Market Overview

Based on a recent historical assessment, the USA Echocardiography Equipment Market was valued at USD ~ million, supported by sustained demand for noninvasive cardiac imaging across acute and outpatient care settings. Growth is driven by high cardiovascular disease prevalence, routine diagnostic utilization in cardiology workflows, and favorable reimbursement coverage for ultrasound-based diagnostics. Continuous replacement cycles, technology upgrades in imaging resolution, and broad clinical acceptance of echocardiography as a first-line diagnostic modality further reinforce equipment procurement across healthcare providers nationwide.

Major metropolitan regions including New York, Los Angeles, Chicago, Houston, and Boston dominate demand due to dense hospital networks, advanced cardiac care centers, and strong specialist concentration. These cities benefit from large patient volumes, integrated health systems, and early adoption of advanced diagnostic technologies. The presence of academic medical centers, strong private healthcare investment, and established imaging infrastructure supports higher utilization rates, while regional procurement programs and group purchasing mechanisms further strengthen equipment deployment across these leading healthcare hubs.

Market Segmentation

By Product Type

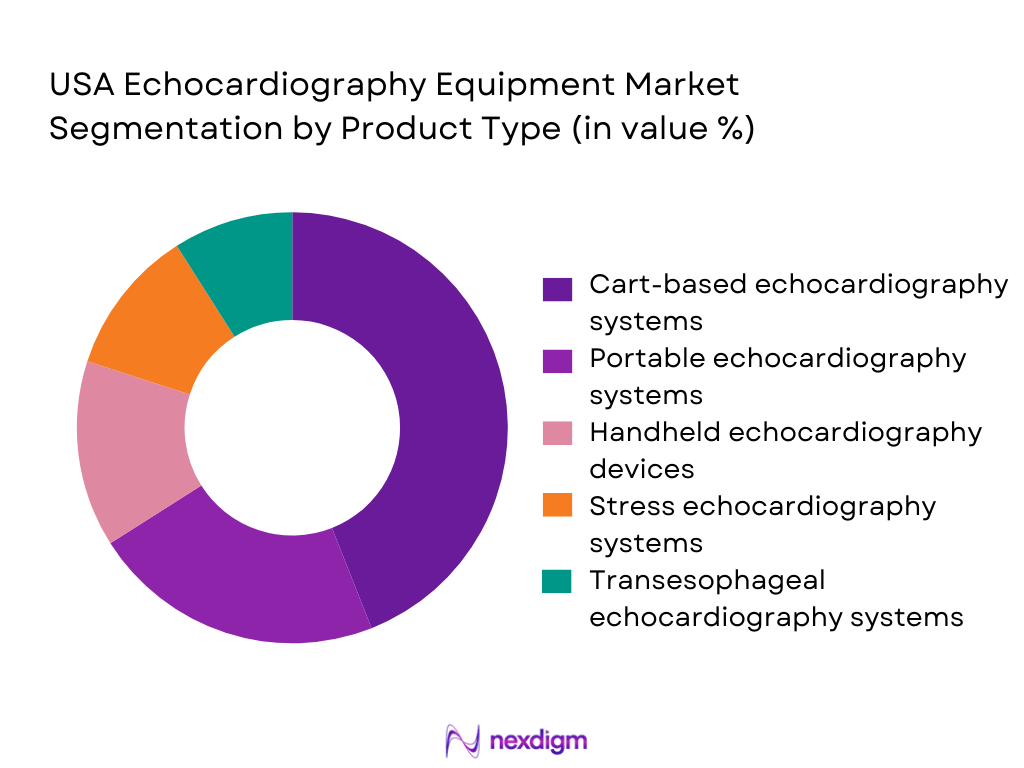

USA Echocardiography Equipment Market is segmented by product type into cart-based echocardiography systems, portable echocardiography systems, handheld echocardiography devices, stress echocardiography systems, and transesophageal echocardiography systems. Recently, cart-based echocardiography systems have held a dominant market share due to their widespread installation in hospitals and diagnostic imaging departments, superior imaging capabilities, and compatibility with advanced cardiac assessments. These systems support high patient throughput, multi-probe functionality, and integration with hospital information systems, making them essential for tertiary care facilities. Strong brand presence, long replacement cycles, clinician familiarity, and procurement through capital equipment budgets further reinforce dominance. Additionally, cart-based platforms are preferred for complex diagnostics, training environments, and regulated clinical workflows, ensuring continued demand despite rising interest in portable and handheld alternatives.

