Market Overview

The USA crankshafts market is valued at around USD ~ billion, based on the revenue trajectory published for the United States crankshaft segment within a global crankshaft study. Earlier cycle revenue of roughly USD ~ billion highlights a solid absolute increase in demand for crankshafts across automotive, off-highway, marine, and industrial engines. This growth is underpinned by close to 10 million light vehicles produced annually in the United States, a large legacy vehicle parc, and sustained internal-combustion engine (ICE) demand in commercial, agricultural, and industrial sectors, even as electrification gradually advances.

Market Segmentation

By End-Use Vehicle / Engine Type

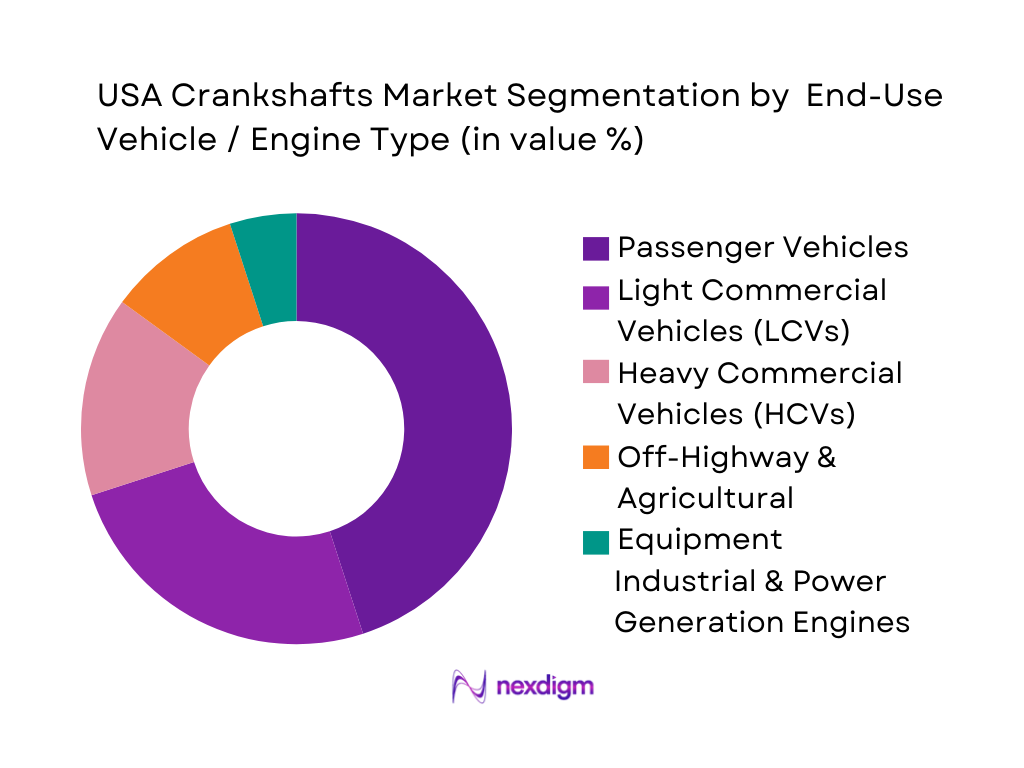

Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicles, Off-Highway & Agricultural Equipment, Industrial & Power Generation Engines. The USA crankshafts market is segmented by end-use into passenger vehicles, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), off-highway & agricultural equipment, and industrial & power generation engines. Passenger vehicles account for the dominant share owing to a large installed base of more than 250 million light-duty vehicles in operation and annual sales of over 15 million new light vehicles. High volumes of gasoline engines, frequent replacement cycles, and strong aftermarket demand for remanufactured and performance crankshafts reinforce this dominance, while LCVs and HCVs contribute additional demand through diesel and high-torque engine platforms.

