Market Overview

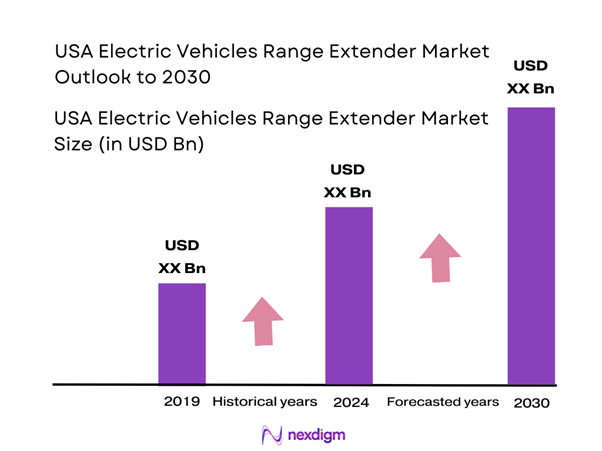

The USA Electric Vehicles Range Extender Market is valued at USD 1.6 billion in 2024 with an approximated compound annual growth rate (CAGR) of 9% from 2024-2030, based on a five-year historical analysis. The growth of this market is primarily driven by advancements in hybrid technology and increased consumer demand for electric vehicles that can offer extended ranges. Government policies promoting eco-friendly transportation, along with a broader awareness of sustainability, have encouraged consumers to consider electric vehicles, enhancing overall market momentum.

Major cities dominating the USA Electric Vehicles Range Extender Market include San Francisco, Los Angeles, New York, and Seattle. These cities are characterized by a more environmentally conscious population and a robust infrastructure supporting electric vehicles. Additionally, strong incentives from local government bodies to adopt electric vehicles further drive demand in these urban centers, making them pivotal market locations.

Safety standards established by the National Highway Traffic Safety Administration (NHTSA) play a crucial role in shaping the electric vehicles range extender market. In 2022, the NHTSA proposed new safety regulations for electric vehicles, focusing on battery safety, crashworthiness, and pedestrian detection systems. As electric vehicles gain popularity, addressing safety concerns becomes imperative to protect consumers and build trust in EV technology.

Market Segmentation

By Vehicle Type

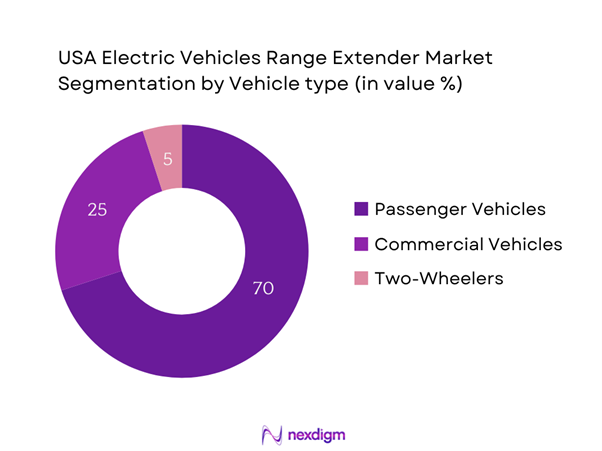

The USA Electric Vehicles Range Extender Market is segmented by vehicle type into passenger vehicles, commercial vehicles, and two-wheelers. Passenger vehicles hold a dominant share in the market due to their widespread adoption and preference among consumers seeking eco-friendly alternatives to traditional gasoline-powered cars. The increasing variety of models available, coupled with improved range and charging infrastructure, has made passenger electric vehicles highly desirable. This segment is expected to maintain its leading position as manufacturers continuously innovate to meet consumer needs effectively.

By Range Extender Technology

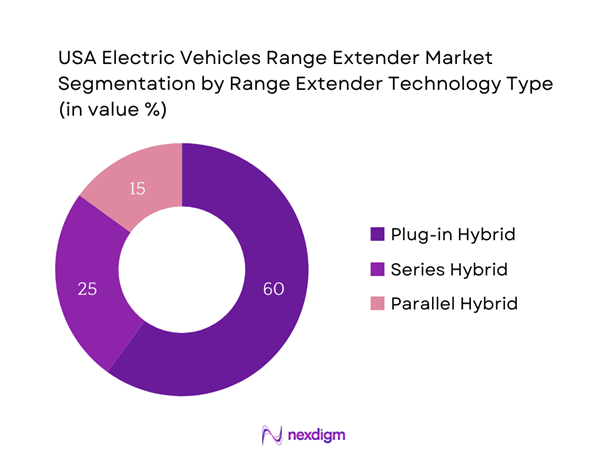

The market is also segmented by range extender technology, comprising plug-in hybrid, series hybrid, and parallel hybrid vehicles. Plug-in hybrid vehicles dominate this segment, primarily because they offer the flexibility of using both electric power and traditional fuel. This dual capability alleviates range anxiety for consumers, making it a more appealing option. As the technology matures and charging infrastructure expands, this segment is anticipated to grow robustly, reaffirming its dominance in the market.

