Market Overview

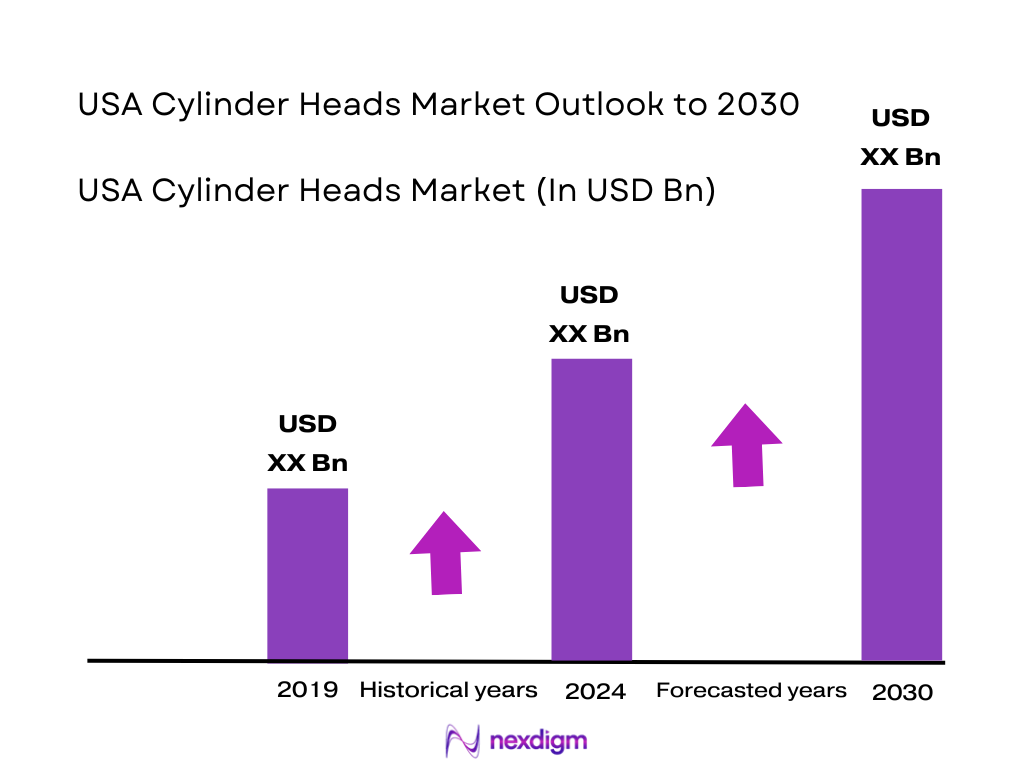

The USA Cylinder Heads Market sits inside a global automotive cylinder head ecosystem that rises from roughly USD ~ billion at the start of the latest five-year benchmarking window to around USD ~ billion in its most recent data point, driven by tighter emissions norms and higher per-vehicle content. Within this context, cylinder head demand in the United States is underpinned by a domestic auto-parts manufacturing base exceeding USD ~ billion and robust vehicle sales volumes, which together sustain both OEM fitment and a sizeable replacement and remanufacturing pool.

Globally, Asia–Pacific leads cylinder head production, yet North America—and especially the United States—holds a substantial share because of high light-vehicle output, large commercial fleets, and a mature aftermarket for engine rebuilds. Within the USA, dominance is concentrated in the Detroit–Michigan corridor, the Southern manufacturing belt (Alabama, Tennessee, Mississippi, Texas), and West-Coast performance hubs. These clusters combine proximity to OEM assembly plants, dense Tier-1/2 casting and machining suppliers, and a large base of specialist performance and remanufacturing shops focused on gasoline pickup/SUV and heavy-duty diesel platforms.