By Manufacturing Process / Type

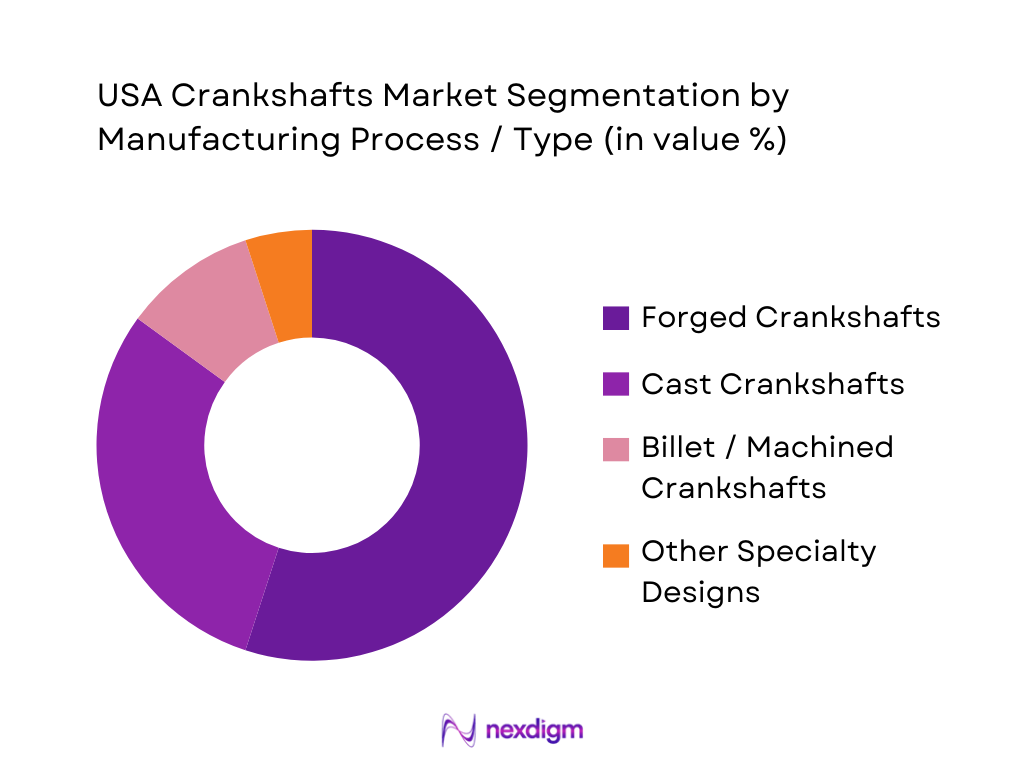

The USA crankshafts market is segmented by manufacturing process into forged crankshafts, cast crankshafts, billet/machined crankshafts, and other specialty designs. Forged crankshafts dominate due to their superior fatigue strength, impact resistance, and suitability for high-load commercial and performance engines. Global studies show forged crankshafts capturing the largest revenue share—above half of total crankshaft value—driven by OEM preference for steel alloy forgings in both passenger and commercial vehicles. In the USA, this preference is amplified by a sizable pickup, SUV, and heavy-duty truck parc, along with strong demand from racing and motorsports where forged and billet designs are standard.

Competitive Landscape

The USA crankshafts market combines high-volume OEM-oriented suppliers with a dense ecosystem of performance, racing, marine, and aftermarket specialists. At the top end, global forging houses and integrated Tier-1s supply crankshafts to Detroit-based and transplant OEMs for light vehicles, heavy trucks, and off-highway equipment. In parallel, a fragmented set of mid-sized and niche US companies focuses on precision-machined forged and billet crankshafts for drag racing, NASCAR, NHRA, endurance racing, custom street performance, and marine power. Competition is driven by metallurgy expertise, precision machining capabilities, heat-treatment control, balancing/torsional vibration optimization, and the ability to engineer crankshafts for higher cylinder pressures, longer service life, and emissions-driven efficiency requirements.

