Market Overview

The USA EV battery swapping systems market is expected to experience substantial growth, primarily driven by the accelerating adoption of electric vehicles (EVs), the expanding EV infrastructure, and increased demand for faster, more efficient charging solutions. The market size for 2024 is projected at USD 450 million, supported by the government’s emphasis on clean energy, regulatory frameworks incentivizing EV use, and the continuous development of battery swapping technology. Leading companies, like NIO and Tesla, are investing heavily to ensure quick and efficient battery exchange processes, positioning battery swapping systems as a reliable alternative to conventional charging stations.

Major cities like Los Angeles, New York, and San Francisco, alongside metropolitan hubs in California, Texas, and New York, dominate the USA EV battery swapping systems market. This dominance is attributed to these regions’ progressive policies supporting EV infrastructure, large-scale adoption of electric vehicles, and well-established charging networks. California, being a key player in EV adoption, sets the tone with its supportive regulatory environment and high EV penetration rate, further accelerating the need for battery swapping stations to accommodate growing EV fleets.

Market Segmentation

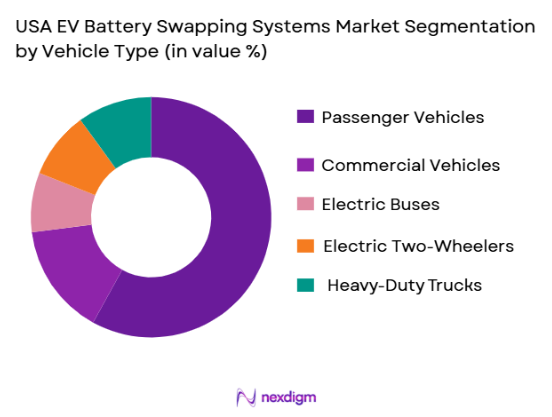

By Vehicle Type

The market is segmented by vehicle type into passenger vehicles, commercial vehicles, electric buses, electric two-wheelers, and heavy-duty trucks. The passenger vehicles sub-segment is the dominant player in this category, contributing the largest share in the market. This is driven by the growing consumer demand for electric cars, backed by federal and state incentives, advancements in EV technology, and increasing environmental awareness. Brands like Tesla and Rivian have accelerated the transition to electric cars in the USA, making passenger vehicles a leading sub-segment in the EV battery swapping systems market.

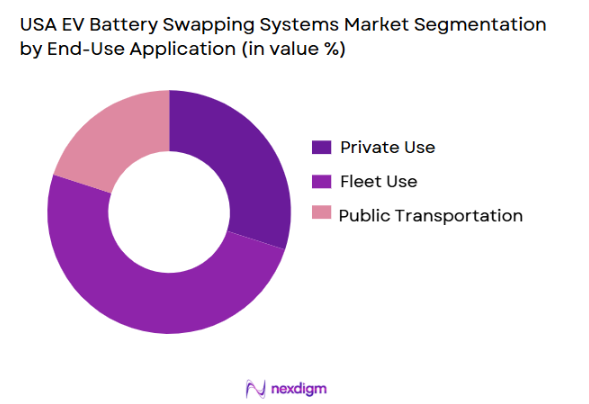

By End-Use Application

The market is segmented into private use, fleet use, and public transportation. Fleet use is leading this segment due to the adoption of EVs in delivery fleets, public transport, and logistics companies. Battery swapping is a preferred solution for fleets as it minimizes downtime and improves operational efficiency. Moreover, the scalability of battery swapping stations makes it easier for fleet operators to maintain a higher number of EVs without worrying about long charging times. As the fleet market expands with companies like Amazon and UPS transitioning to electric delivery vehicles, the demand for EV battery swapping solutions will continue to rise.

Competitive Landscape

The USA EV battery swapping systems market is becoming increasingly competitive, with several key players leading the charge in terms of technology, infrastructure development, and market adoption. Key companies driving market growth include NIO, Tesla, and Plug Power, each contributing to different facets of EV battery swapping, from battery technology to the establishment of battery swapping stations.

