Market Overview

Based on a multi-year industry analysis, the digital stethoscope segment represents a high-value niche within the broader global stethoscope market, which itself exceeds USD ~ million in annual revenue. Recent research places digital stethoscopes at about USD ~ million in annual sales worldwide, driven by adoption in cardiology, primary care and telehealth workflows. In parallel, US national health expenditures have climbed to roughly USD ~ trillion, or more than USD 14,000 per person, expanding the addressable base of physician and clinical services where digital auscultation tools are deployed.

Within this global context, the USA functions as the single most important country market for digital stethoscopes, anchored by its very high per-capita health spending—over USD 12,000 per person in the latest comparative data—and dense networks of tertiary hospitals and academic medical centers. Adoption is concentrated in metropolitan hubs such as Boston, New York, the San Francisco Bay Area, Houston and Chicago, where large integrated delivery networks, cardiology centers of excellence, and virtual-care platforms pilot AI-enabled devices from players like Eko Health and 3M Littmann. These ecosystems favor digital stethoscopes that integrate with EHRs and telehealth platforms and support advanced cardiac triage.

Market Segmentation

By Product Architecture

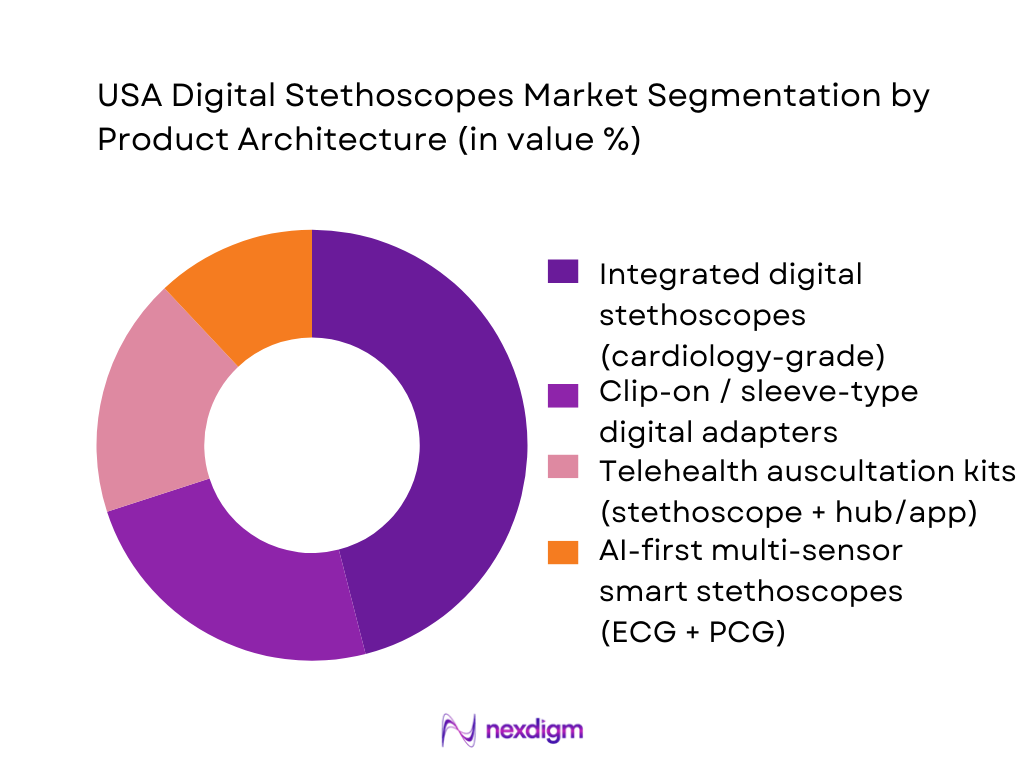

The USA Digital Stethoscopes Market is segmented by product architecture into integrated digital stethoscopes, clip-on or sleeve-type adapters, telehealth auscultation kits, and AI-first smart stethoscopes combining PCG with ECG and waveform visualization. Integrated digital stethoscopes currently hold a dominant share in the USA under this segmentation because they blend familiar cardiology-grade acoustics with digital amplification, noise cancellation and app connectivity. Partnerships such as 3M Littmann CORE with Eko software give clinicians up to 40x amplification, AI murmur detection and EMR integration in a single, trusted form factor, making these devices the default upgrade path from acoustic tools.