| Company | Establishment Year | Headquarters (USA) | Core Focus Segment | Primary Process Capability | Key Materials (Alloys) | End-Use Focus (OEM/Aftermarket) | Notable Strength | Recent Strategic Focus |

| SCAT Enterprises | 1962 | Redondo Beach, CA | ~ | ~ | ~ | ~ | ~ | ~ |

| Callies Performance Products | 1989 | Fostoria, OH | ~ | ~ | ~ | ~ | ~ | ~ |

| Kellogg Crankshaft Company | 1956 | Jackson, MI | ~ | ~ | ~ | ~ | ~ | ~ |

| Ohio Crankshaft Company | 1920 | Cleveland, OH | ~ | ~ | ~ | ~ | ~ | ~ |

| Bryant Racing | ~1980s | Clio, MI | ~ | ~ | ~ | ~ | ~ | ~ |

USA Crankshafts Market Analysis

Growth Drivers

Expansion in Domestic Engine Manufacturing

Domestic crankshaft demand is anchored in the U.S. engine and vehicle production base. U.S. motor vehicle output reached 10,611,555 units in the latest reported year, up from 10,052,958 units a year earlier, according to OICA-based data for the United States. At the same time, employment in motor vehicle manufacturing (NAICS 3361) stands at about 302,600 jobs in the most recent annual reading, underscoring a large installed engine-machining base. U.S. exports of automotive vehicles, parts and engines reached a record USD 179.0 billion recently, while imports in the same category hit USD 426.6 billion, highlighting strong cross-border engine and component flows that pull crankshaft volumes through OEM and Tier-1 supply chains

Premiumisation of Aftermarket Performance Crankshafts

The aftermarket base for crankshafts is underpinned by a very large and aging vehicle parc. Federal Highway Administration data indicate about 282,174,766 registered motor vehicles in the country in the most recent full year for which detailed MV-1 data are available. Other synthesis of FHWA data shows around 278,870,463 personal and commercial vehicles registered, with 170,239,357 trucks and 98,573,935 cars, pointing to a huge service and performance-upgrade pool. By early 2024, the number of registered vehicles had risen to about 286 million, while the average light-vehicle age climbed to 12.6 years.

Market Challenges

Volatility in Steel & Alloy Feedstock

Crankshaft producers are exposed to swings in steel and alloy availability and cost. World crude steel output reached about 1,889.2 million metric tons and 1,904.1 million metric tons in recent years, before edging to 1,886.3 million metric tons, reflecting a broadly flat but high-volume market sensitive to energy prices and trade policy. U.S. crude steel production itself fluctuated around 80.5 million metric tons, 81.4 million metric tons and 79.5 million metric tons, while AISI reports raw steel output of 94.7 million net tons and shipments of 89.5 million net tons. Analysts estimate imports still account for around a quarter of U.S. steel consumption, exposing crankshaft forgers to tariff shifts and trade disputes.

High Precision & Balancing Requirements

Crankshafts operate in a safety-critical environment where machining and balancing tolerances must match rising vehicle utilization. U.S. road users drove about 3.28 trillion miles in the latest year, 32.3 billion miles more than the previous year, according to USDOT data. NHTSA reports 39,345 traffic deaths in the same year, with a fatality rate of 1.20 deaths per 100 million vehicle miles traveled, down from 1.33 the previous year but still above pre-pandemic benchmarks.

Market Opportunities

Electrified Hybrid Crankshaft Development

Hybrid and range-extended powertrains preserve the role of crankshafts while changing performance requirements. U.S. plug-in electric vehicle sales reached 1,402,371 units in the latest full year, with a 9.1% share of the light-vehicle market, and cumulative plug-in stock stands at about 4.7 million units. EIA data show electrified vehicles (hybrids, plug-in hybrids and BEVs) reaching 17.9% of new light-duty vehicle sales in the second half of the latest year. These drivetrains use smaller but highly stressed combustion engines that cycle on and off frequently, requiring crankshafts with excellent fatigue resistance, low friction and quiet operation. As OEMs proliferate hybrid variants across pickups, SUVs and crossovers in the 10.6-million-unit U.S. production base, crankshaft suppliers can capture value through lightweight, low-NVH designs optimized for electrified duty cycles.

Lightweight Metallurgical Innovations

Tightening emissions and fuel-efficiency standards drive demand for lighter crankshafts using micro-alloy steels and advanced forging routes. Transportation contributes around 28% of total U.S. greenhouse-gas emissions, making vehicle efficiency a priority for EPA and DOT policy. NHTSA’s fuel-economy standards issued in 2022 require the light-duty fleet to move toward an industry-wide average of about 49 miles per gallon for passenger cars and light trucks by model year 2026, with mandated annual efficiency increases. At the materials level, U.S. crude steel output of 79.5–81.4 million metric tons annually and global output of about 1,886.3 million metric tons provide the industrial base for high-strength low-alloy steels and compacted-graphite iron used in lighter crankshafts.

