Market Overview

The USA Data Integration and Analysis Solutions Market is valued at USD ~ billion, driven by increasing demand for real-time data processing and integration across industries. The market is propelled by the rapid growth of big data, Internet of Things (IoT), and cloud computing, all of which require effective data integration solutions. Additionally, the increasing adoption of AI and machine learning technologies for advanced analytics is a major growth driver. As organizations generate more data, the need for seamless integration and actionable insights to drive decision-making is further stimulating market expansion. The rise of digital transformation and enterprise automation is expected to keep the market on a growth trajectory through advanced analytics, cloud-based solutions, and hybrid integration platforms.

The United States is the dominant player in the Data Integration and Analysis Solutions Market, driven by its strong technology ecosystem, established IT infrastructure, and large-scale business enterprises that heavily rely on data integration. Cities like New York, San Francisco, and Seattle are key hubs, hosting numerous tech giants, financial services firms, and startups that drive demand for advanced data solutions. These cities have a high concentration of industries such as finance, healthcare, and e-commerce, all of which are data-heavy and require efficient integration and analysis solutions to manage large volumes of data. The market’s growth is further supported by government initiatives focused on digital transformation and data governance.

Market Segmentation

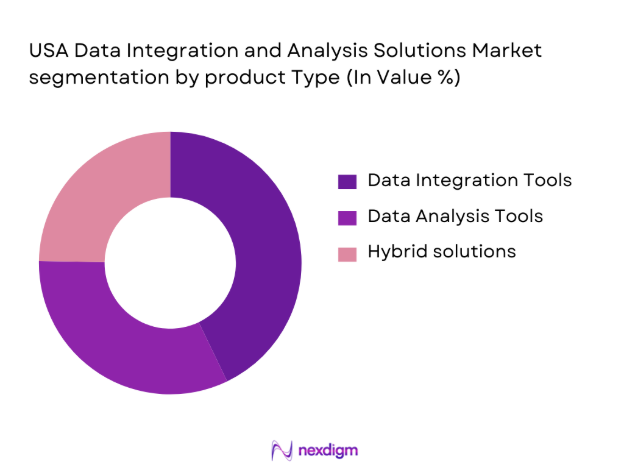

By Product Type

The USA Data Integration and Analysis Solutions Market is segmented by product type, including Data Integration Tools, Data Analysis Tools, and Hybrid Solutions. Recently, Hybrid Solutions have dominated the market due to the increasing preference for multi-cloud and hybrid integration architectures. Hybrid solutions offer flexibility for organizations to integrate and analyze data across both on-premise and cloud environments, which is crucial for businesses undergoing digital transformation. This flexibility, combined with seamless data management capabilities, has made hybrid solutions highly popular across industries like healthcare, retail, and finance.

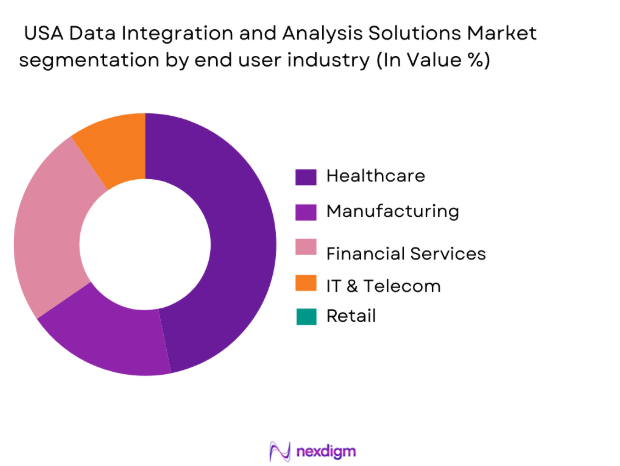

By End-User Industry

The market is segmented by end-user industries, such as Healthcare, Retail, Manufacturing, Finance, and IT & Telecom. The Healthcare sector dominates the market due to increasing regulatory requirements for data management, electronic health records (EHR), and the need for real-time data integration. Healthcare organizations require data integration solutions to streamline patient information, improve care coordination, and comply with HIPAA standards. Additionally, as healthcare data grows exponentially, data integration and analysis solutions are pivotal in transforming raw data into actionable insights for improving patient outcomes.