Market Segmentation

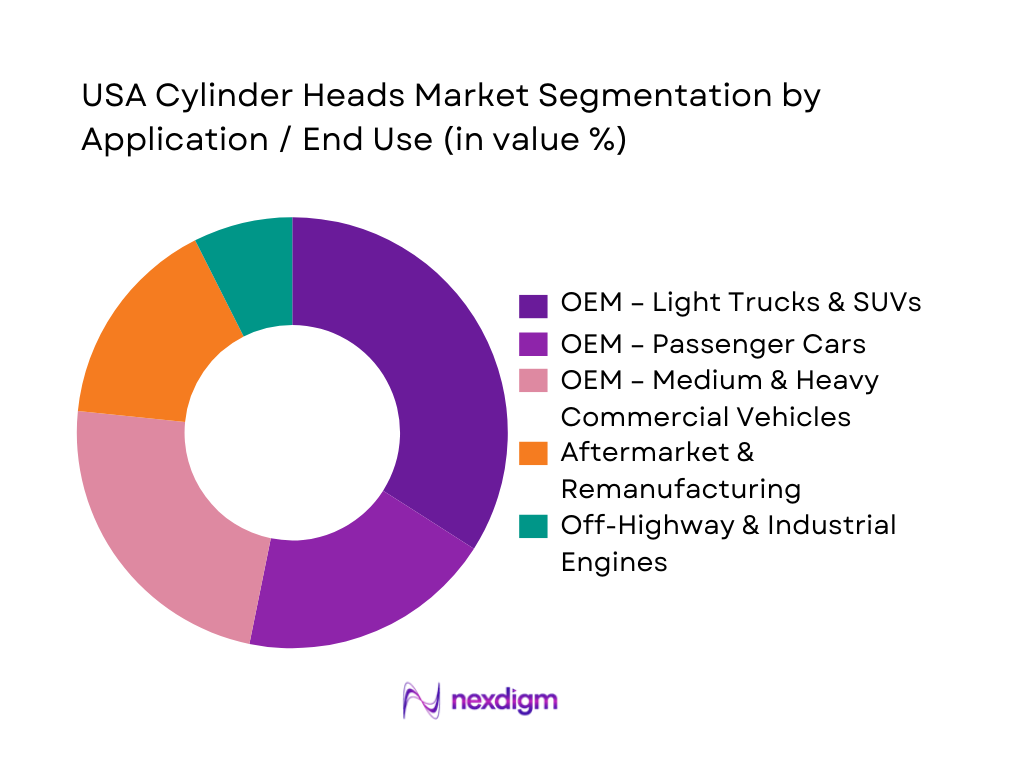

By Application / End Use

The USA Cylinder Heads Market is segmented into OEM passenger cars, OEM light trucks & SUVs, OEM medium/heavy commercial vehicles, off-highway & industrial engines, and aftermarket & remanufacturing. OEM light trucks & SUVs form the dominant slice because the US light-vehicle mix is skewed toward pickups, crossovers and large SUVs, which consistently account for the majority of new-vehicle sales and deliver higher per-vehicle engine displacement. These platforms frequently use multi-valve gasoline engines and high-output turbocharged variants, increasing cylinder head complexity, machining content, and value per unit. The segment also benefits from strong fleet demand in construction, utilities and last-mile delivery, where engines typically see intensive use and thus higher lifecycle replacement rates for heads and head-related hardware compared with typical passenger sedans.

