Market Overview

The USA Engine Control Units (ECU) market is valued at about USD ~ billion based on the latest completed base period indicating that the country accounts for roughly 12.4% of the global automotive electronic control unit space. This sits within a global ECU pool of around USD ~ billion in the latest reported period. Demand is driven by around 15–16 million annual light-vehicle sales, increasing ECU counts per vehicle, and more than 1 million battery-electric vehicles sold across three recent quarters, which add higher-value powertrain, ADAS and connectivity controllers.

The market is anchored by production and engineering clusters in the Midwest and Southeast and demand hubs on the coasts. Michigan alone employs about 164,000 auto manufacturing workers, including roughly 49,000 in vehicle assembly and 115,000 in parts, making it the leading state for powertrain and ECU integration. On the demand side, California hosts about 37% of the nation’s light-duty EV parc and roughly a quarter of new EV registrations, supported by EV market shares above 25%, which require dense, software-rich ECU architectures for emissions, thermal, ADAS and connectivity functions.

Market Segmentation

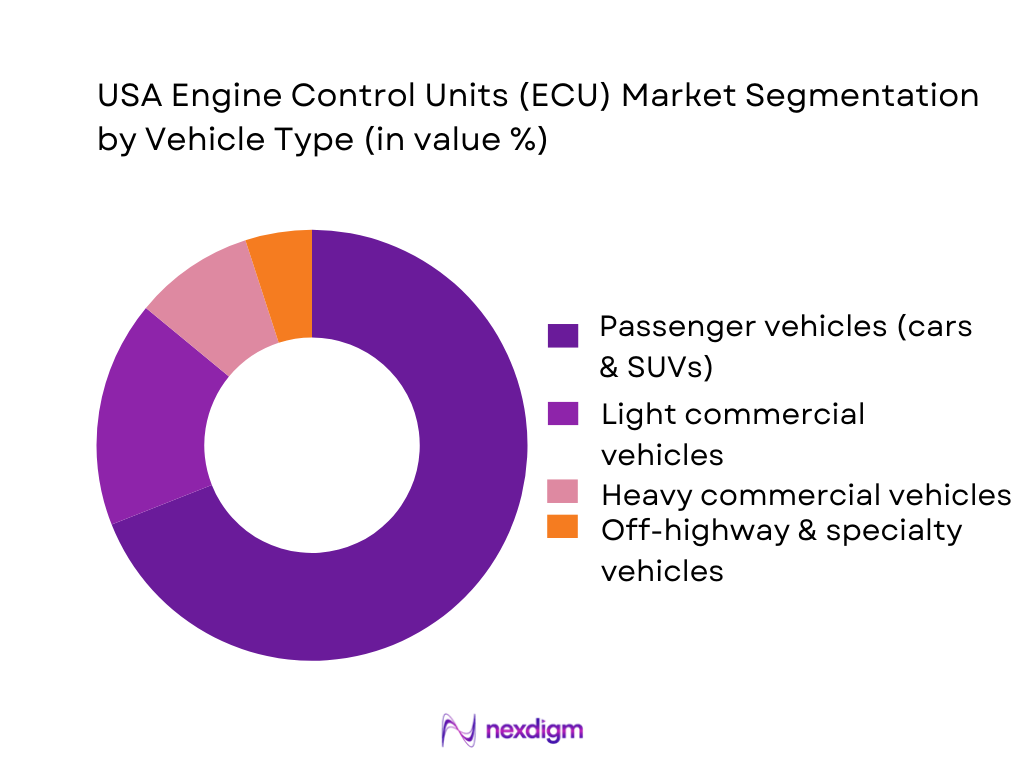

By Vehicle Type

The USA Engine Control Units (ECU) Market is segmented into passenger vehicles, light commercial vehicles, heavy commercial vehicles, and off-highway & specialty platforms. Passenger vehicles dominate ECU demand, reflecting that passenger platforms generate close to seven-tenths of U.S. ECU revenue. This is supported by a light-vehicle sales environment where annual volumes hover in the mid-teens (millions of units), with SUVs and crossovers forming the bulk of new registrations. High penetration of turbocharged gasoline engines, increasingly electrified powertrains (mild hybrids, full hybrids and BEVs), and consumer appetite for ADAS and connected infotainment translate into multiple ECUs per vehicle, from engine and transmission controllers to ADAS and body control modules. Commercial vehicles, while lower in volume, carry high-value ECUs for emissions after-treatment, telematics and fleet management, while off-highway and specialty equipment add niche demand in agriculture, construction and defense applications.

