Market overview

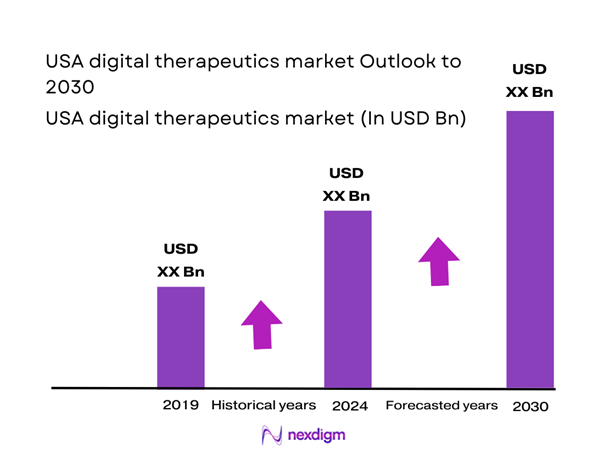

The USA digital therapeutics market is valued at USD ~ billion, rising from USD ~ billion in the prior year, as software-based therapeutic interventions are increasingly adopted for chronic disease management and behavioral health pathways. This growth is reinforced by payer and employer interest in scalable care models, alongside broader healthcare digitization and remote monitoring integration. In parallel, benchmark forecasts for the USA point to a ~ CAGR over the forecast window, reflecting sustained adoption momentum across regulated and non-regulated DTx models.

The market’s activity is concentrated in major innovation and payer hubs—San Francisco Bay Area (digital health startups, employer-sponsored care platforms), Boston–Cambridge (clinical research density and health-system partnerships), New York City (payers, large employers, and integrated delivery networks), and Chicago (national employer benefits and payer operations). At the country level, the U.S. dominates North America due to scale, earlier telehealth adoption, and clearer Software-as-a-Medical-Device pathways; global leaders from Germany and the UK also influence the U.S. competitive bar through reimbursement and evidence frameworks that shape product design expectations.

Market segmentation

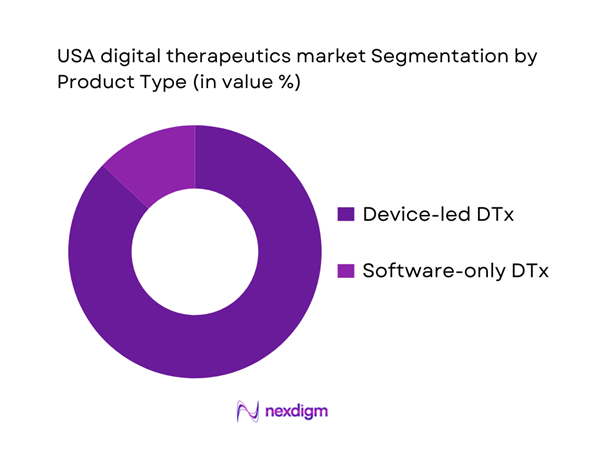

By Product Type

USA digital therapeutics are segmented by product type into device-led DTx bundles and software-only DTx programs. Recently, device-led DTx bundles dominate because many high-uptake clinical use cases in the U.S. are implemented as “DTx + data capture” models (connected devices, sensors, or wearables paired with app-driven therapeutic logic). This improves adherence measurement, closes the loop on real-world outcomes, and makes it easier for payers/employers to justify coverage through utilization and outcomes reporting. Device-led offerings also support clinician confidence by enabling objective monitoring for cardiometabolic, respiratory, and lifestyle-linked conditions—where measurement continuity is central to treatment pathways. Additionally, enterprise buyers prefer bundles that reduce fragmentation (one vendor managing onboarding, monitoring, engagement nudges, and escalation rules), lowering integration friction across care management stacks.

