Market Overview

Based on a recent historical assessment, the USA Digital Twin in Automotive market was valued at approximately USD ~ billion, driven by accelerated adoption of advanced simulation technologies across vehicle design, manufacturing, and lifecycle management. Automotive OEMs and suppliers increasingly rely on digital twins to reduce development costs, shorten validation cycles, and improve product quality amid rising complexity from electrification and software-defined vehicles. Integration of real-time data analytics, cloud computing, and AI-enabled modeling further supports demand across engineering, production optimization, and predictive maintenance use cases.

The market is primarily dominated by the United States due to strong automotive R&D intensity, deep penetration of Industry 4.0 technologies, and the presence of leading software and automotive technology providers. Cities such as Detroit, San Jose, Austin, and Seattle act as major hubs owing to dense OEM clusters, advanced digital infrastructure, and proximity to semiconductor, cloud, and AI ecosystems. Federal emphasis on smart manufacturing and advanced mobility technologies also reinforces regional leadership.

Market Segmentation

By Product Type

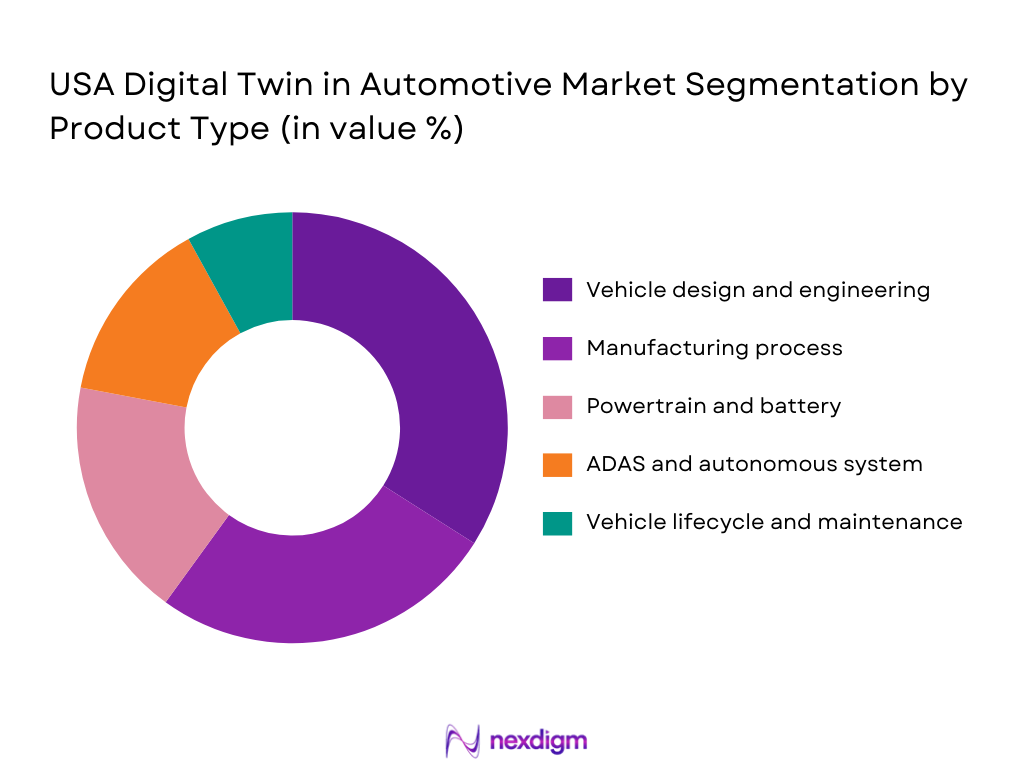

The USA Digital Twin in Automotive market is segmented by product type into vehicle design and engineering digital twins, manufacturing process digital twins, powertrain and battery digital twins, ADAS and autonomous system digital twins, and vehicle lifecycle and maintenance digital twins. Recently, vehicle design and engineering digital twins have held a dominant market share due to their critical role in reducing physical prototyping costs, accelerating design validation, and enabling virtual testing of complex vehicle architectures. Automotive manufacturers increasingly depend on these solutions to manage software-hardware integration, lightweighting initiatives, and compliance with safety standards. The availability of mature CAD, CAE, and PLM-integrated twin platforms, combined with skilled engineering talent and established workflows, further supports dominance. Additionally, early adoption by OEMs and Tier 1 suppliers, along with compatibility across internal R&D processes, has positioned design-focused digital twins as the most commercially entrenched segment.