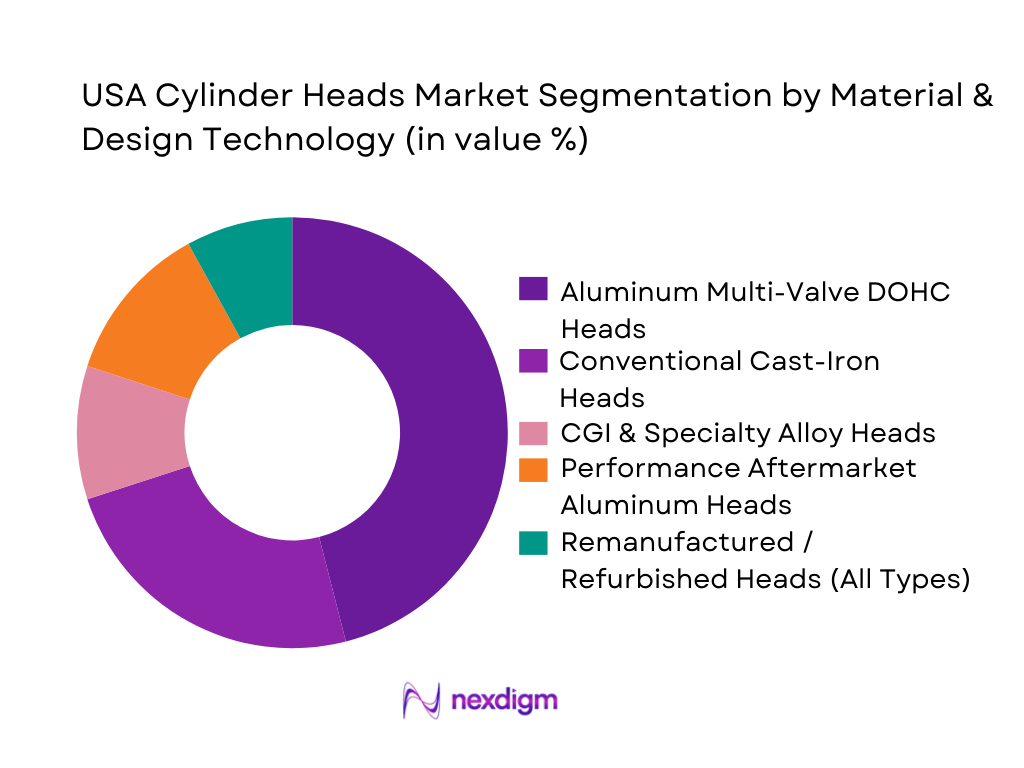

By Material & Design Technology

The USA Cylinder Heads Market is segmented into aluminum multi-valve DOHC heads, conventional cast-iron heads, compacted graphite iron and specialty alloys, performance aftermarket aluminum heads, and remanufactured heads across materials. Aluminum multi-valve DOHC heads dominate due to OEMs’ need to reconcile fuel-economy and emissions targets with power density and refinement, leading to extensive use of lightweight, high-flow designs on gasoline passenger vehicles and light trucks. Globally, aluminum alloys already account for well over half of cylinder head value; this bias is even stronger in the US where CAFE standards and consumer expectations around power and towing have accelerated the migration away from heavier cast-iron designs in mainstream applications. Down-gauged wall sections, integrated exhaust manifolds, and complex water-jacket geometries further increase casting and machining value captured in this sub-segment.