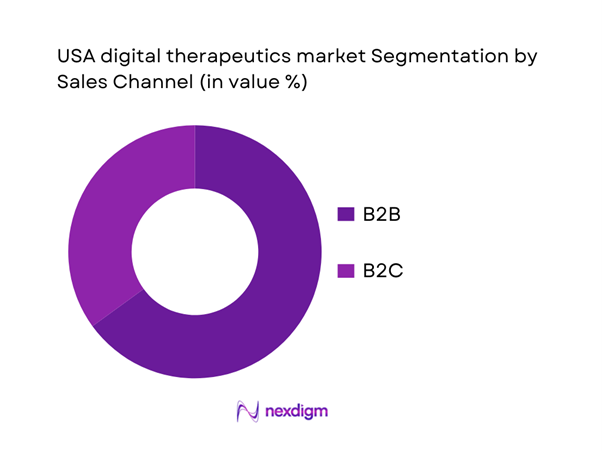

By Sales Channel

USA digital therapeutics are segmented by sales channel into Business-to-Business (B2B) and Business-to-Consumer (B2C). Recently, B2B dominates because the largest near-term demand is concentrated among payers, employers, and provider organizations seeking measurable cost offsets and standardized population-scale deployment. B2B contracts also reduce customer acquisition cost compared with consumer subscription models and enable rapid scale through existing benefit enrollment and care management pathways. For many therapeutic areas—diabetes risk, obesity, cardiometabolic conditions, and behavioral health—buyers increasingly demand integration with care navigation, coaching, and claims/eligibility systems, which structurally favors enterprise deployment. B2B also aligns with outcomes-based pricing structures (engagement milestones, clinical endpoints, or utilization reduction), which are easier to operationalize when the buyer controls the population and data permissions.

Competitive landscape

The USA digital therapeutics market is moderately consolidated in enterprise deployments, where a set of established digital care and DTx-adjacent platforms win contracts through payer/employer relationships, clinical validation, and integration depth. Competition is defined less by “apps” and more by the ability to prove outcomes, sustain engagement, and fit into care workflows (EHR, claims, navigation, and coaching). A parallel layer of innovation persists in FDA-regulated prescription DTx and condition-specific therapeutics, but commercial scale is still most consistently achieved via enterprise channels.

| Company | Est. Year | HQ | Primary therapeutic focus | Core customer (B2B/B2C) | Evidence posture (typical) | Care model | Integration depth | Differentiation lever |

| Omada Health | 2011 | U.S. | ~ | ~ | ~ | ~ | ~ | ~ |

| Teladoc Health | 2002 | U.S. | ~ | ~ | ~ | ~ | ~ | ~ |

| Noom | 2008 | U.S. | ~ | ~ | ~ | ~ | ~ | ~ |

| WellDoc | 2005 | U.S. | ~ | ~ | ~ | ~ | ~ | ~ |

| Click Therapeutics | 2012 | U.S. | ~ | ~ | ~ | ~ | ~ | ~ |

USA Digital Therapeutics Market Analysis

Growth Drivers

FDA Regulatory Acceptance

FDA’s expanding digital health oversight is a direct catalyst for USA digital therapeutics adoption because it reduces regulatory ambiguity for software-based interventions that make treatment claims. A clear signal of this “regulatory normalization” is the FDA’s maintained inventory of authorized AI/ML-enabled medical devices: the agency reported ~ AI/ML-enabled medical devices authorized for marketing through ~ and noted it had added ~ devices in the latest update cycle—evidence that software-centric clinical products are increasingly being cleared through established pathways (510(k), De Novo, PMA). This occurs in a macro environment where the U.S. economy operates at very large scale—USD ~ trillion in GDP—supporting higher healthcare digitization capacity and faster commercialization cycles for regulated products. The practical market impact is that DTx builders can design clinical studies, labeling, and post-market controls to match FDA expectations, which strengthens procurement confidence among payers and providers who treat “FDA-regulated” as a proxy for safety and accountability.