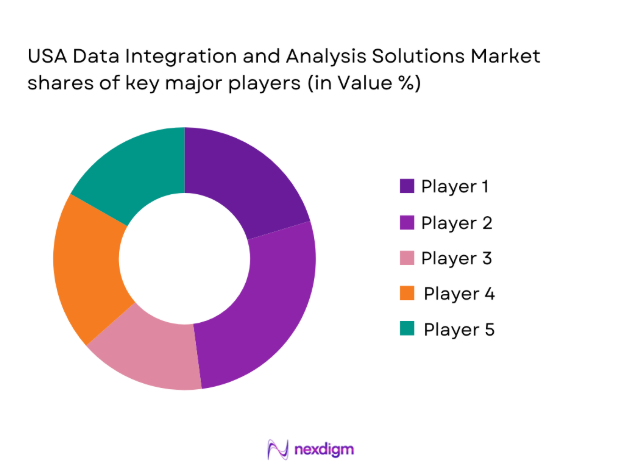

Competitive Landscape

The USA Data Integration and Analysis Solutions Market is dominated by several major players, including Microsoft, Informatica, IBM, Oracle, and SAP. These companies lead the market by offering comprehensive solutions that integrate data from multiple sources and provide advanced analytics capabilities. Their solutions are widely adopted across various industries such as healthcare, retail, and finance due to their scalability, reliability, and seamless integration capabilities. The market is highly competitive with a focus on cloud-native platforms, hybrid deployment options, and AI-powered data analytics.

| Company Name | Establishment Year | Headquarters | Revenue | Key Products | Technological Focus |

| Microsoft | 1975 | Redmond, WA | – | –

|

–

|

| Informatica | 1993 | Redwood City, CA | –

|

–

|

–

|

| IBM | 1911 | Armonk, NY | –

|

–

|

–

|

| Oracle | 1977 | Redwood City, CA | –

|

–

|

–

|

| SAP | 1972 | Walldorf, Germany | –

|

–

|

– |

USA Data Integration and Analysis Solutions Market Analysis

Growth Drivers

Technological Advancements in Data Integration

The USA market for data integration and analysis solutions is significantly driven by technological advancements, especially in cloud computing, machine learning, and AI. With the rapid growth of IoT devices, the need for scalable data integration solutions has never been greater. According to the World Bank, as of 2022, the global number of connected IoT devices surpassed 15 billion, a number expected to continue growing. As IoT continues to proliferate, businesses are adopting more advanced solutions to manage large volumes of data, with AI being used to automate and enhance data processing, thus increasing operational efficiency. These advancements are leading to more sophisticated data integration solutions across industries, helping organizations gain deeper insights and improve decision-making.

Rising Data Volumes from IoT and AI

The rise in IoT and AI technologies has led to an exponential increase in data volumes, creating a pressing need for efficient data integration and analysis solutions. The International Monetary Fund (IMF) has stated that data creation is expected to double every two years, reaching 175 zettabytes globally by 2025. This surge in data has driven the demand for tools that can integrate and analyze data from various sources. IoT devices, smart sensors, and AI-driven technologies are generating massive amounts of structured and unstructured data, making real-time data processing crucial for businesses aiming to stay competitive in an increasingly data-driven world.

Market Challenges

Data Privacy and Security Concerns

Data privacy and security remain significant challenges for the USA Data Integration and Analysis Solutions Market. As more sensitive data is integrated and processed across platforms, businesses must comply with various privacy regulations such as GDPR and CCPA. The U.S. Federal Trade Commission (FTC) reported a 300% increase in data breaches in the last five years, underscoring the growing concerns over data security. With the rise of cyber threats, businesses are increasingly investing in robust security measures to protect integrated data, which poses both financial and operational hurdles for companies adopting new data integration solutions.

Regulatory Barriers in Data Management

The regulatory landscape surrounding data management is becoming increasingly complex, especially as businesses expand across state and national borders. The rise of data privacy laws such as GDPR in Europe and CCPA in California presents challenges for businesses that need to ensure compliance with multiple regulations. The U.S. government has proposed new data privacy legislation to address these concerns, which could further impact the way businesses integrate and analyze data. This ever-changing regulatory environment makes it difficult for companies to navigate and may deter some from adopting new solutions that could aid in data integration.

Opportunities

Growth in the Healthcare Sector’s Data Management Needs

The healthcare industry is experiencing rapid digital transformation, increasing the demand for advanced data integration and analysis solutions. According to the U.S. Department of Health and Human Services (HHS), the adoption of electronic health records (EHR) has reached 85% across hospitals, creating a wealth of data that needs to be integrated, analyzed, and acted upon. As healthcare organizations push for more efficient patient care and streamlined operations, the need for integrated solutions that allow for real-time patient monitoring and decision-making is growing. The U.S. healthcare sector alone is expected to spend over USD 20 billion on health IT systems in the coming years.

Expanding Cloud-Based Data Integration Solutions

As businesses increasingly migrate to the cloud, the demand for cloud-based data integration solutions is expanding. According to the U.S. Census Bureau, over 60% of U.S. enterprises now rely on cloud infrastructure, with many adopting cloud-based data integration solutions to enhance scalability and flexibility. The demand for seamless integration of on-premise and cloud data environments is fueling growth in this segment, particularly among small and medium-sized businesses (SMBs) that are adopting cloud technology at an accelerated rate. Cloud-based data integration tools are enabling businesses to scale efficiently, manage costs, and improve collaboration across different teams and departments.

