Market Overview

The USA crash boxes market is valued at USD ~, underscoring its structural importance within the automotive safety component ecosystem. Demand is anchored in sustained vehicle production, rising penetration of electric powertrains, and continuous tightening of crash safety norms that elevate the role of controlled energy absorption modules. Crash boxes have evolved from basic structural elements to engineered safety systems that influence vehicle ratings, pedestrian protection outcomes, and insurance risk profiles. Their integration across front, rear, and emerging battery protection zones has positioned them as a core investment area for OEMs and Tier suppliers focused on compliance, brand safety perception, and lifecycle cost optimization.

Within the country, dominance is concentrated in manufacturing and engineering hubs across the Midwest automotive belt and the Southern production corridor, where deep-rooted OEM presence and dense Tier supplier ecosystems accelerate innovation and deployment of advanced crash management systems. These regions benefit from proximity to vehicle assembly plants, materials specialists, and testing infrastructure that shortens development cycles. At the technology level, global safety standards and platform architectures shaped by multinational OEM programs strongly influence domestic crash box design, materials selection, and validation protocols, reinforcing the country’s role as both a production and innovation nucleus for crash energy management solutions.

Market Segmentation

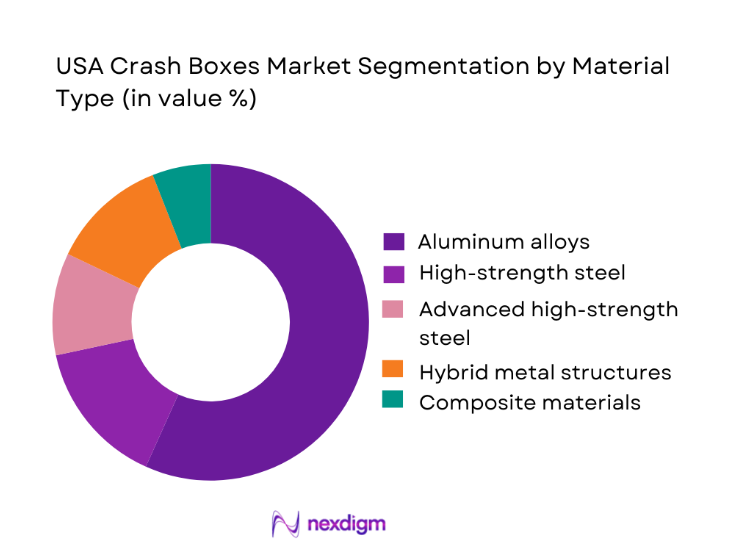

By Material Type

The USA crash boxes market is segmented by material type into high-strength steel, aluminum alloys, advanced high-strength steel, hybrid metal structures, and composite materials. Aluminum alloys dominate this segmentation due to their optimal balance between lightweighting and predictable energy absorption, making them a preferred choice for modern vehicle architectures. Automakers increasingly prioritize aluminum crash boxes to support fuel efficiency targets and extend electric vehicle range without compromising safety performance. The material’s corrosion resistance and recyclability further enhance its appeal in the context of long-term sustainability commitments. In addition, aluminum enables modular front-end designs that can be standardized across multiple platforms, reducing tooling complexity and accelerating time to market. These combined engineering, economic, and environmental advantages have positioned aluminum alloys as the leading material choice across both mass-market and premium vehicle segments in the USA.