Rising Chronic Disease Burden

Digital therapeutics scale fastest where disease burden is large, longitudinal, and behaviorally mediated—exactly the profile of the U.S. chronic disease load. Federal statistics show ~ million people with diabetes and ~ million adults with prediabetes, both of which are DTx-relevant because sustained behavior change, adherence, and monitoring determine outcomes. The mortality base reinforces the same demand logic: CDC reports ~ deaths from heart disease, a leading chronic category tied to cardiometabolic risk pathways that many DTx programs target. This demand sits inside a healthcare spending system already operating at very high absolute intensity—CMS reports national health expenditures of USD ~ trillion and USD ~ per person—which increases buyer willingness (payers, employers, providers) to fund interventions that can reduce downstream utilization and complications without adding physical capacity. At the macro level, the U.S. GDP scale of USD ~ trillion supports large employer populations, high smartphone penetration, and extensive payer and provider infrastructure—conditions that make population-scale DTx deployment feasible. Together, these factors explain why U.S. DTx adoption concentrates around cardiometabolic prevention and chronic care programs: the burden is measurable, expensive, and addressable by scalable software-supported behavior change and care pathways.

Challenges

Reimbursement Uncertainty

A key friction in scaling FDA-regulated and clinically positioned DTx in the U.S. is uneven reimbursement pathways across Medicare, Medicaid, and commercial plans—especially when products do not map cleanly to a well-established benefit category or billing workflow. Policy complexity increases administrative overhead for adoption even as the overall healthcare market is massive: CMS reports USD ~ trillion in national health expenditures and USD ~ billion in Medicare spending, meaning reimbursement ambiguity can materially slow procurement despite clear need. Operationally, reimbursement uncertainty often shows up as coverage variance across plans, prior authorization requirements, and fragmented coding strategies—issues that affect provider willingness to prescribe and employer/payer willingness to deploy at scale. The challenge sits alongside ongoing federal modernization of payer workflows: CMS finalized the CMS Interoperability and Prior Authorization Final Rule (released ~), which mandates API-based improvements for impacted payers. While this rule improves data exchange and can reduce friction over time, it also underscores how policy and compliance timelines shape adoption of digital care tools. In an economy of GDP USD ~ trillion, the U.S. can build these infrastructures, but DTx vendors still face short-term commercialization risk when reimbursement and utilization management policies vary. As a result, companies often prioritize employer and payer direct contracting (B2B) over provider-prescribed routes, potentially slowing the spread of prescription-like DTx models in routine clinical practice until coverage pathways become more consistent.

Physician Prescribing Inertia

Even when a DTx product is clinically sound, physician prescribing behavior can lag because providers must integrate new tools into already burdened workflows (documentation, e-prescribing controls, follow-up cadence). Federal health IT data shows adoption does not automatically translate to “routine prescribing of new digital modalities.” For example, the U.S. health IT program reports office-based physician use of electronic prescribing of controlled substances patterns (EPCS use is tracked and summarized), demonstrating that even mature digital functions require behavior change and operational readiness. At the same time, the clinician time constraint is real: workforce reporting highlights broad system pressure and staffing challenges across care settings. This inertia matters because DTx often requires structured onboarding, monitoring of patient-reported outcomes, and follow-up actions—tasks that can be difficult to fit into short visit times without support staff or automation. The macro environment intensifies the issue: CMS reports USD ~ trillion in national health expenditures, reflecting a high-utilization system where clinicians are managing large volumes and complex patients; and the U.S. GDP of USD ~ trillion supports widespread digital infrastructure but does not remove operational constraints at the point of care. For DTx to overcome prescribing inertia, products typically must integrate into EHR workflows, minimize extra steps, and provide clear clinical decision support outputs. Until those “workflow economics” are solved, DTx adoption may remain stronger in payer/employer deployments than in physician-initiated prescribing pathways, despite favorable policy signals for digital health innovation.