By End User

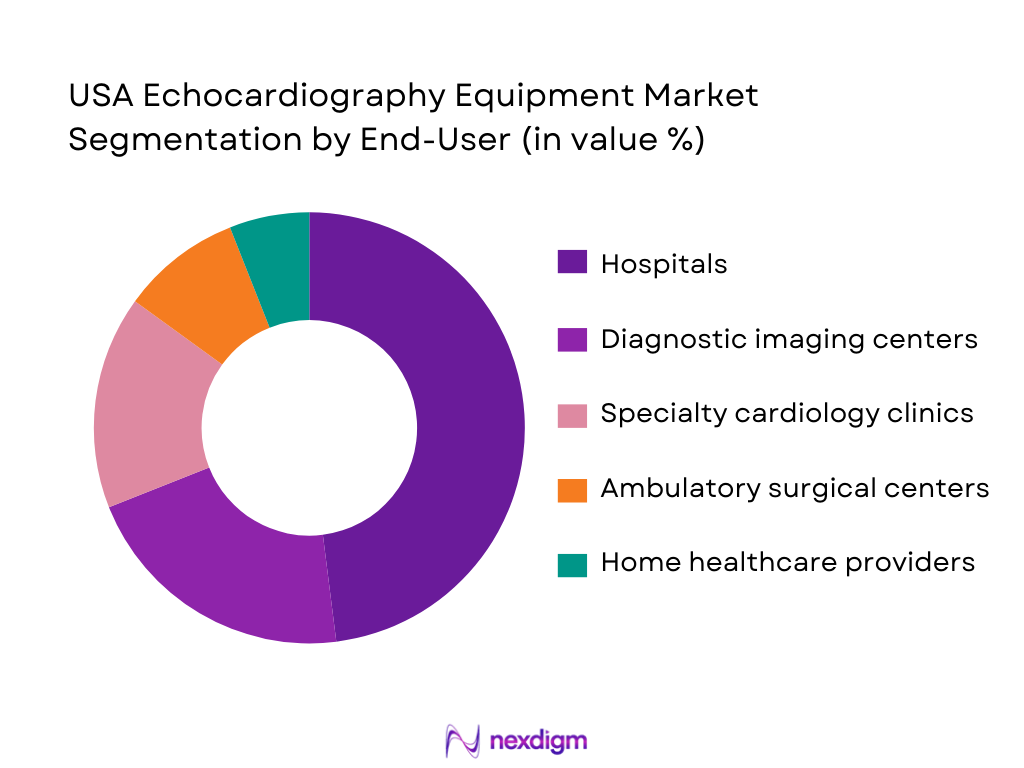

USA Echocardiography Equipment Market is segmented by end user into hospitals, diagnostic imaging centers, specialty cardiology clinics, ambulatory surgical centers, and home healthcare providers. Recently, hospitals have accounted for the dominant market share due to centralized cardiac care delivery, high procedural volumes, and availability of trained sonographers and cardiologists. Hospitals operate comprehensive cardiology departments that require advanced echocardiography systems for inpatient, emergency, and outpatient diagnostics. Capital procurement capacity, long-term vendor contracts, and participation in group purchasing organizations further support hospital dominance. In addition, hospitals serve as referral hubs for complex cardiovascular cases, driving continuous equipment utilization and replacement demand.