By End User

The USA Digital Stethoscopes Market is segmented by end user into hospitals and IDNs, office-based physicians and group practices, telehealth platforms, home-health and remote patient monitoring providers, and training & simulation centers. Hospitals and IDNs currently dominate this segmentation, reflecting their share of US health spending on physician and clinical services—nearly USD ~ trillion annually—and their role as early adopters of connected cardiopulmonary tools. Large systems deploy digital and AI-enabled stethoscopes in cardiology, heart-failure clinics and rapid-response teams, often integrated into tele-ICU and virtual nursing platforms, making this segment the primary engine of installed base growth.

Competitive Landscape

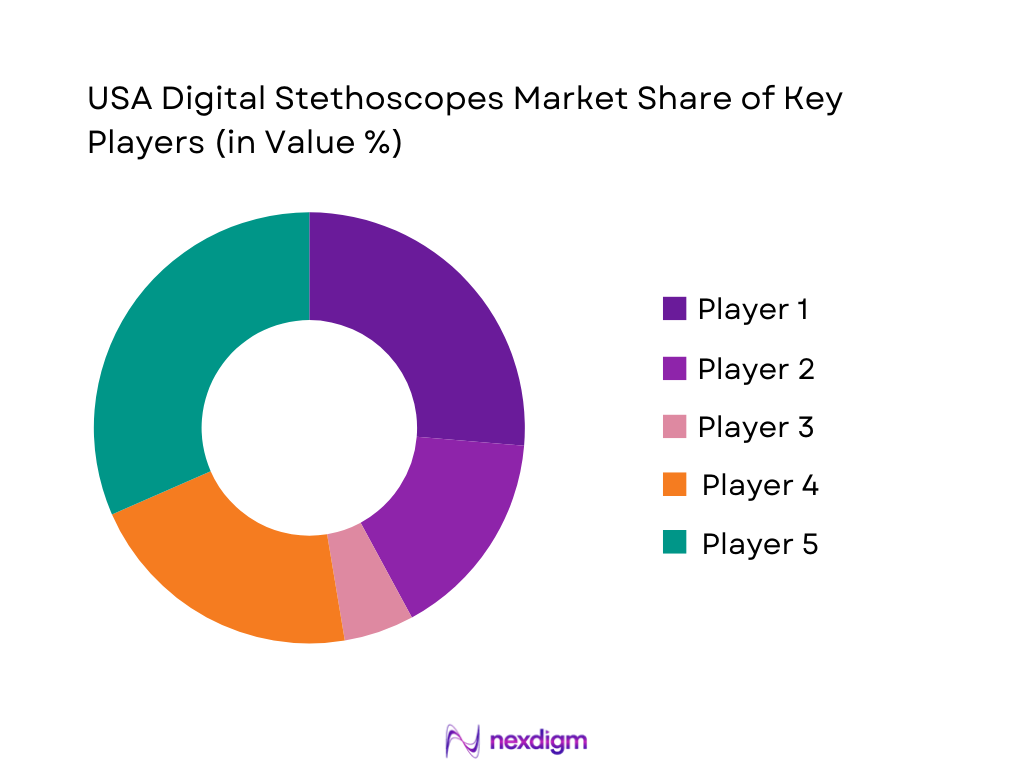

The USA Digital Stethoscopes Market is moderately concentrated, with a handful of vendors shaping product standards around AI, ECG integration, telehealth interoperability and regulatory clearances. Collaborations such as 3M Littmann x Eko, FDA-cleared AI algorithms for murmur and AFib detection, and visualization-focused devices like HD Steth and ViScope position these brands as reference platforms while leaving space for niche innovators in telemedicine-first and training-focused solutions.

| Company | Establishment Year | Headquarters (Global) | Core Digital Stethoscope Offering (USA) | AI / Signal-Processing Focus | Connectivity & Integration Stack | Primary Clinical Focus in USA | Go-to-Market & Channel Model | Regulatory Highlights (Digital Stethoscopes) |

| Eko Health | 2013 | Emeryville, California, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| 3M Littmann (with Eko) | 1902 | Maplewood, Minnesota, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Thinklabs | 1991 | Centennial, Colorado, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| HD Medical | 2000 | Silicon Valley, California, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Lapsi Health (Keiiku) | 2021 | Eindhoven, Netherlands (Active USA Presence) | ~ | ~ | ~ | ~ | ~ | ~ |

USA Digital Stethoscopes Market Analysis

Growth Drivers

Expansion of Telehealth, Virtual Care & Hospital-at-Home Programs

In the USA, a population of around ~ people is increasingly being reached through digital-first care models that depend on remote auscultation. Medicare alone recorded about ~ beneficiaries using telehealth in just the first quarter of 2022, a meaningful share of its roughly ~ beneficiaries, showing teleconsults are now routine rather than exceptional. CMS’s Acute Hospital Care at Home waiver has approved 328 hospitals, which reported around 6,100 home discharges in 2022 and about 23,000 discharges by April 2024, illustrating a sizable cohort requiring bedside-equivalent diagnostics at home—exactly where digital stethoscopes fit into remote exams and virtual rounding workflows.