Competitive Landscape

The USA Electric Vehicles Range Extender Market is characterized by strong competition from a mix of local manufacturers and established global players. Key players include Tesla, Ford, General Motors, and BMW, who have established themselves with innovative technologies and strong brand loyalty. This concentration of influential companies facilitates significant technological advancements in the market and heightens competitive dynamics.

| Company | Establishment Year | Headquarters | Market Position | Innovations | Product Range | Annual Revenue (USD) |

| Tesla | 2003 | Palo Alto, California | – | – | – | – |

| Ford | 1903 | Dearborn, Michigan | – | – | – | – |

| General Motors | 1908 | Detroit, Michigan | – | – | – | – |

| BMW | 1916 | Munich, Germany | – | – | – | – |

| Kia | 1944 | Seoul, South Korea | – | – | – | – |

USA Electric Vehicles Range Extender Market Analysis

Growth Drivers

Increasing Fuel Efficiency Standards

The U.S. has implemented stricter fuel efficiency standards, with regulations mandating an average fuel economy of 49 miles per gallon for cars and light trucks by 2026. The U.S. Department of Energy reports that approximately 70% of Americans support increased fuel economy standards as a way to reduce dependence on oil and mitigate greenhouse gas emissions. By advancing fuel efficiency, these standards encourage manufacturers to enhance electric vehicle technologies, aligning with national goals of reducing emissions and increasing the adoption of sustainable transportation solutions. The push for fuel-efficient vehicles fosters investments in cleaner technologies and drives innovation within the electric vehicle sector.

Rising Environmental Concerns

Rising environmental concerns are influencing consumer behavior and policy-making. The U.S. Environmental Protection Agency noted that nearly 80% of U.S. adults believe global warming is an important issue, leading to growing calls for governmental action on climate change. In 2023, carbon emissions from the transportation sector accounted for around 29% of the total greenhouse gas emissions in the U.S., according to EPA reports. This has prompted both state and federal governments to adopt policies targeting significant reductions in emissions, with electric vehicles seen as key contributors to these reductions. The increasing awareness of environmental issues drives demand for cleaner alternatives in the automotive sector.

Market Challenges

High Initial Cost of Electric Vehicles

The initial cost of electric vehicles (EVs) remains a significant barrier to widespread adoption. According to the U.S. Department of Energy, the average price of a new electric vehicle was approximately $66,000 in 2023, compared to $48,000 for traditional gasoline vehicles. This substantial difference discourages many potential buyers, who cite affordability as a primary concern. Although incentives such as federal tax credits of up to $7,500 exist to alleviate some costs, the financial barrier continues to hinder market penetration. The high upfront investment in EV technology requires continued innovation and cost-reduction strategies from manufacturers to improve accessibility.

Infrastructure Limitations

Insufficient charging infrastructure poses a critical challenge for electric vehicle adoption in the U.S. As of 2023, there were approximately 64,187 publicly accessible charging stations across the country, which works out to only about 0.4 stations per electric vehicle, according to the U.S. Department of Energy. The lack of charging points in rural areas and insufficient fast-charging capabilities limits consumer confidence in the practicality of electric vehicle ownership. To support the projected growth in EV sales, a substantial increase in charging infrastructure investment is needed, possibly exceeding $10 billion as outlined in several infrastructure initiatives by government agencies.

Opportunities

Government Incentives and Subsidies

The U.S. government has taken significant steps to promote electric vehicle adoption through various incentives and subsidies. Currently, EV buyers benefit from federal tax credits of up to $7,500, and numerous states offer additional incentives that can reduce the overall purchase price substantially. In 2022, the total federal investment in electric vehicle-related programs exceeded $7 billion, aimed at expanding the market and building supporting infrastructure. By leveraging these incentives, manufacturers can enhance sales strategies and promote broader adoption amongst consumers, driving the electric vehicle market’s growth trajectory.