By Platform Type

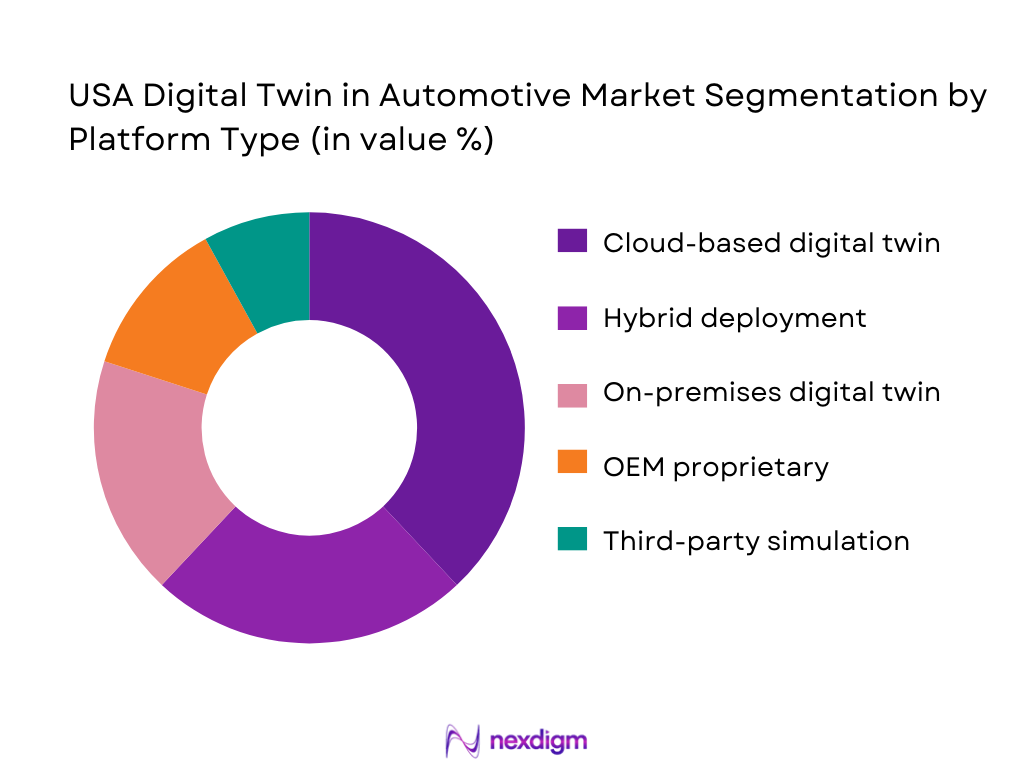

The USA Digital Twin in Automotive market is segmented by platform type into cloud-based digital twin platforms, on-premise digital twin platforms, hybrid deployment platforms, OEM proprietary platforms, and third-party simulation platforms. Recently, cloud-based digital twin platforms have dominated the market share due to scalability, cost efficiency, and seamless integration with real-time vehicle and manufacturing data streams. Automotive firms increasingly prefer cloud deployments to support collaborative engineering, remote access, and continuous model updates across distributed teams. The growing availability of secure automotive-grade cloud infrastructure, coupled with advanced analytics and AI toolkits, further strengthens adoption. Cloud platforms also align with subscription-based procurement models, lowering upfront investment barriers and enabling rapid deployment across multiple vehicle programs and facilities.

Competitive Landscape

The USA Digital Twin in Automotive market is moderately consolidated, with a small number of global software and industrial technology providers exerting significant influence through comprehensive platforms and long-standing OEM relationships. Major players benefit from integrated simulation, analytics, and lifecycle management capabilities, creating high switching costs for customers. Strategic partnerships with automotive manufacturers and cloud providers further strengthen competitive positioning and limit entry for smaller vendors.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Automotive Focus |