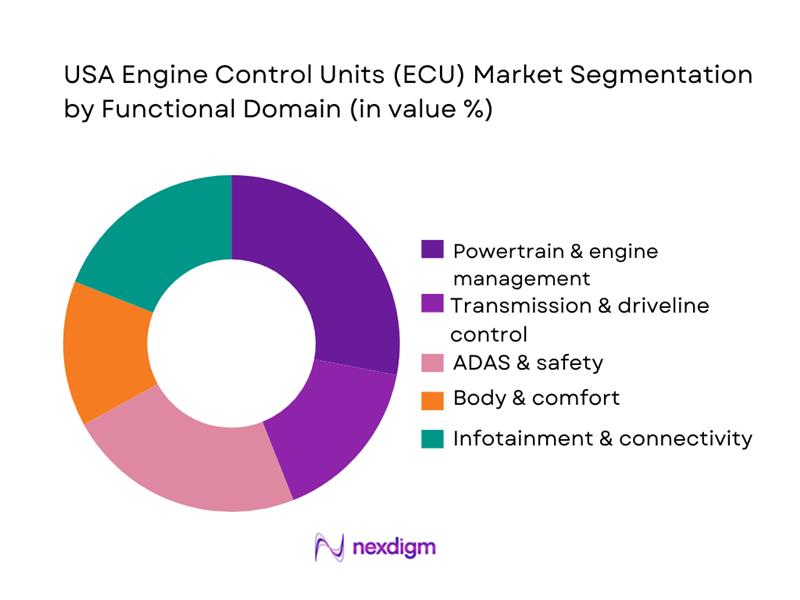

By ECU Functional Domain

The USA Engine Control Units (ECU) Market is segmented into powertrain & engine management ECUs, transmission & driveline control ECUs, ADAS & safety ECUs, body & comfort ECUs, and infotainment & connectivity ECUs. Powertrain & engine management remains the single largest slice because every internal-combustion or hybrid powertrain requires high-reliability controllers to manage fuel injection, ignition, combustion phasing, exhaust gas recirculation and on-board diagnostics under stringent EPA and CARB standards. Transmission and driveline controllers add complexity for multi-speed automatics and e-axles. However, the fastest structural uplift comes from ADAS & safety domains, as federal NCAP evolution and OEM strategies push features such as automatic emergency braking, lane-keeping and adaptive cruise into mainstream segments, each requiring dedicated or domain ECUs. Global ECU research highlights rising shares for safety, communication and body control modules as vehicles become more software-defined, which is mirrored in U.S. architectures where zonal and domain controllers are gradually consolidating functions while preserving domain-specific performance.

Competitive Landscape

The USA Engine Control Units (ECU) Market is concentrated around a group of global Tier-1 suppliers that provide powertrain, safety, body and domain controllers to both Detroit-based and transplant OEMs. Analyses from firms consistently identify Bosch, Continental, Denso, BorgWarner, Valeo, Hella, Hitachi, Panasonic and Autoliv among core ECU suppliers, with a high degree of concentration at the top. These players benefit from deep software stacks, functional-safety capabilities, and long-standing design-win relationships with U.S. OEMs and EV newcomers. Competition increasingly centers on support for over-the-air updates, cybersecurity, and consolidation into domain/zonal controllers rather than simple unit pricing, with semiconductor and software partners (NXP, Infineon, Renesas) influencing platform roadmaps.

| Company | Establishment Year | Headquarters | Core ECU Focus in USA | Key U.S. OEM / Customer Exposure | Local Manufacturing / Engineering Footprint (USA) | Dominant ECU Domains Supplied | Software & OTA Capability Focus | Notable Strategic Edge in U.S. ECU Market |

| Robert Bosch GmbH | 1886 | Gerlingen, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Continental AG | 1871 | Hanover, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Denso Corporation | 1949 | Kariya, Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| BorgWarner Inc. | 1928 | Auburn Hills, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Valeo SA | 1923 | Paris, France | ~ | ~ | ~ | ~ | ~ | ~ |