Technological Advancements

Technological advancements in battery technology and electric drivetrains are presenting numerous opportunities within the electric vehicles range extender market. The average range of new electric vehicles has improved significantly due to advancements in lithium-ion battery technology, now exceeding 300 miles for several models. Reports indicate that the global EV battery market is projected to surpass $100 billion by 2025, demonstrating robust growth potential. Companies investing in cutting-edge research to enhance battery capabilities and charging speeds are likely to gain competitive advantages as consumer expectations for performance and convenience continue to rise.

Future Outlook

Over the next five years, the USA Electric Vehicles Range Extender Market is expected to experience notable growth driven by increasing government support, technological advancements in hybrid and electric vehicle systems, and a rising consumer preference for sustainable transportation solutions. Innovations in battery technology and enhancements in charging infrastructure are anticipated to further facilitate market expansion, making electric vehicles an increasingly viable option for a broader audience.

Major Players in the Market

- Tesla

- Ford

- General Motors

- BMW

- Kia

- Nissan

- Hyundai

- Rivian

- Faraday Future

- Lucid Motors

- Volkswagen

- Audi

- Mercedes-Benz

- Toyota

- Fisker Inc.

Key Target Audience

- Automotive Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Environmental Protection Agency, Department of Energy)

- Electric Vehicle Charging Infrastructure Providers

- Fleet Operators

- Sustainable Transportation Advocates

- Electric Vehicle Dealers

- Automotive Component Suppliers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Electric Vehicles Range Extender Market. This step relies on comprehensive desk research, utilizing secondary and proprietary databases to gather in-depth industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including consumer behavior, technological advancements, and regulatory impacts.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the USA Electric Vehicles Range Extender Market. This includes assessing market penetration rates, the ratio of electric vehicles to traditional internal combustion engine vehicles, and resultant revenue generation. Additionally, an evaluation of service quality metrics, such as customer satisfaction and after-sales support, will be undertaken to enhance the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. By conducting interviews with engineers, product managers, and strategic planners in the automotive sector, we gather operational and financial insights directly from industry practitioners. This valuable feedback is crucial for refining and corroborating the market data collected in previous phases.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with several electric vehicle manufacturers to acquire comprehensive insights into product segments, sales performance, consumer preferences, and technological developments. This interaction serves to verify and supplement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA Electric Vehicles Range Extender Market. A final report will be compiled, synthesizing all research findings into a cohesive document suitable for stakeholders, investors, and industry analysts.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Landscape and Dynamics

- Historical Background of Key Players

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Fuel Efficiency Standards

Rising Environmental Concerns - Market Challenges

High Initial Cost of Electric Vehicles

Infrastructure Limitations - Opportunities

Government Incentives and Subsidies

Technological Advancements - Trends

Shift Towards Sustainable Transportation

Growth in Charging Infrastructure - Regulatory Environment

Emission Regulations

Safety Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Vehicle Type (In Value %)

Passenger Vehicles

– Sedans

– SUVs

– Hatchbacks

Commercial Vehicles

– Light Commercial Vehicles (LCVs)

– Medium and Heavy Commercial Vehicles (MHCVs)

– Delivery Vans

Two-Wheelers

– E-Mopeds

– E-Scooters

– E-Motorcycles - By Range Extender Technology (In Value %)

Plug-in Hybrid

– PHEVs with Internal Combustion Engine

– PHEVs with Fuel Cell Support

Series Hybrid

– Engine-Powered Generator Driven

– Turbine-Based Generator Driven

Parallel Hybrid

– Mild Hybrids

– Full Hybrids - By Battery Capacity (In Value %)

Less than 10 kWh

10–25 kWh

More than 25 kWh - By Fuel Type (In Value %)

Gasoline

Diesel

Biofuels - By Region (In Value %)

New York

Massachusetts

Pennsylvania

Illinois

Ohio

Michigan

Texas

Florida

Georgia

California

Washington

Arizona

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Electric Vehicles Range Extender Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by Range Extender Type, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Capacity, Manufacturing Facilities and Geography, R&D Investment, Integration Capabilities with EV Platforms, Technological Differentiators, Compliance with Emission and Safety Standards, Unique Value Offering, and others)

- SWOT Analysis of Major Players

- Pricing Analysis by Major Players

- Detailed Profiles of Major Companies

Tesla

General Motors

Ford Motor Company

BMW

Nissan

Hyundai

Audi

Mercedes-Benz

Volkswagen

Kia

Rivian

Lucid Motors

Fisker Inc.

Faraday Future

Bollinger Motors

- Market Demand Forecast

- Consumer Preferences and Behavior

- Adoption Barriers and Drivers

- Decision-Making Process Analysis

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030