Opportunities

Medicare & Medicaid Coverage Expansion

A high-impact growth opportunity for U.S. digital therapeutics is broader public-program accessibility, because Medicare and Medicaid represent enormous addressable populations and increasingly influence commercial coverage norms. Financial reporting states Medicare enrollment is approximately ~ million beneficiaries and Medicaid enrollment is about ~ million beneficiaries, indicating that public coverage programs alone touch a population scale comparable to most large countries. Separately, program summaries note Medicaid/CHIP covers more than ~ million Americans, reinforcing the breadth of coverage channels relevant to DTx expansion. These programs are also central to U.S. healthcare financing: reporting shows Medicare spending of USD ~ billion and Medicaid spending of USD ~ billion in national health expenditure accounting—showing why even incremental adoption of clinically validated DTx within public-program pathways can materially expand vendor volumes. The macro environment supports this opportunity: GDP USD ~ trillion reflects the fiscal scale that can support modernization initiatives, while interoperability policy (including payer API rules) is pushing the system toward more standardized digital data flows. Importantly, “coverage expansion” here is not framed as a future statistic; it is grounded in today’s massive enrolled base and the ongoing modernization pressure within public programs.

Digital Formularies Adoption

Digital formularies—structured evaluation and coverage mechanisms for digital health/DTx offerings—represent a growth lever because they convert DTx procurement from ad-hoc pilots into repeatable benefit design decisions, especially in large payer and employer ecosystems. The U.S. policy backdrop is moving in the direction of “operational standardization” for payer workflows: the Interoperability and Prior Authorization Final Rule (released ~) requires impacted payers to implement API-driven processes that support patient access and more efficient authorization and data exchange. While not a DTx formulary by itself, it reduces friction for any benefit that requires eligibility verification, documentation, or utilization management—core plumbing that enables digital therapeutics to be operationalized as covered interventions. The scale of the financing system supports the opportunity: reporting shows USD ~ trillion in total national health expenditures and USD ~ billion in private health insurance spending—meaning commercial payers have both the incentive and the administrative apparatus to standardize coverage categories that improve outcomes and reduce costs. Macro context again matters: GDP USD ~ trillion indicates the U.S. has the economic scale for sustained investment in health IT infrastructure.

Future outlook

Over the next several years, the USA digital therapeutics market is expected to expand as enterprise buyers continue shifting from point solutions to measurable, outcomes-linked digital therapeutic programs, particularly in cardiometabolic and behavioral health use cases. Reimbursement and formulary experimentation (including payer-led digital formularies), higher provider comfort with remote-first pathways, and AI-enabled personalization are likely to improve engagement and clinical impact. At the same time, vendors will be pressured to demonstrate durable outcomes, interoperability, and security-by-design to sustain contract renewals and scale.

Major players

- Omada Health

- Teladoc Health

- WellDoc

- Noom

- Click Therapeutics

- Akili Interactive

- Pear Therapeutics

- 2Morrow

- Propeller Health

- Fitbit Health Solutions

- Canary Health

- Better Therapeutics

- DarioHealth

- Biofourmis

Key target audience

- Health insurance and managed care organizations

- Self-insured employers and employer coalitions

- Integrated Delivery Networks and health systems

- Behavioral health provider networks and specialty clinics

- Pharmacy benefit managers and digital formulary stakeholders

- Digital health platform aggregators and care navigation companies

- Investments and venture capitalist firms

- Government and regulatory bodies

Research methodology

Step 1: Identification of Key Variables

We begin by mapping the USA DTx ecosystem across developers, payers, employers, provider systems, and regulators. Desk research consolidates definitions (prescription vs non-prescription DTx) and builds a variable set covering adoption drivers, commercialization paths, and evidence requirements. The objective is to lock the market boundary and the metrics used for sizing and segmentation.

Step 2: Market Analysis and Construction

We compile historical market signals and triangulate market development using revenue proxies, enterprise adoption patterns, and therapeutic area deployment logic. The analysis evaluates how channel structure (B2B vs B2C) and product models (device-led vs software-only) translate into monetization. We also assess procurement requirements such as integration depth and outcome reporting.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on dominant segments and buyer behavior are validated through structured expert calls (CATIs) across payers, employer benefits leaders, provider digital teams, and DTx product leaders. These discussions provide operational validation on contracting models, engagement performance expectations, and real-world deployment constraints.

Step 4: Research Synthesis and Final Output

We synthesize quantitative outputs (market size, CAGR, segment shares) with qualitative insights (buyer decision criteria, evidence standards, competitive positioning). Findings are cross-checked against reputable industry publications and market databooks, ensuring conclusions are consistent with observable U.S. adoption and regulatory realities.