Future Outlook

Over the next several years, the USA crankshafts market is expected to post steady, volume-driven growth despite long-term electrification headwinds. The projected ~4.2% CAGR for 2024–2030 reflects continued reliance on ICE powertrains in pickups, SUVs, heavy commercial vehicles, agriculture, construction, marine, and industrial engines. At the same time, OEM and Tier-1 investments in US powertrain facilities—such as multi-billion-dollar programs by GM and Stellantis to expand domestic engine and vehicle output—are likely to sustain crankshaft demand even as EV penetration accelerates from a relatively low base in trucks and off-highway applications.

Major Players

- SCAT Enterprises

- Callies Performance Products

- Kellogg Crankshaft Company

- Ohio Crankshaft Company

- Bryant Racing

- Crower Cams & Equipment Co.

- Lunati Power (Lunati Crankshafts)

- K1 Technologies

- Eagle Specialty Products

- Winberg Crankshafts

- Marine Crankshaft Inc.

- Thyssenkrupp (Forged Technologies Division – US operations)

Key Target Audience

- Automotive OEM engine and powertrain divisions (light vehicles, pickups, SUVs, vans)

- Heavy-duty truck and bus manufacturers (Class 6–8 ICE platforms)

- Off-highway, construction, and agricultural equipment OEMs

- Industrial and power-generation engine manufacturers (gensets, marine, compressors)

- Tier-1 and Tier-2 forged components & steel alloy suppliers

- Performance, motorsport, and specialist engine builders / remanufacturers

- Investment and venture capital firms (mobility, automotive, industrial technology funds)

- Government and regulatory bodies (US Department of Transportation, Environmental Protection Agency, National Highway Traffic Safety Administration)

Research Methodology

Step 1: Market Scoping and Variable Definition

The first step involves mapping the USA crankshafts ecosystem across OEMs, Tier-1/Tier-2 suppliers, aftermarket distributors, engine rebuilders, and end-use industries (automotive, off-highway, industrial, marine, powergen). We consolidate definitions of crankshaft types, materials, manufacturing processes, and sales channels using secondary sources such as global crankshaft market reports, automotive component studies, and OEM disclosures. Key variables include production volumes, installed base, replacement rates, crankshaft value per engine, and material/processing mix.

Step 2: Bottom-Up Market Construction and Triangulation

Historical data for global, regional, and US crankshaft revenues is extracted from syndicated reports, then filtered for US-specific revenue lines and end-use splits. We build bottom-up models by combining vehicle and engine production data, off-highway equipment sales, and industrial engine shipments with typical crankshaft values. These estimates are cross-checked against published US crankshaft revenue figures and North America splits to ensure internal consistency and realistic margins by segment.

Step 3: Expert Validation and Hypothesis Refinement

Structured interviews are conducted with executives and technical experts from forging houses, crankshaft machining specialists, engine OEMs, and performance engine builders. Topics include technology migration (forged vs cast vs billet), EV and hybrid impacts, offshore vs domestic sourcing, and aftermarket dynamics. Feedback is used to validate working hypotheses around segment growth, pricing power, and risk factors (e.g., alloy availability, energy costs, emissions standards), and to adjust model assumptions such as replacement intervals and aftermarket penetration.

Step 4: Synthesis, Scenario Modelling, and Final Outputs

In the final phase, we integrate quantitative models and qualitative insights to generate base-case, conservative, and accelerated-transition scenarios for the USA crankshafts market through 2030. Each scenario incorporates different assumptions on ICE vehicle production, EV penetration by segment, regulatory tightening, and reshoring incentives. Outputs include market sizing by value and volume, segmentation by end-use and manufacturing process, competitive benchmarking, and a set of strategic implications and recommendations for OEMs, suppliers, and investors.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions, Abbreviations, Crankshaft Classification Standards & Metallurgical Codes, Market Sizing Framework, Consolidated Research Approach, In-Depth OEM & Tier-1 Interviews, Primary/Secondary Research Mix, Data Triangulation, Limitations & Future Validations)