Cardiovascular & Respiratory Disease Burden and Screening Imperatives

The USA faces a heavy cardiometabolic and respiratory burden that structurally favors earlier, more distributed auscultation. An estimated ~ people live with at least one major chronic condition such as cardiovascular disease, diabetes or chronic respiratory disease, creating huge demand for longitudinal monitoring of heart and lung sounds in primary care and community settings. Around ~ people have diabetes and about ~ adults have prediabetes, conditions tightly linked with heart failure risk, while roughly ~ adults live with chronic kidney disease that further amplifies cardiovascular complications. Overall, the country records over ~ deaths annually, with heart disease and respiratory complications among leading causes—driving hospitals, IDNs and ambulatory networks to adopt digital stethoscopes for earlier screening, risk stratification and long-term disease management.

Challenges

Device & Subscription Economics vs Budget Constraints

Although the USA spends about ~ dollars annually on health care, hospital and clinic budgets are under intense pressure from labor, pharmaceuticals and capital costs, leaving limited room for new subscription-based devices. Per-capita health spending of roughly ~ dollars means payers and providers already operate at some of the world’s highest cost levels, while hospital operating margins for many systems have hovered near breakeven in recent financial cycles. At the same time, about ~ people remained uninsured in 2023, reducing reimbursable visit volumes in some markets and making capital committees cautious about investing in fleet-wide digital stethoscope deployments and recurring cloud-analytics fees. This cost tension forces vendors to demonstrate hard ROI through reduced readmissions, fewer unnecessary imaging orders and more efficient visit workflows rather than relying on purely clinical arguments.

Clinician Adoption, Training & Change-Management Barriers

Rolling out digital stethoscopes at scale in the USA must contend with the realities of a workforce exceeding ~ registered nurses and hundreds of thousands of physicians, each with ingrained auscultation habits. Time-motion and EHR-workflow research has shown that digital tools can initially increase documentation and interaction time for clinicians, raising concerns that new devices will further slow patient flow. Telehealth utilization numbers, such as the ~ Medicare beneficiaries who used telehealth in early 2022, illustrate how quickly a new modality can scale—but also how many front-line staff must be trained when technologies become standard of care. Health-IT studies continue to document reservations around device usability, alert fatigue and audio-quality interpretation, meaning digital stethoscope rollouts must include large-scale training, simulation, and embedded “super-user” support so that clinicians trust AI flags and recorded sounds as much as traditional bedside auscultation.

Opportunities

Remote Monitoring & Chronic Disease Management Cohorts

The USA’s chronic-disease profile creates a large installed base of patients who could benefit from longitudinal, AI-supported digital auscultation at home or in community clinics. Approximately ~ people live with at least one major chronic condition, including large cohorts with heart failure, COPD, CKD and diabetes that drive recurrent hospitalizations and ED visits. Around ~ people have diabetes and ~ adults have chronic kidney disease, both strongly linked with cardiac and pulmonary complications that are detectable early through subtle changes in heart and lung sounds. At the same time, about ~ people are aged 65 or older, an age band with higher multimorbidity, and national hospital-bed density averages 2.8 beds per 1,000 people—limiting capacity for preventable admissions. Remote-capable digital stethoscopes, embedded in RPM kits or home-health visits, can support earlier decompensation detection and targeted escalation, aligning with payer and provider incentives to reduce avoidable admissions and readmissions.

Pediatric, Geriatric & Community Health-Specific Solutions

Demographics and access patterns in the USA create distinct high-value niches for specialized digital stethoscope solutions. Roughly ~ people are under 18, a group where pediatric cardiology, congenital heart disease screening and school-based asthma management all benefit from child-friendly, high-signal devices and remotely reviewable waveforms. Around ~ people are 65 or older, many living with frailty, heart failure or chronic lung disease that make travel to clinics difficult, while only 4.1 long-term-care workers per 100 older adults are available. Community access is further shaped by about ~ rural health clinics and ~ critical access hospitals that serve dispersed populations, along with approximately ~ uninsured people who often rely on safety-net facilities. Digital stethoscope platforms tailored for pediatrics, geriatrics and rural outreach—integrated into mobile clinics, home-visiting programs and public-health initiatives—can unlock growth by addressing clinically complex cohorts where traditional specialist access is constrained and remote auscultation can materially shift outcomes.

