Market Overview

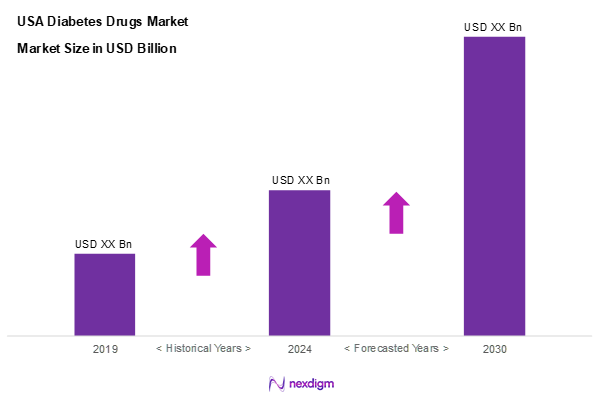

As of 2024, the USA diabetes drugs market is valued at USD ~ billion, with a growing CAGR of 5.4% from 2024 to 2030, reflecting a robust growth trajectory driven by the increasing prevalence of diabetes amid a rising aging population. This growth is supported by advancements in drug formulations and a surge in public awareness about diabetes management.

Major cities such as New York, Los Angeles, and Chicago dominate the USA diabetes drugs market due to their extensive healthcare infrastructures and high population densities. These urban areas benefit from access to cutting-edge research facilities, numerous healthcare providers, and pharmaceutical companies, which enhance the availability of diabetic medications and treatment options, thereby reinforcing their market leadership.

Market Segmentation

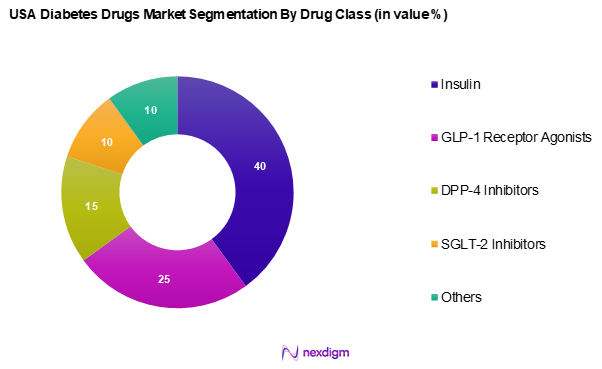

By Drug Class

The USA diabetes drugs market is segmented into insulin, GLP-1 receptor agonists, DPP-4 inhibitors, SGLT-2 inhibitors, and others. Insulin has a dominant market share in this categorization, mainly due to its essential role in the management of both Type 1 and Type 2 diabetes. With millions of patients relying on insulin for their daily treatment, its established position and brand loyalty among users solidify its supremacy in the market. In 2024, insulin’s market share is expected to reach 40%, owing to ongoing innovations in delivery methods and formulations that improve patient adherence and outcomes.

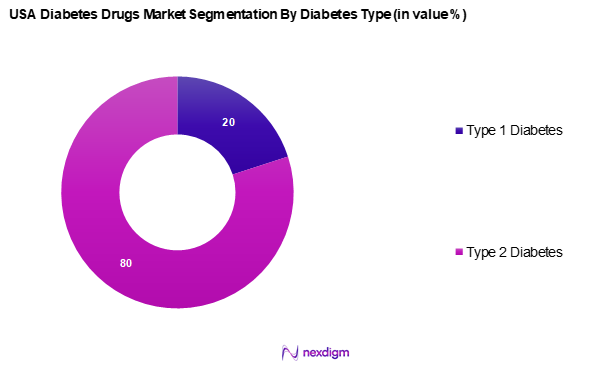

By Diabetes Type

The USA diabetes drugs market is segmented into Type 1 diabetes and Type 2 diabetes. The type 2 diabetes segment dominates the market due to its higher prevalence, accounting for approximately 90% of all diabetes cases in the US. This prevalence is driven by lifestyle factors such as obesity, sedentary habits, and dietary choices. In 2024, the market share for Type 2 Diabetes drugs is projected to be 80%, as healthcare providers increasingly focus on prevention and management strategies to combat the epidemic nature of Type 2 diabetes.