- Executive Summary

- Research Methodology (Market Definition & Clinical Boundary Assumptions, Digital Therapeutics Taxonomy & FDA Classification Logic, Abbreviations, USA Market Sizing Framework, Bottom-Up & Top-Down Validation, Prescription vs Non-Prescription Scoping Logic, Primary Interviews with DTx Developers, Clinicians, Payers & Employers, Data Triangulation Using FDA Databases & CMS Sources, Limitations & Forward-Looking Assumptions)

- Definition and Scope

- Market Evolution and Genesis

- Timeline of FDA-Cleared and FDA-Authorized Digital Therapeutics

- Digital Therapeutics Business Cycle

- USA Digital Therapeutics Value Chain and Stakeholder Mapping

- Growth Drivers

FDA Regulatory Acceptance

Rising Chronic Disease Burden

Shortage of Behavioral Health Professionals

Employer-Led Healthcare Cost Optimization

Alignment with Value-Based Care Models - Challenges

Reimbursement Uncertainty

Physician Prescribing Inertia

Clinical Evidence Generation Costs

Patient Engagement Drop-Off

Data Privacy & HIPAA Compliance Risks - Opportunities

Medicare & Medicaid Coverage Expansion

Digital Formularies Adoption

Integration with GLP-1 and CNS Drug Therapies

Rural Healthcare Access Enablement

AI-Personalized Care Pathways - Trends

Shift Toward Prescription Digital Therapeutics

AI-Adaptive Therapy Models

Real-World Evidence-Driven Adoption

Employer–Payer Partnership Expansion - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Patient Adoption, 2019–2024

- By Prescription Penetration, 2019–2024

- By Application (in Value %)

Diabetes & Metabolic Disorders

Mental Health & Behavioral Disorders

Substance Use Disorder & Addiction

Cardiovascular & Hypertension Management

Neurological Disorders - By Technology Architecture (in Value %)

Prescription Digital Therapeutics (PDTx)

Non-Prescription / Wellness-Adjacent Digital Therapeutics

FDA-Cleared SaMD-Based Therapeutics

AI-Driven Adaptive Therapeutics

Hybrid Digital Therapeutics + Companion Drug Platforms - By End-Use Industry (in Value %)

Hospitals & Health Systems

Specialty Clinics & Behavioral Health Centers

Employers & Corporate Wellness Programs

Health Insurance & Managed Care Organizations

Direct-to-Consumer Channels - By Connectivity Type (in Value %)

Physician-Prescribed & EHR-Integrated Platforms

Payer-Reimbursed Digital Therapeutics

Employer-Sponsored Digital Access Models

Pharmacy-Linked Digital Distribution

App-Store / Direct Digital Access - By Technology Architecture (in Value %)

AI/ML-Driven Cognitive Behavioral Therapy Platforms

Sensor-Integrated Digital Therapeutics

Gamified Behavior Modification Platforms

Remote Monitoring-Linked Therapeutics

Adaptive Feedback & Digital Twin Systems

- Market Share Analysis by Revenue & Active Users

- Cross Comparison Parameters (FDA Clearance Status, Therapeutic Area Coverage, Prescription vs Non-Prescription Mix, Clinical Trial Depth, Reimbursement Coverage Strength, Payer & Employer Partnerships, AI Personalization Capability, EHR & Workflow Integration Depth)

- SWOT Analysis of Key Players

- Pricing & Reimbursement Framework Analysis

- Company Profiles

Pear Therapeutics

Omada Health

Akili Interactive

Propeller Health

Noom

Happify Health

Click Therapeutics

Better Therapeutics

Welldoc

DarioHealth

Biofourmis

Voluntis

Limbix

Sidekick Health

- Demand & Clinical Utilization Patterns

- Budget Allocation & ROI Expectations

- Compliance & Clinical Governance

- Pain Points & Adoption Barriers

- Decision-Making & Vendor Selection Criteria

- By Value, 2025–2030

- By Patient Adoption, 2025–2030

- By Prescription Penetration, 2025–2030