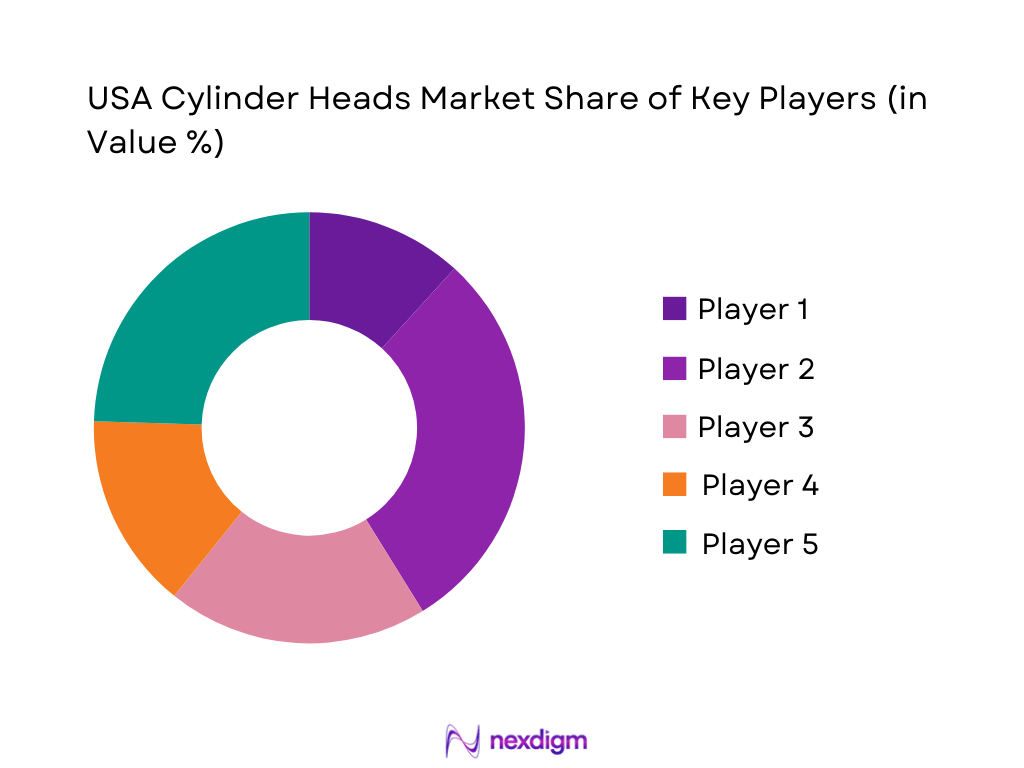

Competitive Landscape

The USA Cylinder Heads Market combines large global casting and machining suppliers with in-house OEM operations and a fragmented performance/remanufacturing ecosystem. Global Tier-1s such as Nemak and MAHLE supply aluminum heads and integrated head–block modules into US engine programs, while OEMs like General Motors, Ford and Toyota continue to produce many heads internally on high-volume engine lines. In parallel, specialist US-based players including Edelbrock, Dart Machinery and American Cylinder Head serve performance, racing and remanufactured segments, leveraging proprietary port designs, CNC machining, and localized service. This structure yields a competitive landscape where cost, casting technology, cycle-time, and application engineering support are at least as critical as price per casting.

| Company | Establishment Year | Headquarters (Core Market) | Cylinder-Head Focus in USA | Primary End-Use Focus | Technology / Material Strength | US Manufacturing / Service Footprint | Channel Focus (OEM / Aftermarket) | Differentiating Edge in Cylinder Heads |

| Nemak | 1879 | García, Nuevo León (North America HQ in Southfield, MI) | ~ | ~ | ~ | ~ | ~ | ~ |

| MAHLE GmbH | 1920s | Stuttgart, Germany (strong U.S. operational presence) | ~ | ~ | ~ | ~ | ~ | ~ |

| Tenneco / DRiV (Federal-Mogul) | 1940s | Lake Forest, Illinois, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Edelbrock Group | 1938 | Olive Branch, Mississippi, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| American Cylinder Head Inc. | 20th century | Oakland, California, USA | ~ | ~ | ~ | ~ | ~ | ~ |

USA Cylinder Heads Market Analysis

Growth Drivers

Light-vehicle and pickup production

In the USA cylinder heads market, OEM demand is anchored in the enormous light-duty parc. Federal Highway Administration data show 197,134,299 light-duty vehicles registered in the country and 284,614,269 total motor vehicles, with light-duty travel reaching 2,039,737 million vehicle-miles in the latest year versus 1,968,790 million miles previously. This sits within a national economy whose GDP rose from 26,006,893,000,000 USD to 29,184,890,000,000 USD over the most recent three years, supporting robust household vehicle spending and continued production of gasoline pickups and SUVs that rely on multi-valve aluminum cylinder heads across both inline and V-engine architectures.

Heavy-duty truck and vocational-fleet builds

The heavy-duty and vocational segment is a structural growth pillar for USA cylinder heads, particularly cast-iron and compacted-graphite designs for diesel engines. FHWA statistics indicate 11,567,428 single-unit trucks and 3,324,112 combination trucks registered, generating 705,521 million and 195,758 million vehicle-miles respectively in the latest year. Average mileage per combination truck is an intense 58,890 miles per vehicle, while total truck fuel use reached 46,459,828 thousand gallons. These workhorses—line-haul tractors, vocational dump trucks, refuse fleets and delivery trucks—drive OEM and replacement demand for high-duty cylinder heads capable of withstanding high brake mean effective pressure and extended idling.

