Market Overview

The U.S. engine blocks market is valued at approximately USD ~ billion, based on latest available figures. A prior figure for 2023 shows a slightly lower number reflecting year-on-year growth in automotive production and replacement parts demand. The market growth is driven by rising production of passenger cars, light trucks and commercial vehicles, increasing complexity of engine designs (including aluminum and compacted graphite iron blocks), and ongoing demand for internal combustion engine (ICE) platforms despite electrification trends.

Within the United States, major automotive manufacturing hubs such as Michigan (Detroit region), Ohio, Indiana, Alabama and Tennessee dominate engine block production. The reasons include established domestic vehicle assembly plants, integrated powertrain manufacturing clusters, robust casting and machining supply chains and favourable logistics. These factors make such cities and states preferred for engine block production and ensure dominance in the domestic market.

Market Segmentation

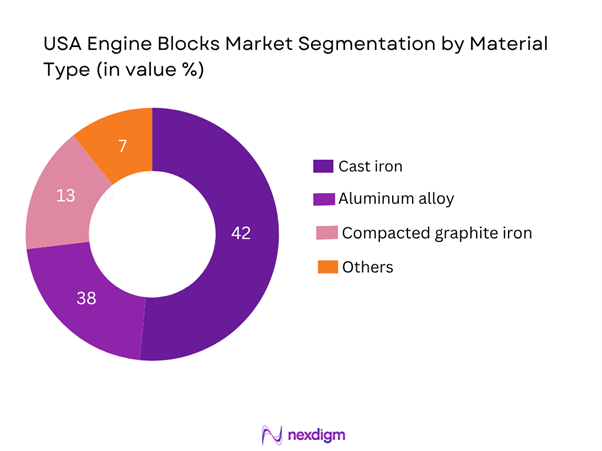

By Material Type

The market is segmented by material into cast iron, aluminum alloy, compacted graphite iron (CGI) and others. Among these, cast iron blocks remain the dominant sub-segment, capturing approximately 42 % of the U.S. market in 2024. This dominance stems from the mature use of cast-iron engine blocks in commercial vehicle and heavy-duty applications, the cost-effectiveness of iron casting, and longstanding OEM familiarity. While aluminum alloy blocks are gaining ground for lightweighting and fuel efficiency, the transition is gradual given tooling costs and durability concerns, thus leaving cast iron as the leading material.

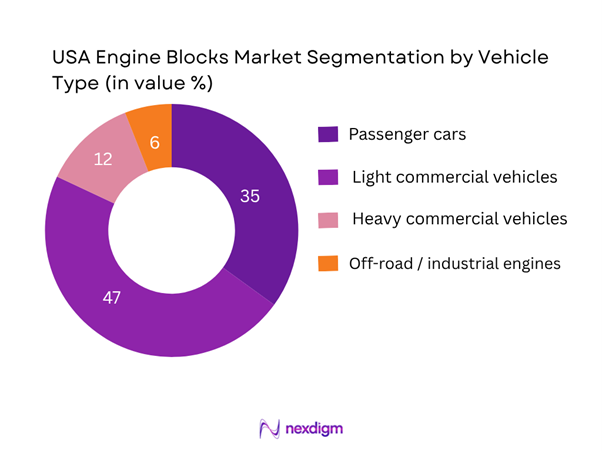

By Vehicle Type

The U.S. engine blocks market is segmented into passenger cars, light commercial vehicles/SUVs/pickups, heavy commercial vehicles, and off-road/industrial engines. Light commercial vehicles/SUVs/pickups dominate with ~47 % share in 2024, reflecting the strong consumer and fleet demand for trucks and SUVs in the U.S., which require robust engine blocks and high volumes. These applications drive large-scale production, while passenger cars follow at ~35 %. Heavy commercial vehicles and off-road engines hold smaller shares but are critical for aftermarket and specialist applications.

Competitive Landscape

The U.S. engine blocks market comprises several major players. Market consolidation is moderate with key OEM-suppliers and casting specialists providing engine blocks and components. These companies benefit from existing automotive powertrain ecosystems, vertical integration, and advanced manufacturing capabilities.

| Company | Establishment Year | Headquarters | Key Material/Technology Focus | Vehicle Type Focus | Casting/ Machining Capacity | Geographic Footprint U.S. |

| Cummins Inc. | 1919 | Columbus, Indiana | – | – | – | – |

| Nemak (Aluminum Casting) | 1999 | Mexico (HQ) | – | – | – | – |

| Mahle North America | 1920 (parent) | Michigan, U.S. | – | – | – | – |

| Teksid (via Stellantis) | 1978 | Italy (global) | – | – | – | – |

| Johnson Controls / Powertrain JV | Various | U.S. | – | – | – | – |

USA Engine Blocks Market Analysis

Growth Drivers

Vehicle output growth

The U.S. light-vehicle market achieved about 15.9 million units sold in 2024, up by approximately 2.2 % from the prior year, reflecting recovery in automotive demand. Concurrently, U.S. motor-vehicle production was reported at around 10.61 million units in December 2023. The fact that production exceeds 10 million units indicates substantial manufacturing volume, which correlates to the demand for engine blocks (as part of powertrain assemblies). The large installed manufacturing base and heightened vehicle output support engine block demand, especially for new internal-combustion engine (ICE) vehicles and replacement of outdated platforms.