Future Outlook

Over the next several years, the USA Digital Stethoscopes Market is expected to expand steadily in value, broadly aligned with mid-single-digit CAGR levels (around 5.5%) indicated for the US digital stethoscope segment and similar global benchmarks. Growth will be driven by the rising prevalence of cardiovascular disease and heart-failure admissions, increasing use of telemedicine and virtual nursing programs, and the integration of FDA-cleared AI that doubles detection rates for conditions such as heart failure and atrial fibrillation compared with traditional auscultation alone. As payers and health systems shift more cardiac care to outpatient and community settings, digital stethoscopes will play a larger role in home-based triage and population-health programs, particularly when bundled with RPM kits.

Major Players

- Eko Health

- 3M Littmann

- Thinklabs Medical

- HD Medical

- Welch Allyn / Hillrom

- Lapsi Health

- Cardionics

- American Diagnostic Corporation

- eKuore

- Contec Medical Systems

- A&D Medical

- Heine Optotechnik

- Riester

- Omron Healthcare

Key Target Audience

- Executives of hospitals and integrated delivery networks

- Large multi-specialty physician groups and primary-care networks

- Telehealth and virtual-first care platforms

- Home-health and remote patient monitoring providers

- Medical device OEMs and diagnostic platform integrators

- Investments and venture capitalist firms

- Government and regulatory bodies

- Health insurance payers and managed care organizations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map for the USA Digital Stethoscopes Market, covering device manufacturers, AI algorithm providers, telehealth platforms, hospital systems, group practices and RPM vendors. Extensive desk research is conducted using secondary and proprietary databases, FDA 510 filings, vendor disclosures and macro-health expenditure datasets. This allows us to identify critical variables such as installed base by end user, product architecture mix, AI-adoption tiers, and connectivity requirements.

Step 2: Market Analysis and Construction

Next, historical and forecast data from syndicated market studies on global and US digital stethoscope markets are compiled, normalized and reconciled with stethoscope and telehealth adoption indicators. This includes segmenting revenue by product architecture, end user and clinical application, triangulating growth patterns against trends in cardiovascular disease burden, virtual-care visit volumes and national spending on physician and clinical services. A bottom-up view of unit volumes and ASPs is built and calibrated against top-down revenue benchmarks.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on drivers, barriers, and segment growth are validated through structured interviews and surveys with cardiologists, hospital IT leaders, telehealth CMOs, biomedical engineers, and procurement heads across the USA. Discussions focus on product evaluation criteria, integration roadmaps, pilot-to-scale patterns and ROI thresholds for digital auscultoscope deployments. Where possible, these insights are cross-checked against published case studies and clinical trials of AI-powered stethoscopes.

Step 4: Research Synthesis and Final Output

In the final synthesis, findings from quantitative modeling and expert feedback are consolidated into segment-wise revenue estimates, growth scenarios and competitive positioning maps. Special emphasis is placed on mapping AI capability tiers, EMR and telehealth integration depth, and US-specific regulatory and reimbursement inflection points. The result is a validated top-to-bottom and bottom-to-top view of the USA Digital Stethoscopes Market, with clear linkages between macro health-system trends, clinical workflow changes and vendor-level opportunities.

- Executive Summary

- Research Methodology (device definition & inclusion criteria, digital vs hybrid stethoscopes, top-down & bottom-up sizing, clinician interviews, telehealth platform inputs, procurement benchmarks)

- Definition & Scope of Digital Stethoscopes in the USA

- Evolution of Auscultation: From Acoustic to AI-Augmented Digital Devices

- Role of Digital Stethoscopes in Cardio-Pulmonary Diagnostic Pathways

- Device Taxonomy: Integrated Digital, Digital Attachments, Telehealth Kits & AI-First Devices

- Business Cycle: R&D, Regulatory Clearance, Commercialization, Upgrades & Decommissioning

- Growth Drivers

Expansion of Telehealth, Virtual Care & Hospital-at-Home Programs

Cardiovascular & Respiratory Disease Burden and Screening Imperatives

Clinician Shortages, Task Shifting & Need for Remote Decision Support

Infection Prevention, Reusability, Device Sharing & Standardized Workflows

Integration with AI Decision Support, Sound Libraries & EHR Systems - Challenges

Device & Subscription Economics vs Budget Constraints

Clinician Adoption, Training & Change-Management Barriers

Data Security, HIPAA Compliance & IT Integration Complexity

Competition from Point-of-Care Ultrasound & Other Diagnostic Modalities

Interoperability Gaps, Proprietary Ecosystems & Vendor Lock-In - Opportunities

Remote Monitoring & Chronic Disease Management Cohorts

Pediatric, Geriatric & Community Health-Specific Solutions

AI-First Screening Programs & Risk Stratification Workflows

Value-Based Care Programs & Alignment with Quality Metrics

OEM Partnerships with Telehealth, RPM & EHR Vendors - Trends

Multi-Sensor Platforms (Stethoscope, ECG, Pulse & Other Vitals)

