Market Overview

The USA E-Call Systems market is experiencing substantial growth driven by increasing regulations aimed at improving vehicle safety. The market size is projected to reach USD ~ billion based on a recent historical assessment. The growing need for real-time emergency response systems in vehicles and advancements in telematics are major contributors. As governments enforce stricter safety regulations and consumers demand more advanced in-car communication solutions, the market for e-call systems continues to expand rapidly.

The market is dominated by key players located in North America and Europe, where the demand for advanced automotive safety systems is high. The U.S. is a primary leader due to its regulatory environment and large automotive industry. The country’s strong infrastructure, supported by OEMs and telecommunications providers, facilitates widespread adoption of e-call systems. Additionally, U.S. cities with higher vehicle ownership rates and a focus on public safety see greater deployment of e-call systems in their fleets.

Market Segmentation

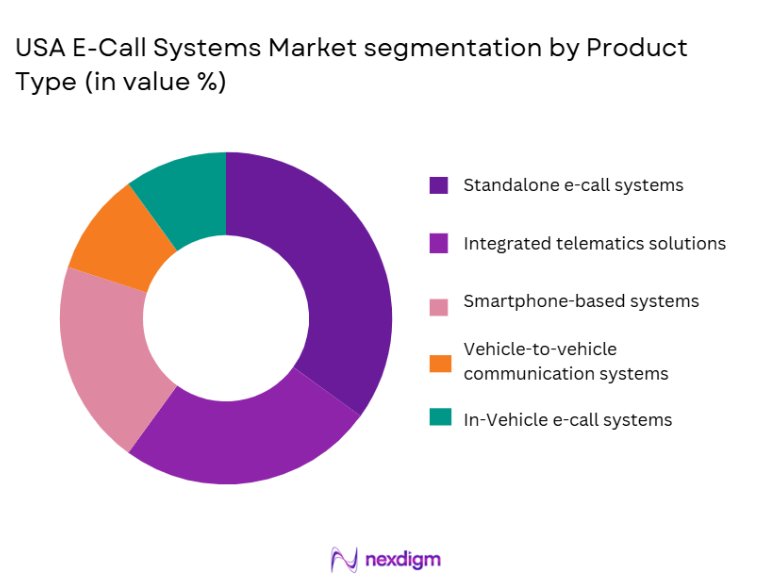

By Product Type

The USA E-Call Systems market is segmented by product type into standalone e-call systems, integrated telematics solutions, smartphone-based systems, and vehicle-to-vehicle communication systems. Recently, integrated telematics solutions have held a dominant market share due to their ability to provide a range of connected services, including emergency response, navigation, and infotainment. Consumer preference for comprehensive connectivity solutions, as well as the growing importance of vehicle-to-vehicle communication, have contributed to this dominance. This segment benefits from partnerships between automakers and technology providers, further driving the growth of integrated systems that offer more than just emergency features.

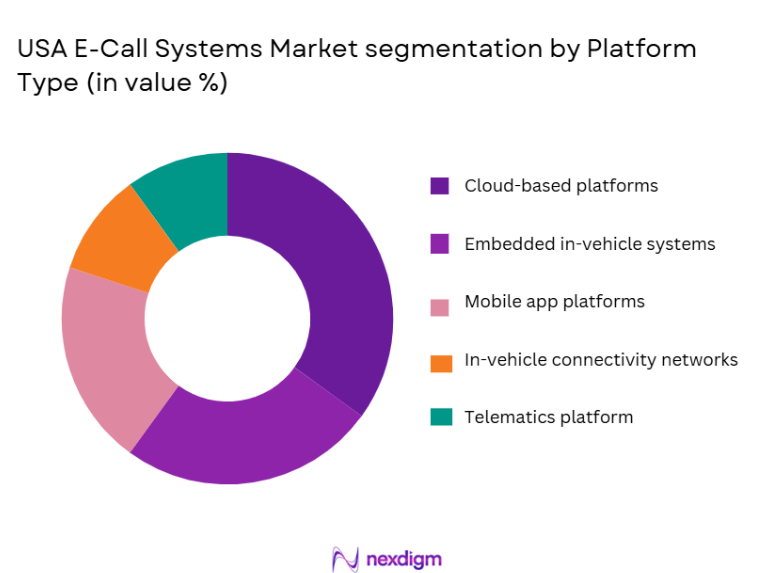

By Platform Type

The USA E-Call Systems market is segmented by platform type into cloud-based platforms, embedded in-vehicle systems, mobile app platforms, and in-vehicle connectivity networks. Cloud-based platforms have seen significant adoption due to their ability to provide real-time data sharing and enhance emergency response capabilities. The flexibility of cloud solutions, along with the ability to integrate with various telematics and emergency services platforms, makes them increasingly popular. This segment is expected to continue growing as the market shifts towards more scalable, data-driven solutions, especially with the increasing deployment of 5G networks.