Market Challenges and Constraints

ICE-to-electrification transition risk

The USA cylinder heads market faces long-term structural risk as electric-vehicle penetration accelerates. A Reuters synthesis of Alternative Fuels Data Center data notes that U.S. EV registrations reached about ~ million vehicles by late 2024, up from roughly 1.4 million registrations a year earlier, while public charging points expanded to around 176,032 units. Even though the on-road parc still includes over 284,614,269 vehicles, each battery-electric light vehicle removes one multi-cylinder head (or two in V-engines) from future OEM and aftermarket demand. This transition particularly threatens gasoline passenger-car head volumes as coastal states with higher EV uptake accelerate ICE phase-down policies.

Emissions and durability requirements tightening

Cylinder-head producers must engineer for increasingly stringent emissions and durability targets, especially in heavy-duty diesel. EPA regulations on greenhouse gas emissions from commercial trucks and buses identify long-haul combination trucks as a significant share of freight-related CO₂, with freight trucks nationally logging over 901,279 million vehicle-miles in the latest FHWA data. Phase-in standards for upcoming engine cohorts require lower NOx and CO₂ per brake-horsepower-hour, forcing higher peak cylinder pressures and exhaust temperatures. At the same time, the overall U.S. economy has expanded to 29,184,890,000,000 USD GDP, keeping freight demand structurally high and leaving OEMs with limited scope to de-rate engines. These dynamics increase development cost and validation time for cylinder-head castings, cooling-jacket layouts and valve-seat materials.

Market Opportunities

Aluminum and CGI lightweighting

Light-weight cylinder-head designs in aluminum and compacted graphite iron (CGI) remain a key opportunity as OEMs balance performance, efficiency and emissions. Producer Price Index data confirm ongoing activity in U.S. aluminum casting and mill-shape industries, with aluminum-mill-shape indexes around 235 and aluminum-casting series in FRED tracking elevated manufacturing intensity with index values in the high 700s. Simultaneously, FHWA reports 3,246,817 million vehicle-miles of travel across all motor vehicles, maintaining fuel-efficiency pressure on OEMs. This pushes engine programs toward thinner-wall, high-strength heads with integrated exhaust manifolds, cooled EGR and dowel-less architectures, opening design and supply opportunities for U.S. foundries and Tier-1s capable of casting complex aluminum and CGI geometries with low porosity and tight dimensional control.

Boosted GDI and high-BMEP engine programs

While EVs grow, many OEMs are doubling down on advanced internal-combustion programs—turbocharged gasoline direct-injection (GDI) and high-BMEP diesels—particularly for pickups, SUVs and heavy trucks that dominate U.S. road use. FHWA statistics show light-duty vehicles traveling 2,039,737 million miles annually and trucks adding another 901,279 million miles, reinforcing the need for durable, efficient combustion systems. In parallel, the national economy’s expansion from 26,006,893,000,000 USD to 29,184,890,000,000 USD supports continued investment in new engine platforms. These boosted engines require cylinder heads with optimized tumble/swirl ports, integrated charge-air cooling, reinforced fire decks and precise valve-seat cooling, creating opportunities for suppliers that can engineer advanced castings and multi-stage heat treatments tailored to high specific-output engines.

Future Outlook

Over the next several years, the USA Cylinder Heads Market is expected to expand modestly in value despite the long-run transition toward electrified powertrains. Cylinder head revenues will be supported by a still-large installed base of gasoline and diesel vehicles, continued strong sales of pickups and SUVs, and heavy-duty diesel applications where internal combustion remains entrenched. Global automotive cylinder head studies generally indicate low-to-mid single-digit annual growth, with one major source projecting roughly 3.1% CAGR from the current baseline into the early 2030s; this trajectory is a reasonable proxy for the USA given similar volume and content dynamics. Additional upside exists in high-value performance and remanufactured heads, where complex multi-valve and boosted applications command premium machining and materials pricing even as total unit volumes slowly plateau.

