging materials, projected to reach USD 50 billion by 2024 due to their lower manufacturing costs and weight advantages. The growing usage of innovative biodegradable packaging, championed by brands concerned about their environmental impact, further intensifies competition, leading corrugated packaging producers to seek value-added offerings to maintain market positions.

Opportunities

Sustainable Packaging Solutions

The current shift towards sustainable packaging solutions presents a robust opportunity for growth within the corrugated packaging market. The market for sustainable packaging was valued at approximately USD 300 billion in 2022 and is expected to continue its strong performance as consumers increasingly demand eco-friendly options. In 2024, over 70% of consumers stated that they are willing to pay a premium for sustainable packaging, indicating a readiness to support brands adopting responsible practices. As businesses strive to meet these preferences, the demand for innovative and sustainable corrugated options will likely grow significantly.

Growing Demand from E-commerce

The continuous growth in the e-commerce sector offers significant avenues for corrugated packaging companies. The National Retail Federation reported that U.S. online retail sales reached USD 1.03 trillion in 2022, with expectations for additional growth in 2023 and beyond. Such figures illustrate an upward trajectory in e-commerce transactions and the subsequent need for efficient, reliable packaging solutions that transport products securely while also facilitating a positive customer experience. Brands focusing on packaging that enhances user experience can capitalize on this booming demand, solidifying their market positions and enhancing profitability.

Future Outlook

Over the next five years, the USA corrugated packaging market is expected to exhibit substantial growth driven by increasing e-commerce sales, rising consumer awareness of sustainability, and advancements in packaging technologies. The shift towards eco-friendly packaging solutions presents new opportunities for growth, enhancing both consumer experience and environmental responsibility. This favorable trend suggests that the market will attract investments in innovation and efficiency improvements.

Major Players

- International Paper

- WestRock

- Smurfit Kappa

- Packaging Corporation of America

- Graphic Packaging Holding

- Clearpack

- DS Smith

- Novolex

- Mondi Group

- Sonoco Products

- Ahlstrom-Munksjö

- Ranpak Holdings

- Paper Mart

- Pratt Industries

- RockTenn Company

Key Target Audience

- E-commerce companies

- Manufacturing firms

- Retail brands

- Investments and venture capitalist firms

- Government and regulatory bodies (EPA, FDA)

- Distribution and logistics

- Packaging designers and innovation firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA corrugated packaging market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the USA corrugated packaging market. This includes assessing market penetration, evaluating the ratio of marketplaces to service providers, and analyzing resultant revenue generation. Furthermore, a comprehensive evaluation of service quality statistics will be conducted to ensure reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple corrugated packaging manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA corrugated packaging market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Historical Overview

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rise in E-commerce

Environmental Regulations

Innovation in Packaging Solutions - Market Challenges

Raw Material Price Fluctuations

Competition from Alternative Packaging - Opportunities

Sustainable Packaging Solutions

Growing Demand from E-commerce - Trends

Shift to Eco-Friendly Materials

Digital Printing Innovations - Government Regulation

Packaging Waste Regulations

Compliance Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Regular Slotted Container (RSC)

– Standard Shipping Boxes

– Recycled RSC Boxes

– Eco-Friendly RSC Variants

Die-Cut Boxes

– Custom Shaped Boxes

– Self-Locking Die-Cut Boxes

– Display Packaging

Multi-Depth Boxes

– Adjustable Height Boxes

– Multi-Crease Boxes

Heavy-Duty Boxes

– Triple-Wall Corrugated Boxes

– Bulk Packaging Boxes

– Pallet-Ready Boxes

Folding Cartons

– Tuck End Cartons

– Sleeve Cartons

– Windowed Cartons - By End User Industry (In Value %)

Food and Beverage

– Packaged Food Boxes

– Beverage Multipack Boxes

– Perishable Produce Packaging

Electronics

– Consumer Electronics Packaging

– Anti-Static Corrugated Boxes

– Device-Specific Custom Inserts

Pharmaceuticals

– Medicine Transport Boxes

– Vaccine & Cold Chain Boxes

– Tamper-Evident Packaging

Personal Care

– Cosmetic Packaging

– Hygiene Product Boxes

– Subscription Boxes

E-commerce

– Returnable Packaging

– Branding-Oriented Printed Boxes

– Compact & Lightweight Shippers - By Distribution Channel (In Value %)

Direct Sales

Distributors/Wholesalers

Online Sales - By Region (In Value %)

New York

Massachusetts

Pennsylvania

Illinois

Ohio

Michigan

Texas

Florida

Georgia

California

Washington

Arizona - By Design (In Value %)

Printed

– Flexographic Printing

– Digital Printing

– Offset Lithography

Unprinted

– Plain Kraft Boxes

– Generic Stock Boxes

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Corrugated Packaging Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths & Weaknesses, Organizational Structure, Revenues, Distribution Channels, Customer Segments, Production Capacity & Utilization Rate, Raw Material Sourcing Strategy, Technological Capability, Sustainability & Compliance Initiatives, Unique Value Proposition, Innovation and R&D Focus, others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

International Paper Company

WestRock Company

Smurfit Kappa Group

Packaging Corporation of America

Graphic Packaging Holding Company

DS Smith

Mondi Group

Sonoco Products Company

Ranpak Holdings Corp.

Georgia Pacific LLC

Domtar Corporation

Arjo Wiggins

Ahlstrom-Munksjö

Smurfit-Stone Container Corporation

Prologis Inc.

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030