Advanced Noise Cancellation & Signal Processing for Noisy Environments

Cloud Dashboards, Longitudinal Sound Libraries & Collaboration Tools

Subscription, Device-as-a-Service & Outcome-Tied Commercial Models

Student, Residency & Simulation Bundles for Education - Regulatory & Compliance Landscape

- Technology & Innovation Roadmap

- Stakeholder Ecosystem Mapping

- Porter’s Five Forces Analysis for USA Digital Stethoscopes

- SWOT Analysis for the USA Digital Stethoscopes Market

- By Value, 2019-2024

- By Volume, 2019-2024

- Average Realization per Device & Revenue Mix, 2019-2024

- Mix of First-Time Installations vs Replacement / Upgrade Purchases, 2019-2024

- By Product Architecture (in Value %)

Fully Integrated Digital Stethoscopes

Digital Attachments & Conversion Modules for Acoustic Stethoscopes

Telehealth & Home-Exam Kits with Integrated Digital Stethoscopes

AI-Enabled Diagnostic Stethoscopes with Automated Interpretation

Training, Teaching & Simulation-Focused Digital Stethoscopes - By Connectivity & Integration Layer (in Value %)

Bluetooth-Only Connected Devices

Bluetooth plus Wi-Fi / Cellular-Enabled Devices

Devices with EHR / EMR Integration (HL7 / FHIR API Enabled)

Devices Integrated with Telehealth & Remote Patient Monitoring Platforms

Standalone / Offline Recording Devices - By Clinical Application (in Value %)

Cardiology & Structural Heart Disease Assessment

Pulmonology & Respiratory Disease Management

Primary Care & Internal Medicine Use Cases

Emergency, Critical Care, Transport & Pre-Hospital Settings

Pediatrics, Neonatology & School-Based Health - By End-User Setting (in Value %)

Hospitals & Integrated Delivery Networks

Ambulatory Care Centers & Physician Offices

Telehealth Providers, Virtual-First Clinics & Hospital-at-Home Programs

Academic Medical Centers, Residency & Nursing Schools

Home Health, Long-Term Care, Skilled Nursing & Hospice - By Distribution & Procurement Channel (in Value %)

Direct OEM & Inside Sales to Health Systems

Group Purchasing Organizations & Hospital Supply Contracts

Medical Distributors & Device Marketplaces

Bundled Sales via Telehealth / RPM / EHR Platform Partnerships

Online Retail & E-Commerce / DME Channels - By Price / Feature Tier (in Value %)

Entry-Level Digital Stethoscopes

Mid-Range Clinical Devices

Premium Cardiology & AI-Enhanced Devices

- Market Share of Major Players by Value & Volume

Market Share of Major Players by Product Architecture & Care Setting Focus - Cross Comparison Parameters for Major Companies (Company Overview & Ownership Structure, USA Digital Stethoscope Portfolio Depth & Clinical Focus Areas, AI & Clinical Decision-Support Capabilities, Connectivity & Integration Stack, USA Installed Base, Key Reference Sites & Flagship Deployments, Reimbursement, Coding Enablement & Support for Billing Workflows, Service, Training, Field Support & Fleet Management Infrastructure, Cybersecurity, HIPAA Compliance Model & Data Governance Policies)

- SWOT Analysis of Leading Competitors

- Pricing & Packaging Analysis by Device Configuration & Subscription Tier

- Distribution, Service & Support Models Across USA Regions

- Detailed Profiles of Major Companies

Solventum / 3M Littmann

Eko Health

Thinklabs Medical

HD Medical

Welch Allyn – A Baxter Company

Cardionics

American Diagnostic Corporation

Sonavi Labs

M3DICINE

eKuore Medical

TytoCare

AMD Global Telemedicine

Nonin Medical

CliniCloud

- Clinical Personas & Usage Intensity by Specialty and Setting

- Budget Owners, Decision-Making Units & Procurement Workflows

- Evaluation Criteria: Audio Quality, AI Capability, Integration, TCO & Support

- Needs, Pain Points & Unmet Requirements Across End-User Segments

- Adoption Curve by Customer Archetype

- By Value, 2025-2030

- By Volume, 2025-2030

- Average Realization per Device & Revenue Mix, 2025-2030

- Mix of First-Time Installations vs Replacement / Upgrade Purchases, 2025-2030