Competitive Landscape

The USA E-Call Systems market is moderately consolidated with several key players dominating the market. Large technology and automotive companies hold the majority of market share due to their established relationships with OEMs, governments, and emergency services providers. The ongoing developments in telematics, automotive safety, and emergency services technology further consolidate the market, as these players lead innovation and infrastructure deployment.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue |

| AT&T | 1983 | Dallas, Texas | ~ | ~

|

~

|

~

|

| Verizon | 1983 | New York, NY | ~

|

~

|

~

|

~

|

| Bosch | 1886 | Stuttgart, Germany | ~

|

~

|

~

|

~

|

| Harman International | 1980 | Stamford, Connecticut | ~

|

~

|

~

|

~

|

| Continental AG | 1871 | Hanover, Germany | ~

|

~

|

~

|

~

|

USA E-Call Systems Market Analysis

Growth Drivers

Regulatory Push for Safety Standards

The implementation of mandatory regulations for emergency response systems in vehicles is one of the most significant growth drivers for the USA E-Call Systems market. Regulations such as the U.S. Federal Communications Commission (FCC) mandate for in-vehicle emergency systems have pushed automotive manufacturers to integrate e-call technologies into their vehicles. This regulatory push aligns with the growing trend of increasing vehicular safety, spurring market growth and technological adoption. Governments worldwide are establishing frameworks that require automotive manufacturers to install advanced telematics solutions, including automatic emergency calls to ensure swift action during accidents. These regulations guarantee not only better protection for drivers but also prompt emergency services’ response times, thereby making e-call systems a standard feature in modern vehicles.

Rising Consumer Demand for In-Car Connectivity

Consumer demand for connected vehicles is another critical factor driving the USA E-Call Systems market. With an increasing reliance on in-car connectivity for navigation, entertainment, and real-time communication, consumers expect their vehicles to provide advanced safety features as well. E-call systems, which offer a seamless way to contact emergency services in case of accidents, have become a key differentiator in the automotive industry. The growing preference for vehicles with integrated safety features such as automatic crash detection, which can trigger an emergency call, has significantly contributed to the expansion of the e-call systems market. Manufacturers are incorporating e-call technology not only for emergency purposes but also to enhance consumer satisfaction by offering an all-in-one connectivity package.

Market Challenges

High Integration Costs

The high costs associated with integrating e-call systems into vehicles present a significant challenge for the market. The technology required to implement these systems involves expensive hardware and software components that need to be compatible with existing vehicle architectures. For automakers, this represents a considerable investment in R&D, testing, and certification. Additionally, the complexity of integrating e-call systems with other vehicle safety technologies, such as automatic braking and crash sensors, increases the overall cost of production. Smaller manufacturers or those targeting lower-cost vehicles may struggle to adopt this technology without significant financial backing or strategic partnerships.

Lack of Infrastructure for Widespread Adoption

While e-call systems are mandated in many regions, the infrastructure to support their widespread adoption is still underdeveloped in certain areas. In regions where emergency response services are not equipped with the necessary communication technologies to handle e-call requests effectively, the full potential of these systems cannot be realized. Additionally, regions with insufficient mobile network coverage or outdated telecommunication infrastructure may face challenges in maintaining real-time communication between vehicles and emergency responders. The lack of integration between telecommunication providers, vehicle manufacturers, and emergency services can delay the deployment of e-call systems, hindering market growth in these areas.

Opportunities

Integration of 5G Networks for Enhanced Connectivity

One of the most significant opportunities for the USA E-Call Systems market is the integration of 5G technology. 5G networks offer ultra-low latency and high-speed data transmission, which will significantly improve the responsiveness and accuracy of emergency calls made through e-call systems. As the deployment of 5G networks expands, e-call systems will be able to provide real-time updates to emergency services, ensuring faster response times and more effective management of accidents. The potential for seamless communication between vehicles, emergency responders, and traffic management systems could revolutionize the way accidents are handled, improving safety and reducing response times.