| Company Name | Establishment Year | Headquarters | Key Focus Areas | EV Adoption Rate | Infrastructure Investments | Partnerships |

| NIO Inc. | 2014 | Shanghai, China | ~ | ~ | ~ | ~ |

| Tesla Inc. | 2003 | Palo Alto, USA | ~ | ~ | ~ | ~ |

| Plug Power Inc. | 1997 | Latham, USA | ~ | ~ | ~ | ~ |

| BYD | 1995 | Shenzhen, China | ~ | ~ | ~ | ~ |

| Rivian | 2009 | Plymouth, USA | ~ | ~ | ~ | ~ |

USA EV Battery Swapping Systems Market Analysis

Growth Drivers

Urbanization

Urbanization in the USA is a critical factor driving the adoption of electric vehicles (EVs), including the need for EV battery swapping systems. According to the U.S. Census Bureau, over 82% of the U.S. population lived in urban areas as of 2020. Urbanization drives infrastructure development, including the implementation of EV charging and swapping stations. Cities like Los Angeles and New York, which have the highest EV adoption rates, are increasingly integrating battery swapping systems to meet the growing demand for efficient, sustainable transportation options. This urban growth continues to foster the adoption of clean energy solutions like battery swapping systems.

Industrialization

The industrialization of the USA has led to the growth of commercial fleets, logistics companies, and transportation hubs, all of which are significant consumers of electric vehicles. The USA’s industrial sector, contributing approximately ~% of GDP in 2025, has seen a surge in companies transitioning to EV fleets. With the rise in demand for sustainable transport solutions, industries are embracing battery swapping systems to keep their fleets operational without extensive downtime. For example, large logistics companies like FedEx and Amazon are transitioning to electric fleets, fueling the demand for battery swapping infrastructure.

Restraints

High Initial Costs

A significant barrier to the widespread adoption of EV battery swapping systems in the USA is the high initial capital cost associated with setting up battery swapping stations. The installation of battery swapping stations requires substantial investment in infrastructure and technology, often exceeding USD 1 million per station. The high upfront costs, including the need for land acquisition, technology installation, and regulatory compliance, limit the number of companies and municipalities able to invest in these systems. This challenge is exacerbated in smaller cities and rural areas where EV adoption is slower.

Technical Challenges

EV battery swapping systems face significant technical hurdles, such as standardization of battery types and sizes across different vehicle manufacturers. As of 205, there is no universal standard for EV batteries, making it difficult to implement a one-size-fits-all battery swapping system. For instance, Tesla, NIO, and BYD all use different battery technologies, presenting challenges for widespread adoption. The lack of interoperability hampers the scalability of swapping systems across the nation.

Opportunities

Technological Advancements

Technological advancements in battery design, energy storage solutions, and swapping infrastructure are creating opportunities for the USA EV battery swapping market. The ongoing development of solid-state batteries, which offer higher energy density and faster charging capabilities, is expected to revolutionize battery swapping systems. In addition, the integration of artificial intelligence (AI) and automation in battery swapping stations is streamlining operations and reducing downtime. These innovations are expected to make battery swapping systems more cost-effective and efficient, fueling market growth.

International Collaborations

International collaborations between American companies and global EV manufacturers like NIO and BYD are providing opportunities for cross-border sharing of technology and best practices. These partnerships are crucial in developing standardized battery swapping systems that can be scaled across the U.S. In 2023, NIO’s partnership with U.S.-based companies to expand its battery swapping infrastructure in California demonstrated the growing potential for international cooperation. Such collaborations could significantly reduce the costs of implementation and increase market penetration.

Future Outlook

Over the next 5 years, the USA EV battery swapping systems market is expected to show significant growth, driven by continuous government support, advancements in battery technology, and increasing consumer demand for eco-friendly transportation solutions. The market will benefit from improved battery efficiencies, rapid adoption of EVs, and the scaling of battery swapping infrastructure to meet the needs of both private consumers and commercial fleets. Partnerships between key stakeholders, including OEMs and energy providers, will accelerate the development and deployment of battery swapping stations across major urban areas.

Major Players in the Market

- NIO Inc.

- Tesla Inc.

- Plug Power Inc.

- BYD

- Rivian

- General Motors

- Hyundai Motor Group

- Aulton New Energy

- CATL

- Shell Recharge Solutions

- Greenlots

- BP Pulse

- Siemens Energy

- AutoX

- Toyota Tsusho Corporation

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., U.S. Department of Energy, California Air Resources Board)

- EV Manufacturers and OEMs

- Battery Manufacturers

- Charging Infrastructure Developers

- Fleet Operators (e.g., Amazon, UPS)

- Electric Bus Operators

- Energy and Utility Companies (e.g., PG&E, Con Edison)

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping out all key players within the USA EV battery swapping systems market, including EV manufacturers, battery technology providers, charging infrastructure companies, and government bodies. This is done through secondary research, leveraging proprietary databases and industry reports.