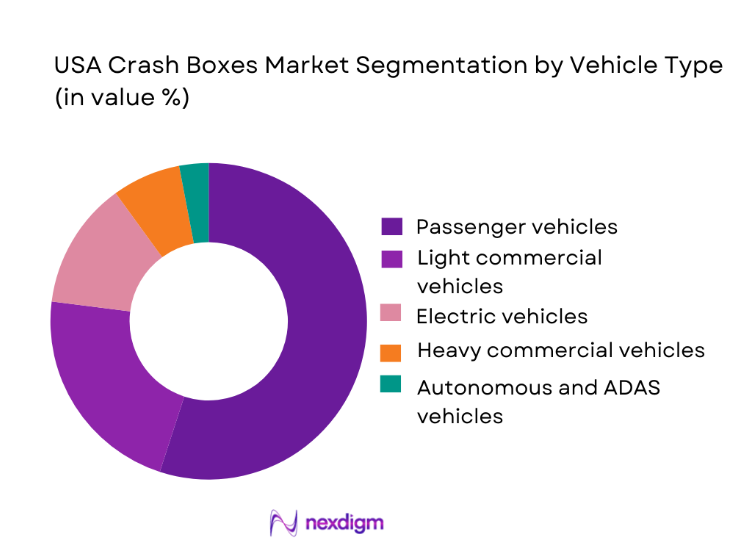

By Vehicle Type

The market is segmented into passenger vehicles, light commercial vehicles, heavy commercial vehicles, electric vehicles, and autonomous and ADAS-enabled vehicles. Passenger vehicles dominate this segmentation because of their consistently high production volumes and the strong emphasis OEMs place on safety ratings in this category. Consumer purchasing decisions in the USA are heavily influenced by crash test results, pushing automakers to integrate advanced crash boxes as a core differentiator in sedans, SUVs, and crossovers. Frequent model refresh cycles also drive recurring demand for redesigned crash structures that meet updated safety protocols. Furthermore, passenger vehicles are at the forefront of adopting multi-stage and pedestrian-friendly crash box systems, reinforcing their leadership in both volume and technological sophistication within the market.

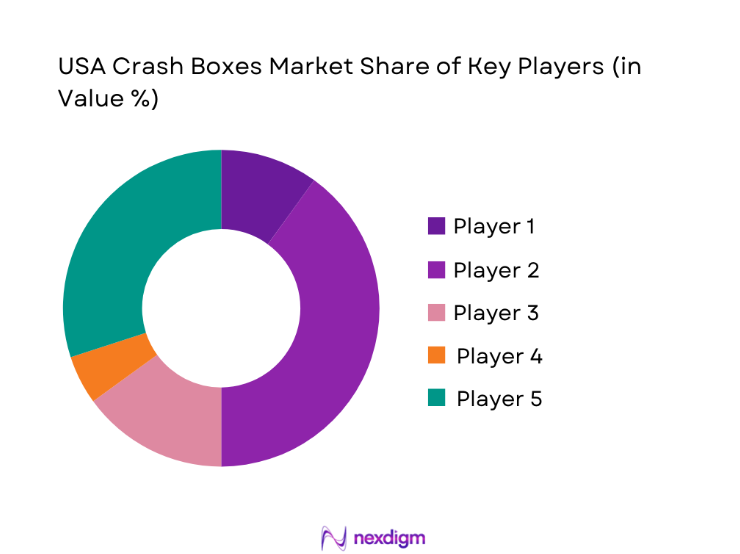

Competitive Landscape

The USA crash boxes market is dominated by a few major players, including Magna International and global or regional brands like Gestamp, Benteler Automotive, and Martinrea International. This consolidation highlights the significant influence of these key companies.

| Company | Established | Headquarters | Manufacturing Footprint (USA) | Core Material Expertise | Key OEM Clients | Crash Testing Capability | Annual Production Capacity | Sustainability Focus |

| Magna International | 1957 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Gestamp | 1997 | Spain | ~ | ~ | ` | ~ | ~ | ~ |

| Benteler Automotive | 1876 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Martinrea International | 2001 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Dura Automotive Systems | 1990 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

USA Crash Boxes Market Analysis

Growth Drivers

Stricter crash safety compliance requirements

Regulatory authorities continue to elevate crash performance benchmarks, compelling OEMs to invest more heavily in engineered energy absorption systems. This shift directly increases demand for high-performance crash boxes capable of managing varied impact scenarios while maintaining structural integrity. As safety ratings become more influential in consumer purchasing decisions, automakers are aligning design priorities with advanced crash management technologies. The outcome is a structural rise in crash box adoption across all vehicle classes, reinforcing the market’s long-term growth trajectory and embedding safety components deeper into core vehicle cost structures.

Expansion of electric vehicle platforms

The rapid expansion of electric vehicle architectures is reshaping crash box requirements, especially around battery protection and underbody safety. Electric vehicles introduce new mass distribution patterns and impact dynamics, which require redesigned crash energy management solutions. Suppliers that can engineer multi-stage and modular crash boxes for these platforms are gaining strategic importance. This evolution not only drives incremental demand but also elevates the technological value of crash boxes, positioning them as critical components in next-generation vehicle safety systems.