Major Players

- American Cylinder Head Inc.

- Aisin Corporation

- Cummins Inc.

- Dart Machinery LLC

- Edelbrock Group

- Ford Motor Company

- General Motors

- Linamar Corporation / Montupet

- MAHLE GmbH

- Nemak S.A.B. de C.V.

- Stellantis

- Tenneco / DRiV

- Toyota Motor North America

- Trick Flow Specialties

Key Target Audience

- Powertrain and engine program directors at light-vehicle OEMs

- Heavy-duty diesel engine manufacturers and fleet powertrain managers

- Tier-1 and Tier-2 casting and precision machining suppliers

- Aftermarket distributors and national engine remanufacturing networks

- Performance and motorsports engine builders and specialty cylinder-head shops

- Investments and venture capitalist firms

- Government and regulatory bodies

- Industrial gas, tooling and process-technology providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a detailed ecosystem map of the USA Cylinder Heads Market, integrating OEMs, Tier-1/2 foundries, aftermarket suppliers, performance specialists and remanufacturers. This is underpinned by extensive desk research across global cylinder head reports, US auto-parts manufacturing statistics, trade and export databases, and OEM disclosures. The objective is to define critical variables such as engine platform volumes, material mix (aluminum vs. iron), channel split (OEM vs. aftermarket), and technology penetration (multi-valve, turbo, emissions-optimized designs).

Step 2: Market Analysis and Construction

In this phase, we compile and normalize historical data for the global automotive cylinder head market and align it with US-specific production and aftermarket indicators. Global market values and growth rates are derived from multiple syndicated cylinder head studies; these are cross-checked against North American cast-iron head reports and cylinder head & block aggregate valuations to ensure consistency. A bottom-up model allocates global value to the USA using US shares of light-vehicle production, commercial-vehicle fleets, and auto-parts output, with separate layers for OEM fitment, performance, and remanufacturing.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on application mix, material transitions, and channel dynamics are validated through structured interviews and computer-assisted calls with engine designers, foundry engineers, performance head manufacturers, and large engine-reman organizations in the US. These conversations test assumptions on head replacement cycles, aluminum vs. iron cost trade-offs, and the impact of emissions and fuel-economy regulations on head design. Feedback is triangulated with public statements from major players such as Nemak, MAHLE, and Edelbrock, as well as regional North American analyses that highlight the US leadership position in cast-iron and aluminum cylinder head demand.

Step 4: Research Synthesis and Final Output

The final phase blends top-down market sizing with bottom-up segment modeling to derive application- and material-level revenue splits for the USA Cylinder Heads Market. Detailed cross-checks are conducted against global and regional cylinder head forecasts, OEM engine-program life cycles, and US aftermarket trends, ensuring that derived shares remain consistent with broader auto-parts dynamics. This synthesis yields a coherent view of current market size, an indicative 2024–2030 growth band, and segment-specific opportunities in OEM, performance and remanufactured heads, forming the basis for strategic recommendations and investment decisions.

- Executive Summary

- Research Methodology (Cylinder-head and engine-family definitions, inclusion of ICE vs hybrid range-extender heads, OEM production vs in-use parc modelling, top-down vehicle and engine parc estimation, bottom-up line-throughput and rebuild-volume sampling, segmentation by material, fuel, vehicle class and channel, use of OEM/Tier-1/WD/engine-rebuilder primary interviews, secondary data sources and triangulation logic, data normalisation and currency treatment, assumptions and limitations)