ICE engine longevity

In the U.S., the automotive industry employed about 4,486,300 people in 2024, representing 2.8 % of all non-farm jobs. This large employment pool underscores the scale of the ICE engine value-chain, including engine blocks and powertrain manufacturing. The longevity of ICE engines (and related blocks) means replacement and refurbishment cycles extend beyond initial vehicle production, supporting sustained engine-block demand even as new technologies transition. The entrenched ICE infrastructure thereby remains a driver for engine block manufacturing and aftermarket replacement.

Market Challenges

Shift to EVs reducing ICE blocks demand

The U.S. plug-in electric vehicle (EV) market achieved cumulative sales of about 4.7 million units since 2010, with 1,402,371 units sold in 2023. As EV penetration increases, fewer new internal-combustion engine (ICE) vehicles are manufactured, which directly reduces demand for ICE engine blocks. The transition to EVs therefore presents a structural head-wind for engine-block demand, especially for future new-vehicle production rather than just replacement volumes.

Raw material cost volatility

Automotive manufacturing is highly exposed to steel and aluminium price fluctuations. For instance, in 2022 the automotive manufacturing sector was identified as the second-largest steel consumer, accounting for 25 % of steel sector revenue. Because engine blocks require large volumes of metal castings and machining, raw-material cost spikes or supply disruptions can squeeze margins or delay investment in block-casting capacity, which is a significant challenge for the engine-block market.

Emerging Opportunities

Remanufacturing & replacement blocks

The global automotive remanufacturing market was valued at USD 60.78 billion in 2022, with North America (including the U.S.) representing a significant share. For engine blocks specifically, remanufactured blocks represent a cost-effective alternative to new castings, especially for older ICE fleets. With aging vehicles in the U.S. and demand for replacement engine blocks, the engine-block market can tap into remanufacturing channels, supporting volume outside of new vehicle production and capital-intensive new block sales.

CG-iron adoption

Compacted graphite iron (CGI) is gaining traction as a material for engine blocks because it offers higher strength with lower weight compared to traditional cast iron. The North America iron-casting market alone is projected at USD 18,957.3 million in 2025, driven by automotive engine-component demand. For engine-block applications, CGI presents an opportunity to upgrade manufacturing and offer higher-value products, especially for commercial and heavy-duty vehicles where performance and durability are key, enabling manufacturers to capture share by offering advanced block materials

Future Outlook

Over the next six years the U.S. engine blocks market is expected to show steady growth despite the rise of electrification. Demand will be driven by transition engines (hybrid systems), further lightweighting (aluminum, CGI), aftermarket replacement cycles and niche performance segments. OEMs will invest in advanced casting and machining, automation, and supply-chain localisation which supports domestic production resilience. While full-electric powertrains will gradually reduce pure ICE block volumes, the segment will remain relevant through 2030 due to long engine life-cycles and retrofit/replacement needs.

Major Players

- Cummins Inc.

- Nemak

- Mahle GmbH (North America operations)

- Teksid (Stellantis casting operations)

- Ford Motor Company (Powertrain division)

- General Motors Company (Powertrain/manufacturing)

- Toyota Motor North America (combustion engine blocks)

- Honda Performance Development (Engine manufacturing)

- TRW Automotive (powertrain components)

- Rheinmetall Automotive (U.S. engine block supplier)

- Compact Powertrain Inc.

- Martinrea International Inc. (engine block castings)

- GF Casting Solutions (North America)

- Walker Precision Castings (engine block specialist)

- BorgWarner Inc. (powertrain segment – blocks for niche applications)

Key Target Audience

- OEM powertrain manufacturing divisions (U.S. vehicle assemblers and engine makers)

- Tier-1 automotive casting and machining suppliers

- Investments and venture capitalist firms (focused on advanced powertrain materials & manufacturing technologies)

- Government and regulatory bodies (e.g., U.S. Department of Energy, U.S. Environmental Protection Agency)

- Fleet operators and commercial vehicle leasing firms (engine block replacement strategy)

- Aftermarket component manufacturers and distributors

- Raw-material and metallurgical companies (suppliers of aluminum, cast iron, CGI)

- Logistics and supply-chain service providers specialising in automotive powertrain parts

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the U.S. engine blocks market: OEMs, Tier-1 suppliers, foundries, machining centres and material suppliers. This step is underpinned by extensive desk research, utilising a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, such as material trends, manufacturing capacity, application segments and regulatory drivers.