| Siemens Digital Industries Software | 2007 | USA | ~ | ~ | ~ | ~ | ~ |

| Dassault Systèmes | 1981 | France | ~ | ~ | ~ | ~ | ~ |

| PTC | 1985 | USA | ~ | ~ | ~ | ~ | ~ |

| ANSYS | 1970 | USA | ~ | ~ | ~ | ~ | ~ |

| Altair Engineering | 1985 | USA | ~ | ~ | ~ | ~ | ~ |

USA Digital Twin in Automotive Market Analysis

Growth Drivers

Electrification and Software-Defined Vehicle Development Complexity

Electrification and the shift toward software-defined vehicles have significantly increased system complexity across automotive platforms, driving strong demand for digital twin solutions that can model, simulate, and validate interactions between mechanical, electrical, and software components. Digital twins enable OEMs to virtually test battery systems, power electronics, and thermal management architectures under diverse operating conditions without extensive physical prototypes. This capability reduces development timelines, mitigates costly late-stage design changes, and supports compliance with stringent safety and performance requirements. As electric vehicles integrate advanced control software and over-the-air update capabilities, digital twins also assist in validating software behavior across multiple hardware configurations. The ability to continuously update virtual models using real-world data further enhances reliability and lifecycle optimization. Automotive manufacturers increasingly view digital twins as essential tools to manage platform modularity, accelerate innovation, and maintain competitiveness in an environment defined by rapid technological change.

Smart Manufacturing and Predictive Operations Adoption

The growing adoption of smart manufacturing practices across the US automotive sector is a major growth driver for digital twin technologies, as manufacturers seek higher efficiency, resilience, and cost control within production operations. Digital twins of manufacturing lines allow real-time monitoring, process optimization, and predictive maintenance, reducing unplanned downtime and improving yield. By simulating production scenarios, manufacturers can identify bottlenecks, test layout changes, and optimize resource utilization before physical implementation. Integration with IoT sensors and analytics platforms further enhances operational visibility and decision-making. As labor costs rise and supply chain disruptions persist, automotive firms increasingly rely on digital twins to maintain production continuity and flexibility. These solutions support data-driven manufacturing strategies, aligning with broader Industry 4.0 initiatives and reinforcing sustained market growth.

Market Challenges

High Integration Complexity and Data Interoperability Constraints

One of the primary challenges facing the USA Digital Twin in Automotive market is the complexity associated with integrating digital twin platforms across heterogeneous IT and engineering environments. Automotive organizations often operate legacy systems, proprietary software, and fragmented data architectures that complicate seamless twin deployment. Achieving accurate and synchronized digital representations requires standardized data models, high-quality sensor inputs, and robust system interoperability, which can be resource-intensive. Integration challenges may lead to extended implementation timelines, increased costs, and resistance from internal stakeholders. Smaller suppliers in particular may struggle to align with OEM digital ecosystems. These barriers can slow adoption and limit the scalability of digital twin initiatives across the automotive value chain.

Cybersecurity and Intellectual Property Risks

Digital twin platforms rely heavily on connected data streams, cloud infrastructure, and shared digital assets, increasing exposure to cybersecurity threats and intellectual property risks. Automotive digital twins often contain sensitive design data, manufacturing processes, and software logic that require strong protection against breaches and unauthorized access. Ensuring compliance with data security standards and safeguarding proprietary information adds complexity and cost to deployment. Concerns over data ownership and access rights may also hinder collaboration between OEMs, suppliers, and technology partners. These risks necessitate advanced security frameworks, which can act as adoption constraints for risk-averse organizations.

Opportunities

AI-Driven Autonomous Vehicle Validation and Optimization

The rapid development of autonomous driving technologies presents a major opportunity for digital twin adoption, as virtual environments are essential for validating perception, decision-making, and control systems. Digital twins enable simulation of millions of driving scenarios, including rare and hazardous conditions that are impractical to test physically. Integration of AI and machine learning enhances model accuracy and accelerates system training. As regulatory scrutiny around autonomous vehicle safety intensifies, digital twins provide cost-effective, scalable validation pathways. This creates significant growth potential for advanced twin platforms tailored to autonomous system development and certification.

Lifecycle-Based Fleet and Mobility Services Expansion

The expansion of connected fleet operations and mobility services offers opportunities for digital twins to support lifecycle management, predictive maintenance, and performance optimization. Fleet operators increasingly seek data-driven insights to reduce operating costs and improve asset utilization. Digital twins that integrate real-time vehicle data can support condition-based maintenance, energy efficiency optimization, and usage-based service models. As mobility services scale across logistics, ride-hailing, and commercial fleets, demand for lifecycle-focused digital twin solutions is expected to increase substantially.