- Definition, Scope and Taxonomy

- Evolution of Cylinder-Head Design in USA Light & Heavy-Duty Engines

- Role of Cylinder Heads in Emissions, Combustion and NVH Control

- Engine-Parc Structure and Replacement Cycles

- Supply Chain and Value Chain Mapping

- Growth Drivers

Light-vehicle and pickup production

Heavy-duty truck and vocational-fleet builds

Aging engine parc and overhaul cycles

Diesel and HD engine utilisation - Market Challenges and Constraints

ICE-to-electrification transition risk

Emissions and durability requirements tightening

High capital intensity of foundry and machining

Alloy and energy cost volatility

Labour and skills constraints in machining and rebuilding - Market Opportunities

Aluminum and CGI lightweighting

Boosted GDI and high-BMEP engine programs

Growth in remanufacturing and exchange heads

Performance & racing upgrades

Specialty heads for alternative fuels and hydrogen ICE - Trends

Multi-valve and variable-valve-actuation friendly heads

Integrated exhaust manifolds

Cooled EGR passages

Sodium-filled valves and enhanced cooling jackets

Advanced port and chamber CFD optimisation - Regulatory, Emissions and Compliance Analysis

- Stakeholder & Decision-Maker Ecosystem

- Porter’s Five Forces Analysis

- SWOT Analysis of USA Cylinder Heads Market

- Supply–Demand Balance and Capacity Utilisation

- By Value, 2019-2024

- By Volume, 2019-2024

- By Key Engine Families, 2019-2024

- By New vs Remanufactured vs In-Situ Repair, 2019-2024

- By Engine Fuel & Combustion Type (in Value %)

Gasoline PFI

Gasoline GDI & turbo-GDI

Diesel light-duty

Diesel heavy-duty

CNG/LPG, alternative & dual-fuel ICE - By Vehicle Category (in Value %)

Passenger cars

SUVs & crossovers

Light-duty pickups & vans

Medium-duty trucks & buses

Heavy-duty on-highway tractors - By Material & Casting Technology (in Value %)

Cast-iron heads

Compacted-graphite-iron (CGI) heads

Gravity-cast aluminum heads

High-pressure die-cast aluminum heads

Semi-permanent-mold aluminum heads - By Valvetrain & Cylinder Configuration (in Value %)

Pushrod OHV heads, SOHC heads

DOHC multi-valve heads

hemispherical and pent-roof combustion-chamber heads

3–4 cylinder heads

5–6 cylinder heads - By Sales Channel (in Value %)

OEM production fitment

OEM service and dealer channels

Independent aftermarket new heads

Remanufactured / exchange-program heads

Performance & racing heads via specialty distributors and online - By End-Use Application (in Value %)

On-highway transportation

Off-highway construction & mining

Agriculture & forestry

Marine propulsion

Stationary gensets and industrial power - By Region within USA (in Value %)

Midwest engine and truck belt

South & Gulf states

Northeast corridor

West Coast

Mountain & Central regions

- Market Share and Competitive Positioning

- Cross-Comparison Parameters (Company overview and ownership, cylinder-head portfolio depth by engine family and vehicle class, OEM vs aftermarket vs reman revenue mix in USA, material and casting-technology mix (iron, CGI, aluminum; sand vs HPDC vs gravity), engine-platform and fuel-type coverage, USA manufacturing/machining/testing footprint, distribution and e-commerce reach (WDs, jobbers, OEM service, online), quality, warranty and field-failure performance metrics)

- Competition Ecosystem Mapping

- Pricing and Program Analysis

- Detailed Profiles of Major Companies

Nemak

Linamar Corporation

Teksid

MAHLE GmbH

Federal-Mogul / DRiV

American Cylinder Head Inc.

Cylinder Heads International

Dart Machinery

Edelbrock LLC

Brodix Inc.

Trick Flow Specialties

Air Flow Research

EngineQuest

Freedom Racing Engines

- OEM Engine Plants and Vehicle Assemblers

- Dealer Networks and OEM Service Channels

- Warehouse Distributors, Jobbers and Retail Channels

- Independent Engine Rebuilders and Machine Shops

- Fleets and Large End-Users

- By Value, 2025-2030

- By Volume, 2025-2030

- By Key Engine Families, 2025-2030

- By New vs Remanufactured vs In-Situ Repair, 2025-2030