Challenges

Volatility in aluminum and specialty steel pricing

Fluctuations in raw material costs create uncertainty for crash box manufacturers operating under long-term OEM contracts with limited pricing flexibility. This volatility pressures margins and complicates capacity planning, especially for suppliers heavily invested in aluminum-intensive designs. As material inputs represent a substantial portion of component cost, sustained price swings can disrupt profitability and slow investment in new tooling and innovation. The challenge lies in balancing cost containment with the need to maintain high safety performance standards.

High tooling and validation investment burden

Crash boxes are safety-critical components that demand extensive testing, certification, and tooling precision. The upfront capital required for dies, simulation platforms, and physical crash testing represents a significant barrier, particularly for smaller suppliers. Extended validation cycles also delay revenue realization, increasing financial risk. These structural constraints limit new market entry and place continuous pressure on existing players to achieve scale efficiencies while maintaining rigorous compliance standards.

Opportunities

Growth of battery protection modules in electric vehicles

As electric vehicle penetration rises, the need for dedicated crash structures that safeguard battery packs is creating a new growth avenue within the crash boxes market. Suppliers that can design integrated solutions combining frontal, side, and underbody protection stand to gain strategic advantage. This opportunity extends beyond traditional bumper systems into a broader safety architecture role, expanding both revenue potential and supplier influence in vehicle platform development.

Adoption of recyclable and low-carbon materials

Automakers are increasingly aligning procurement strategies with sustainability goals, opening opportunities for crash box manufacturers that invest in recyclable alloys and low-emission production processes. The shift toward circular material use enhances brand positioning for both OEMs and suppliers while meeting emerging regulatory and investor expectations. This trend supports premium pricing for environmentally optimized crash components and strengthens long-term partnerships with forward-looking automakers.

Future Outlook

The USA crash boxes market is positioned for sustained strategic relevance as vehicle architectures evolve toward electrification, connectivity, and enhanced safety performance. Over the coming years, crash boxes will transition from standardized structural parts to highly engineered safety modules tailored to platform-specific risk profiles. Suppliers that integrate digital design tools, sustainable materials, and modular manufacturing approaches will be best placed to capture value as OEMs seek partners capable of delivering compliance, innovation, and cost efficiency in equal measure.

Major Players

- Magna International

- Gestamp

- Benteler Automotive

- Martinrea International

- Aisin Corporation

- ZF Group

- Valeo

- Autoliv

- Hyundai Mobis

- Toyoda Gosei

- Yanfeng Automotive Safety Systems

- Plastic Omnium

- CIE Automotive

- Dura Automotive Systems

- Nemak

Key Target Audience

- Automotive OEM procurement and sourcing leaders

- Tier suppliers of structural and safety components

- Investments and venture capitalist firms

- Government and regulatory bodies including the National Highway Traffic Safety

- Administration and the U.S. Department of Transportation

- Electric vehicle platform developers

- Fleet operators and mobility service providers

- Automotive testing and homologation agencies

- Insurance and vehicle safety rating organizations

Research Methodology

Step 1: Identification of Key Variables

This phase focuses on mapping the full ecosystem of OEMs, Tier suppliers, material providers, and testing agencies involved in the USA crash boxes market. Extensive desk research is conducted to define variables influencing demand, including production volumes, regulatory stringency, and material adoption trends. The objective is to establish a robust analytical framework that captures both structural and cyclical market drivers.

Step 2: Market Analysis and Construction

Historical data is compiled to assess component penetration across vehicle platforms and correlate it with revenue generation patterns. Market construction relies on aligning vehicle production metrics with average crash box pricing and technology mix. This ensures that market sizing reflects real-world deployment rather than theoretical demand.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings are validated through structured consultations with engineering leaders, procurement heads, and safety compliance experts across the automotive value chain. These interactions provide qualitative insights into tooling strategies, validation timelines, and future technology roadmaps. The process strengthens the credibility of assumptions underpinning market forecasts.