Competitive Landscape

The USA diabetes drugs market is characterized by the presence of few major players, fostering a competitive yet concentrated environment. Key players include pharmaceutical giants, leveraging their extensive research and development capabilities and established distribution networks to maintain market position.

| Company | Establishment Year | Headquarters | Revenue (USD Mn) | Drug Class Focus | Market Share

(%) |

Strategic Initiatives |

| Novo Nordisk | 1923 | Bagsvaerd, Denmark | – | – | – | – |

| Sanofi US Services Inc. | 1973 | Paris, France | – | – | – | – |

| Eli Lilly and Company | 1876 | Indianapolis, USA | – | – | – | – |

| Merck & Co. Inc. | 1891 | Kenilworth, USA | – | – | – | – |

| AstraZeneca | 1999 | Cambridge, UK | – | – | – | – |

USA Diabetes Drugs Market Analysis

Growth Drivers

Rising Prevalence of Diabetes

The prevalence of diabetes in the United States continues to rise, with approximately 37.3 million Americans currently affected by the disease. This number is projected to increase to 50 million by 2025, reflecting a significant public health concern. The CDC reports that 3.2 million diabetes-related hospitalizations occurred in 2022, driving a demand for diabetes medications and care solutions. Additionally, the aging population is a critical factor, as the proportion of individuals aged 65 and older is expected to exceed 20% by 2025, escalating the prevalence of diabetes, which is more common in older adults.

Increasing Healthcare Expenditure

The USA healthcare expenditure was projected to reach USD 4.3 trillion in 2024, approximately 18% of the Gross Domestic Product (GDP). This increase in spending underscores a national focus on managing chronic diseases, including diabetes. The Centers for Medicare & Medicaid Services (CMS) reported that diabetes-related costs alone were about USD 327 billion in 2017, and these costs are anticipated to escalate as more individuals require medical intervention. This soaring healthcare expenditure emphasizes the growing significance of diabetes therapies as policymakers work to allocate more resources toward managing chronic conditions.

Market Challenges

High Cost of Diabetic Drugs

The financial burden associated with diabetic medication remains a critical challenge for patients and healthcare providers. The average annual cost of diabetes medications per patient was approximately USD 7,400 in 2022, reflecting the growing prices for insulin and related therapies. The recent increases in drug prices, coupled with the high incidence of diabetes, have created significant financial strain on patients. Furthermore, the cost of insulin has tripled over the past decade, making effective diabetes management increasingly difficult for those without sufficient insurance coverage. This challenge necessitates urgent action from stakeholders to address affordability issues.

Regulatory Scrutiny

The FDA closely monitors the approval processes for diabetes drugs, which can lengthen development timelines and restrict market entry for new therapies. In 2022, the FDA approved a record 63 new medications across various therapeutic areas, highlighting the regulatory pressure for safety and efficacy. However, for diabetes medications, multiple trials are often required, leading to costly and time-consuming development periods. Moreover, recent scrutiny regarding drug pricing and market access has prompted the FDA to consider revisions to its approval processes, influencing how quickly new therapies reach patients. This regulatory landscape can serve as a hurdle for innovation and market competitiveness.

Opportunities

Expansion of Biosimilars

Biosimilars present a significant opportunity for growth in the diabetes drug market. As biological medicines face patent expirations, the availability of biosimilars offers clinicians and patients lower-cost alternatives without compromising efficacy. Currently, the biosimilar market is valued at approximately USD 26.5 billion globally and is poised for further expansion. This shift is driven by the estimated potential savings of around USD 54 billion for healthcare systems over the next decade, enhancing access to essential diabetes therapies. The increasing acceptance of biosimilars among healthcare providers signifies a shift in treatment paradigms that can respond to growing economic pressures in diabetes management.

Rising Demand for Personalized Medicine

The demand for personalized medicine in diabetes treatment is rapidly increasing as advancements in genomics and data analytics enable healthcare providers to offer tailored therapies. Current statistics show that approximately 80% of diabetes patients express interest in personalized treatment plans based on their unique genetic and health profiles. The growth of wearable technology and monitoring systems enhances patients’ ability to manage their conditions while providing valuable data to healthcare providers. As healthcare continues to evolve toward individualized treatment strategies, the market for personalized diabetes therapies is expected to gain substantial traction, reflecting a demand for more effective and patient-centered approaches.