Future Outlook

The USA Digital Twin in Automotive market is expected to experience sustained expansion over the next five years, supported by continued electrification, autonomous vehicle development, and smart manufacturing investments. Advancements in AI, cloud computing, and real-time analytics will enhance digital twin accuracy and usability. Regulatory support for virtual testing and emissions of optimization is likely to strengthen adoption. Demand-side momentum from OEMs, suppliers, and fleet operators will further reinforce market growth.

Major Players

- Siemens Digital Industries Software

- Dassault Systèmes

- PTC

- ANSYS

- Autodesk

- Altair Engineering

- Hexagon AB

- IBM

- Microsoft

- SAP

- Oracle

- Bentley Systems

- Bosch Engineering

- NVIDIA

- General Electric Digital

Key Target Audience

- Automotive OEM

- Tier 1 automotive suppliers

- Electric vehicle manufacturers

- Autonomous vehicle developers

- Fleet operators

- Mobility service providers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The research identifies key technological, operational, and regulatory variables influencing the digital twin in the automotive market, including adoption drivers, platform capabilities, and end-user demand patterns.

Step 2: The Market Analysis and Construction

Market structure is developed through analysis of product types, platforms, and end-user segments, supported by secondary data and industry benchmarks.

Step 3: Hypothesis Validation and Expert Consultation

Findings are validated through consultations with automotive technology experts, engineers, and industry stakeholders to ensure accuracy and relevance.

Step 4: Research Synthesis and Final Output

Validated insights are synthesized into a structured market model, ensuring consistency, clarity, and alignment with industry realities.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising adoption of virtual product development in automotive engineering

Increasing complexity of electric and autonomous vehicle systems

Demand for predictive maintenance and lifecycle optimization

- Market Challenges

High initial integration and data standardization complexity

Cybersecurity and intellectual property protection risks

Shortage of skilled digital twin and simulation specialists

- Market Opportunities

Expansion of digital twins for battery performance optimization

Integration of AI-driven analytics with real-time vehicle data

Adoption of digital twins across connected mobility ecosystems

- Trends

Growing use of real-time sensor-fed digital twins

Convergence of digital twins with AI and machine learning

Increased focus on sustainability and emissions optimization

- Government Regulations

Automotive safety and validation standards influencing virtual testing

Data security and privacy regulations affecting connected vehicle data

Emission and efficiency regulations driving simulation-based design

- SWOT Analysis

- Porter’s Five Forces

- By Market Value ,2019-2025

- By Installed Units ,2019-2025

- By Average System Price ,2019-2025

- By System Complexity Tier ,2019-2025

- By System Type (In Value%)

Vehicle design and engineering digital twins

Manufacturing process digital twins

Powertrain and battery digital twins

ADAS and autonomous system digital twins

Vehicle lifecycle and maintenance digital twins - By Platform Type (In Value%)

Cloud-based digital twin platforms

On-premise digital twin platforms

Hybrid deployment digital twin platforms

OEM proprietary digital twin platforms

Third-party simulation and analytics platforms - By Fitment Type (In Value%)

Factory-integrated digital twin systems

Retrofit digital twin solutions

Model-based virtual validation systems

Embedded sensor-linked digital twins

Software-only simulation twins - By End-User Segment (In Value%)

Automotive OEMs

Tier 1 automotive suppliers

Electric vehicle manufacturers

Autonomous vehicle developers

Fleet operators and mobility service providers - By Procurement Channel (In Value%)

Direct OEM procurement

Tier supplier contracts

Enterprise software licensing

Cloud service subscriptions

System integrator partnerships

- Market Share Analysis

- Cross Comparison Parameters (Platform capability, Integration flexibility, Data analytics depth, Scalability, Industry partnerships, Real-time data processing, AI and machine learning integration, Interoperability with OEM systems, Cybersecurity and data governance, Deployment cost structure, Customization and configurability)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Siemens Digital Industries Software

Dassault Systèmes

PTC

ANSYS

Autodesk

Altair Engineering

Hexagon AB

IBM

Microsoft

Oracle

SAP

Bentley Systems

Bosch Engineering

NVIDIA

General Electric Digital

- OEM focus on reducing development cycles and costs

- Suppliers leveraging digital twins for quality and yield improvement

- EV manufacturers using twins for battery and thermal optimization

- Fleet operators adopting twins for predictive maintenance

- Forecast Market Value ,2026-2030

- Forecast Installed Units ,2026-2030

- Price Forecast by System Tier ,2026-2030

- Future Demand by Platform ,2026-2030