USA ECU Market Analysis

Growth Drivers

Vehicle production trends

Robust vehicle activity in the United States underpins sustained ECU demand across powertrain, safety and body domains. Total vehicle miles traveled reached about ~ trillion miles and ~ trillion miles in consecutive recent years, indicating steadily high utilization of the on-road parc that must be supported by modern engine and chassis controllers. In parallel, the United States economy generated roughly USD ~ trillion in output with a population of around 333 million, highlighting the scale of consumer and freight mobility that keeps light-duty and heavy-duty vehicle production elevated and ECU-intensive. Taken together, high VMT levels and a very large, affluent vehicle base translate into continued high installation rates and replacement demand for ECUs in new assemblies and in-use fleets.

Hybrid & EV ramp-up

Electrification is structurally increasing ECU content per vehicle. Plug-in EVs accounted for 9.1% of all light-duty sales in the country over a recent full year, up from 6.8% the year before, with monthly shares staying at or above 8% throughout the year and peaking at 9.9%. When hybrids are included, combined hybrid, plug-in hybrid and battery electric models reached a 17.9% share of light-duty sales in the second half of that year, reflecting a rapid shift in new-vehicle powertrain mix. Electrified light-duty vehicles consumed an estimated 7,596 GWh of electricity in the same year—almost five times the level five years earlier—showing a steep increase in the active EV parc that depends on sophisticated battery management, inverter, thermal and hybrid ECUs.

Market Challenges and Constraints

Semiconductor shortages

The ECU supply chain remains exposed to semiconductor tightness and geographic concentration risk. Global semiconductor sales totaled roughly USD ~ billion in 2022 and USD ~ billion in 2023, with a large share of wafer fabrication in East Asia, underscoring dependence on a few manufacturing hubs. U.S. policy responses include the CHIPS and Science Act, under which more than USD ~ billion in incentives and research funding has been authorized to bolster domestic semiconductor capacity, including auto-grade chips. Even as new fabs are announced, Commerce and other agencies continue to highlight automotive as one of the sectors most affected by earlier chip disruptions, reinforcing OEM and Tier-1 efforts to redesign ECUs around multi-source controllers and to qualify alternative nodes to reduce single-point supply risk in the U.S. ECU market.

ECU cost inflation

Input-cost pressures across the U.S. motor-vehicle parts sector have pushed ECU producers to manage higher bill-of-materials and operating expenses. Bureau of Labor Statistics data show that the motor-vehicle-parts producer price index rose 4.2% in 2022, 1.3% in 2023 and 0.8% in 2024, with a cumulative increase of 6.4% over three years, indicating persistent upstream price growth for electronic and mechanical components. Consumer price data for motor-vehicle maintenance and repair also show index levels climbing above 440 on the 1982–84=100 scale in 2024–25, signalling higher costs to maintain increasingly electronics-rich vehicles. For ECU manufacturers in the United States, these trends translate into tighter margins on fixed-price supply contracts and a greater focus on platform reuse, consolidated domain controllers and software-led value capture.

Opportunities

Hybrid and EV ECU platforms

The scale and policy direction of U.S. electrification create strong headroom for hybrid and EV ECU platforms. Global analysis shows EVs displaced about ~ million barrels per day of oil in 2023, with the global EV fleet consuming around 130 TWh of electricity, signalling a structural pivot that heavily involves the United States. Domestically, light-duty EV electricity use reached 7,596 GWh in 2023, and federal rules finalized by the environmental regulator are targeting more than half of new light-duty vehicle sales to be electric by the early 2030s. North American battery and EV supply-chain investment has surpassed USD ~ billion in announced projects up to the end of 2023, laying a capital base for expanded domestic EV and battery production. These dynamics support robust growth in battery-management systems, on-board chargers, inverter ECUs and thermal controllers tailored to U.S. duty cycles and regulatory conditions.

Domain & zone controllers

Shift toward centralized E/E architectures in the U.S. aligns with broader electrification and software-defined-vehicle trends, opening space for domain and zone controllers. Federal energy statistics show that hybrids, plug-in hybrids and battery EVs reached a combined 16–18% share of new light-duty vehicle sales in the latter half of 2023, meaning more platforms designed from the ground up for electrified and connected functions that benefit from consolidated compute. At the same time, public charging ports expanded from about 96,500 in 2020 to approximately 168,000 in 2023 and around 219,000 by early 2025, requiring robust coordination between propulsion, thermal, charging and telematics systems in each vehicle. As automakers seek to cut wiring, enable faster OTA updates and support higher-level ADAS, U.S. ECU suppliers can benefit from migrating legacy distributed ECUs into high-performance domain and zone controllers optimized for local OEM strategies and regulations.