Future Outlook

Over the next five years, the USA diabetes drugs market is expected to demonstrate substantial growth propelled by increased investments in diabetes management solutions and ongoing innovation in drug development. Technological advancements, such as smart insulin devices and integrated diabetes management systems, will play a vital role in shaping the market dynamics. Additionally, a rise in telemedicine and remote patient monitoring is anticipated to enhance patient adherence to treatment plans, further driving market expansion.

Major Players

- Novo Nordisk

- Sanofi US Services Inc.

- Eli Lilly and Company

- Merck & Co. Inc.

- AstraZeneca

- Boehringer Ingelheim

- Johnson & Johnson

- Bayer AG

- GlaxoSmithKline

- Amgen

- Abbott Laboratories

- Takeda Pharmaceutical

- Pfizer

- Mallinckrodt Pharmaceuticals

- Zeneca Holdings Inc.

- Others

Key Target Audience

- Pharmaceutical Companies

- Biotechnology Firms

- Healthcare Providers (Hospitals and Clinics)

- Retail and Online Pharmacies

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (FDA, CDC)

- Health Insurance Companies

- Diabetes Advocacy Groups

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive overview of the USA diabetes drugs market by identifying all significant stakeholders, including manufacturers, healthcare providers, regulatory bodies, and patients. This will be achieved through extensive desk research, employing both secondary and proprietary sources to compile essential industry data and identify critical trends impacting market dynamics.

Step 2: Market Analysis and Construction

This phase focuses on gathering and analyzing historical and current data relevant to the USA diabetes drugs market. The analysis covers market penetration, sales trends, and revenue generation across various segments. Statistical models and analytical tools will be employed to ensure accurate estimates of market size and growth rates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will undergo validation through structured interviews with professionals and experts across the diabetes care ecosystem. By engaging specialists involved in drug development, marketing, and patient care, this step aims to gather qualitative insights that complement quantitative data gathered in earlier phases, enriching the overall analysis.

Step 4: Research Synthesis and Final Output

The final stage includes synthesizing all data collected through market analysis and expert insights to produce a detailed and validated market report. This process will involve cross-referencing findings with additional sources to ensure a comprehensive picture of the USA diabetes drugs market, ultimately providing actionable recommendations for stakeholders.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics and Trends

- Competitive Landscape

- Supply Chain & Value Chain Analysis

- Growth Drivers

Rising Prevalence of Diabetes

Increasing Healthcare Expenditure - Market Challenges

High Cost of Diabetic Drugs

Regulatory Scrutiny - Opportunities

Expansion of Biosimilars

Rising Demand for Personalized Medicine - Trends

Integration of Technology in Diabetes Management

Growth of Telemedicine - Government Regulation

Drug Approval Processes

Pricing Regulations - SWOT Analysis

- Stakeholders’ Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Drug Class, (In Value %)

Insulin

GLP-1 Receptor Agonists

DPP-4 Inhibitors

SGLT-2 Inhibitors

Others - By Diabetes Type, (In Value %)

Type 1 Diabetes

Type 2 Diabetes - By Distribution Channel, (In Value %)

Retail Pharmacies

Hospital Pharmacies

Online Pharmacies - By Region, (In Value %)

Northeast

Midwest

South

West - By End User, (In Value %)

Hospitals

Clinics

Home Care - By Administration Route, (In Value %)

Injectable

Oral

- Market Share of Major Players on the Basis of Value/Volume

Market Share of Major Players by Type of Drug Class Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Drug Class, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Unique Value Offering)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Novo Nordisk

Sanofi US Services Inc.

Eli Lilly and Company

Merck & Co. Inc.

AstraZeneca

Boehringer Ingelheim

Johnson & Johnson

Bayer AG

GlaxoSmithKline

Amgen

Abbott Laboratories

Novo Nordisk

Takeda Pharmaceutical

Pfizer

Mallinckrodt Pharmaceuticals

Zeneca Holdings Inc.

Others

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030