Competitive Landscape

The USA Echocardiography Equipment Market is moderately consolidated, with a small group of multinational medical imaging companies holding strong influence through broad product portfolios, advanced technology capabilities, and long-standing relationships with healthcare providers. Leading players benefit from established service networks, regulatory expertise, and continuous innovation in imaging software and hardware, while smaller vendors focus on niche portability and point-of-care solutions.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Installed Base Strength |

| GE HealthCare | 1892 | USA | ~ | ~ | ~ | ~ | ~ |

| Philips Healthcare | 1891 | Netherlands | ~ | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Germany | ~ | ~ | ~ | ~ | ~ |

| Canon Medical Systems | 1930 | Japan | ~ | ~ | ~ | ~ | ~ |

| Samsung Medison | 1985 | South Korea | ~ | ~ | ~ | ~ | ~ |

USA Echocardiography Equipment Market Analysis

Growth Drivers

Rising Burden of Cardiovascular Diseases in the United States

explanation continues in the same sentence as cardiovascular disease remains the leading cause of mortality, driving consistent demand for early diagnosis and routine cardiac monitoring across all care settings. High prevalence of hypertension, coronary artery disease, heart failure, and structural abnormalities increases reliance on echocardiography as a noninvasive diagnostic standard. Hospitals and clinics prioritize ultrasound imaging due to safety, repeatability, and cost effectiveness. Preventive screening programs further expand utilization. Aging demographics amplify diagnostic volumes. Clinical guidelines favor echocardiography for initial assessment. Reimbursement structures support procedural frequency. Together, these factors sustain equipment demand across providers.

Technological Advancements in Echocardiography Imaging Platforms

explanation continues in the same sentence as continuous innovation in imaging resolution, automation, and software analytics enhances clinical value and adoption. Three dimensional and four-dimensional imaging improves diagnostic confidence. AI-assisted measurements reduce operator dependency. Workflow automation increases throughput. Integration with electronic medical records streamlines reporting. Portable designs expand point-of-care use. Improved probes enhance patient comfort. These advancements justify equipment upgrades. Providers adopt newer systems to remain clinically competitive.

Market Challenges

High Capital Cost and Budgetary Constraints

explanation continues in the same sentence as advanced echocardiography systems require significant upfront investment that can strain healthcare budgets. Hospitals must balance competing capital priorities. Smaller facilities face affordability barriers. Maintenance contracts increase lifecycle costs. Technology obsolescence accelerates replacement decisions. Budget approvals are often delayed. Procurement cycles lengthen. Financial scrutiny impacts upgrade frequency. These factors slow adoption of premium systems.

Shortage of Skilled Sonographers and Cardiologists

explanation continues in the same sentence as effective echocardiography utilization depends on trained professionals. Workforce shortages limit procedure capacity. Training requirements are extensive. Rural regions are disproportionately affected. Staff turnover disrupts continuity. Advanced systems require specialized expertise. Learning curves delay productivity. Credentialing processes add constraints. These challenges affect equipment utilization efficiency.

Opportunities

Expansion of Point-of-Care and Handheld Echocardiography Solutions

explanation continues in the same sentence as demand grows for rapid bedside diagnostics in emergency and outpatient settings. Handheld devices enable decentralized care. Primary care adoption increases. Remote assessments expand access. Training programs support wider use. Cost advantages attract smaller facilities. Telemedicine integration enhances reach. Regulatory acceptance improves. This segment offers strong growth potential.

Integration of Artificial Intelligence and Automation Tools

explanation continues in the same sentence as AI-driven analysis enhances diagnostic accuracy and workflow efficiency. Automated measurements reduce variability. Decision support aids clinicians. Time savings improve throughput. Software upgrades extend system lifespan. Data analytics support population health. Vendors differentiate through AI capabilities. Providers value productivity gains. This creates new revenue opportunities.

Future Outlook

The USA Echocardiography Equipment Market is expected to experience steady development over the next five years, supported by sustained diagnostic demand and continuous technological evolution. Advancements in imaging software, artificial intelligence integration, and portability will shape procurement decisions. Regulatory support for noninvasive diagnostics and stable reimbursement frameworks will encourage adoption. Demand will increasingly shift toward flexible, high-efficiency systems that support diverse care environments.