Future Outlook

Over the next 5 years, the USA Data Integration and Analysis Solutions Market is expected to continue its growth trajectory, driven by the increasing need for businesses to manage vast amounts of data, perform real-time analytics, and support data-driven decision-making. The rise of cloud computing, along with the integration of AI and machine learning into data management platforms, will significantly contribute to the market’s expansion. Additionally, as industries such as healthcare, finance, and retail push for enhanced data integration solutions to stay competitive, demand for these tools will remain strong.

Major Players in the USA Data Integration and Analysis Solutions Market

- Microsoft

- Informatica

- IBM

- Oracle

- SAP

- Talend

- Snowflake

- Databricks

- MuleSoft (Salesforce)

- SnapLogic

- AWS (Amazon Web Services)

- Cloudera

- SAS Institute

- Qlik

- TIBCO Software

Key Target Audience

- Large Enterprises

- IT and Cloud Service Providers

- Government Agencies (FMCSA, NHTSA, Department of Commerce)

- Healthcare Organizations

- Financial Institutions

- Retail Corporations

- Regulatory Bodies (GDPR, HIPAA Compliance Bodies)

- Investments and Venture Capitalist Firms (focused on data technology)

Research Methodology

Step 1: Identification of Key Variables

In this phase, we will identify and categorize all critical factors influencing the USA Data Integration and Analysis Solutions Market. This includes examining key drivers like big data adoption, cloud integration trends, and AI advancements, using secondary research sources.

Step 2: Market Analysis and Construction

We will consolidate historical market data, industry reports, and financial trends to forecast future growth. This process will involve analyzing existing market dynamics, such as the impact of cloud adoption and real-time data analytics, to develop projections.

Step 3: Hypothesis Validation and Expert Consultation

We will validate our assumptions with industry experts via interviews and surveys, ensuring the accuracy of our data. These consultations will focus on understanding emerging trends and challenges in data integration.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the collected data into actionable insights. This includes integrating feedback from stakeholders to refine our market forecasts and provide a comprehensive understanding of future market dynamics.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Technological Advancements in Data Integration

Rising Data Volumes from IoT and AI

Increasing Demand for Real-Time Analytics

Rising Focus on Data-Driven Decision Makin - Market Challenges

Data Privacy and Security Concerns

Integration Complexity and Scalability Issues

Lack of Skilled Workforce for Data Analytics

Regulatory Barriers in Data Management - Opportunities

Growth in the Healthcare Sector’s Data Management Needs

Expanding Cloud-Based Data Integration Solutions

Opportunities in AI-Driven Data Analytics Solutions - Trends

Shift Towards AI-Powered Data Integration

Increased Focus on Data Compliance and Governance

Automated Data Integration and Real-Time Processing Solutions - Government Regulation

Data Protection and Privacy Regulations (GDPR, CCPA)

Government Initiatives for Industry 4.0 and Smart Cities - SWOT Analysis

- Stake Ecosystem

Stakeholder Identification and Engagement

Role of Technology Providers, Integrators, and End-Users - Porter’s Five Forces

Supplier Power

Buyer Power

Threat of New Entrants

Threat of Substitutes

Competitive Rivalry - Competition Ecosystem

Competitive Landscape Overview

Key Market Players and Strategic Insights

- Market Size by Value, 2019-2025

- Market Size by Volume, 2019-2025

- Market Size by Average Price, 2019-2025

- By Product Type (In Value %)

- Data Integration tools

Analytical tools

Hybrid solutions - By End-User Industry (In Value %)

Healthcare

Retail

Manufacturing - By Region (In Value %)

Central

Eastern

Western

Southern - By Deployment Mode (In Value %)

Cloud

On-Premises

Hybrid - By Data Type (In Value %)

Structured

Semi-Structured

Unstructured)

- Market Share of Major Players by Value/Volume, 2024 (Market Share Analysis by Key Players)

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value Offering)

- SWOT Analysis of Major Players (Detailed SWOT of Key Players)

- Pricing Analysis Based on SKUs for Major Players (Pricing Insights by Solution Type)

- Detailed Profiles of Major Companies

- Informatica

- Microsoft

- IBM

- Oracle

- SAP

- Talend

- Snowflake

- Databricks

- MuleSoft (Salesforce)

- SnapLogic

- AWS (Amazon Web Services)

- Cloudera

- SAS Institute

- Talend (part of Qlik)

- Qlik

- Market Demand and Utilization

Sector-Specific Demand Insights

Market Dynamics Based on Data Needs - Purchasing Power and Budget Allocations

Market Trends by Industry Type and Size

Investment Trends in Data Solutions - Regulatory and Compliance Requirements

Impact of Regulatory Landscape on Market Growth - Needs, Desires, and Pain Point Analysis

Customer Needs and Gaps in Current Solutions

Key Pain Points in Data Management and Integration - Decision-Making Process

Influence of C-suite Executives vs Technical Teams

Strategic Importance of Data Integration Solutions in Business Operations

Future Market Size by Value, 2026-2030

Future Market Size by Volume, 2026-2030

Future Market Size by Average Price, 2026-2030