Future Outlook

Over the next several years, the USA Engine Control Units (ECU) Market is expected to expand steadily, projected 5.8% compound annual growth rate for the U.S. automotive ECU space through the end of the decade. This trajectory reflects rising ECU content per vehicle as ADAS moves down-segment, emissions and fuel-efficiency standards remain demanding, and the EV parc continues to grow from more than 1 million annual BEV sales. Global ECU research suggests overall ECU revenues could climb from about USD 106 billion in the latest period to over USD 175 billion in the early next decade, implying a supportive global backdrop for U.S. suppliers. At the architecture level, OEMs are migrating from many discrete ECUs to zonal and domain controllers, fueling opportunities for high-value compute platforms and software-defined vehicles, while also inviting competition from semiconductor-centric players and cloud ecosystem partners.

Major Players

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- BorgWarner Inc.

- Valeo SA

- HELLA GmbH & Co. KGaA

- Autoliv Inc.

- Hitachi Astemo Ltd.

- Panasonic Automotive Systems Co., Ltd.

- ZF Friedrichshafen AG

- Aptiv PLC

- Marelli Holdings Co., Ltd.

- Mitsubishi Electric Corporation

- NXP Semiconductors N.V.

- Infineon Technologies AG

Key Target Audience

- Automotive OEM strategy, purchasing and electronics engineering teams

- Tier-1 powertrain, safety, body and cockpit system suppliers

- Automotive semiconductor and embedded-software vendors

- Investments and venture capitalist firms

- Government and regulatory bodies

- Fleet operators and telematics-driven logistics providers

- Aftermarket ECU remanufacturers, calibration and tuning companies

- Automotive cybersecurity, over-the-air update and cloud-vehicle platform providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the full USA Engine Control Units (ECU) Market ecosystem, covering OEMs, Tier-1s, semiconductor vendors, calibration providers, and regulatory agencies. Extensive desk research drew on country-level ECU statistics from global ECU studies from syndicated sources, and U.S. automotive production and EV adoption data from federal and industry bodies. This allowed us to define critical variables such as ECU content per vehicle, vehicle mix, regulatory intensity and technology migration.

Step 2: Market Analysis and Construction

Historical revenue and volume data for the U.S. automotive ECU space were compiled using base-year values and growth paths from leading market databooks, combined with vehicle-production and registration statistics. We assessed ECU penetration across passenger and commercial segments, triangulating global ECU revenue estimates with the U.S. share. Global CAGR benchmarks around 6–7% from multiple firms were used as a cross-check against country-specific forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on domain-wise ECU mix, vehicle-type dominance, and shifts toward zonal architectures were validated through secondary interviews and commentary from OEM and supplier earnings calls, investor presentations and technical conferences. We referenced qualitative insights on U.S. state-level manufacturing concentration, EV leadership regions and regulatory outlook to verify assumptions about demand clusters and technology focus areas.

Step 4: Research Synthesis and Final Output

Finally, we synthesized bottom-up segment sizing (by vehicle type and ECU functional domain) with top-down validation from published U.S. ECU revenue figures and global ECU scaling. This included constructing 2024 segmentation shares and projecting forward using the U.S. growth trajectory of about 5.8% CAGR through the decade. The resulting view provides an integrated, validated picture of the USA Engine Control Units (ECU) Market, emphasizing both domain-level opportunities and competitive dynamics.