Major Players

- GE HealthCare

- Philips Healthcare

- Siemens Healthineers

- Canon Medical Systems

- Samsung Medison

- Mindray Medical

- Fujifilm Healthcare

- Hitachi Healthcare

- Esaote

- Butterfly Network

- Clarius Mobile Health

- BK Medical

- Edan Instruments

- Chison Medical Technologies

- Analogic Corporation

Key Target Audience

- Hospitals and healthcare systems

- Diagnostic imaging centers

- Cardiology clinics

- Ambulatory surgical centers

- Medical device distributors

- Investments and venture capitalist firms

- Government and regulatory bodies

- Healthcare procurement organizations

Research Methodology

Step 1: Identification of Key Variables

Key demand, supply, technology, and regulatory variables influencing the market were identified through secondary research. Data points included diagnostic utilization, equipment types, and end-user adoption patterns. Emphasis was placed on U.S.-specific healthcare delivery structures.

Step 2: Market Analysis and Construction

Collected data were analyzed to construct market structure, segmentation, and competitive positioning. Revenue proxies and utilization metrics were validated across multiple sources. Market sizing logic focused on cardiovascular ultrasound applications.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were reviewed against industry expert insights and clinical practice patterns. Vendor strategies and procurement behaviors were cross-validated. Adjustments were made to ensure consistency and realism.

Step 4: Research Synthesis and Final Output

All insights were synthesized into a structured market report. Quantitative and qualitative findings were aligned. Final outputs were reviewed for coherence, accuracy, and compliance with reporting standards.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising prevalence of cardiovascular diseases

Expansion of diagnostic imaging infrastructure

Technological advancements in cardiac imaging systems - Market Challenges

High capital cost of advanced echocardiography systems

Shortage of skilled cardiac imaging professionals

Regulatory compliance and approval complexity - Market Opportunities

Adoption of AI-enabled echocardiography solutions

Growth of point-of-care cardiac diagnostics

Integration with telecardiology platforms - Trends

Miniaturization of imaging devices

Increased use of 3D and 4D echocardiography

Shift toward portable and handheld systems - Government Regulations

FDA medical device approval requirements

Reimbursement policies under public healthcare programs

Data privacy and patient safety regulations - SWOT Analysis

- Porter’s Five Forces

- By Market Value ,2019-2025

- By Installed Units ,2019-2025

- By Average System Price, 2019-2025

- By System Complexity Tier ,2019-2025

- By System Type (In Value%)

Cart-based echocardiography systems

Portable echocardiography systems

Handheld echocardiography devices

Stress echocardiography systems

Transesophageal echocardiography systems - By Platform Type (In Value%)

Hospital-based diagnostic platforms

Cardiology clinic platforms

Ambulatory surgical center platforms

Point-of-care imaging platforms

Mobile diagnostic service platforms - By Fitment Type (In Value%)

Fixed installation systems

Semi-mobile systems

Fully mobile cart-mounted systems

Bedside point-of-care systems

Wearable-assisted diagnostic integrations - By End-user Segment (In Value%)

Hospitals and medical centers

Diagnostic imaging centers

Specialty cardiology clinics

Academic and research institutes

Home healthcare providers - By Procurement Channel (In Value%)

Direct manufacturer sales

Distributor and dealer networks

Group purchasing organizations

Government and public tenders

Online and digital procurement platforms

- Market Share Analysis

- Cross Comparison Parameters (Product portfolio breadth, Imaging resolution, Portability options, Pricing competitiveness, After-sales service quality, AI-enabled analysis capabilities, Software upgrade flexibility, Integration with hospital IT systems, Probe and transducer variety, Training and clinical support, Regulatory compliance readiness)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

GE HealthCare

Philips Healthcare

Siemens Healthineers

Canon Medical Systems

Fujifilm Healthcare

Mindray Medical

Samsung Medison

Hitachi Healthcare

Esaote

Koninklijke Philips

Butterfly Network

Clarius Mobile Health

BK Medical

Shenzhen Edan Instruments

Chison Medical Technologies

- Demand concentration in large hospital networks

- Growing adoption in outpatient cardiology clinics

- Increased use in emergency and critical care settings

- Rising interest from home healthcare providers

- Forecast Market Value ,2026-2030

- Forecast Installed Units ,2026-2030

- Price Forecast by System Tier ,2026-2030

- Future Demand by Platform ,2026-2030