Step 2: Market Analysis and Construction

We will gather historical data on the adoption rates of electric vehicles, the growth of battery swapping infrastructure, and the success of early adoption in key metropolitan areas. This data will be compiled to build a reliable market model.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through primary interviews with industry experts, including OEMs, battery swapping companies, energy providers, and government officials. These consultations will help ensure accuracy in the market model and forecast.

Step 4: Research Synthesis and Final Output

The final stage will involve the analysis of data from manufacturers, fleet operators, and infrastructure developers to provide insights into the future growth of battery swapping systems. This will be followed by a synthesis of all market research to deliver a comprehensive report.

- Executive Summary

- Research Methodology(Market Definitions and Assumptions, USA-Specific Terminologies, Abbreviations, Market Sizing Logic, Bottom-Up & Top-Down Validation, Triangulation Framework, Primary Interviews Across OEMs, Battery Manufacturers, Infrastructure Developers, Charging Providers, and Government Agencies, Demand-Side & Supply-Side Weightage, Data Reliability Index, Limitations & Forward-Looking Assumptions)

- Definition and Scope

- Market Genesis and Evolution Pathway

- USA EV Battery Swapping Industry Timeline

- Battery Swapping Business Cycle

- EV Battery Swapping Systems Supply Chain & Value Chain Analysis

- Key Growth Drivers

Rising EV Adoption in the USA

Government Policies Supporting Battery Swapping

Increasing Demand for Faster Charging Solutions

Reduction of Battery Costs and Standardization - Market Opportunities

Expansion of Battery Swapping Stations in Urban & Rural Areas

Growth in Fleet Adoption for Last-Mile Delivery

Integration of Battery Swapping with Renewable Energy Solutions - Key Trends

Rising Investments in Battery Swapping Technology

Growing Focus on Battery Recycling and Reuse

Development of Sustainable Battery Technologies - Regulatory & Policy Landscape

US Federal Policies on EV Charging and Battery Swapping

State-Specific Regulations & Incentives

EV Battery Recycling and Sustainability Standards - SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price, 2019-2025

- By EV Type Adoption, 2019-2025

- By Charging Infrastructure Development, 2019-2025

- By Vehicle Type (In Value %)

Passenger EVsCommercial EVs

Electric Buses

Electric Two-Wheelers

Heavy-Duty Vehicles - By End-Use Application (In Value %)

Private Use

Fleet Use

Public Transportation

Logistics & Freight - By Battery Swapping Infrastructure (In Value %)

Dedicated Battery Swap Stations

Mobile EV Battery Swapping Solutions - By Technology (In Value %)

Standard Battery Swapping Systems

Fast & Ultra-Fast Battery Swapping Systems - By Region (In Value %)

West Coast

East Coast

Midwest

Southern USA - By Consumer Segment (In Value %)

Early Adopters

Mass Market (Private & Fleet Users)

Commercial Fleets

- Market Share Analysis

- Cross Comparison Parameters(Product Portfolio Breadth, Battery Swapping Efficiency, Charging Speed, Regulatory Approvals, Distribution Footprint, Manufacturing & Localization Capabilities, R&D Investment and Technological Advancements, Strategic Partnerships & Collaborations)

- SWOT Analysis of Key Players

Strengths

Weaknesses

Opportunities

Threats - Pricing Analysis

Comparison of Prices Across Battery Types

Pricing Strategies for Different Consumer Segments - Detailed Company Profiles

NIO Inc.

Tesla Inc.

Gogoro Inc.

Aulton New Energy

Hyundai Motor Group

CATL

BYD

Shell Recharge Solutions

BP Pulse

Greenlots

EVgo

AutoX

Aeva Mobility

Toyota Tsusho Corporation

Siemens Energy

- Demand Pattern & Utilization Metrics

- Procurement Models & Purchasing Cycles

- Compliance & Certification Expectations

- Needs, Desires & Pain-Point Mapping

- Decision-Making Framework (Private Consumers vs Fleets)

- Cost vs. Sustainability Prioritization

- By Value, 2026-2030

- By Volume, 2026-2030

- By Average Selling Price, 2026-2030