Step 4: Research Synthesis and Final Output

The final phase integrates insights from bottom-up and top-down analyses into a cohesive market narrative. Direct engagement with component manufacturers supports verification of production capacity, pricing trends, and innovation pipelines. This synthesis ensures that the final report delivers a comprehensive and decision-ready perspective on the USA crash boxes market.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, terminology and abbreviations, crash box taxonomy and vehicle architecture mapping, market sizing logic by vehicle production and crash box content value, revenue attribution across modules materials tooling and service parts, primary interview program with OEMs Tier 1s and body structure suppliers, data triangulation and validation approach, assumptions limitations and data gaps)

- Definition and Scope

- Market Genesis and Evolution of Modular Energy Absorbers in the USA

- Crash Safety and Repairability Drivers for Crash Box Adoption

- Front End Module and Longitudinal Structure Integration Pathways

- Value Chain Structure Across OEMs Tier 1 Body Structure Suppliers and Material Providers

- Growth Drivers

Crash safety requirements and stricter NCAP ratings focus

OEM push for lower repair cost and modular replaceability

Lightweighting initiatives shifting material mix toward aluminum and hybrids

Increased SUV and pickup production boosting crash module demand

Insurance influence on repairability and parts standardization - Challenges

Material joining and corrosion management for mixed material structures

Tooling cost and long platform nomination cycles

Performance validation requirements across speed and offset crash tests

Supply constraints for aluminum extrusions and specialty alloys

Aftermarket fitment complexity and parts certification needs - Opportunities

Growth of bolt on replaceable crash boxes for faster repairs

Advanced extrusion and hydroforming for high efficiency energy absorption

Composite crash modules for EV lightweight platforms

Digital crash simulation services for design optimization

Localized manufacturing to improve lead times and supply resilience - Trends

Shift toward modular and serviceable front end crash structures

Increasing aluminum adoption in premium and EV platforms

Greater use of simulation led design and crash correlation workflows

Integration of crash boxes into complete front end module assemblies

Standardization of crash module designs across vehicle platforms - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Content Value per Vehicle, 2019–2024

- By OEM vs Aftermarket Revenue Split, 2019–2024

- By Steel vs Aluminum vs Composite Mix, 2019–2024

- By Fleet Type (in Value %)

Passenger cars

SUVs and crossovers

Light trucks and pickups

Commercial vans and light fleet vehicles

Electric and hybrid vehicles - By Application (in Value %)

Front crash boxes

Rear crash boxes

Corner impact crash modules

Bumper beam and crash box integrated assemblies

Pedestrian protection energy absorbing modules - By Technology Architecture (in Value %)

Stamped steel crash boxes

Extruded aluminum crash boxes

Hydroformed energy absorber designs

Composite and hybrid crash box structures

Modular bolt on replaceable crash box assemblies - By Connectivity Type (in Value %)

OEM nominated platform integration

Tier 1 front end module supply

Sub tier stamping extrusion and forming supply

Aftermarket replacement parts distribution

Collision repair and insurance ecosystem supply - By End-Use Industry (in Value %)

Automotive OEMs and platform engineering teams

Tier 1 front end module suppliers

Body in white structure suppliers

Collision repair networks and body shops

Material and forming service providers - By Region (in Value %)

Midwest manufacturing belt

Southeast vehicle assembly corridor

Texas and South Central light truck hubs

West Coast EV and advanced vehicle programs

Northeast engineering and aftermarket clusters

- Competitive ecosystem structure across body structure suppliers and front end module leaders

- Positioning driven by crash correlation manufacturing scale and repairability design

- Partnership models between OEMs Tier 1s and extrusion stamping specialists

- Cross Comparison Parameters (energy absorption efficiency, peak force management performance, material mix and mass per module, replaceability and repair time impact, corrosion resistance and durability, manufacturability and forming complexity, crash simulation correlation capability, cost per vehicle platform)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Magna International

Gestamp

Benteler

Dura Automotive Systems

Tower International

Martinrea International

Shiloh Industries

Novelis

Cleveland Cliffs

Hydro Extrusions

Constellium

SGL Carbon

Teijin Automotive Technologies

Plasan

Flex N Gate

- OEM criteria for crash performance repairability and cost

- Tier 1 module integration priorities and delivery performance

- Collision repair network demand for availability and fitment accuracy

- Insurance influence on replacement versus repair decisions

- Total cost of ownership drivers across materials tooling and service parts

- By Value, 2025–2030

- By Content Value per Vehicle, 2025–2030

- By OEM vs Aftermarket Revenue Split, 2025–2030

- By Steel vs Aluminum vs Composite Mix, 2025–2030