Partnerships Between Automakers and Telecom Providers

Another opportunity for the market lies in the growing collaboration between automakers and telecom providers. Telecom companies bring their expertise in communication networks, while automakers provide the vehicle platforms for e-call integration. By forming strategic partnerships, these two sectors can create a more cohesive and reliable e-call infrastructure. Telecom companies can enhance the performance of e-call systems by ensuring better network connectivity, while automakers can use their vehicles as the foundation for these services. These partnerships are expected to drive innovation in connected vehicle technologies and create a seamless e-call experience for consumers.

Future Outlook

The USA E-Call Systems market is poised for significant growth over the next five years, driven by advancements in telematics and regulatory support for in-vehicle safety features. With the increasing adoption of connected vehicle technologies and the implementation of 5G networks, e-call systems will become more efficient, enabling faster emergency response times. The market will also benefit from greater collaboration between automotive manufacturers, telecom providers, and emergency service providers, improving the overall infrastructure for e-call systems. As regulations continue to evolve, the demand for e-call systems will rise, contributing to the market’s expansion.

Major Players

- AT&T

- Verizon

- Bosch

- Harman International

- Continental AG

- TomTom

- Qualcomm

- Panasonic Automotive

- Ericsson

- Apple Inc.

- General Motors

- Ford Motor Company

- BMW Group

- Tesla

- Audi AG

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- OEMs and automotive manufacturers

- Automotive suppliers and vendors

- Emergency services organizations

- Telecom service providers

- Fleet operators

- Insurance companies

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key market variables and factors that influence the e-call systems market. This includes analyzing market trends, regulatory requirements, and technological advancements in telematics and automotive safety systems.

Step 2: Market Analysis and Construction

In this step, detailed market sizing is conducted by gathering secondary research and identifying primary sources. Data from OEMs, telecom providers, and emergency services are analyzed to build a robust market model.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses related to market dynamics are validated by conducting expert interviews and consulting with industry professionals. This step ensures the data is relevant and accurate.

Step 4: Research Synthesis and Final Output

The final step synthesizes all the research and analysis into a comprehensive report that provides insights into the USA E-Call Systems market. This report serves as a valuable resource for stakeholders looking to understand market trends, drivers, challenges, and opportunities.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising government regulations for vehicle safety

Increasing adoption of telematics and IoT in vehicles

Growing demand for real-time emergency services - Market Challenges

High installation costs for advanced e-call systems

Integration complexity with existing vehicle systems

Limited infrastructure for widespread implementation - Market Opportunities

Advancements in 5G connectivity for real-time data transmission

Partnerships between automotive and telecom companies

Expansion in emerging markets with low adoption rates - Trends

Integration of AI in e-call systems

Rise in autonomous vehicle adoption impacting emergency response

Growing focus on data security and privacy concerns - Government Regulations

Mandatory vehicle safety regulations

Regulatory framework for emergency response systems

Data privacy laws and e-call system compliance

- By Market Value 2019-2025

- By Installed Units 2019-2025

- By Average System Price 2019-2025

- By System Complexity Tier 2019-2025

- By System Type (In Value%)

In-vehicle e-call systems

Standalone e-call systems

Integrated telematics solutions

Smartphone-based e-call systems

Vehicle-to-vehicle communication e-call systems - By Platform Type (In Value%)

Telematics platform

Embedded in-vehicle systems

Cloud-based platform

Mobile app platforms

In-vehicle connectivity networks - By Fitment Type (In Value%)

OEM-installed systems

Aftermarket solutions

Integrated vehicle networks

Standalone systems

Third-party telematics providers - By EndUser Segment (In Value%)

Automotive manufacturers

Government & public safety agencies

Emergency services

Telecom service providers

OEMs and suppliers - By Procurement Channel (In Value%)

Direct sales from manufacturers

Through telematics service providers

Third-party retailers

Automotive dealer networks

Government contracts and tenders

- Market Share Analysis

- CrossComparison Parameters (Integration with existing vehicle systems, Regulatory compliance, Cost-effectiveness, Data transmission speed, Platform compatibility)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

AT&T

Verizon

Bosch

General Motors

Harman International

Continental AG

Daimler AG

TomTom

Qualcomm

Panasonic Automotive

Teleflex

Apple Inc.

Ericsson

Google

Audi AG

- Emerging role of emergency service agencies in system deployment

- Automotive manufacturers seeking to integrate e-call systems

- Role of insurance companies in incentivizing adoption

- Telecom operators exploring new revenue models

- Forecast Market Value 2026-2030

- Forecast Installed Units 2026-2030

- Price Forecast by System Tier 2026-2030

- Future Demand by Platform 2026-2030