- Definition & Scope

- Evolution of Crankshaft Manufacturing Technologies

- Market Genesis & Industry Lifecycle

- Crankshaft Manufacturing Value Chain Analysis

- Crankshaft OEM–Tier Structure

- Supply Chain Ecosystem Mapping

- Growth Drivers

Expansion in Domestic Engine Manufacturing

Premiumisation of Aftermarket Performance Crankshafts

Technological Advancements in Forging & Machining

Rising Demand from Heavy-Duty & Industrial Engines

Increasing Adoption of Low-Emission & Hybrid Powertrains - Market Challenges

Volatility in Steel & Alloy Feedstock

High Precision & Balancing Requirements

Dependence on Imported Billet Forgings

Competition from Reconditioned & Remanufactured Crankshafts

High Capital Costs for CNC & Automated Machining - Market Opportunities

Electrified Hybrid Crankshaft Development

Lightweight Metallurgical Innovations

Domestic Manufacturing Incentives

Export Opportunities to LATAM & Europe

High-Performance Racing Crankshaft Demand - Trends

Transition to Geometric Tolerances & Automated Balancing

Increased Use of Counterweight Optimization

Robotics in Crankshaft Machining Lines

Multi-Piece Crankshaft Adoption for High RPM Engines

Hybrid Engine-Compatible Crankshaft Designs - Government Regulations

Emission Norms & Engine Standards

Metallurgical Quality Standards (SAE, ASTM)

US Manufacturing Incentives

Import–Export Duties for Engine Components - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- Competition Ecosystem

- By Value, 2019-2024

- By Volume (Units), 2019-2024

- By Average Manufacturing Cost (Ex-Factory), 2019-2024

- By Manufacturing Process (In Value %)

Forged Steel Crankshafts

Cast Iron Crankshafts

Billet Crankshafts

Fully Machined Crankshafts

Semi-Finished Crankshafts - By Engine Type (In Value %)

Gasoline Engines

Diesel Engines

Hybrid Powertrain Engines

High-Performance/Racing Engines

Off-Highway Engines - By Vehicle Type (In Value %)

Passenger Cars

Light Commercial Vehicles

Heavy Trucks

Agriculture & Construction Machinery

Marine & Powergen Engines - By Material Type (In Value %)

Micro-Alloyed Steel

Nodular Cast Iron

Carbon Steel

Alloy Steel

High-Performance Steel Blends - By Distribution Channel (In Value %)

OEM Supply

Tier-1 Engine Manufacturers

Aftermarket Replacement

Performance/Custom Aftermarket

Engine Rebuilders - By Region (In Value %)

Midwest Manufacturing Belt

South-Central Engine Production Clusters

West Coast Automotive Ecosystem

Northeast Vehicle Fleet Hubs

Southeast Industrial & Off-Highway Demand Base

- Market Share of Major Players (Value/Volume)

- Market Share by Manufacturing Process (Forged/ Cast/ Billet)

- Cross Comparison Parameters (Metallurgical Strength & Fatigue Resistance Score, Machining Precision Tolerance Levels, Heat-Treatment Technology Capability, OEM/Aftermarket Penetration, Annual Production Capacity (Units), Product Customisation Capability, Price Positioning Across SKUs, Distribution Network Strength (Dealers/Rebuilders))

- SWOT Analysis of Major Players

- Pricing Analysis by SKU Category

- Detailed Profiles of 15 Major Companies

Scat Crankshafts

Callies Performance Products

Crower Cams & Equipment

Eagle Specialty Products

Bryant Racing Crankshafts

Lunati Power

Kellogg Crankshaft Co.

Ohio Crankshaft

Winberg Crankshafts

Cola Crankshaft

Crankshaft Supply Inc.

Performance Crankshaft

JE Pistons (Diversified Engine Components)

Precision Crankshaft Service

- OEM Procurement Behaviour

- Engine Rebuilders: Volume & Replacement Cycles

- Aftermarket Workshops: Purchasing Patterns

- Performance/Racing Builders: Customisation Requirements

- Pain-Point Analysis & Decision Drivers

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Manufacturing Cost, 2025-2030