- Executive Summary

- Research Methodology (parameters: market definition, ICE vs xEV boundary, ECU vs broader E/E architecture scope, top-down & bottom-up triangulation, OEM build data, ECU-per-vehicle factors, primary expert interviews, secondary desk research stack)

- Definition and Role of Engine Control Units in USA Automotive Context

- Evolution of Engine and Powertrain Control Architectures in USA

- ECU Positioning within the Vehicle E/E Architecture and Powertrain Stack

- USA ECU Market Structure: OEMs, Tier-1s, Tier-2s and Semiconductor Ecosystem

- ECU Supply Chain, Value Chain and Key Interfaces with Adjacent Systems

- Regulatory and Standards Landscape Influencing ECU Design

- Growth Drivers

Vehicle production trends

Hybrid & EV ramp-up

ADAS integration

Connectivity & OTA demands

Fleet digitization - Market Challenges and Constraints

Semiconductor shortages

ECU cost inflation

Cybersecurity threats

Functional safety compliance costs

Calibration complexity - Opportunities

Hybrid and EV ECU platforms

Domain & zone controllers

Software-defined engines

Predictive maintenance

Fleet telematics integration - Emerging Technology and Architecture Trends

- Regulatory and Compliance Impact

- Market-Level SWOT Analysis

- Stakeholder and Ecosystem Mapping

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Propulsion Mix, 2019-2024

- By Vehicle Class, 2019-2024

- By ECU Domain (in Value %)

Engine Management Control Units

Powertrain Control Modules / Combined ECM-PCM

Transmission Control Units

Hybrid & EV Power Electronics Control Units

Exhaust Aftertreatment & Emission Control ECUs - By Propulsion / Fuel Type (in Value %)

Gasoline Engine Control Units

Diesel Engine Control Units

Flex-Fuel and Alternative Fuel Engine Control Units

Hybrid and Plug-In Hybrid Engine & Powertrain ECUs

BEV Motor and Inverter Control Units (where engine-equivalent) - By Vehicle Class and Platform (in Value %)

Passenger Cars (Entry, Mid, Premium)

SUVs and Crossovers

Pickups and Light Commercial Vehicles

Medium and Heavy-Duty Trucks & Buses

Off-Highway Construction, Agriculture and Industrial Equipment - By ECU Bit Architecture and Processing Capability (in Value %)

16-bit ECUs for Legacy and Cost-Sensitive Applications

32-bit ECUs for Mainstream Engine and Powertrain Platforms

64-bit and High-Performance ECUs for Advanced Powertrains and Integrated Controllers

Hardware-Accelerated ECUs - By Communication Protocol and Network Integration (in Value %)

CAN / CAN FD-Centric ECUs

LIN-Slave Engine and Auxiliary ECUs

FlexRay-Connected Powertrain ECUs

Automotive Ethernet-Enabled Powertrain and Domain Controllers

Diagnostics and Over-the-Air Updatable ECUs - By Sales and Service Channel (in Value %)

OEM Factory-Fit ECU Supply

Tier-1 Module Integrator Supply to OEMs

Authorized Dealer Service and Warranty Replacements

Independent Aftermarket ECUs and Cloned Modules

Remanufactured and Reprogrammed ECU Offerings - By Emission and Compliance Band (in Value %)

Federal-Only ECU Calibrations

Federal plus CARB-Compliant ECU Calibrations

Fleet-Specific and Vocational Use ECU Calibrations

- Market Share Analysis of Major Players

- Cross Comparison Parameters for Major Players (parameters: ECU domain coverage, US OEM program penetration, functional safety & cybersecurity stack maturity, semiconductor and toolchain partnerships, US calibration and application engineering footprint, EV/hybrid ECU portfolio depth, aftermarket & remanufacturing programs, revenue and growth dependence on US ECU business)

- Player-Level SWOT Snapshot

- ECU Product and Technology Positioning Analysis

- Detailed Profiles of Major Companies

Robert Bosch GmbH / Bosch Mobility

Continental AG

DENSO Corporation

ZF Friedrichshafen AG

Aptiv PLC

Marelli Corporation

Hitachi Astemo

Mitsubishi Electric Corporation

Valeo SA

Lear Corporation

Delphi Technologies / BorgWarner Inc.

FORVIA HELLA (Hella GmbH & Co. KGaA)

NXP Semiconductors N.V.

Renesas Electronics Corporation

- OEM Platform and Program Mapping

- Fleet and Commercial Customer Perspectives

- Dealer, Workshop and Aftermarket Behavior

- End-User Needs, Pain Points and Unmet Requirements

- Buyer Journey and Decision-Making Process for ECU Sourcing

- By Value, 2025-2030

- By Volume, 2025-2030

- By Propulsion Mix, 2025-2030

- By Vehicle Class, 2025-2030