Step 2: Market Analysis and Construction

In this phase, we compile and analyse historical data pertaining to the U.S. engine blocks market. This includes assessing engine block production volumes, value of shipments, replacement parts demand, and the ratio of material types (cast iron vs aluminium vs CGI). Furthermore, an evaluation of manufacturing capacity utilisation, foundry expansion and supply-chain disruptions will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through interviews with industry experts representing foundry operators, automotive OEM powertrain managers, and material suppliers. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves synthesising the data into a structured report, performing forecasting using bottom-up estimates (based on volumes and average selling prices) and top-down triangulation (using global benchmarks and regional performance). This interaction ensures that the statistics derived from the modelling approach are validated and representative of the U.S. engine blocks market.

- Executive Summary

- Research Methodology (Definitions and Scope (engine block, block-assembly, short-block, long-block), Abbreviations used, Market-sizing Approach, Data assumptions and currency/base‐year (USD) conversions, Primary research, Secondary research (industry databases, casting industry associations, foundry trade data), Limitations and Future Research Directions)

- Definition and Scope

- Genesis and Evolution of Engine Blocks in USA

- Timeline of Major Technological Milestones

- Business Cycle and Macro Drivers

- Supply Chain & Value Chain Analysis

- Regulatory & Trade Framework

- Growth Drivers

Vehicle output growth

ICE engine longevity

Foundry relocation

Lightweighting mandate - Market Challenges

Shift to EVs reducing ICE blocks demand

Raw material cost volatility

Casting capacity constraint - Market Opportunities

Remanufacturing & replacement blocks

CG-iron adoption

Aftermarket export - Market Trends

Block integrated design

Modular short-block

Aluminium intensive engines

3D printed cores - Government Regulation & Standards

Emission norms

Manufacturing site regulation

Trade tariffs - SWOT Analysis

- Stakeholder Ecosystem (OEMs, Tier-1 foundries, casting suppliers, OEM reman centres, aftermarket specialists)

- Porter’s Five Forces

- By Value (USD), 2019-2024

- By Volume (units or tonnes), 2019-2024

- By Average Price/Unit (USD per engine block or per kg), 2019-2024

- By Material Type (in value %)

Cast Iron

Compacted Graphite Iron (CG-Iron)

Aluminium Alloy

Hybrid (Iron/Aluminium + insert)

Others (e.g., Magnesium, Composite) - By Manufacturing Process (in value %)

Sand Casting

High-Pressure Die Casting

Investment Casting / Lost Wax

Machined Insert / Hybrid Casting

Others (e.g., Additive manufacturing / 3D printed cores) - By Vehicle Type / Application (in value %)

Passenger Cars (ICE)

Light Commercial Vehicles (LCVs)

Heavy Commercial Vehicles (HCVs)

Off-Highway / Industrial Engines

After-market / Remanufactured Blocks - By Fuel / Powertrain Type (in value %)

Gasoline ICE

Diesel ICE

Hybrid (ICE + Electric)

Others (CNG, LPG, Bi-fuel) - By Distribution Channel (in value %)

OEM Supply (new vehicle build)

Tier-1 & Tier-2 Suppliers (block assemblies)

After-market/Reman (replacement engine blocks) - By Region (USA) (in value %)

Northeast / Mid-Atlantic

Midwest (Rust Belt foundry base)

South (Southeast auto-hub)

West (California, Southwest)

Others (Puerto Rico, Alaska, Hawaii)

- Market Share of Major Players (by value/volume) in USA for engine blocks

- Cross-Comparison Parameters (Company Overview, Business Strategies, Recent Developments & M&A, Strength & Weakness, Organizational Footprint, Revenue & Revenue by Block Type, Casting Capacity, Number of Foundry Sites, Supply-Base Integration, Technology Partnerships, After-market Service Coverage, Sustainability & CO₂ footprint, Regional Reach)

- SWOT Analysis of Major Players

- Pricing Analysis – Basis SKUs (engine block casting price per block or per kg) for Major Players

- Detailed Profiles of Major Companies:

Nemak

Mahle GmbH

Federal‑Mogul LLC

Waupaca Foundry, Inc.

Tupy S.A.

Metaldyne Performance Group

Shanxi Chenming Casting Co., Ltd. (USA-export partner)

Ryobi Limited

Fushun Special Steel Co., Ltd. (iron/CG-iron supplier)

General Motors Company (internal block production)

Ford Motor Company (internal engine block division)

Cummins Inc. (commercial vehicle block supplier)

Daimler Truck North America LLC (commercial heavy-vehicle block sourcing)

Rheinmetall AG (lightweight block materials technology)

Tenneco Inc. (after-market/re-manufacturing engine block focus)

- Demand & Utilisation by Vehicle OEM (domestic production, imports)

- Reman/After-market Demand (replacement engine blocks, rebuilders)

- Purchasing Behaviour & Budget Allocations

- Need-Gap & Pain-Point Analysis

- Decision-Making Process

- By Value (USD), 2025-2030

- By Volume (units or tonnes), 2025-2030

- By Average Price/Unit (USD per engine block or per kg), 2025-2030